AFTER STRAUSS-KAHN - Countries pushing for a quick resignation of disgraced IMF chief Strauss-Kahn, and others arguing a slower approach underline by coded messages who stands to gain or lose when a new IMF chief is named by a weighted majority vote at the IMF's 24-person executive board. But whoever wins, we all lose when the IMF-run gold laundering and illicit or 'gray' capital recycling operations get known.

The IMF board has its 400-pound gorilla, the USA represented by Timothy Geithner and seconded, as Alternate US governor of the Fund, by Ben Bernanke with a total of 17.75 percent of votes as of May 18, 2011 according to the IMF website. No other country at present holds more than the approximate 6 percent of votes each held by Japan and Germany. Voting power of member states is the focus of protracted, mostly secret discussions. The latest started in 2008 and reached an interim accord in 2010, but the basic target is who gets their hands on IMF powers like its gold sales, its help to private banks with and through the BIS, its SDR printing rights, and its control of capital flows.

The USA's 17.75 percent of votes is set against the European bloc led by Germany, France, and UK with a total of about 14.5 percent. Adding other European states including Italy and Holland, the weighting tilts in favour of the Europeans, but the solidarity of the European bloc is itself less than certain. Officials in developing nations also show no special sign of unity to back a single candidate, when there is an IMF leadershiprace, despite the claim that non-OECD G20 countries led by the "BRIC group" are pushing to boost the say of emerging economies in the IMF and World Bank. Among the BRIC we can note the careful statement on how to select Strauss-Kahn’s replacement from Chinese Foreign Ministry spokeswoman Jian Yu, stressing this process must be “fair, transparent” and aimed at finding the best person for the job.

Clearly underlining the fragility of the so-called divide among IMF member countries along North-South lines, Brazil's President Dilma Rousseff has no intention of using the current crisis to push an emerging market candidate to lead the fund, according to government officials speaking off-record. Brazil's Finance minister Guido Mantega put things a lot clearer in a 17th May Brazilian TV interview, saying: “I am rooting so that this situation resolves itself in a positive way for Strauss-Kahn", prompting observers to note that as IMF chief, Strauss-Kahn has been an ally of Brazil and other emerging markets seeking greater IMF power to decide key issues at the IMF. Behind the scenes, this also concerns central bank gold reserves, which in Brazil's case are low, while Brazil's ex-colonial mother country of Portugal has huge financing deficits but also large official gold reserves hocked to the IMF as part of the 2011 bailout.

What has happened during the 3-plus years when Strauss-Kahn headed the IMF is a fantastic change of the gold market and world central bank finances, to the extent that IMF gold laundering is the right term to apply, along with IMF cash injections to selected big-name private banks, operated with the BIS. With Strauss-Kahn suddenly gone, the situation is ripe for crisis because so many trial balloons were flying, along with the false flags and market-fooling operations set up by this long-time player in French political infighting, supposedly to save the global finance system.

BIG BAILOUTS

The vast change in the IMF's role and power in world finance and money system functioning is shown by IMF bailout operations since 2006. These exploded more than 100-fold to around $ 91 billion in 2010. This trend continues as the world finance and banking crisis deepens, and the IMF has to generate its own financial resources to operate ever bigger bailouts. Since the start of 2011 these include the IMF's one-half share in the $ 146 billion 2011 bailout operation for Greece with the European Union and central bank (ECB),and the $ 111 billion bailout for Portugal.

As far back as May 2009 the key future role of the IMF as lender of last resort to failing government finances and weakened private commercial banks was highlighted by IMF members approving a sudden jump in future resources to $ 500 billion, following the proposal for that jump made only one month before, at the April 2009 G20 meeting. Of this, the Obama administration would pledge $ 100 billion. Separately, the IMF would issue - that is print - additional SDRs or special drawing rights to a total of $ 250 billion in exchange value, that is SDRs exchanged for US dollars as and when needed.

Overall these actions would increase lending power of the IMF by $ 750 billion. We can note that in 2006, total IMF whole-year operations were less than $ 1 billion in exchange equivalent.

To be sure these amounts may be massive, but they run behind the debt-and-deficit crisis of governments, and the closely-related crisis of the supposedly "still in recovery" and restructuring private bank system. This has its own lender of last resort - the Bank for International Settlements or BIS in Bale, Switzerland.

