By: Jim_Willie_CB

It is not clear whether the American financial community has the ability to observe and conclude that the US Federal Reserve is adrift and relies upon deception as policy in revealing its directions. Its position is to hold steady, inflate to oblivion, support financial markets in heavy volume secretly, and lie about leaving its trapped policy corner. The USFed is a propaganda machine that deals with ruses as a substitute for transparent policy discussion in the public forum. Two years ago the ruse disseminated widely was the Green Shoots of an economic recovery that had no basis at all.

The scorched earth showed more evidence of ruin than fresh business creation, at a time when the grotesque insolvency was spreading like a disease throughout the entire US financial system. On one hand the USFed was busy operating numerous credit and liquidity facilities in order to prevent systemic seizure, busily redeeming the Wall Street toxic bonds at the highest possible prices. On the other hand they were talking about Green Shoots, as insolvency spread across the big banks to the household equity. They lost their credibility in the process. They have lost it completely after two full years of 0% rates, the ultimate in central bank shame. The Jackass dismissed the Green Shoots ploy quickly, regularly, and correctly, as whatever little shoots were present probably the handiwork of ant colonies or termite hills, mistaking green insect feces, or even some toxic green runoff from a nearby financial office of a corporation.

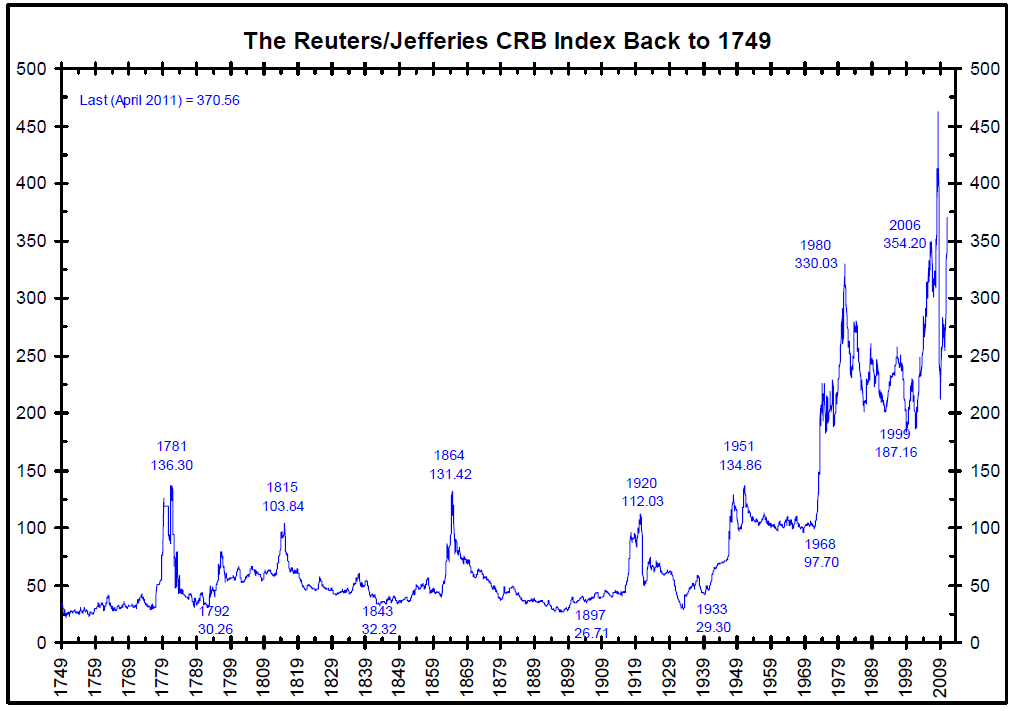

One year ago the ruse disseminated widely was the Exit Strategy from the 0% monetary corner that had no basis at all. The USFed was well aware that 0% as an official rate was untenable, dangerous, and would produce different maladies. They promoted a phony story of a Jobless Recovery, an utter contradiction and bad joke played upon the American workers. To make the cost of money free encourages speculation in the most general systemic sense. The primary gold market fuel is the price of money being far below the current price inflation rate. Anyone who believes the CPI is actually 2% to 3% is braindead. Even USGovt statistics list the numerous categories with strong price increases, yet the overall CPI is lower than all components. Power to adjustments. My description has been that the USFed is stuck in the 0% policy corner. The corner has been described since the start of 2009 when it was instituted. If the USFed raises rates, they torpedo the housing market left as derelict adrift at sea, listing badly, taking on more water, weighed down by the inventory burden. Given that the USEconomy was so dependent upon housing for three or four years, and that dependence has turned to deep vulnerability, they cannot hike interest rates and exit the policy corner without sending home prices into a fast acceleration downward. They will bottom out 20% to 30% below construction costs.

