by

Last week’s review of the macro market indicators looked like higher prices for Gold and a bias higher for Crude Oil and US Treasuries. The US Dollar Index looked to continue its death march lower with the Shanghai Composite and Emerging markets moving to the upside. Continued subdued volatility would be supportive to more upside for the equity index ETF’s, SPY, IWM and QQQ, but being mindful that all three printed potentially bearish reversal candles on Thursday. Continued caution on the long side.

The week moved as anticipated from the charts with the exception of the Shanghai composite, which bounced lower off of resistance and the Emerging market that consolidated sideways. A very technical week. But what about the details and what does it mean for next week. Let’s look at the charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

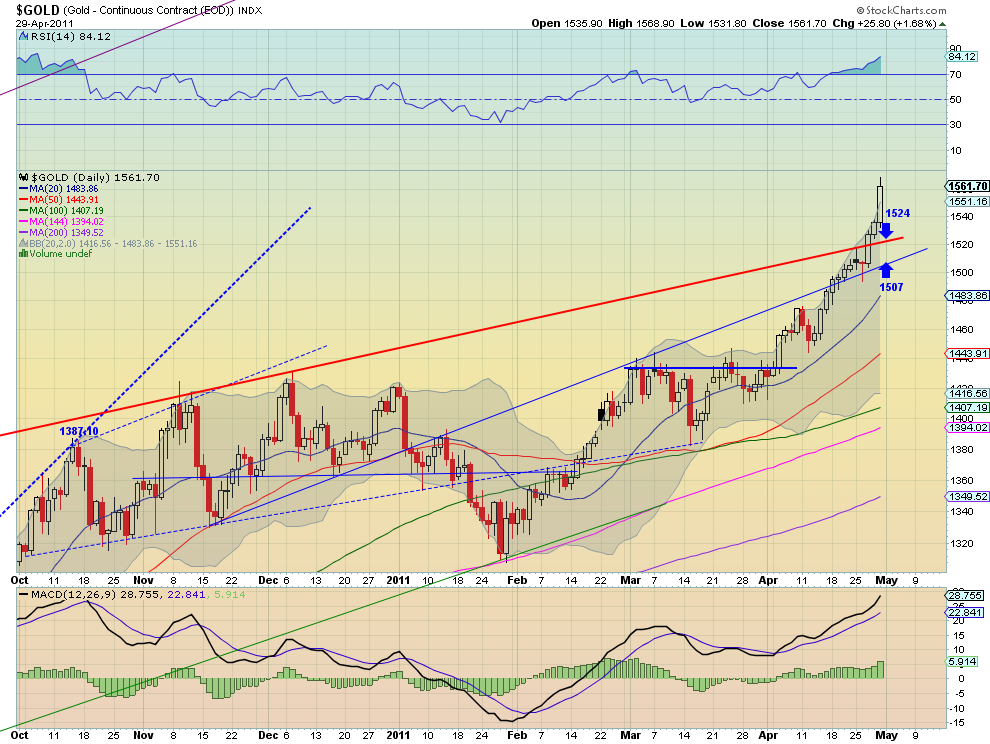

Gold Weekly,$GC_F

Gold returned to its beastly ways rocketing higher after holding support of the trendline extension (in blue on daily chart). The Simple Moving Averages (SMA) are accelerating higher along with the Moving Average Convergence Divergence (MACD) indicator. The Relative Strength Index (RSI) is also sloping higher but is starting to get a bit lofty at 84 on the daily chart and it closed outside of the Bollinger bands (BB), both suggesting some caution and a potential pullback or consolidation. If it does then there is support at 1524 and then 1507. The weekly chart shows the rise to resistance at the intermediate dashed trend line, with resistance higher at 1610. It also has rising SMA and MACD, and a RSI that is near the caution zone with it outside of the weekly BB. The weekly also suggest some caution, and it is understandable after a $150 move in 4 weeks. Look for Gold to continue its trend higher but with the expectation that it will slow down its rise and consolidate shortly.

