By John Mauldin

In 1633 Galileo Galilei, then an old man, was tried and convicted by the Catholic Church of the heresy of believing that the earth revolved around the sun. He recanted and was forced into house arrest for the rest of his life, until 1642. Yet “The moment he [Galileo] was set at liberty, he looked up to the sky and down to the ground, and, stamping with his foot, in a contemplative mood, said, Eppur si muove, that is, still it moves, meaning the earth” (Giuseppe Baretti in his book the The Italian Library, written in 1757).

Flawed from its foundation, economics as a whole has failed to improve much with time. As it both ossified into an academic establishment and mutated into mathematics, the Newtonian scheme became an illusion of determinism in a tempestuous world of human actions. Economists became preoccupied with mechanical models of markets and uninterested in the willful people who inhabit them….

Some economists become obsessed with market efficiency and others with market failure. Generally held to be members of opposite schools – “freshwater” and “saltwater,” Chicago and Cambridge, liberal and conservative, Austrian and Keynesian – both sides share an essential economic vision. They see their discipline as successful insofar as it eliminates surprise – insofar, that is, as the inexorable workings of the machine override the initiatives of the human actors. “Free market” economists believe in the triumph of the system and want to let it alone to find its equilibrium, the stasis of optimum allocation of resources. Socialists see the failures of the system and want to impose equilibrium from above. Neither spends much time thinking about the miracles that repeatedly save us from the equilibrium of starvation and death.

– George Gilder, Knowledge and Power: The Information Theory of Capitalism and How It is Revolutionizing Our World

And to that stirring introduction let me just add a warning up front: today’s letter is not exactly a waltz in the park. Longtime readers will know that every once in a while I get a large and exceptionally aggressive bee in my bonnet, and when I do it’s time to put your thinking cap on. And while you’re at it, tighten the strap under your chin so it doesn’t blow off. There, now, let’s plunge on.

Launched by Larry Summers last November, a meme is burning its way through established academic economic circles: that we have entered into a period of – gasp! – secular stagnation. But while we can see evidence of stagnation all around the developed world, the causes are not so simple that we can blame them entirely on the free market, which is what Larry Summers and Paul Krugman would like to do: “It’s not economic monetary policy that is to blame, it’s everything else. Our theories worked perfectly.” This finger-pointing by Keynesian monetary theorists is their tried and true strategy for deflecting criticism from their own economic policies.

Academic economists have added a great deal to our understanding of how the world works over the last 100 years. There have been and continue to be remarkably brilliant papers and insights from establishment economists, and they often do prove extremely useful. But as George Gilder notes above, “[As economics] ossified into an academic establishment and mutated into mathematics, the Newtonian scheme became an illusion of determinism in a tempestuous world of human actions.”

Ossification is an inherent tendency of the academic process. In much of academic economics today, dynamic equilibrium models and Keynesian theory are assumed a priori to be correct, and any deviation from that accepted economic dogma – the 21st century equivalent of the belief by the 17th century Catholic hierarchy of the correctness of their worldview – is a serious impediment to advancement within that world. Unless of course you are from Chicago. Then you get a sort of Protestant orthodoxy.

It’s About Your Presuppositions

A presupposition is an implicit assumption about the world or a background belief relating to an utterance whose truth is taken for granted in discourse. For instance, if I asked you the question, “Have you stopped eating carbohydrates?” The implicit assumption, the presupposition if you will, is that you were at one time eating carbohydrates.

Our lives and our conversations are full of presuppositions. Our daily lives are based upon quite fixed views of how the world really works. Often, the answers we come to are logically predictable because of the assumptions we make prior to asking the questions. If you allow me to dictate the presuppositions for a debate, then there is a good chance I will win the debate.

The presupposition in much of academic economics is that the Keynesian, and in particular the neo-Keynesian, view of economics is how the world actually works. There has been an almost total academic capture of the bureaucracy and mechanism of the Federal Reserve and central banks around the world by this neo-Keynesian theory.

What happens when one starts with the twin presuppositions that the economy can be described correctly using a multivariable dynamic equilibrium model built up on neo-Keynesian principles and research founded on those principles? You end up with the monetary policy we have today. And what Larry Summers calls secular stagnation.