Worse, a rate hike would trigger a credit derivative series of explosions from the Interest Rate Swaps. These queer devices hold down long-term rates far below the prevailing price inflation level. That is why the USFed Chairman Bernanke insists of an undying focus of the inflation expectations, the USTreasury Bond yields and TIPS yields (both of which they purchase in monetization operations). They control them using IRSwaps. If the USFed holds steady, as they must, they generate significant rising costs for everything from food to energy to metals to cotton. Even scraps (paper, metal, plastics) are rising in price. Even the toys sector must contend with fast rising prices in time for the Christmas season. See the Li & Fund effect, also called Foxconn in China. They also make i-Pods. The current path lifts the cost structure to such a level that both businesses and households are experiencing a pinch. The fast collapse of the Philly Fed index is testament to the pinch. Shelves at major retail chains are experiencing a slow decline in volume. It is called the profit squeeze. Business profit margins are shrinking, even as household discretionary spending funds are shrinking. The Jackass dismissed the Exit Strategy ploy quickly, regularly, and correctly, as the monetary policy corner was described consistently and clearly. It was a bluff, but a very bad one. It served as a litmus test to divide the financial analysts into two camps, the dumkopfs and the sage. The dumb analysts fell for it, based upon an idealistic belief that the 0% policy should end and the recovery was happening slowly. The savvy analysts did not fall for it, since the consequences of ending the 0% rate would be like suffocating your children in the middle of the night.

THE BIG RUSE & THE BIG BIND

The extended PIIGS pen of nations, fully ruined and recognized widely as ruined, do not have the tools to prevent rising bond yields. They uniformly rise versus the German Bund benchmark. Their differentiation actually permits the Euro currency to trade more freely, even to rise. The Chinese were responsible for much of the Euro rise from 130 to 150, as they dumped USTBonds in favor of discounted PIGS debt, later to be converted into shopping malls, commercial buildings, and factories. Somehow, that factor did not appear on the US news networks. The USGovt has tools, wondrous electronic tools, which enable them at zero cost to fight off the barbarians at the gate. It is the Printing Pre$$. Unfortunately, its backfire is a powerful rising cost structure that has shown visibly in the high food & gasoline costs. So hardly at zero cost!! A year ago, the USFed folded like a cheap lawn chair. Instead of exiting their 0% corner, and implementing the advertised Exit Strategy, they went one step deeper down the rathole. That was exactly the Jackass forecast, QE to follow 0% stuck. They combined the ZIRP with the QE. They added the debt monetization scourge of Quantitative Easing to the already reckless no cost money of the Zero Interest Rate Policy. So they doused the national economy with gasoline only to see it lit into flames, while cutting the legs off the burning victim trying to escape.