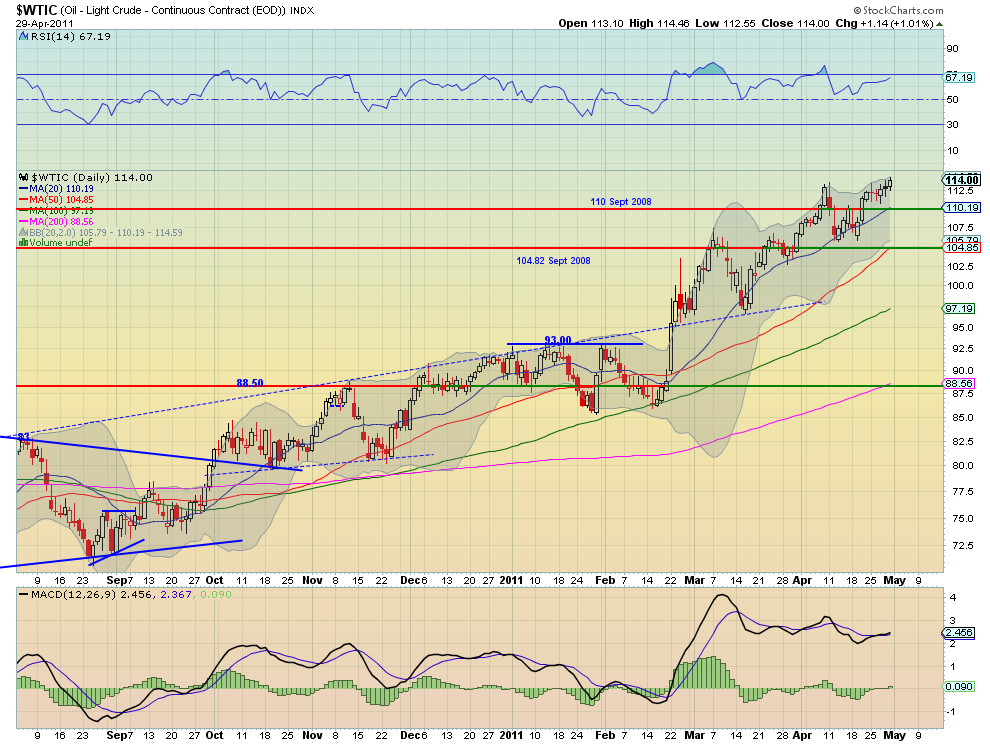

West Texas Intermediate Crude Weekly,$CL_F

Crude Oil moved higher slowly through out the week with a series of small candles on the daily chart, culminating with a breakout higher Friday. The SMA’s are all sloping higher and the RSI is slowly rising on the daily timeframe, but the MACD has just turned positive. The weekly chart shows a push through 113.50 resistance to end the week and it can now look higher. The SMA’s are turning higher and the RSI is rising, but the MACD is stalling. Look for Crude Oil to continue its move higher into next week with the potential that it consolidates or has some small moves. 121.29 is the target after it can get through the 119 level which is a Measured Move (MM) higher on the daily chart.

