«Things could theoretically turn into what I call a «Lehman moment».» (Bild: Richard Drew/AP/Keystone)

Wall Street veteran Art Cashin does not fully trust the record levels at the stock market and draws worrisome parallels between the geopolitical tensions over Ukraine and the Cuban missile crisis.

From the assassination of President Kennedy via the stock market crash of 1987 and the Fall of the Berlin Wall through to the burst of the dotcom bubble, the terror attacks of 9/11 and the collapse of Lehman Brothers: Art Cashin has experienced all the major world events of the last half century at the floor of the New York Stock Exchange. Currently, the highly respected Wall Street veteran keeps a close eye on the geopolitical tensions in the Middle East and on the situation in Ukraine which reminds him of the Cuban missiles crisis. «The markets are edgy and nervous», says the Director of Floor Operations for UBS (UBSN 16.46 0.43%) Financial Services while constantly checking the quotation board. Like many traders here, he is somewhat skeptical of the huge stock market rally that started in March 2009. «I think it is a question of the extraordinarily low interest rates», he explains.

Mr. Cashin, September is historically the most difficult month of the year for equities. What is your take on September 2014 so far?

It is strange that September still lingers as a particularly weak month. It goes back to when America was more of an agrarian society and we depended on what would happen with the crop cycles. If a cooking factory for example had to buy wheat from the farmers it would send a check out drawn on an account at a city bank and the country bank would then cash it and put the money in the farmer’s account. Before the Federal Reserve was created, there was a wide spread between the time that money was asked for and when it was replaced. For centuries, this caused bank panics around this time of the year, most notably the panic of 1907. You would think that now that we are no longer an agrarian society, those changes would ease up on the financial pressures. But the market has kind of an echo.

So what are traders talking about at the present time here at the New York Stock Exchange?

We are concerned about two questions. First, how will the Fed do in keeping money reasonably easy without causing inflation? Second, where do we stand with the current geopolitical challenges? For now, these challenges seem to be short term concerns. But should we begin to see a financial contagion and pressure building on banks in Europe, perhaps out of the Ukraine situation, things could theoretically turn into what I call a «Lehman moment». That is when markets come under pressure but seem to be under control, and then things change suddenly.

How do you handle these concerns in your daily business as stock market operator?

Having done this over half a century now, the market tends to have recurring cycles of some type or other. For example, at the beginning of the Cuban missile crisis no one thought that it would turn into a major event. Yet, as time went on and neither side relented, it began to look like we might be on the verge of a nuclear war. That had great reverberations in the financial markets. Then, finally the Russian convoy that was going to resupply the Cuban missiles turned and headed back. Immediately, the stock market began to rally on that sense of relief and that rally continued for months. So you can have these theoretical events – whether they are geopolitical or not – and you get two sweeping changes: First, you can get further and further pressure on prices. And then suddenly, when it releases, you can get almost a rocket shot to the upside.

What are the signals you are looking for to stay on top in such a market?

Over the years, we on the floor have taken to look at what we call the risk monitors. For instance, the yield on the 10-year Treasury note is usually an indicator for the flight to safety. People are looking to get over to the United States protected by the two large oceans. You also look at the gold market where people invest who are concerned that things are changing radically and who think they need some currency protection. And then, particularly in situations like this, you look at things like oil because that is inextricably involved with Russia and with the Middle East and what is going on with the Islamic terror organization ISIS.

And what are the risks monitors signaling?

Right now, it almost looks like peace is breaking out. The price of oil is sharply lower, both Texas West Intermediate and Brent. That indicates a lot less stress there. Although traders can be believers in conspiracies too. There is some wonder if perhaps Saudi Arabia and the United States are encouraging downward pressure on oil prices which would in turn put pressure on Russia and limit the availability to finance what they are doing. So there may be either market forces or government forces behind this.