PURE QE3 DECEPTION

The current ruse disseminated widely is the End of QE2 and no continuation of Quantitative Easing (aka debt monetization). The ruse has no basis at all in reality. The USFed would have to find buyers for the USTreasury Bonds. They have been buying 75% to 80% of USTBonds since the end of 2010. They have been supporting the US housing market by purchasing mortgage bonds. In other words, they have been preventing the more complete implosion of the mortgage market. It is one thing for the USTBond to go No Bid. The USFed has the direct responsibility to cover that up quickly and proclaim every USTreasury auction a rip-roaring success with great 2.3 bid to cover ratio. But it is another matter altogether to permit the mortgage rates to fly upward from lack of bids. If mortgage rates move to 7% or the adjustable ARM mortgages reset 3% to 4% higher suddenly, then housing prices will descend by another 10% to 15% quickly, as in with lightning speed.

Of course the USFed will have a QE3. Of course the USFed will continue QE programs. Of course the USFed will keep the funny money flowing into every type of bond market except the Municipal Bonds. The munis are not part of Wall Street and the syndicate that sprawls to cover the USGovt itself. So as the states and municipalities go further into a ruinous condition, events work within their grand plan to consolidate power in New York City, whose satellite in WashingtonDC was captured on a somber September day in 2001. The agenda for munis is so simple. They wish to kill the worker pensions, so that government workers have none, just like the general population. No home equity, no upward labor mobility, no union power, no pensions, a perfect world for the elite domination. Of course the USFed will keep pumping money into the stock market. With all the flash trading, still over 70% of all NYSE trade volume, with all the hardly hidden activity to support stocks by the Working Group for Financial Markets (aka Plunge Protection Team), the vulnerable stock market would dive like a cement rock. Perhaps the USFed wants to see the S&P500 and Dow Industrial stock indexes take a frightening dive. That would produce buyers of USTBonds, a point that the financial networks consistently fail to notice as motive for withdrawal of liquidity funds. The USFed can generate a USTBond rally easily, simply by stopping the stock support that so often lifts the stock indexes in the nick of time for late afternoon rallies, and johnny on the spot before early morning setbacks render too much damage.

Clearly, a sudden recognized slide in all things financial within the controlled US arenas would create perfect political cover for the USFed to announce QE3. The objections lodged from global creditors would be shouted down on the USCongress floors, on the New York Stock Exchange floor, in the big US bank board rooms, and the mutual fund chart rooms. The households would be torn in two opposite directions. They citizens want support for their stock accounts that include pension funds. But they do not want even higher costs for food, energy, and everything they purchase in retail centers. Strangely, perversely, the US stock market indexes are inversely correlated to the USDollar. The currency must resume its decline in order to lift the US stock market. Obviously, the S&P500 index rise is offset by lower US$ purchasing power, but the dynamic is ignored as much as possible. The correlation seems about minus 60% to 65% in a rough eye view.

The USFed will next spread fear from financial market powerful downdrafts. They will assure stock market declines. They will invite public response to lost mutual fund and pension funds (both managed and personal). They will work to shake the masses down to the point that the USCongress begs them to return to a strong powerful QE3. They will urge the USFed to make the QE3 even broader, to include Municipal Bonds. The big US banks will push the USFed to cover their mortgage bonds that are exposed to Put-Backs. The defrauded bond investors have won a skein of court cases. The story is so old that the US press does not cover court rulings against the devious MERS device. So the banks are losing from the bond table and losing from the foreclosure table. The US Federal Court in Texas found that MERS failed to address the issue of the legal effect of an assignment executed by unauthorized signers. The court also rebuked MERS, noting that the signing officer had no such authority, something that MERS should know. The court pointed out far more than mere negligence by MERS. Over 20,000 robo-signers were busy in the foreclosure process. They were not properly authorized. See the Naked Capitalism article (CLICK HERE). Home foreclosures are being reversed by the courts. Bonds are being ordered for putback to the Wall Street issuers. Exposure to the big US banks is huge, like well over $1 trillion. The USFed will be asked to lap up the toxic swill on court room floors.

