By John Letzing

Monday, July 18, 2011

IBM net up as software, hardware sales rise

Europe’s Italian Muse?

ROME – The euro contagion triggered by Greece’s sovereign-debt crisis has now infected Italy. Silvio Berlusconi’s government, together with a fiscally conscious opposition, managed to secure – in only a few days – parliamentary approval of a package of measures worth more than €50 billion, in order to restore market confidence in the soundness of Italy’s economic fundamentals.

In the absence of a strong and credible EU-wide commitment to stop the contagion, other eurozone countries hit by the sovereign-debt crisis have been following a similar script. But the financier George Soros is right: Europe needs a “Plan B.” The huge crisis now hitting the eurozone and the European Union must not be wasted. It must be used to move Europe farther along the road of integration, lest the Union begin to reverse course.

When the euro was created, its architects were well aware that no monetary union in history had succeeded without the backing of a political union. Hopes nonetheless were pinned on the existence of a large, European-wide market and eurozone member states’ commitment to keeping fiscal deficits, public debt, and inflation under control. But several eurozone members did not keep their word, and the crisis engulfing their sovereign debt now endangers the survival of the eurozone as a whole.

As coordination among sovereign states has plainly not worked, only two possibilities are left. One option is that eurozone members remain sovereign and claim back their monetary powers, which implies not only the death of the euro, but also a threat to the internal market and to the EU’s very existence. The other option is to cede more sovereignty to the EU, which implies not only the survival of the euro, but also, and perhaps more importantly, the birth of Europe’s political union.

This choice is becoming clear for all to see. Both Jean Claude Trichet, the ECB president, and Jacques Attali, the founding president of the European Bank for Reconstruction and Development, have now called openly for the establishment of a European Ministry of Finance. The glacially technocratic and apolitical International Monetary Fund, in its latest report on the eurozone, goes as far as mentioning “political union and ex ante fiscal risk sharing” as conditions for any monetary union to work.

But few people have thought through what a politically united Europe might look like. Most, indeed, implicitly assume a massive transfer of almost all functions of government from member states to the federal center, and thus the creation of a “European superstate.”

We believe instead that a “Federation Lite,” with a budget limited to about 5% of Europe’s GDP (compared to almost half of GDP in most EU member countries), would enable a realistic political union. These resources, €600-700 billion, would replace and not add to national budgets, since they would accompany the transfer of some governmental functions. In some cases, this would also allow for economies of scale.

Indeed, consider defense. A single standing EU army in lieu of Europe’s largely irrelevant and inefficient national armed forces, with a budget of around 1% of EU GDP – some €130 billion – would instantly become the world’s second leading military force, after the US, in terms of resources and, one would hope, capabilities. Assuming a flat rate of national contributions to the federal budget, Greece, for example, would shed 2-3 precious percentage points from its public deficit.

In addition to defense and security, it would make sense to move other competencies to the federal level. Prime candidates are diplomacy and foreign policy (including development and humanitarian aid), immigration, border control, some infrastructural projects with European-wide network effects, large-scale research and development projects, and regional re-distribution.

These functions of government, and a federal budget of this size, would, of course, require the equivalent of a finance minister. It would be well worth it: a critical mass of €600-700 billion would make macroeconomic stabilization and re-distribution possible when necessary, without the establishment of ad hoc mechanisms or, worse, the publicity and attention surrounding summit after summit called to decide the next package of aid to financially distressed countries.

The term “transfer union” is now used, especially in Germany, as a pejorative synonym for federation. We agree that moving resources from one place to another cannot be the raison d’être of a political entity. Only specific governmental functions can. But when some of these functions are assigned to a federal level of government, one has the additional tool of being able to transfer resources to pay for these tasks. When this is necessary, states experiencing a boom should be taxed more than states experiencing a bust.

This redistribution is purely routine in any federation, beginning with the United States, and the public pays little or no attention to it. New York’s government and people do not protest because Mississippi receives far more from the federal budget, relative to what it contributes, than New Yorkers do.

Despite today’s problems, the eurozone is not only richer, but also economically sounder, than most other countries and regions. The main threat to the euro is precisely the eurozone’s lack of a modicum of political unity – a Federation Lite that makes solidarity possible, and even automatic, when it is needed.

In this sense, the looming prospect of a full-blown Italian debt crisis could prove beneficial by focusing European minds. The words e pluribus unum need not be included on euro notes and coins to recognize that the principle for which they stand – the political unification of Europe, no less than that of the US – is indispensable to the euro’s survival.

In the absence of a strong and credible EU-wide commitment to stop the contagion, other eurozone countries hit by the sovereign-debt crisis have been following a similar script. But the financier George Soros is right: Europe needs a “Plan B.” The huge crisis now hitting the eurozone and the European Union must not be wasted. It must be used to move Europe farther along the road of integration, lest the Union begin to reverse course.

When the euro was created, its architects were well aware that no monetary union in history had succeeded without the backing of a political union. Hopes nonetheless were pinned on the existence of a large, European-wide market and eurozone member states’ commitment to keeping fiscal deficits, public debt, and inflation under control. But several eurozone members did not keep their word, and the crisis engulfing their sovereign debt now endangers the survival of the eurozone as a whole.

As coordination among sovereign states has plainly not worked, only two possibilities are left. One option is that eurozone members remain sovereign and claim back their monetary powers, which implies not only the death of the euro, but also a threat to the internal market and to the EU’s very existence. The other option is to cede more sovereignty to the EU, which implies not only the survival of the euro, but also, and perhaps more importantly, the birth of Europe’s political union.