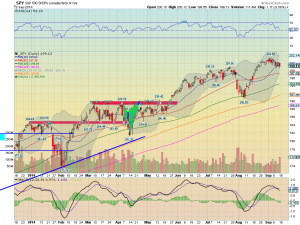

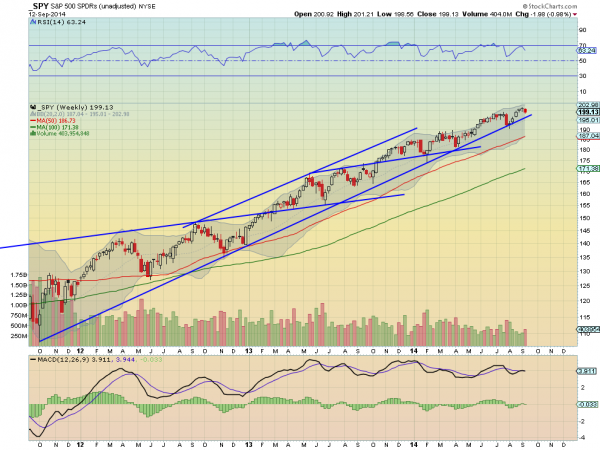

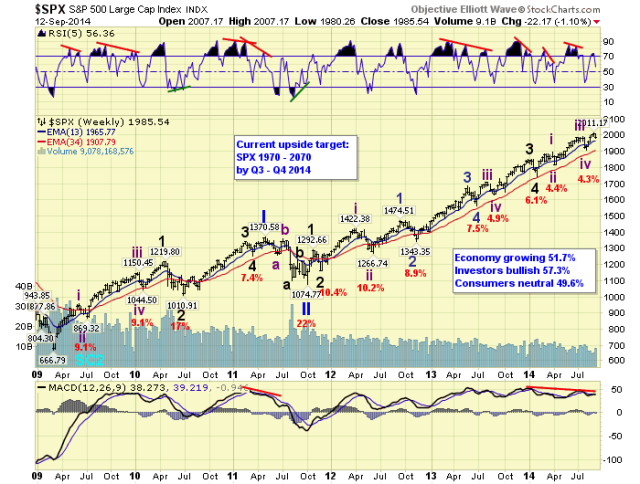

And how stable is the situation on the stock market? Equities have stalled somewhat lately. Nevertheless, at the End of August the S&P 500 closed over 2000 for the first time and so far equities have performed quite well this year again.

I think it is a question of the extraordinarily low level of interest rates. There are very few places that investors can go to and get some return. So some people are using historic yard sticks and they are saying: «If rates are this low and the economy is this okay then the value of stocks should go higher.» But some of us question that since rates are artificially low.

So what is your take on those super low rates?

I think it means that there are still deflationary pressures out there and that the central banks all around the world are fighting off that deflation risk by keeping rates low. Rates are incredibly low in Europe, they are incredibly low in Japan, they are incredibly low in England and in the United States. That drives people to look at some other avenue to get a return and they have been driven into the stock market.

With the looming end of the QE3 program, the stock market soon will have to pass an important test. But surprisingly, in contrast to the end of QE1 and QE2 investors do not seem to be so nervous this time.

But we are seeing a rather similar reaction in the bond market. Perversely, when they ended the earlier QEs, treasury yields went down instead of going up. So we are seeing a little of that. I think the reaction of the stock market has to do with something that is referred to as the Greenspan put, and later as the Bernanke put. Investors believe that the Fed is concerned about its own independence and therefore it cannot let anything drastic happen. Our government has not been able to do anything on a fiscal basis. So the Fed has gone out and developed tons and tons of access free reserves. If that fails the central bankers know that it will be quite convenient for all the politicians to point the finger at the Fed. Hence, not only is the Fed interested in maintaining the economy but also in its own independence.

During your career on Wall Street, you have seen the coming and going of several Fed chiefs. How would you grade Janet Yellen so far?