GLOBAL QE

The very same factors that forced the emergency G-7 meeting to cap the Japanese Yen currency rise have returned. A high Yen exchange rate renders their vast supply industry as unprofitable, imposing great strain. Expect another emergency meeting, which in my view should be described as a Global Quantitative Easing (Global QE) since the major central banks will coordinate their actions to buy the vast tranches of USTreasury Bonds that Japan needs to sell. The large Japanese financial institutions must close their finance gaps and avoid price inflation. Doing so without asset sales would cause a pure unfiltered inflationary effect. They do not want additional woes in addition to what grotesque strain has already come. The exercise will be repeated, as the Jackass forecasted a month ago. My forecast is for a secret G-7 Meeting to agree to USTBond purchases to push down the Yen currency, but without any publicity, zero press coverage, all in total secrecy. It is a development factor far bigger than any QE conducted solely by the USFed. Since coordinated the world over, call it Global QE. Look for some distortion of purpose for any suddenly convened meeting of finance ministers. They might call it coordinated global monetary planning, or cooperation with emerging economies, or adjustments to global trade settlements, or some such deception. It is just another side to the Competing Currency Wars. The underlying force behind the rising Yen is their industrial slowdown, the arrival of a trade deficit, and the urgent need to finance reconstruction costs by foreign asset sales without causing price inflation. My analysis has called it the Global QE initiative, a factor far bigger than any QE conducted by the USFed.

Insurance companies will play a surprisingly large role. They face mammoth claims from damaged buildings and stalled factories. The large Japanese financial institutions must close their finance gaps and avoid price inflation from pure monetary inflation. Foreign asset sale is the key. Their deficit is growing, industry faltering, electricity supply spotty, supply chain unreliable, and US bond sales rising. The reconstruction is underway. The financial markets still need help. Their economy faces an unprecedented slowdown more accurately called a general coordinated breakdown. As the nation must pay for its reconstruction, expect big waves of bond sales to match big stimulus and monetization. Foreign asset sales will be the compromise made politically. Although palatable, they will cause the JapYen currency to rise further, enough to sound alarms and cause even more profit squeeze.

The Japanese Economy is enduring the biggest collapse in modern history. Let's see if its cities can avoid cracks and rising tides. Their trade deficits are assured, my forecast. However, this time around a paradox of trade deficits and reconstruction costs will conspire to LIFT the Japanese Yen currency. Their government wants to limit stimulus and associated deficits and bond issuance that would lift interest rates. Their ministry officials want more debt monetization to inflate the problem away. The Bank of Japan wants to hold the line with no more purchase of debt. The utilities are forcing rolling electrical blackouts in order to avoid higher prices for electricity. Their carmakers have registered staggering declines in output. Their industrial sector is reeling. The solution most politically appealing will turn out to be not the hyper inflation from debt monetization, BUT RATHER SALES OF FOREIGN ASSETS. The sale of USTreasury Bonds is most politically acceptable, with a national disaster offering strong cover for justification. Their sale will be brisk in heavy volume, all in time. The rising JapYen currency will force the Global QE, as purchase of USTBonds that Japan sells will join the USTBonds sold by the USDept Treasury. An extravaganza of debt monetization will go global. Why no analysts discuss this is beyond the reach of Jackass comprehension. Probably blind spots, corporate directives, preoccupation with the sovereign debts, attention to the USGovt debt limit, and a new foreign war every few months. To be sure, plenty of distraction out there.

THREAT OF USGOVT DEBT DEFAULT

The cynic among us might have suspected that a mission directive for the Obama Admin was to force spending increases, to avoid entitlement benefit cuts, and to generally lead the nation into a worse insolvency condition so that the USDollar declines dangerously and a USGovt debt default is assured. The nation could start over. The elite plans could be implemented on a global level. To be sure, the Republicans object and block any and all new tax increases that would supposedly raise revenues. They would be counter-productive anyway, since higher tax rates result in lower tax revenues, something the legislators and economists have failed to comprehend for four decades. To be sure, the Democrats object and block any and all limitations to entitlement spending like Social Security, Medicare, and USGovt pensions. Any reductions would close the deficit a little, but more like a pittance. To be sure, the security agencies and bankers object and block any and all attempts to curtail the wars to seize crude oil and establish the vertical integration of contraband. Their purpose is considered sacred, while their costs are covered by taxpayers, but their profits are solely for the syndicate. The defense contractors are exemplary employers too, with high paying jobs but no trickle down effect on the product side.

