By John Mauldin

The Endgame Headwinds

If Something Can’t Happen…

GDP = C + I + G + Net Exports

Increasing Productivity

Toronto, Cleveland, LA, Philadelphia, Boston, and Italy

I have written repeatedly about the Endgame in the weekly letter, as well as in a New York Times best-seller on the same topic. By Endgame I mean the period of time in which many of the developed economies of the world will either willingly deleverage or be forced to do so. This age of deleveraging will produce a fundamentally different economic environment, which the McKinsey study referenced below suggests will last anywhere from 4-6 years. Now, whether this deleveraging is orderly, as now appears to be the case in Britain, or more resembles what I have long predicted will be a violent default in Greece, it will create a profoundly different economic world from the one we have lived in for 60 years. This makes sense, in that the prior world was defined by ever-increasing amounts of leverage. Outright reductions in leverage or even a significant slowing of the rate of growth is a whole new ballgame, economically speaking.

In all this I have explained the various options facing the developed world, but I have refrained from putting forth my own estimates as to what will actually happen and what the environment surrounding that outcome will be. That is about to change. I have been giving this a great deal of thought and research. While my conclusions will be somewhat controversial (I know, surprise, surprise), with enough to offend almost everyone on some point, I hope that I can muster enough clarity to help you think through your own personal views and how you will respond to what I think will be yet another crisis on the not-too-distant horizon. Whether that is Crisis Lite or Crisis Depression is up to us and the politicians we elect. I argue that we need to choose most wisely, because we are at a crossroads that is as critical as any since 1940.

As I start this letter, I am on a flight to San Diego, where I will co-host my 8

th annual Strategic Investment Conference. As usual, I will be the last speaker on Saturday. This letter will be the beginning of that speech, and we will conclude (hopefully) next week. What I hope to do here is summarize the main points, add some new ones, and then move on to how I think the Endgame will play out. These next two e-letters will be among the more critical ones of the last few years. Feel free to forward, and if you are reading this letter you can join my one million closest friends and sign up for my free weekly letter at

www.johnmauldin.com. (This letter may print longer than usual, as it will have a significant number of graphs.)

But before we jump in, many of you know that I am a serial entrepreneur. I look for business opportunities for inclusion in “the Mauldin companies.” My “hobby,” if you will, is looking at cutting-edge biotechnology. You have been asking for details and an update on one I mentioned last year. We partnered with a very serious biotech research firm, International Stem Cell Corporation, whose scientists discovered a patent-pending formula that rejuvenates skin. We continue to partner with them to help augment this breakthrough and, most importantly, to help fund their therapeutic research to find cures for very serious diseases. You can learn more at

www.lifelineskincare.com/antiagingbreakthrough. Now, let’s get into the letter.

Before we can get to how I think the Endgame of the debt supercycle plays out in the US, we need to quickly survey the current environment, and revisit (at least for long-time readers) a few basic economic themes that I will call the “headwinds” of economic growth. So many leaders in so many countries think that with the right policies they can grow (export) their way out of the problem. As I have written, not everyone can grow their way out of a crisis at the same time. Someone has to buy.

And while the right policies will in fact help, growth is, in my opinion, going to be severely constrained in the multi-year period of the Endgame. But, jumping right to the bottom line here, one way or another we will get through this very difficult period. Really. And my personal view is that in the period following the Endgame cycle we’re going to see a very real economic boom, for reasons we will visit briefly in this series and at length over the coming year. I am quite optimistic longer-term, but the flight to get there may be very bumpy if you are not prepared for it. I will try to do my part to help you.

Briefly, for new readers, let me define what I mean by the Endgame, as dealt with at length in

Endgame: The End of the Debt Supercycle and How It Changes Everything (

www.amazon.com/endgame). The US in particular and much of the developed world in general began a cycle of ever-increasing debt in the late ’40s, after World War II, both in the private and public sectors. Government began to grow as a percentage of overall GDP in the latter part of this cycle. In addition, politicians created large (well, huge) entitlement programs of pensions and health-care benefits that require significant taxes and, as we shall see, are unsustainable in the our present medium term.