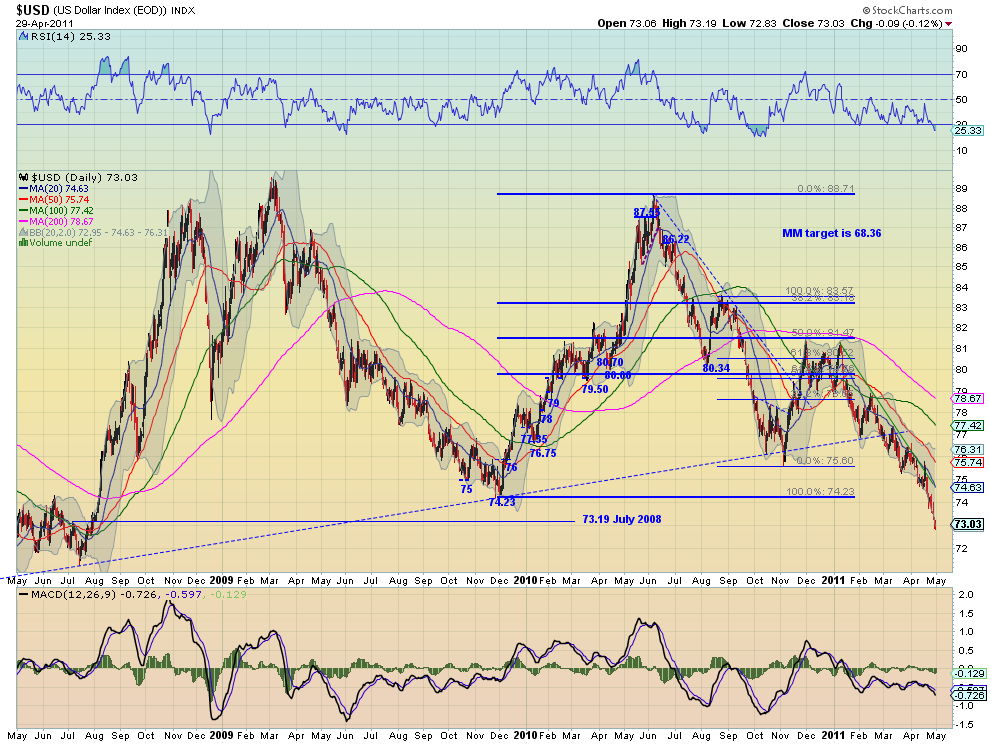

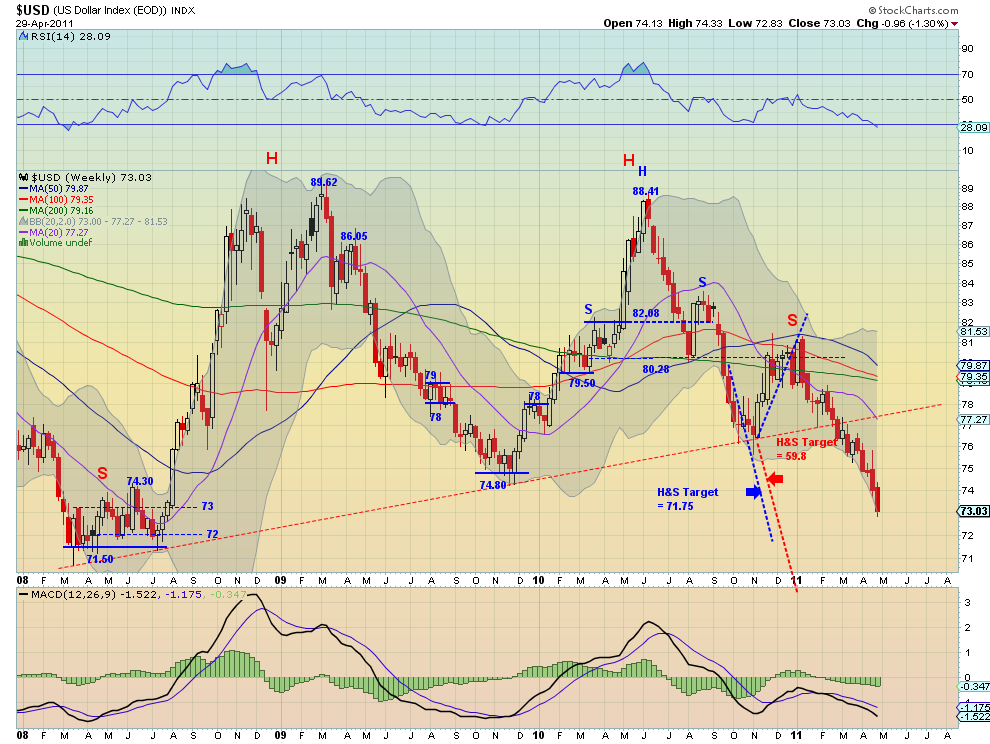

US Dollar Index Weekly,$DX_F

Down. That is all there is to say about the US Dollar Index. It was down for the week and it looks set up to continue lower next week. Everything is trending down on both timeframes: the SMA’s, RSI, and the MACD. The danger zone approaches as it heads to the 71.50 area which is an all time low. There is support at 73 and 72 along the way. Enough said.