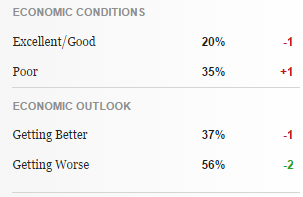

First, let’s acknowledge what we do know. The US economy is not growing as fast as anyone thinks it should be. Sluggish is a word that is used. And even our woeful economic performance is far superior to what is happening in Europe and Japan. David Beckworth (an economist and a professor, so there are some good guys here and there in that world) tackled the “sluggish” question in his Washington Post “Wonkblog”:

The question, of course, is why growth has been so sluggish. Larry Summers, for one, thinks that it’s part of a longer-term trend towards what he calls “secular stagnation.” The idea is that, absent a bubble, the economy can’t generate enough spending anymore to get to full employment. That’s supposedly because the slowdowns in productivity and labor force growth have permanently lowered the “natural interest rate” into negative territory. But since interest rates can’t go below zero and the Fed is only targeting 2 percent inflation, real rates can’t go low enough to keep the economy out of a protracted slump.

Rather than acknowledge the possibility that the current monetary and government policy mix might be responsible for the protracted slump, Summers and his entire tribe cast about the world for other causes. “The problem is not our theory; the problem is that the real world is not responding correctly to our theory. Therefore the real world is the problem.” That is of course not exactly how Larry might put it, but it’s what I’m hearing.

It’s been more than five years since the global financial crisis, but developed economies aren’t making much progress. As of today, the United States, Canada, Germany, France, Japan, and the United Kingdom have all regained their pre-crisis peaks in real GDP, but with little else to show for it.

Where orthodox neo-Keynesian policies like large-scale deficit spending and aggressive monetary easing have been resisted – as in Japan years ago or in the Eurozone debtor countries today – lingering depressions are commonly interpreted as tragic signs that “textbook” neo-Keynesian economic policy could have prevented the pain all along and that weak economic conditions persist because governments and central banks are not doing enough to kick-start aggregate demand and stimulate credit growth at the zero lower bound.

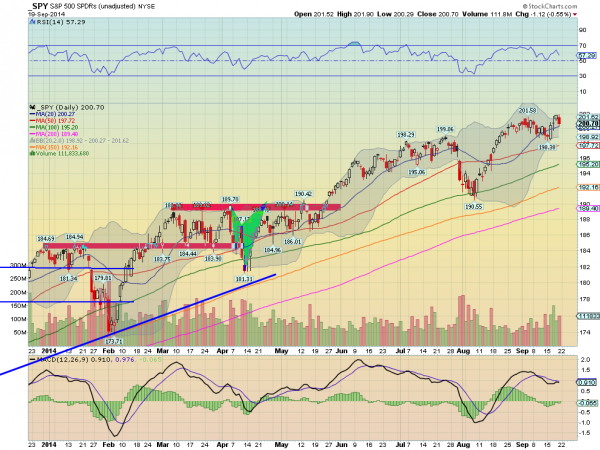

In places like the United States and Japan, where neo-Keynesian thought leaders have already traded higher public debt levels and larger central bank balance sheets for unspectacular economic growth and the kinds of asset bubbles that always lead to greater instability in the future, their policies have failed to jump-start self-accelerating recoveries. Even in the United States, when QE3 has been fully tapered off, I would expect to see the broader economy start to lose momentum once again.

We’ve tried countercyclical deficit spending to resist recessions, procyclical (and rather wasteful) deficit spending to support supposed recoveries, and accommodative monetary easing all along the way (to lower real interest rates and ease the financing of those pesky deficits); but growth has been sluggish at best, inflation has been hard to generate, and labor market slack is making it difficult to sustain inflation even when real interest rates are already negative.

Call me a heretic, but I take a different view than the economists in charge. To my mind, the sluggish recovery is a sign that central banks, governments, and, quite frankly, the “textbook” economists (despite their best intentions) are part of the problem. As Detlev Schlichter commented in his latest blog post (“Keynes was a failure in Japan – No need to embrace him in Europe”), “To the true Keynesian, no interest rate is ever low enough, no ‘quantitative easing’ program ever ambitious enough, and no fiscal deficit ever large enough.” It’s apparently true even as debt limits draw closer.

While the academic elites like to think of economics as a reliable science (with the implication that they can somehow control a multi-trillion-dollar economy), I have repeatedly stressed the stronger parallel of economics to religion, in the sense that it is all too easy to get caught up in the dogma of one tradition or another. And all too often, a convenient dogma becomes a justification for those in power who want to expand their control, influence, and spending.

Whereas an Austrian or monetarist approach would suggest less government and a very light handle on the monetary policy tiller, Keynesian philosophy gives those who want greater government control of the economy ample reasons to just keep doing more.