There is a limit to how much money an individual or country can borrow. We all intuitively know this. If you grow your debt faster than your income and your ability to service the debt over a long period of time, people will eventually stop loaning you money. This is true for individuals, businesses, and nations. The end result is a restructuring of the debt (default by one of several means, including serious inflation) or a very reduced standard of living (by previous standards) for a period of time in order to service the debt. For individuals, that may mean cutting off the cable, no eating out, no vacations, etc. For countries it means reduced government programs and benefits, and higher taxes.

And make no mistake. I believe that the situation in the US is becoming urgent all too quickly. We are risking the health of the economic body of the US. While the republic will survive the crisis, the shocks and burdens it will place on all of us will be very great. For those not prepared it will seem like the end of the world, as jobs and safety nets might evaporate without proper restructuring. As I argue, the goal of fiscal sanity is to get the growth of the debt below that of the growth rate in nominal GDP. Failure to do so will result in the US suffering much as Greece or Ireland are today. Ugly.

The 2008 banking crisis showed us the limits of how much individuals can borrow, at least against their home equity. Since then, private debt (except recently for student loans in the US) has begun to shrink. But governments everywhere stepped into the breach by massively borrowing. But even governments, including the US, have a limit. We see that in Greece and Ireland, and are watching the debt crisis unfold in Portugal and Spain as well. It will soon become all too painfully clear in Japan. As I have often noted, Japan is a bug in search of a windshield. Japan is big enough that when it hits its own version of the Endgame, it will shake the world. It will not be pretty. (But there are opportunities for the nimble.)

As we will quickly cover here, the economic environment in which individuals and governments either willingly or are forced by the markets to reduce their borrowing and debt is significantly different from the period where they could create ever-increasing amounts of leverage. I call this period the Endgame. What we think of as normal gets turned upside down. Volatility increases, at a minimum. For many people this will qualify as a true crisis. But if you can see it coming and prepare, you can at least insulate yourself (somewhat) from many of the negative aspects of the Endgame. And volatility and crisis also mean that there will be opportunities for those prepared for them.