It seems all three camps are dedicated to a path that results in debt strain, creditor revolt, and eventual default. Recall the Jackass forecast in September 2008, of a USTreasury debt default in the next two to three years. The time has finally come to deal with such a threat. The argument that the USDept Treasury together with the US Federal Reserve could avoid such a default outcome is being tested. For almost a full year, the USFed has been monetizing mountains of USGovt debt and much of the USAgency Mortgage debt. The effects have been noticed palpably at a global level. The blame has been attributed by nations across the world, and directed squarely at the USFed and USGovt for profligate spending, enormous deficits, and a hyper inflation reaction. All parties involved in the budget deliberations, the debt limit discussions, and the protection of interests are willing to test the default button option. The denials go so far as to describe a less than onerous outcome where much of the interest payments would continue, and much of the agency functions would continue. Strangely, the soldiers pay checks might be scrubbed. If a default occurs, traps doors and greased chutes would open to lead the nation on a fast track to the Third World. To begin with, liquidity would be harmed to such an extent that the Saudis would probably not accept USDollars for crude oil.

David Stockman served as the Budget Director in the Reagan Admin. He had some choice words in summary. He said, "The real problem is the de-facto policy of both parties is default. When the Republicans say no tax increases, they are saying we want the US government to default. Because there is not enough political will in this country to solve the problem even halfway on spending cuts. When the Democrats say you cannot touch Social Security, when you have Obama sponsoring a war budget for defense that is even bigger than Bush, then I say the policy of the White House is default as well. That is the question that really needs to be understood better and appraised by the bond market. Both parties are advocating default even as they point the finger at each other."

NEW HAT TRICK LETTER REPORT

The Hat Trick Letter made a key change in the May reports. Since most every major systemic failure forecast recorded, explained, and repeated since 2004 has come true, and the USEconomy is in deterioration with a squeeze underway, and the US financial system is insolvent, and the US Housing market also suffers widespread negative equity (28.4% of homes), no great need or interest is served in delineating the home foreclosure statistics, the personal bankruptcies, bloated bank hidden inventory of unsold homes, the wrecked mortgage bond market, the jobless claims that cannot revive, or the banker games to conceal the reason why they lend little. Items do appear in the Introduction sections. Instead, the Macro Economic Report for the Hat Trick Letter has given way to the Global Money War Report for full discussion and analysis of the Competing Currency Wars, the debt soaked tattered sovereign bonds, the crumbling monetary system, the discredited central banks, and the acceptance of hyper monetary inflation as a solution. The Gold & Currency Report will continue, which covers the details at the ground level with many stories on investment demand, on exchange traded fund frauds (good and bad), on certain economic stories in beleaguered nations like Japan and Spain, like threats of default in nations like Greece, soon to be followed by other PIIGS nations, and details on the Chinese Economy.

So the Hat Trick Letter has adapted with a higher level gold report to cover the monetary war in progress, and a lower level gold report to cover the global reaction geared toward survival. That survival is assured by investment in Gold & Silver. The ugly irony is that the major financial news networks comprehend little if anything about the motives and principal factors behind the powerful precious metals bull market. They only focus on inflation (which they deny as part of the propaganda machine) and geopolitical tensions (which are valid but secondary). They overlook that the global monetary system is in ruins and the central banks have morphed into hyper inflation nuclear reactors, with the cost of money at zero acting like a foot stuck on the accelerator. They do not properly assess the monetary system ruin, nor the bank insolvency ruin.