Schlichter expands his critique of the logic of pursuing more of the same debt-driven policies and highlights some of the obvious flaws in the pervasive Keynesian thinking:

Remember that a lack of demand is, in the Keynesian religion, the original sin and the source of all economic troubles. “Aggregate demand” is the sum of all individual demand, and all the individuals together are not demanding enough. How can such a situation come about? Here the Keynesians are less precise. Either people save too much (the nasty “savings glut”), or they invest too little, maybe they misplaced their animal spirits, or they experienced a Minsky moment, and took too much risk on their balance sheets, these fools. In any case, the private sector is clearly at fault as it is not pulling its weight, which means that the public sector has to step in and, in the interest of the common good, inject its own demand, that is [to] “stimulate” the economy by spending other people’s money and print some additional money on top. Lack of “aggregate demand” is evidently some form of collective economic impotence that requires a heavy dose of government-prescribed Viagra so the private sector can get its aggregate demand up again.

Generations of mismanagement have left major economies progressively weaker, involving

- dysfunctional tax/regulatory/entitlement/trade policies created by short-sighted and corrupt political systems,

- private-sector credit growth encouraged by central bank mismanagement, and

- government expansion justified in times of crisis by Keynesian theory.

But rather than recognizing real-world causes and effects, neo-Keynesian ideologues are making dangerous arguments for expanding the role of government spending in places where government is already a big part of the problem.

We are going to delve a little deeper into this thesis of “secular stagnation” posited last year by Larry Summers and eagerly adopted by Paul Krugman, among others; and then we’ll take a trip around the rich world to assess the all-too-common trouble with disappointing growth, low inflation, and increasingly unresponsive labor markets. Then I’ll outline a few reasons why I think the new Keynesian mantra of “secular stagnation” is nothing more than an excuse for more of the same failed policies.

I think we’ll see a consistent theme: fiscal and monetary stimulus alone cannot generate “financially stable growth with full employment.” In fact, such policies only make matters worse. And funny things happen in the Keynesian endgame.

USA: Secular Stagnation or Public Sector Drag?

This latest theory – “secular stagnation” – argues that powerful and inherently deflationary forces like shrinking populations…

… and potentially slowing productivity growth (as posited by Northwestern University professor Bob Gordon)…

… are adding to the deleveraging headwinds that always follow debt bubbles. According to the “stagnation” theory, structural forces have been bearing down on the natural rate of interest and weighing on the full-employment level of economic growth since the early 1980s; but the slowdown in trend GDP growth has been masked by a series of epic bubbles in technology stocks and housing.

Even before the 2008 crisis, the argument goes, the real interest rate required to restart the business cycle had been trending lower and lower for years, and the average level of growth experienced during business cycles has fallen.

Moreover, it has taken longer and longer to recoup the jobs that were lost in each of the last three recoveries.

It’s hard to argue with the data, but it’s really a matter of how we interpret it. While the five-year-old “recovery” is still the weakest business cycle in modern US history…

… I quite frankly still believe the effects on growth are temporary. Difficult and long-lasting, for sure (as Jonathan Tepper and I outlined in our books Endgame and Code Red), but temporary nonetheless as private-sector deleveraging continues. We have encountered a massive debt crisis and still have a long way to go in dealing with the sovereign debt bubbles that are being created in Europe and Japan – with the potential of one’s ballooning out of control in the US unless we turn ourselves around.

It may take a crisis, but the forces that plague rich-world economies will eventually shake out and usher in a new era of technology-driven growth. In other words, this too shall pass… but continuing with the same old policies is highly likely to create another crisis through which we all must pass first.

Yes, shrinking workforces, private-sector debt overhangs, and technological innovation are making it difficult to achieve “financially stable growth with full employment” (quoting Summers); but governments and central banks are themselves becoming an increasing drag on rich-world economies. Our governments have saddled us with excessive public debt, onerous overregulation, oppressive tax codes, and their attendant distorted market signals; while our central banks have engaged in currency manipulation and monetary-policy overmanagement. Those in power who rely on Keynesian policies almost always find it inconvenient to cut back in times of relative economic strength (as Keynes would have had them do). And if, according to their arguments, the economy is still too weak even in periods of growth to enable the correction of government balance sheets, then perhaps their reluctance has something to do with debt piling up, market signals being distorted, and governments being empowered to encroach on every aspect of the lives of their productive citizens .

My friend Grant Williams used this chart in a speech yesterday. It shows that we have come to need ever more debt just to produce the same amount of GDP. With a deleveraging in the private sector underway, it is no wonder that growth is under pressure.