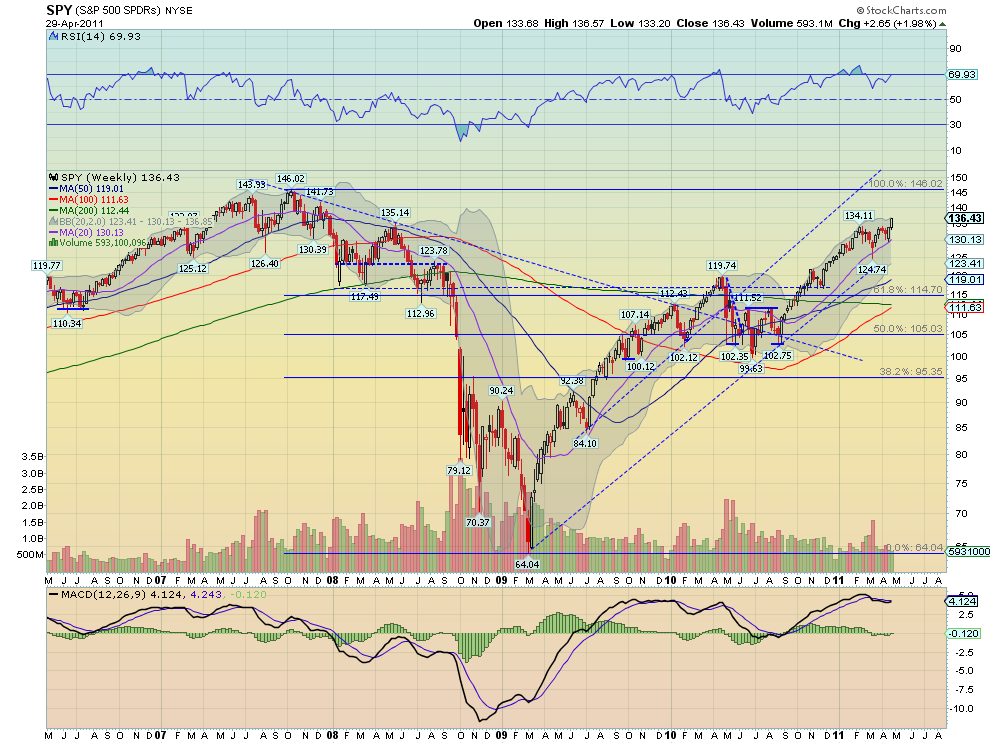

Now, let’s look at three graphs. The first is familiar to long-time readers. It shows the rise of debt in the US. And even with the recent pullback in consumer debt, because of the enormous government deficits, the rise is still there if we update this chart to last year.

The next two charts come from the Bank of International Settlements. They outline for 12 countries what happens, in terms of the debt-to-GDP ratio, if current spending and tax rates remain unchanged (the top dotted line), what happens if there are efforts to rein in spending with small gradual spending cuts and tax increases (middle line), and what would happen with serious spending cuts and significant tax increases (the lowest line). Some countries, even with measures that could be considered draconian, simply do not recover.

While the chart shows what would happen if age-related spending were held constant, most seniors would think that getting ever-smaller pensions and health care would be drastic measures indeed. These countries are in an unsustainable spiral, which means drastic (the word used by the BIS) measures will be needed.

Note that there is only one example of a country that ever saw its debt-to-GDP rise over 150% and did not default, and that is Britain at the height of its empire and power, with long-term rates at a very low level and a completely different investment and bond climate. But notice how many of the countries are now on a path to twice that level in the very near future.

There is rule in economics: If something can’t happen, it won’t happen. That may seem obvious, but so many people think the current linear trend can go on forever. This time is different, we tell ourselves. And I (and some others, like David Walker, Stockman, etc.) are telling you that so many things are on unsustainable paths that changes in present trends, as much as we might not like to think about them, are inevitable. So what we must think about now is what will happen when change is either forced on a country or entered into willingly. Some times you have to think the unthinkable.

Look at the projected debt for the US, compiled last year by the Heritage Foundation, based on realistic assumptions, not with rose-colored glasses. This is a chart of something that will not happen. Long before we get ten years of multi-trillion-dollar debt, the bond market will being to require much higher rates than we currently experience, driving up the interest-rate cost as a percentage of tax revenues to very painful levels, forcing cuts in all sorts of things we currently think of as absolutely necessary, like military, education, and Medicare spending. Later on I will put a timeline on this prediction.

One way or another, the budget deficits are going to come down. As we will see later, we can choose to proactively deal with the deficit problem or we can wait until there is a crisis and be forced to react. These choices result in entirely different outcomes.

In the US, the real question we must ask ourselves as a nation is, “How much health care do we want and how do we want to pay for it?” Everything else can be dealt with if we get that basic question answered. We can radically cut health care along with other discretionary budget items or we can raise taxes, or some combination. Both have consequences. The polls say a large, bipartisan majority of people want to maintain Medicare and other health programs (perhaps reformed, but still existent), and yet a large bipartisan majority does not want a tax increase. We can’t have it both ways, which means there is a major job of education to be done.

The point of the exercise (reducing the fiscal deficit to sustainable levels) is to reduce the deficit over 5-6 years below the growth rate of nominal GDP (which includes inflation, about which more below). A country can run a deficit below that rate forever, without endangering its economic survival. While it may be wiser to run some surpluses and pay down debt, if you keep your fiscal deficits lower than income growth, over time the debt becomes less of an issue.

But either raising taxes or cutting spending has side effects that cannot be ignored. Either one or both will make it more difficult for the economy to grow. Let’s quickly look at a few basic economic equations. The first is GDP = C + I + G + net exports, or GDP is equal to Consumption (Consumer and Business) + Investment + Government Spending + Net Exports (Exports – Imports). This is true for all times and countries.