GLOBAL FACTORS

The global monetary war has mushroomed. Greece is set to default on its debt, the signs all loud & clear. Spain is ready to be bailed out, its economy sliding backwards fast. The impact of a default in Europe is magnificent and all horrendous. Banks will fail. The motive for continued band-aid bailouts that only buy time and fix nothing have been to enable banks to redeem their debt, just like in the United States. Bond holders have been protected. Dominique Strauss-Kahn urged Irish Govt bond holders to take a significant haircut loss, his final sin. The first sin was the promotion of the SDR from the Intl Monetary Fund, whose basket of currencies would be used in global bank reserves. His second sin was the introductory concept of an SDR-based debt instrument, as in a global bond. To supplant the USDollar and USTBond is cause for removal, with bond holder losses the icing on the prison cake. The European kettle is ready to boil over again, with nothing fixed. The wild card is the Credit Default Swaps, those curious devices that lurk within hidden banking systems. A Greek Govt default would set events in motion, and likely reveal the profound fraud and insolvency of European banks. The kicker could be the contagion to the British and American banks. The Western banks are all interwoven in a grand incest.

A recent twist is the higher wages paid to Chinese workers almost uniformly. They will become stronger consumers, but their corporate exporters will pass along higher prices to the US retail chains. Finally, after thirty years, the USEconomy will import price inflation from Asia. The new Shanghai silver futures contracts are most likely not welcome to the COMEX and its Wall Street overseers. The common practice of ambushing the Gold & Silver prices overnight or immediately after hours in the late afternoon might soon come to an end. The Shanghai hours are 8pm to 11am eastern US time zone. Sense the opposition. Given the strong Chinese consumer price inflation and corresponding citizen response in coin and bar purchase, the opposition is gaining strength. The Asians love gold as much as the Americans are ignorant of it.

The population has reacted with continued Gold & Silver coin purchase. The central banks outside the Western sphere of influence have reacted with Gold bullion accumulation in reserves, far more than publicly announced. Mexico not only purchased almost 100 metric tons of gold recently, but their CB governors voted unanimously to install silver as money itself. The investment community has reacted with legitimate exchange traded funds like the Sprott Fund. The contrast of a Sprott premium in price versus the negative premium in the GLD and SLV should highlight their absence of required metal in inventory in stark contrast to the ample inventory in the Sprott funds, but most analysts have yet to figure out the premium issue at all. The biggest and most tainted ETFunds are working toward their own climax, surely with cash redemption amidst lawsuits. They cannot offer their inventory and shares to the COMEX as part of the great game, without eventual consequence. When the premium on GLD and SLV hits minus 10%, perhaps some will awaken. Usually vault fees, insurance costs, security costs, transport costs, and management results in actual totals that must be covered within the price paid for the shares. But not with this pair of polluted funds joined to the cartel.

ONLY CHANGE WITH SILVER IS PRICE

The silver speculation is just another deceptive story. The Open Interest fell gradually all through the Silver price rise toward the $50 level. After such a bone crushing silver ambush, the net positions for non-commercials, substracting shorts from longs, showed relative tranquility with no big decline at all in their positions, thus still a bullish commitment. They have fewer positions, but the game is still very much on. Hedge funds do show the lowest net long silver position since February 2010, but still a solid position. Evidence lies inside the Commitment of Traders Report, discussed in more detail in the May Hat Trick Letter. The Managed Money (like hedge funds, commodity trading accounts) still have a strong bullish position. They profited from the rise as they reduced positions, and were not wounded by the rise!! Then take the little guys. The Small Trader ledger item recorded the largest pure short position since August, with 18,605 contracts short silver on 26 April 2011, when silver had a $45.45 price. The smaller players were actually net short, and collected a hefty profit, a story not told by the lapdog US press. Conclude that many of the small guys, the good guys, were correctly positioned for the harsh smackdown on silver in the first week of May. The small speculators profited from decline!! They and the fund managers will be back, bigger than before, bolder than ever, motivated with fervor, with their ears taped back ready for more blood. It seems abundantly clear that the major driving force behind this current silver market has been actual demand for physical silver metal.