Debt is simply future consumption brought forward. Another way to think about it is that debt is future consumption denied. But there comes a point when debt has to be repaid, and by definition, from that point forward there is going to be a period of slower growth. I have called that point the Endgame of the Debt Supercycle, and it was the subject of my book Endgame.

As a result of central bank and governmental machinations, Keynesian growth is ultimately debt-fueled growth (either through the swelling of public debt via deficit spending or the accumulation of private debt via credit expansion); and eventually, public and private balance sheets run out of room to expand anymore. It has taken decades for cracks to show up in the prevailing theory, but now the cracks are everywhere.

One place where the crack-up is especially evident is Japan, where an uber-Keynesian combination of aggressive fiscal deficits and a planned doubling in the monetary base started to lift real GDP and inflation numbers last year before falling back into a deflationary trap. Yet the Japanese experience has seemingly convinced ECB President Mario Draghi that similar policies should be implemented across the Eurozone.

Last quarter, the Japanese economy shrank by an annualized 7.1%; business investment fell by 5.1%; and residential spending was down 10%. This is after one of the most massive Keynesian quantitative easing efforts in the history of the world.

So, let’s go to Japan, which may now have to retitle itself “the land of the setting sun,” since it is facing the steepest expected decline in population and in workforce-to-population ratio on the planet.

Japan’s long-awaited “recovery” is already losing steam without the effective implementation of Prime Minister Shinzo Abe’s “third arrow” of structural reform, which to my mind was always the most critical element of his entire “Abenomics” project (and of course the most politically difficult). Despite massive fiscal and monetary stimulus and a desperate attempt to boost tax revenues by hiking the sales tax this past April, Japanese GDP collapsed in Q2:

Let’s review how Japan got there.

Prime Minister Abe took office in late December 2012 and, together with his (initially reluctant) colleagues at the Bank of Japan, quickly fired the first two fiscal and monetary policy arrows, which aimed to propel the world’s third-largest economy out of its deflationary trap. The third arrow has yet to fly.

Source: Wall Street Journal, March 2013

Since January 2013 the Bank of Japan has expanded its balance sheet by 78% (42% on an annualized basis)…

… and pushed the USD/JPY exchange rate to a six-year low of a fraction under 109 yen per dollar as of the market close yesterday.

In true Keynesian form, the Japanese government ran a massive fiscal deficit in 2013, equivalent to 8.4% of GDP. This was its 22nd consecutive year of deficit spending, starting in mid-1992…

… despite the fact that the Japanese public-sector debt-to-GDP ratio is quickly approaching 250%:

While inflation has popped to its highest level since the early 1990s…

… headline CPI has been decelerating since May and could quickly revert to deflation in the event of continued economic weakness, as was the case after the 1997 tax hike… which would then bring on even more “money-financed” deficit spending.

Abe advisor Etsuro Honda was very clear on this point: “Regardless of the next sales tax hike, it could be that additional monetary easing might be called for if inflation and demand fail to pick up and the output gap doesn’t narrow…. I can fully see the possibility that such a situation will occur.”

Of course, the party cannot go on forever. More than twenty years of constant deficit spending and public-sector debt growth have finally led to a situation where debt service and entitlements are crowding out the government’s general budget.

And now the situation is turning dangerous. Japan has been flirting with current account deficits for the past few years, and the trend looks decidedly negative over the coming decade. That, in turn, could force the Abe administration to look for foreign investment to fund its ongoing operations, pushing interest rates up dramatically to the point that debt service and entitlements could consume more than half the annual operating budget.

Bottom line: Abenomics has delivered a bounce in economic growth and inflation, but it’s failing to push Japan into a self-sustaining recovery. Without a detour through structural reforms (which would be quite painful), this road leads to higher public debt balances and even more dysfunction in the medium term, leaving Japan only a shock away from disaster. As predicted here three years ago, I continue to believe that the yen will be over 200 to the dollar by the end of the decade, and possibly much sooner.

Keynesians argue that Abe had the right idea, he just didn’t spend enough and will need to spend a lot more in the near future. In other words, fiscal and monetary stimulus can lift inflation and boost growth in the short term… but the problem is that you can’t have that stimulus if you want to consolidate the national debt and boost tax revenues at the same time.

Some economists would argue that Abe’s policies don’t necessarily have to add to the debt load, as long as the government has a firm commitment from the central bank to monetize the debt along the way. The fact that that would destroy the buying power of the yen doesn’t seem to be a consideration for them. The elderly on fixed incomes might disagree.