Now, what typically happens in a business-cycle recession, as businesses produce too many goods and start to cut back, is that consumption falls; and the Keynesian response is to increase government spending in order to assist the economy to start buying and spending, and the theory is that when the economy recovers you can reduce government spending as a percentage of the economy – except that has not happened for a long time. Government spending just kept going up. In response to the Great Recession, government (both parties) increased spending massively. And it did have an effect. But it wasn’t just the stimulus, it was the absolute size of government that increased as well.

And now massive deficits are projected for a very long time, unless we make changes. The problem is that taking away that deficit spending is going to be the reverse of the stimulus – a negative stimulus if you will. Why? Because the economy is not growing fast enough to overcome the loss of that stimulus. We will notice it. This is a short-term effect, which most economists agree will last 4-5 quarters, and then the economy may be better, with lower deficits and smaller government.

However, in order to get the deficit under control, we are talking on the order of reducing the deficit by 1% of GDP every year for 5-6 years. That is a very large headwind on growth, if you reduce potential nominal GDP by 1% a year in a world of a 2% Muddle Through economy. (And GDP for the US came in at an anemic 1.75% yesterday, with very weak final demand.)

Further, tax increases reduce GDP by anywhere from 1 to 3 times the size of the increase, depending on which academic study you choose. Large tax increases will reduce GDP and potential GDP. That may be the price we want to pay as a country, but we need to recognize that there is a cost to growth and employment. Those who argue that taking away the Bush tax cuts will have no effect on the economy are simply not dealing with either the facts or the well-established research. Now, that is different from the argument that says we should allow them to expire anyway

There are only two ways to grow an economy. Just two. You can increase the working-age population or you can increase productivity. That’s it. No secret sauce. The key is for us to figure out how to increase productivity. Let’s refer to the last equation.

The I in the equation is investments. That is what produces the tools and businesses that make “stuff” and buy and sell services. Increasing the government spending, “G”, does not increase productivity. It transfers taxes taken from one sector of the economy and gives them to another, with a cost of transfer, of course. While the people who get the transfer payments and services certainly feel better off, those who pay taxes have less to invest in private businesses that actually increase productivity. As I have shown elsewhere, over the last two decades, net new jobs in the US have come from business start-ups. Not large businesses (they are a net drag) and not even small businesses. Understand, some of those start-ups become Google and Microsoft, etc. But many just become small businesses, hiring 5-10-50-100 people, but the cumulative effect is growth in the economy and productivity.

Now, if you mess with our equation, what you find is that

Savings = Investments.

If the government “dis-saves” or runs deficits, it takes away potential savings from private investments. That money has to come from somewhere. Of late, it has come from QE2, but that is going away soon. And again, let’s be very clear. It is private investment that increases productivity, which allows for growth which produces jobs. Yes, if the government takes money from one group and employs another, those are real jobs, but that is money that could have been put to use in private business. It is the government saying we know how to create jobs better than the taxpayers and businesses we take the taxes from.

This is not to argue against government and taxes. There are true roles for government. The discussion we must now have is how much government we want, and recognize there are costs to large government involvement in the economy. How large a drag can government be? Let’s look at a few charts. The first two are from my friend Louis Gave, who will be speaking at my conference this weekend. This first one is the correlation between the growth of GDP in France and the size of government. This chart shows the rate of growth in GDP and the ratio of the size of the public sector to the private sector. The larger the percentage of government in the ratio, the lower the growth.

I know, you think that is just the French. We all know their government is too involved in everything, don’t we. But it works in the US as well. The chart below shows the combined federal, state and local expenditures as a percentage of GDP (left-hand scale, which rises as the line falls) versus the 7-year structural growth rate, shown on the right-hand side. And you see a very clear correlation between the size of total government and structural growth. This chart and others like it can be done for countries all over the world.

S

idebar: Now, I would not argue, as some libertarians do, that we need almost no government. I do not. But we must recognize the cost-benefit. I think the benefits of police are clear. Schools. A professional military (its use can be up for debate). Financial regulation. Courts. Etc. Certainly, society functions better with these and other services, and in a broad sense you can say that increases productivity. We “buy” services collectively with tax dollars that are seen as essential public goods. Those services could be offered by private companies.