The debt and bank failure crisis is far more massive than what the IMF can get its hand on in the way of gold reserves, or dares to print as SDRs. US Federal debt has grown by about $ 3 600 billion from December 2008 to April 2011, to more than $ 14 500 billion or close to 98 percent of US economic output. European government debt growth since Dec 2008 is probably close to, or larger than this. Asian OECD countries led by Japan in debt terms have also suffered runaway debt growth. Global debt growth and therefore search for liquidities since end-2008 is likely at minimum $ 25 000 billion, almost exactly one-half of world annual GDP today.

MISSING GOLD, MISSING CAPITAL FLOWS

The link between state level financial bailouts run by the IMF featuring loans and support to the sale of state debt, and support to the world's private banking system by the BIS, is covered by accords and protocols dating back to the IMF's founding in 1944. The BIS was founded earlier, at the start of the 1930's Great Depression.

The processes described in IMF and BIS publications are not related to most real world operating arrangements run by these two semi-secret entities, and their real arrangements are unpublished and held secret, in particular the sale and swapping of central bank gold and the reporting of illicit or illegal capital flows. Concerning gold, the claimed reasons for this secrecy include the market effect of announcing gold sales and impacts on the currency exchange rates of bailed-out countries.

In the 3-plus years since Strauss-Kahn took power at the IMF, according to IMF reports and statistics the firewalls between central bank gold sales and swaps, and illicit, grey or "hot" capital flows and flight have stayed firm and leakproof, despite global financial and monetary upheaval. As one example, IMF reports claim that as of year 2010, global capital flight to and from low income and small island countries (these including non-OECD tax havens) is around $ 25 billion. The probable amount is more like $ 200 billion. Other estimates run higher.

The same deliberate opacity, or less politely simple lying applies to IMF and BIS gold sales and swaps. For the USA, the powerful GATA movement underlines that the US no longer even calls the supposed large hoard of gold at Fort Knox “gold reserves”, but instead calls them reserves and swaps. In other words, like the IMF, the US central bank carefully avoids saying how much of the hoard is “loaned” or "pledged" through the BIS and either directly or indirectly handed over to the so-called bullion-banks, the select group of private banks authorized to re-sell government gold, with the IMF and BIS.

In the same way as other central banks, the US government will not say how it could possibly replace sold or swapped gold, and how much of the gold stored at Fort Knox officially belongs to other governments. If it tried to buy gold - like other central banks are trying - the purchase of large tonnages of gold could only and would only drive up the price of gold. Today, the actual amount of US gold still held at Fort Knox and able to be sold, that is "unencumbered" and actually belonging to the U.S, is a closely-guarded state secret.

The IMF website as of May 18, 2011 continues to say the IMF will maintain gold sales, and suggests rather than states it can and will if necessary sell about 400 tons per year, as in 2009-2010 when IMF-origin gold sales were about 403 tons.

The website doe not give any firm data on the balance of swap gold versus freely saleable gold making up the claimed gold reserves of the IMF. It goes on to say that reserves available to the fund, including swaps with central banks - as of April 1978 - were exactly 3226 tons. As of March 2011, it claims this amount is 2814 tons when reporting to the World Gold Council, but has also published the figure of 2981 tons for the same date. Whatever the exact number, and knowing there are 32 150 Troy ounces to a metric ton, we find this is a tiny amount relative to gigantic financing needs.

We can compare this 2011 claim for IMF gold reserves with the 1978 base, and the global economy's growth since 1978, OECD debt growth since 2008, and the programmed future growth of IMF bailout operations in the near-term. In real terms, IMF gold reserves have plummeted. Even worse and in reality, they are likely even smaller, needing political fixers like Strauss-Kahn to weave plausible- looking stopgap solutions.

Many observers suggest actual physical, unencumbered and available-to-sell gold reserves of the IMF as of April 2011 are well below 200 tons. Around 2600 tons of claimed reserves are therefore in the form of gold pledges and swaps with central banks, for example the US Fed, the Portugueseeeee and Brazilian central banks and others, also involving the BIS, and its friends the authorized bullion banks including JPMorgan Chase, Barclays, Scotia Mocatta and the Sino-English HSBC. This last bullion bank, without ever declaring it, operates a major gold buying strategy for Chinese authorities only at the second-tier bullion bank level, that is semi private purchase rather than directly with the IMF through offsetting IMF SDRs against physical gold.