So with their highly leveraged banking system and already crushing sovereign debt loads, why wouldn’t the Europeans embrace the same model?

I’ve written extensively on the Eurozone in recent months, so I will keep this section brief.

Much of Southern Europe has been mired in depression, with hopelessly slow or negative growth rates, low inflation or outright deflation, and extremely high levels of unemployment (especially among young workers), for several years.

It’s a toxic situation for a multi-country monetary system that still lacks the underpinning of banking or fiscal unions. Demonstrations in the Catalonia region of Spain, inspired by this week’s Scottish referendum, reveal the very real political risks that are only growing with voter frustration.

Perhaps it was just talk, but Mario Draghi laid out a three-point plan similar to Abe’s in his presentation at the recent Jackson Hole meeting of central bankers. It quickly acquired the sobriquet “Draghinomics.”

Draghi recently cut the ECB’s already-negative interest rates and has promised a large round of quantitative easing. But the core problems facing Europe are not interest rates or a lack of liquidity but rather a structurally unwieldly labor market, too many regulations being dreamed up in Brussels, a lack of capital available to small businesses, and major regulatory headwinds for business startups.

Compound all that with the significant structural imbalances between Northern and Southern Europe, dramatically overleveraged banks, and an obvious sovereign debt bubble, and you have all the elements of a major crisis in the making.

That the Eurozone is a fragile and politically unstable union will come as no surprise to Thoughts from the Frontline readers who have been diligently perusing my letters for the past several years, but it is a critical point that we cannot ignore. How, I wonder, can Draghi even hope for a successful European implementation of a three-point plan like Japan’s – where a leader who started with very strong approval ratings has burned through most of his political capital before structural reforms have even gotten off the ground?

Draghi simply does not have the political power to make the changes that are necessary. All he can do is prop up a failing system with liquidity and low rates, which will ultimately create even more serious problems.

The Failure of Monetary Policy

There are many economists, with Paul Krugman at their fore, who believe that Keynesian monetary policy is responsible for the United States doing better than Europe. I beg to differ. The United States is outshining Europe due to the combined fortuitous circumstances of massive new discoveries of unconventional oil and gas, new technologies, and an abundance of risk-taking entrepreneurs. Indeed, take away the oil boom and the technology boom centered in Silicon Valley, and the US would be as sclerotic as Europe is.

None of the above has anything to do with monetary policy. In fact, I would argue that current monetary, fiscal, and regulatory policy is getting in the way of that growth.

Robert A. Hefner III, chairman of The GHK Companies and the author of The Grand Energy Transition: The Rise of Energy Gases, Sustainable Life and Growth, and the Next Great Economic Expansion, wrote a wonderful piece in last month’s Foreign Affairs, entitled “The United States of Gas” (hat tip, Dennis Gartman).

Consider how much can change in one year alone. In 2013, on properties in Oklahoma in which the GHK Companies hold interests covering 150 square miles, one large U.S. independent company drilled and completed over 100 horizontal wells. Had those wells been drilled vertically, they would have exposed only about 1,000 feet of shale, whereas horizontal drilling allowed nearly 100 miles to be exposed. And rather than performing the 100 injections of fracking fluid that a vertical well would have made possible, the company was able to perform between 1,000 and 2,000 of them. The company’s engineers also tinkered with such variables as the type of drill bits used, the weight applied while drilling, the rotation speed of the drill, and the size and number of fracking treatments.

Thanks to that continuous experimentation, plus the savings from scale (for example, ordering tubular steel in bulk), the company managed to slash its costs by 40 percent over 18 months and still boost its productivity. The result: in 2014, six or seven rigs will be able to drill more wells and produce as much oil and gas as 12 rigs were able to the year before. Since the shale boom began, over a decade ago, companies have drilled about 150,000 horizontal wells in the United States, a monumental undertaking that has cost approximately $1 trillion. The rest of the world, however, has drilled only hundreds of horizontal wells. And because each borehole runs horizontally for about one mile (and sometimes even two miles) and is subjected to ten or more fracking injections, companies in the United States have fracked about 150,000 miles of shale about two million times. That adds up to around a thousand times as much shale exposed inside the United States as outside it.

There is a divide in the United States, and indeed in the world, between those who believe (and the emphasis is on believe) that government in all its various shapes and sizes is the font of all growth and progress and those who believe that it is individual effort and free markets that “move the ball down the field” of human progress. Count me in the latter group.