But there is a limit in the minds of most people. Do you want your government to own the steel mills and airlines? Energy production? In many countries and at times in history, the answer was yes. But government-run businesses are rarely as efficient as private ones. And that efficiency is a direct component of productivity.

Next, (and finally for this week), let’s look at a chart from my good friend Rob Arnott. This is part of what will one day be an Outside the Box. (For new readers, this is a publication that goes out Monday night, which features the writing and thinking of someone other than your humble analyst, and which I don’t always agree with, but that does make us think. You can get it at

www.johnmauldin.com just by putting in your email address and becoming one of my 1 million closest friends.)

The chart needs a little set-up. It shows the contribution of the private sector and the public sector to GDP. Remember, the C in the equation was private and business consumption. The G is government. And G makes up a rather large portion of overall GDP.

The top line (in dark blue) is real GDP per capita. The next line (yellow) shows what GDP would have been without borrowing. So a very real portion of GDP the last few years has come from government debt. Now, the green line below that is private-sector GDP. This is sad, because it shows that the private sector, per capita, is roughly where it was in 1998. The growth of the “economy” has been government.

Is it any wonder that we have no net new jobs over the last decade? I get that there have been two recessions, but in an effort to appear to be “doing something,” to “feel your pain,” government is slowly sucking the air out of the room. Not all at once. Just a bit at a time.

And it shows up in worker pay. The average worker has not seen their pay rise in real terms in almost 15 years. If they have a job. In fact, for the last decade, they LOST 5%.

Do you want more tax revenues so we can have more government services like health care? We have to grow the private economy. If we tax the private economy as it is now, that will just reduce the growth in the private economy and slow or reduce the growth of jobs. There is simply no way to get around that fact.

I will close here and start with part two next week. But the short take-away? The fiscal deficit and the national debt are a cancer on our economic body. They threaten to destroy the economic body of the republic. As a conservative, simply writing the words “tax” and “increase” in the same sentence makes me nervous. But I am even more afraid of what will happen if we do not get the deficit under control over time (next week we’ll explore why we cannot do it all at once). Sometimes, when they have cancer, people take drugs they would not normally want to be in the same zip code with, in order to increase their chances of surviving. But those drugs have side effects, some of them quite severe and long-term.

How we solve this crisis will determine the nature of the Endgame. But that is for next week.

I am in La Jolla with about 450 attendees at my annual Strategic Investment Conference, co-hosted with Altegris Investments. It is a fabulous, sold-out event. It is truly one of the highlights of my year, joining so many old and new friends for a few days. And the intellectual conversation? Wow. We are recording the panels and hope to make them available at some point.

I fly to Toronto on Sunday for a quick speech, then back to Dallas, on to Cleveland for a night, then right off to Rob Arnott’s annual conference in LA. Another very impressive line-up and one that I am privileged to be allowed to participate in. Then home for a weeks to catch my breath.

I will be in Philadelphia Tuesday May 24 to moderate a panel and listen to a serious gathering of speakers at the 29th annual Monetary and Trade Conference, where the topics are “Is Housing Ready for a Rebound?” and “QE2, Housing and Foreclosures: Are they Related?”

Philly Fed president Tom Hoenig, Chris Whalen, Michael Lewitt, Paul McCulley, William Poole, and Gretchen Morgensen, among others. To find out more you can go to

http://www.interdependence.org/Event-05-24-11.php. Then it’s on to Boston with some friends for fun (and a board meeting), then straight to Italy and a train to the little village of Trequanda in Tuscany, where vacation for me is staying in the same place for a few weeks, writing and thinking, and having friends show up. The kids will be there for the beginning, and Tiffani and I will make it a working vacation after that. And then I’m off to Kiev, Geneva, and London with my youngest son in tow; but more on that later.

It is time to hit the send button. I have 450 guests wondering where I am, so I bid you adieu for today, and we will finish up next week. Have a great week.

Your just a very happy and contented analyst,