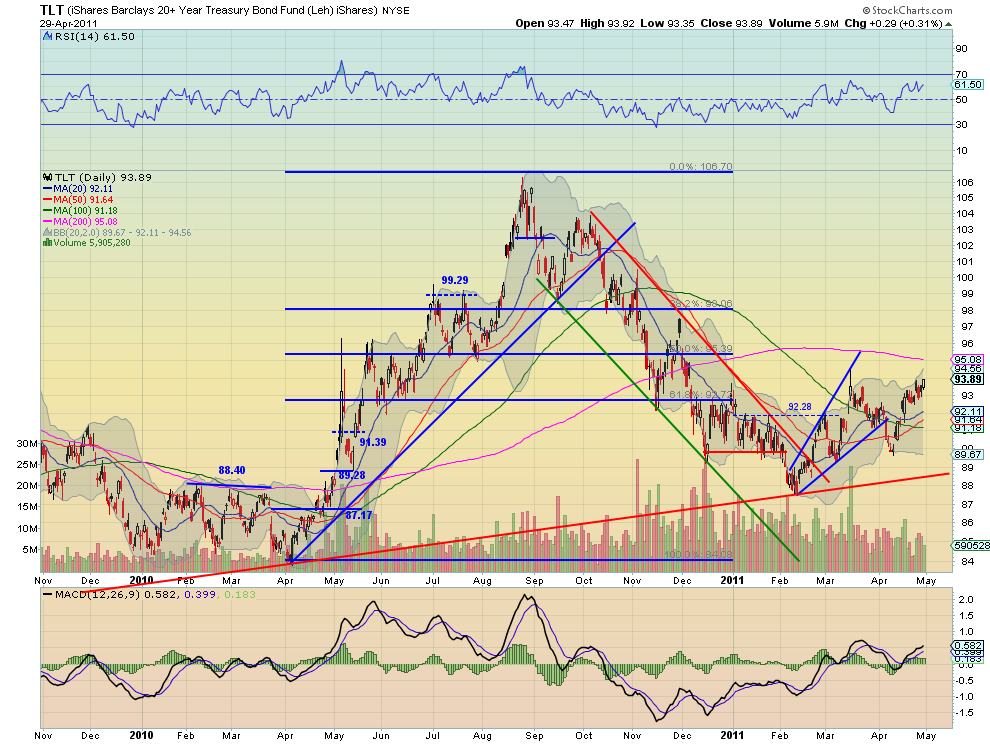

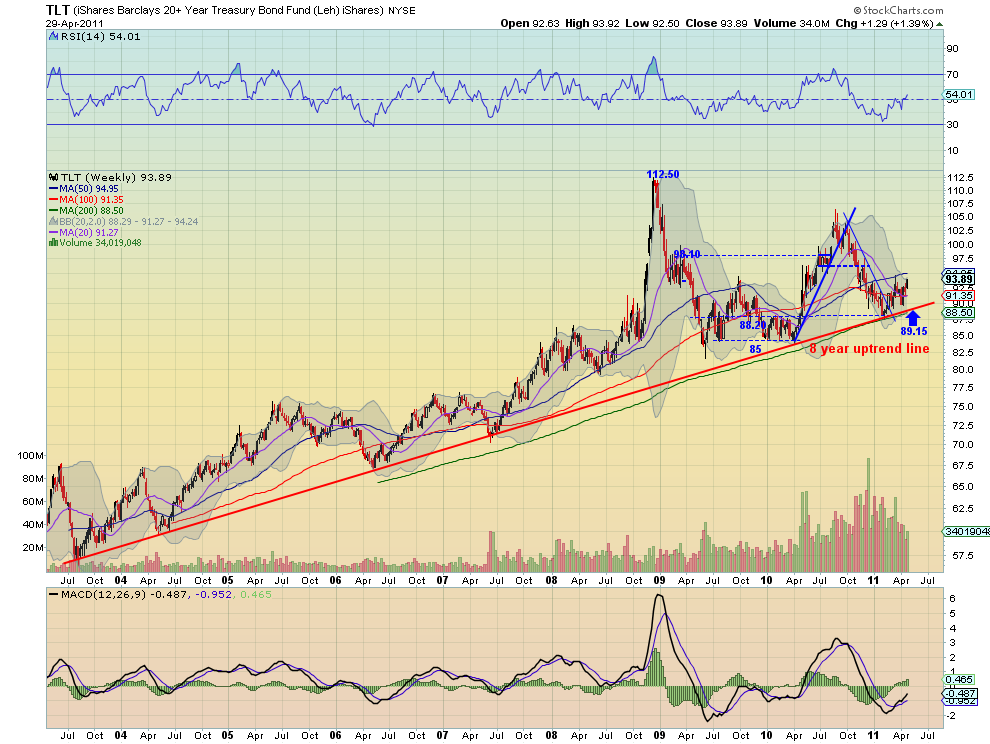

iShares Barclays 20+ Yr Treasury Bond Fund Weekly,$TLT

US Treasuries, proxied by the TLT, continued the recent uptrend the past week within mixed technicals. On the daily timeframe the shorter 20 and 50 day SMA’s have turned higher but the longer 100 and 200 day SMA’s are still sloping downward. The RSI is vacillating in bullish territory and the MACD is flat but positive. The weekly chart is slightly bullish with an RSI and MACD that are rising and all but the shortest SMA sloping higher. The long term trend remains higher and look for Treasuries to continue in that direction next week with some resistance at the 95 area, which could the catalyst for a breakout higher or pullback.

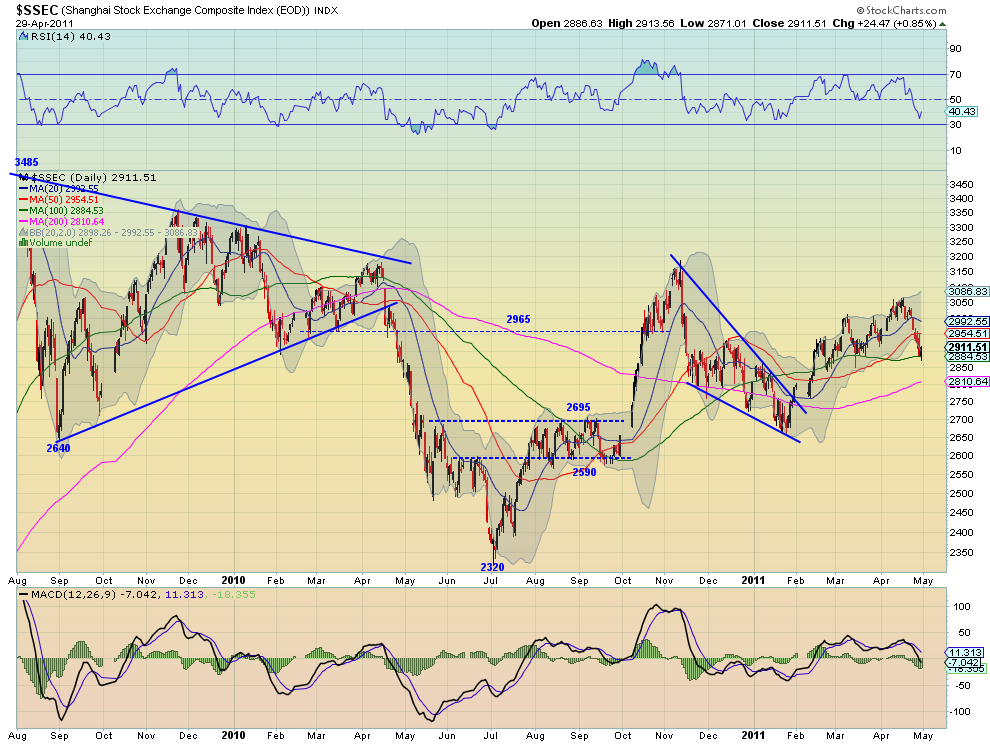

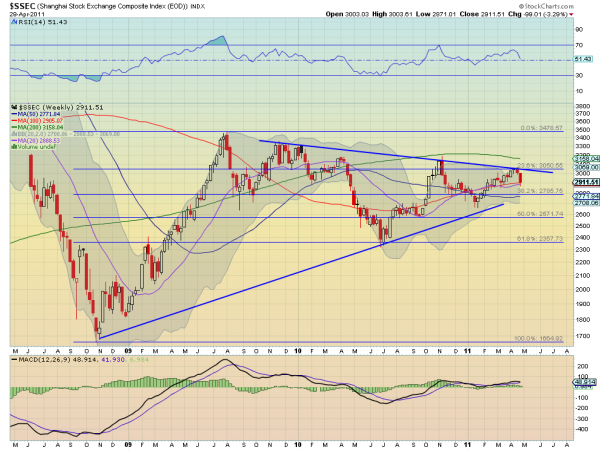

Shanghai Stock Exchange Composite Weekly,$SSEC

The Shanghai Composite continued its technical bounce off of the 23.6% Fibonacci retracement at 3050 of the move off of the lows from 2008. The RSI and MACD on the daily chart suggest move downside and the BB are expanding to allow for it. The SMA’s on the daily chart are also starting to turn on the short timescale. The weekly chart shows that it is on support of the 20 and 100 week SMA’s and at the mid line of the symmetrical triangle around 2900. The RSI is sloping lower and the MACD is about to cross down, suggesting a continued ride lower next week with 2810 and 2785 as potential support areas.