Government is necessary to the extent that we need to maintain a level playing field and proper conduct, but with the recognition that wherever government is involved there are costs for that service that must be paid by the private market and producers. For example, almost everyone thinks that the government’s being involved in student loans is a public good. We should help young people with education, right? Except that John Burns released a report this week that shows that student loans will cost the real estate industry 414,000 home sales. Young people are so indebted they can’t afford to buy new homes. Collateral damage?

The unintended consequences of government policies and manipulation of the markets are legendary. But often unseen.

Monetary policy as it is currently constructed is only marginally helping private markets and producers. Monetary policy as it is currently practiced is an outright war on savers, which sees them as collateral damage in the Keynesian pursuit of increased consumer demand.

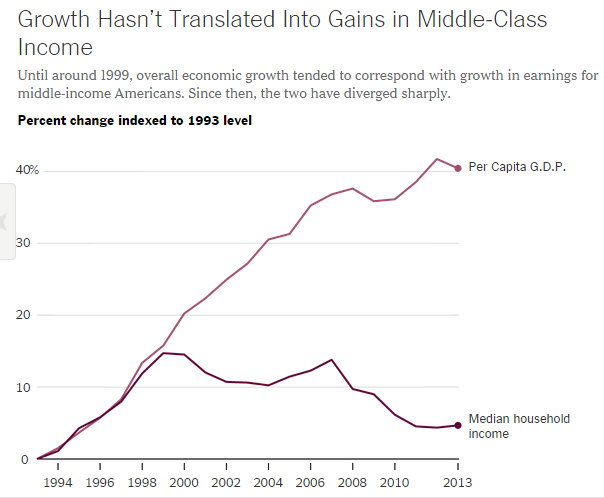

It is trickle-down monetary policy. It has inflated the prices of stocks and other income-producing securities and assets, enriching those who already have assets, but it has done practically nothing for Main Street. It has enabled politicians to avoid making the correct decisions to create sustainable growth and a prosperous future for our children, let alone an environment in which the Boomer generation can retire comfortably.

It is a pernicious doctrine that refuses to recognize its own multiple failures because it starts with the presupposition that its theory cannot fail. It starts with the presuppositions that final consumer demand is the end-all and be-all, that increased indebtedness and leverage enabled by lower rates are good things, and that a small room full of wise individuals can successfully direct the movement of an entire economy of 300 million-plus people.

The current economic thought leaders are not unlike the bishops of the Catholic Church of 16th-century Europe. Their world was constructed according to a theory that they held to be patently true. You did not rise to a position of authority unless you accepted the truth of that theory. Therefore Galileo was wrong. They refused to look at the clear evidence that contradicted their theory, because to do so would have undermined their power.

Current monetary and fiscal policy is leading the developed world down a dark alley where we are all going to get mugged. Imbalances are clearly building up in almost every corner of the market, encouraged by a low-interest-rate regime that is explicitly trying to increase the risk-taking in the system. Our Keynesian masters know their policies and theories are correct – we must only give them time to more perfectly practice them. That the results they’re getting are not what they want cannot be their fault, because the theory is correct. Therefore the problem has to lie with the real world, full of imperfect people like you and me.

What our leaders need is a little more humility and a little less theory.

Washington DC, Dallas, Chicago, Athens (Texas), and Boston

I find myself in the Hill Country north of San Antonio, Texas, attending the Casey Research Summit, where I speak tomorrow. I’m surrounded by many friends in very pleasant circumstances. And when I hit the send button, I will have two days of fascinating conversations ahead of me. I am doing a number of videos with various interesting personalities, which we will post on the Mauldin Economics site in the coming weeks. More on that later.

On Monday I fly back to Dallas, where I will stay until the end of the month, then head off to Washington DC. In the middle of October I’ll visit Chicago, Athens (Texas), and Boston, all in one week.

I can't hit the send button without noting that Jack Ma, the Chinese ultra-billionaire founder of Alibaba, was at the New York Stock Exchange for the launch of his IPO and sought out my friend Art Cashin, saying “I can't leave without a picture with Art Cashin.” As one of Art's friends subsequently wrote on our round-robin group email, Jack is clearly a man who understands who is really running things. The incident also shows that anyone can be a groupie. But what really intrigues me is that here is one of the richest men in the world, a force in China, obsessively focused on creating a merchandising machine, and yet he is so in touch with the world of investment and business that he watches CNBC enough to know who Art is. And to appreciate the character and class that Art has shown us for years – and want to meet him. Jeff Bezos may have his work cut out for him in the coming years.