WHY SELL GOLD THAT DOESNT EXIST ?

All these rightly named players are effective sellers of physical gold - when they have it. When they dont have it, and in last resort they have to buy it. All face rising competition from the gold ETFs (exchange tradable gold funds) and private metal buyers. Upstream and only in the case of the IMF, it has the master privilege of being able to print SDRs, and swap these for gold from any central bank willing and able to do so. The second condition is increasingly determinant, but the first one is also getting sticky.

Evidence shows that being able to sell gold is getting harder with every passing day. This is marked by the massive rise in gold prices since year 2000, and further shown by the leaden predictability of central banks buying gold when its price is rising, like today, and selling gold when its price is falling. The second case is exemplified by the UK's Bank of England dumping up to one-half of its physical gold reserves early this century (starting in May 1999) at the ultimate bottom market price: a veritable triumph for the hands-on finance minister of the period, 'Goldfinger' Gordon Brown.

With Strauss-Kahn the IMF had a person with his fingers on an ultra-fast fly zipper, charged with creative gaming claimed to avert terminal and global economic nemesis. The founding of the BIS in 1930 and the 1944 founding of the IMF were set in times of global economic crisis and its sequel: world war 2.

The Keynesian doctrine is that fiat paper money must be defended by "de-monetizing" gold, that is central banks acting in concert to depress gold prices, by dumping gold without warning on the physical market. To do this, central banks need to constitute large physical gold reserves - but should they buy gold when the price is rising ? Keynes himself never considered that question !

When gold gets too expensive and-or where the physical gold does not exist it must be invented, through the interplay of IMF SDRs and gold swap arrangements - and creative lying. Showing the fundamental schizophrenia of this economic doctrine, and its succeeding neoliberal mutant version, inflation is seen as the greatest evil next to declining economic growth, itself enshrined as the only way to create employment and provide social security. In this Neo-Keynesian doctrine, gold prices must be permanently held down and fiat paper money must be printed in sufficient amounts to drive economic growth, but not to generate inflation. When inflation inevitably rises, it is magicked out of the statistics by creative lying. The solid backstop for this is inventing CPI-price inflation data that coyly ignores food, energy and rental housing.

The role of Keynesian-type economics and spiralling government debt are in fact and reality mother-and-son related, as is well known, but since 2008 this fine tuning has gone into meltdown. For the IMF-BIS system or process for bailing out both governments and private banks, the writing in on the wall.

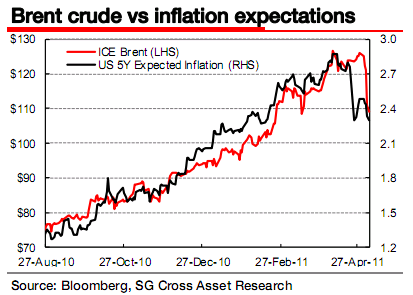

Tracing IMF gold sales, the gold price shows that since 2008 its surprise sales strategy has little or no lingering impact on gold prices, and the role of major second tier players like Goldman Sachs Co, is only to cause short downturns and downward ripples in the gold price expressed in US dollars, euros or yen, or alternatively short upturns in the value of the US dollar. Exactly like other out of control commodities like oil, the world gold market now includes a vast overlay of futures trading players, resulting in a physical-to-paper gold ratio for open market gold trading of at least 1 : 200.

The IMF can print SDRs, utilise these to obtain gold pledges from central banks that may or may not have the physical god they claim to have, and with its shadowy ally and partner the BIS can prop the overstretched private banking system of the OECD countries, by laundering this gold. To this capital injection we can almost certainly add IMF and BIS recycling and cleaning of black and illicit capital flows,, perhaps as much as $ 180 billion per year.

Few persons know exactly how much of the claimed physical gold reserves still exist in the world's central banks, and how, and how much illicit capital flows are channelled to the world's private high street banks. One of them was however Dominique Strauss-Kahn. With the sudden disappearance of this sex animal the risk for the IMF and BIS is a break in the logjam of hidden and grey data: the killer facts could heavily weaken the scam, or even make it disappear - at a critical moment.

See the original article >>