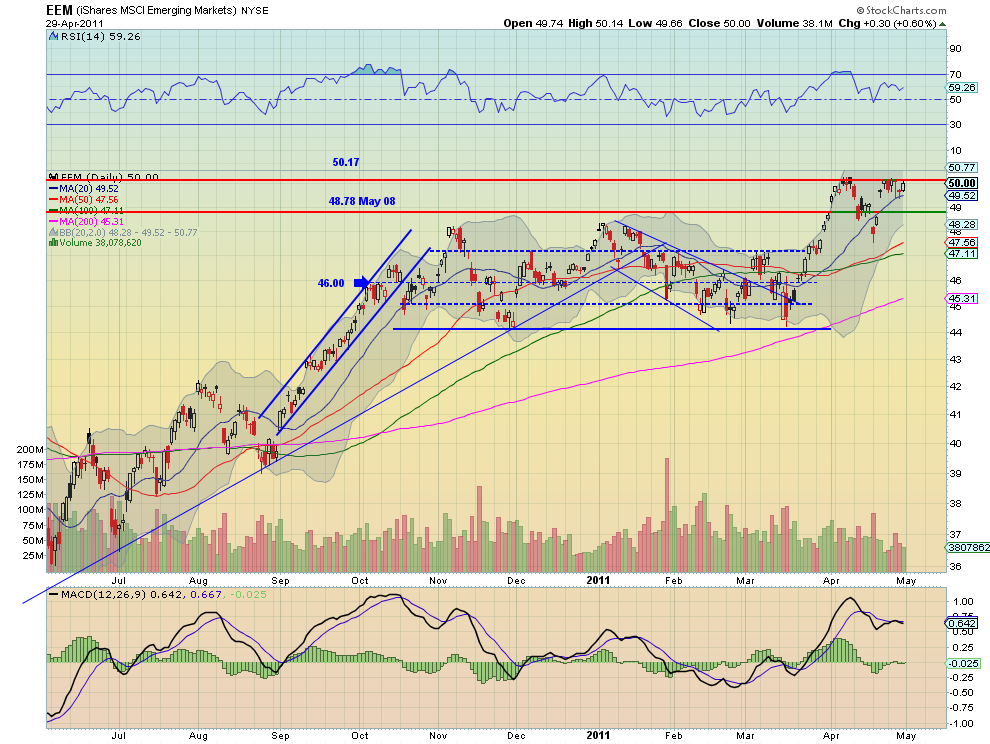

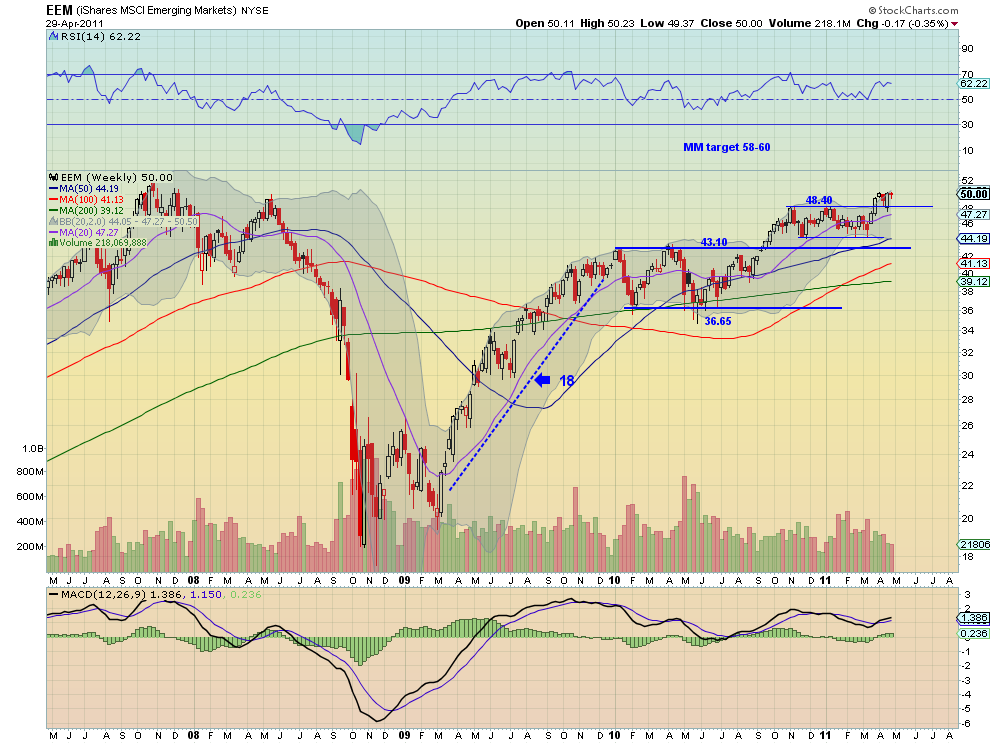

iShares MSCI Emerging Markets Index Weekly,$EEM

Emerging Markets, proxied by the EEM, stalled this week moving in a tight range between long term support/resistance at 50.17 and the 20 day SMA. The daily chart shows the indecision with the RSI moving sideways and the MACD flat near zero. The SMA’s are sloping upward, but barely other than the 20 day SMA. the weekly chart shows that indecision as a near doji print. It also has relatively flat SMA’s and RSI with a MACD that is positive but barely. Look for EEM to continue to test the resistance at 50.17 next week with perhaps the rising 20 day SMA giving it the kick to get over the top, with the 48.40 as support on any pullback.