The beauty of the silver decline is that when it reverses, there is no technical resistance of significance back to the $50 level. However, due to the shock effect, the climb will be slower than a sudden technical mirror image reversal. The precious metals investors should hope for a slow steady relentless painful nasty stubborn awesome devastating rise in price that doles out excruciating pain to the cartel, permits once again for the less enlightened doubters to cover their wrong short positions in a chronic manner. The story in the Silver chart has four weeks and four different stories. The first week of May had the powerful decline, the result of hitting the Hunt nominal target, Soros putting out his deceptive story of selling that which he called a bubble for a full year, the COMEX raising the margin requirement five times in quick succession, the USFed putting out its deceptive story about ending debt monetization and maybe hiking rates (gotta be dumb as a post to believe), the USEconomy demanding less in commodities. The second week showed a strong clear Doji Star, which epitomizes a move to stability. The Silver price found its footing and stood still, encouraging many investors to re-enter the market. The third week was less clear except to technical chart readers. It featured a strong clear Bull Hammer identified by an open and close at the high for the week, with price movement lower during the week. The hint was given on Monday of this week for a rebound. The US$ DX index was rising a little, as the Euro currency was sliding lower, like over 100 basis points for the day. Gold & Silver ignored it. Gold rose a little, while Silver was even at $35. Today, Silver is pushing $38 per ounce, and Gold is rising too. No resistance ahead!!

Yet the Mississippi flood waters will crimp supply lines just when the US financial dons wish to push down the entire commodity price structure, including Gold & Silver. Neither precious metal is a commodity though, since they are money. Tell the central banks of the world and the major sovereign wealth funds that Gold & Silver are commodities when they are shifting reserve assets away from the US$-based bonds and toward Gold & Silver. They are money, and the USGovt with their Wall Street handlers wishes the world not to regard them as money. The experiment in paper fiat money since 1971 is coming to an end, a conclusion racked with toxic spew, great hardship, and threats to wealth.

One should constantly remember that no solution to the financial crisis has been installed, nothing fixed, no big banks liquidated, no end to monetary inflation, no end to outsized USGovt deficits, no end to secretive subterranean support of stocks and bonds, no revival of the housing market, no discharge of big bank home inventory, no return of US industry from Asia, no interruption to the endless costly wars, no end to money laundering of narco funds to Wall Street banks, no end to the propaganda obediently pumped out by the US press & media networks, and no change of Goldman Sachs running the USGovt finance ministry. Expect no change in anything that you believe in. Expect no change to the 0% policy (ZIRP) with no change to the heavy monetary inflation (QE), as the path to ruin is set, and the policy of Inflate to Infinity cannot be stopped. Gold will not stop until it surpasses at least $5000 to $7000 in price. Silver will not stop until it surpasses at least $150 to $200 in price. Such forecasts invite mockery, but in two years they will seem prescient.

The ruin of money is the momentum play. The elite are fully invested in the current system, and are fully willing to put more money into reinforcements to preserve their wealth, power, and position. The global financial system is coming apart at the seams, and the financial guardians in charge from the syndicate cannot any longer hold it together. The Gold & Silver prices are the hint of lost control. Expect breathtaking grand upward moves in price in the next several months. It will be fun to watch the dim bulbs explain their positions after their wrong viewpoints have been so well covered by the financial rags. They will surely squirm, guys like Soros. Some will gloat, guys like Sprott. Few are aware, but the events in the first week of May are what a COMEX default looks like, in its preliminary phase!!! JPMorgan could not meet the schedule of May silver deliveries, that simple. In time, the distance between paper Gold & Silver and physical Gold & Silver will be great. Then the COMEX shuts down, unless they act as a Cash & Carry exchange. Doubtful!