I think it is a little too early to tell because she has not been fully able to implement her policies. We have not been done with the taper and she has not clearly defined what yardsticks or mileposts she is using. She is a scholarly woman and has done a great deal of studying, like Mr. Bernanke. Also, I have a new person to look at in the Fed and that would be Stanley Fischer. He brings a lot of experience in as vice chairman. As we begin to look at his speeches and comments, we will see that he is going to have an enormous influence and we may be begin to see him helping Ms. Yellen. He is not going to confront her but helping her to, perhaps, understand why things have to change a little.

With the end of QE3 and the return to a somewhat more traditional monetary policy, investors will likely put their focus more on the fundamentals like revenues, profit margins and earnings. In what shape is Corporate America?

That is one of the great debates here. It really breaks down to on what do you view the stock market is based on. On one side, there are the skeptics. They look at macroeconomics like the GDP numbers, the unemployment rate and a variety of other things. Those people tend to have been skeptical all the way through this rally. On the other side, there are the believers in the stock market and the recovery. They have seen the earnings go up and have been spot on so far. But there is a couple of asterisks that you have to put in. Thanks to the low interest rates, companies are finding that they can improve their balance sheets and they are buying back their own shares. So even when you are earning a little less money, if there are fewer shares around, than the price earnings ratio looks pretty good. That is why the critics of the stock market say that it is all part of financial engineering. Nevertheless, the supporters will respond: «Well, here is the earnings and we are at seventeen times earnings and that is very good for us.»

On what side of this debate are the traders here on the floor at?

The view of the traders is a slight degree of skepticism. As I say, having done this over fifty years, traders are always making sure they know the way out. When I go into a room, the first thing I look for is the exit sign. So when things turn bad I know which way to go.

Also, some skeptics argue that you cannot trust this really since it is based on unusually low trading volumes. Especially at the end of August we have seen some of the lowest volume days over the past seven years.

Over the years, I was always thought that volume equals validity. Just as you would not want to elect a president with only ten or twelve people voting. You want to see a broad consensus. Likewise, you would like to see a broad consensus on what is going on at the stock market. But these days, some of that lack of volume is structural. We have new products like Exchange Traded Funds. So you can with one purchase buy the five hundred stocks in the S&P 500 instead of the five hundred transactions that would have taken place in the past. That contributes to a lower volume, too.

How did the trading business change over the last few years in general?

We are going through a transition into automated electronic trading and we are still adapting to that. The new owners of the New York Stock Exchange, the Intercontinental Exchange, said that they would like to revamp what is going on, change some of the rules and perhaps produce a little more visible activity. I for one miss some of the old trading, especially the simple things. When there was a big crowd, noise would tell me things. When the noise level picked up I would know the activity is picking up. And if you are doing it as long as I am, you could almost tell by the pitch of the noise whether they were buyers or sellers: The buyers sound a little more like a Russian chorus. The sellers, on the other hand – I guess because they were nervous – would have a higher pitch when they shout «Sell! Sell! Sell!»

Today, the silent machines of high frequency traders do most of the trading. How do you cope with those superfast computers and highly sophisticated algorithms?

They may be faster but they are not necessarily smarter. Sometimes an old dog can still learn variations of new tricks and get things done. They might get the first step out of the building but you have to think on behalf of your clients what other impact will that have. If they are doing something in General Motors (GM 33.27 -1.01%), what does it mean to Ford (F 8.9 -4.81%) or someone else? So in this business, your clients expect you to be able to relate something that is happening in a particular stock with something in the rest of the market.

In May of 2010, the Flash Crash made the world suddenly aware of what can happen when robots are in charge in the trading arenas. How vulnerable is the US stock market today to a similar threat?

I am, of course, prejudiced. I prefer the trading system that we have had through the years. Here on the floor, not one stock traded at a penny during the Flash Crash. That was only in the electronic markets. And that was because here were humans who looked at each other and said: «That does not make any sense. There is no news out, there is no event. Let’s slow down and see where things are going.» As a consequence, the prices here on the floor tended not to be distorted in a manner that they were in other places. So as far as market structure is concerned, I think it is very helpful to have humans around. I prefer that somebody is watching the market as trades are being executed – just as I would not want to fly in an airplane with no pilot.