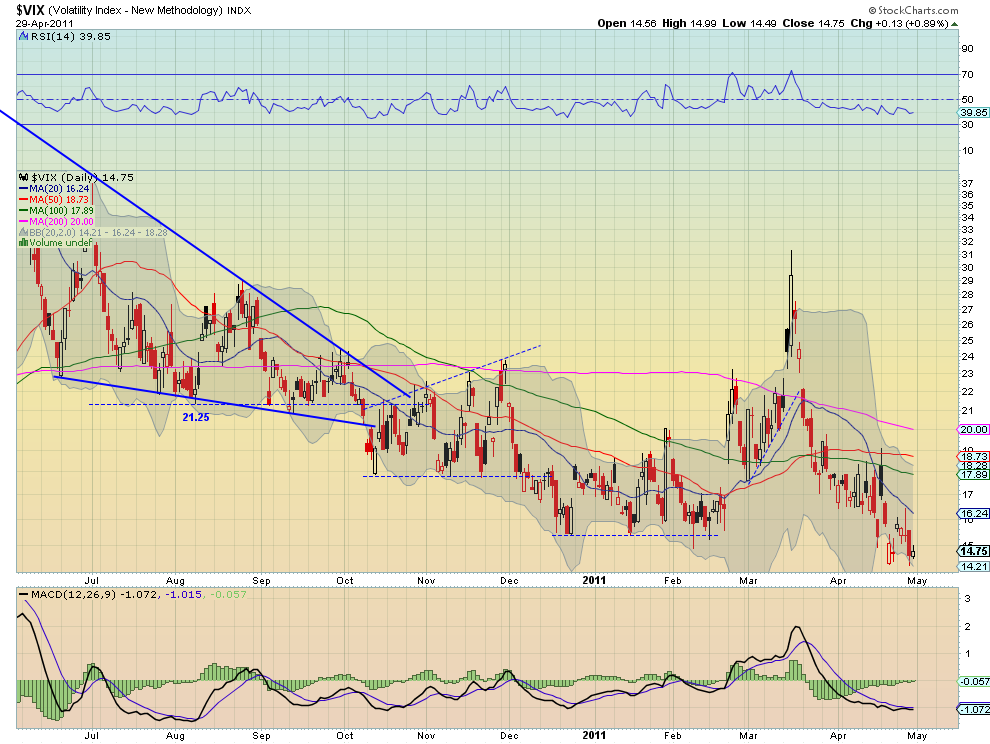

VIX Weekly,$VIX

The Volatility Index continued its slow grin lower this week ending near last week’s nearly 4 year low. On the daily timeframe the SMA’s are flat to pointing down and the RSI is slowly sloping lower, but with a MACD diverging, and improving, suggesting the bottom may be near. The weekly chart shows that the the move lower could continue. The RSI is still moving lower ad the MACD has crossed down, while all the weekly SMA are sloping lower except for the 200 week SMA. Look for the VIX to remain relatively calm next week with upside resistance in the 16 – 18 range and the real possibility that it dips lower to the 12.40 are from mid 2007.

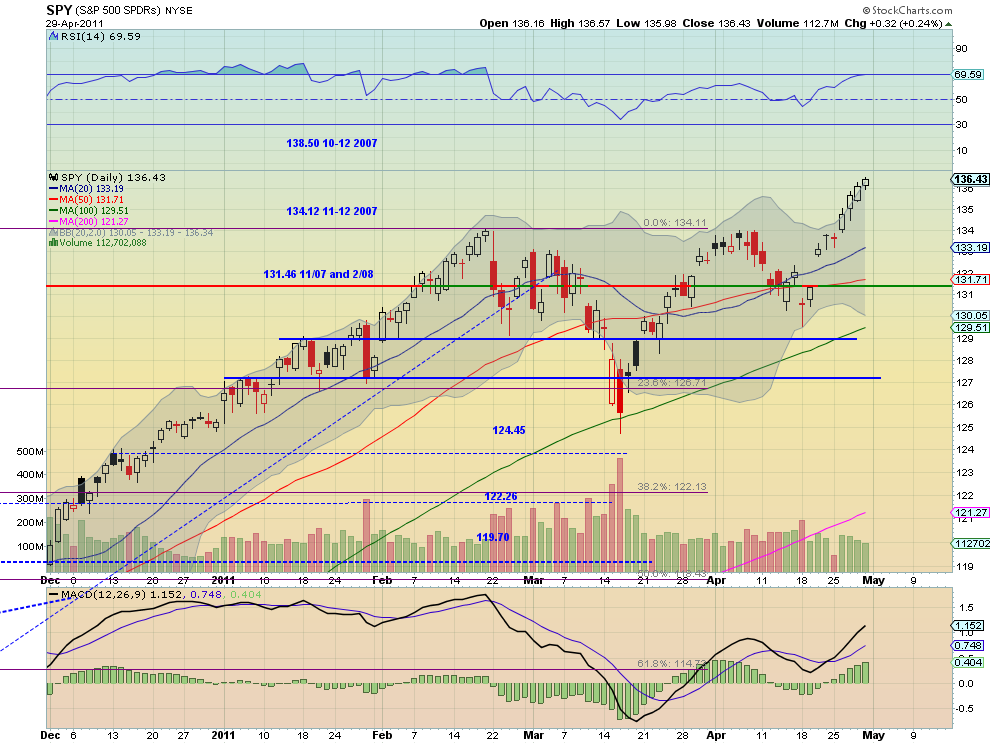

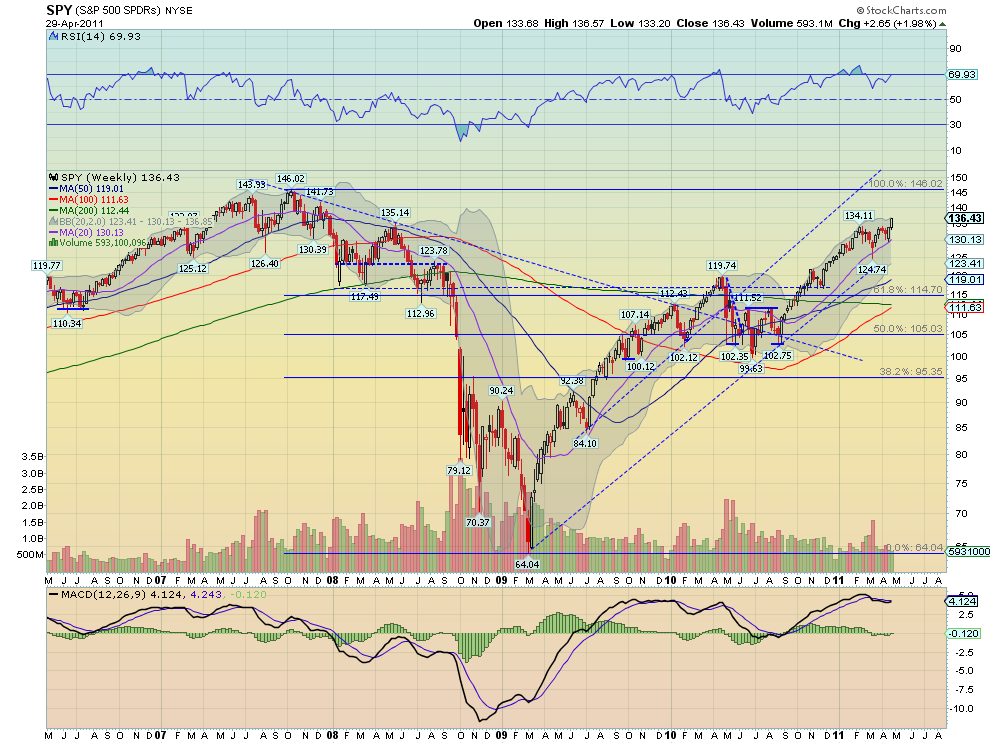

SPY Weekly,$SPY

The SPY continued its trend higher and looks strong. The SMA are all sloping higher and the RSI and MACD are rising and increasing. As it rides higher the BB are expanding to allow for more upside. The next target on the daily chart is a MM to 139.11. The weekly chart looks very bullish as well with rising SMA’s and RSI and a MACD that is crossing positive. If the move higher had more volume associated with it bulls would have more comfort, but the trend is up. Look for this to continue next week with additional resistance at 141.73 and 146.02. Any pullback should now find support at the 134.11 area.

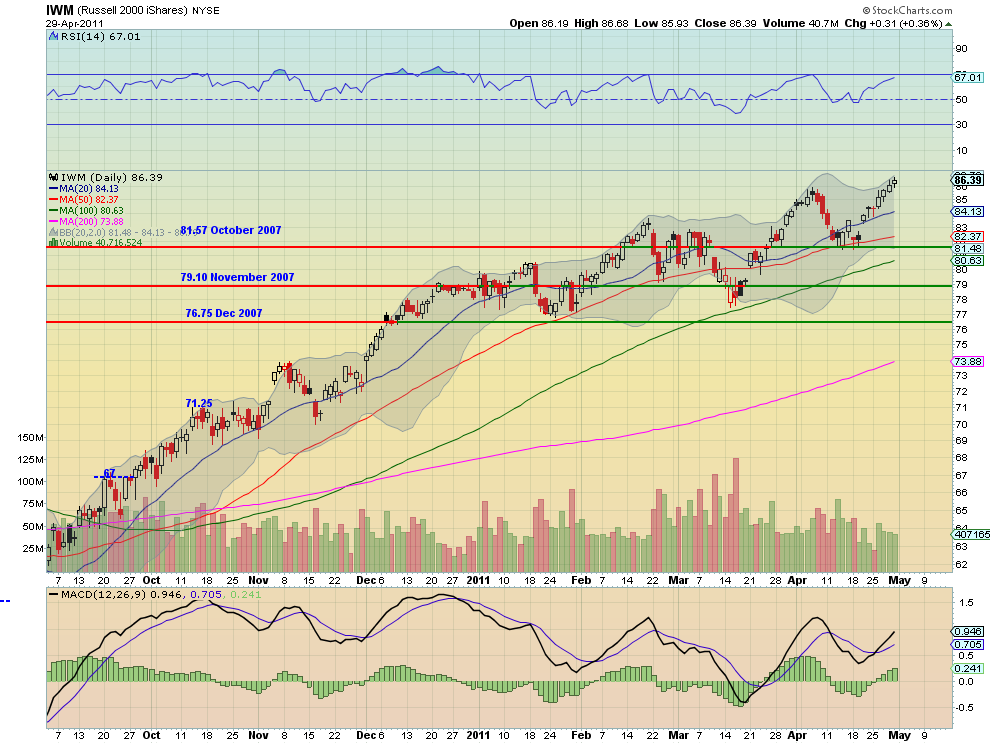

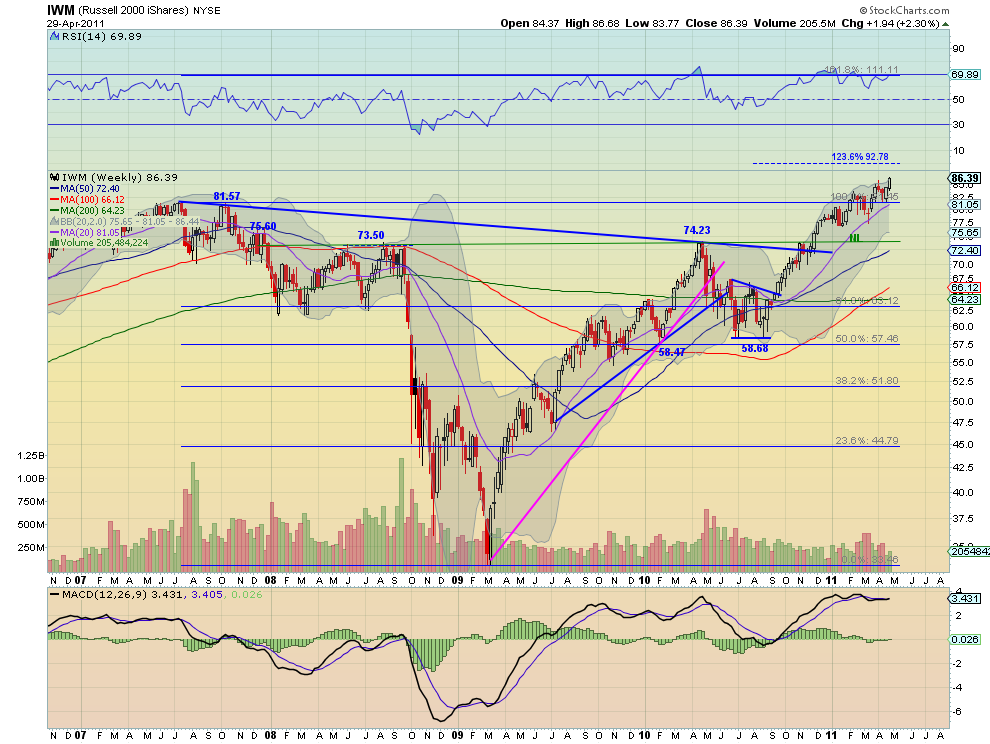

IWM Weekly,$IWM

The IWM also continued its trend higher and looks strong. The SMA here are all sloping higher and the RSI and MACD are rising and increasing. As it rides higher the BB are expanding to allow for more upside as well. The next target on the daily chart is a MM to 89.84. The weekly chart looks very bullish as well with rising SMA’s and RSI pinned at the 70 level and a MACD that is crossing positive. If the move higher had more volume associated with it bulls would have more comfort, but the trend is up. Look for this to continue next week with additional resistance at 92.78. Any pullback should now find support at the 85-86 area.

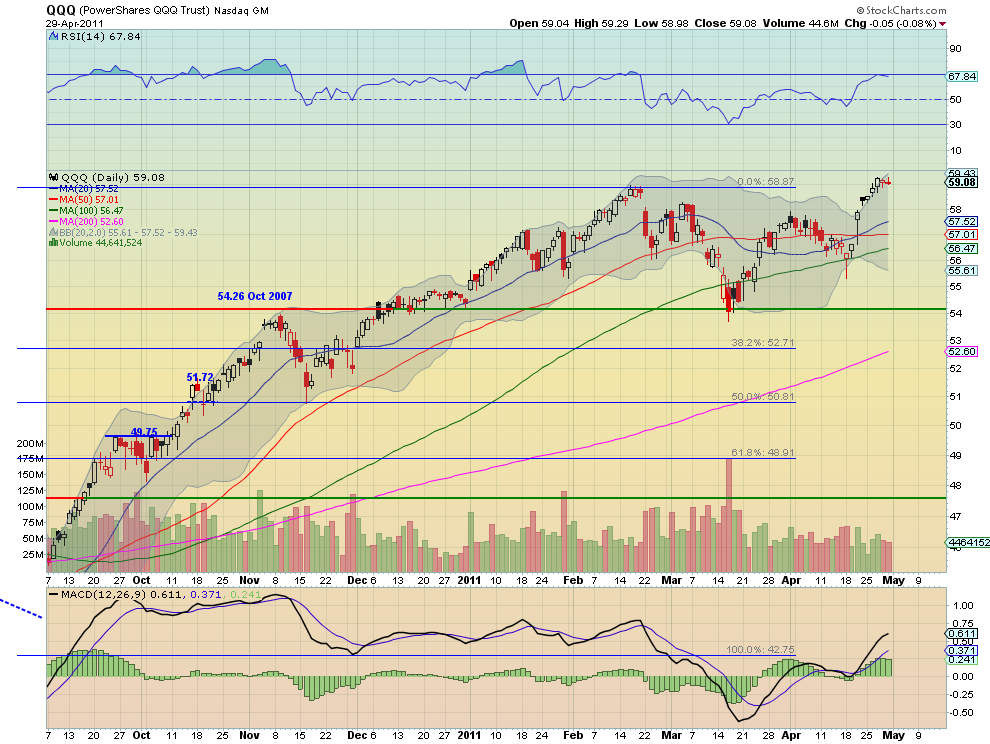

QQQ Weekly,$QQQ

The QQQ continued its trend higher but is not as strong as the SPY and IWM, and consolidated the back half of the week. The SMA are all flatter with the RSI flat near 70 and the MACD flattening but positive. It did move outside of the expanding BB and is now back inside. The next target on the daily chart is a MM to 59.70. The weekly chart looks more bullish with rising SMA’s and RSI and a MACD that is crossing positive. Look for higher prices next week out of consolidation with additional resistance at 61.08 and 62.67. Any pullback should now find support at the 57-58 area

So next week looks cautiously higher for both Gold and Crude Oil. The US Dollar Index looks to continue it death march lower searching for new all time lows while US Treasuries continue to favor the upside. The Shanghai Composite on support has more downside potential and the Emerging Markets look to be in a range, with a bias higher. Low and stable Volatility look to continue to support an environment for the Equity Index ETF’s, SPY, IWM and QQQ to move higher, with the SPY and IWM looking to have the best prospects in the short term. Use this information to understand the major trend and how it may be influenced as you prepare for the coming week ahead. Trade’m well.

See the original article >>

No comments:

Post a Comment