This choice is becoming clear for all to see. Both Jean Claude Trichet, the ECB president, and Jacques Attali, the founding president of the European Bank for Reconstruction and Development, have now called openly for the establishment of a European Ministry of Finance. The glacially technocratic and apolitical International Monetary Fund, in its latest report on the eurozone, goes as far as mentioning “political union and ex ante fiscal risk sharing” as conditions for any monetary union to work.

But few people have thought through what a politically united Europe might look like. Most, indeed, implicitly assume a massive transfer of almost all functions of government from member states to the federal center, and thus the creation of a “European superstate.”

We believe instead that a “Federation Lite,” with a budget limited to about 5% of Europe’s GDP (compared to almost half of GDP in most EU member countries), would enable a realistic political union. These resources, €600-700 billion, would replace and not add to national budgets, since they would accompany the transfer of some governmental functions. In some cases, this would also allow for economies of scale.

Indeed, consider defense. A single standing EU army in lieu of Europe’s largely irrelevant and inefficient national armed forces, with a budget of around 1% of EU GDP – some €130 billion – would instantly become the world’s second leading military force, after the US, in terms of resources and, one would hope, capabilities. Assuming a flat rate of national contributions to the federal budget, Greece, for example, would shed 2-3 precious percentage points from its public deficit.

In addition to defense and security, it would make sense to move other competencies to the federal level. Prime candidates are diplomacy and foreign policy (including development and humanitarian aid), immigration, border control, some infrastructural projects with European-wide network effects, large-scale research and development projects, and regional re-distribution.

These functions of government, and a federal budget of this size, would, of course, require the equivalent of a finance minister. It would be well worth it: a critical mass of €600-700 billion would make macroeconomic stabilization and re-distribution possible when necessary, without the establishment of ad hoc mechanisms or, worse, the publicity and attention surrounding summit after summit called to decide the next package of aid to financially distressed countries.

The term “transfer union” is now used, especially in Germany, as a pejorative synonym for federation. We agree that moving resources from one place to another cannot be the raison d’être of a political entity. Only specific governmental functions can. But when some of these functions are assigned to a federal level of government, one has the additional tool of being able to transfer resources to pay for these tasks. When this is necessary, states experiencing a boom should be taxed more than states experiencing a bust.

This redistribution is purely routine in any federation, beginning with the United States, and the public pays little or no attention to it. New York’s government and people do not protest because Mississippi receives far more from the federal budget, relative to what it contributes, than New Yorkers do.

Despite today’s problems, the eurozone is not only richer, but also economically sounder, than most other countries and regions. The main threat to the euro is precisely the eurozone’s lack of a modicum of political unity – a Federation Lite that makes solidarity possible, and even automatic, when it is needed.

In this sense, the looming prospect of a full-blown Italian debt crisis could prove beneficial by focusing European minds. The words e pluribus unum need not be included on euro notes and coins to recognize that the principle for which they stand – the political unification of Europe, no less than that of the US – is indispensable to the euro’s survival.

Emma Bonino is vice-president of the Italian Senate and a former European Commissioner. Marco De Andreis is Director of Economic Research at Italy’s customs agency and a former EU official.

Etichette:

articles,

Economy article,

Finance article,

market articles

TIC Data Summary: Russian Treasury Holdings Tumble; China, Japan Add

by Tyler Durden

The Treasury released its May Treasury International Capital data today, which confirms recent trends: while China, both domestically and through the UK, and Japan both added to their gross exposure of US debt in May, Russia's holdings continued to tumble in line with warnings out of Moscow discussed previously and with the continued Kremlin rotation out of Treasurys and into gold. And while Putin has obviously had enough with shenanigans in the US, the same can not be said for his posturing colleagues in China (and Japan) who at least two months ago, brought their holdings of US to 2011 (and record) highs of $1159.8MM and $912.4MM respectively. So much for China dumping bonds. Another source of Treasury demand: petrodollars, which saw their UST holdings in May hit an all time high of $229.8 billion. Overall, gross purchases of Long-Term US securities by official and private foreign buyers declined modestly to $44.6 billion from $44.8 billion. Netting out foreign securities purchased of $21 billion, yields net flows of $23.6 billion on expectations of $40 billion, or in other words May saw a modestly lower inflationary impact due to an influx in foreign capital in the US economy. Also when netting out US purchases of foreign securities as well as changes in bank dollar-denominated liabilities the net number was -$67.5 billion.

Foreign holdings of US bonds by top 4 holders.

But...just Russia, which instead ended up converting $10 billion of USTs into 22 tons of gold in May and generating a massively higher return. That wily old Putin...

Monthly breakdown by gross foreigner asset class purchase and disposition. Notable is that while foreigers sold the most in Agencies ($8.2 billion) since September 2010, they bought the most Corporate bonds ($5.6 billion) since August 2010.

See the original article >>

Etichette:

articles,

Economy article,

Finance article,

market articles

S&P Threatens To Downgrade Everything

By James Bianco

Media coverage of S&P downgrade threat;

• Reuters – S&P threatens downgrade of U.S. financial companies

Standard & Poor’s on Friday raised the pressure on debt negotiators in Washington, saying it could downgrade insurers, securities clearinghouses, mortgage agencies and a laundry list of other firms without a deal soon to lift the debt ceiling and cut the deficit. While S&P had already made clear it could downgrade the United States’ sovereign credit rating, the Friday move struck directly at the heart of the financial system, raising the prospect of knock-on effects should the country exhaust its ability to borrow to pay bills. The Treasury took the last available step Friday to try and extend that borrowing capacity. S&P on Friday put on review for possible downgrades a range of powerful financial firms — many of them little known to the public but crucial to the country’s financial infrastructure. U.S. government securities are central to the operations of most of the companies cited. They include the Depository Trust Co, which facilitates payment transfers among major banks, as well as several Federal Home Loan Banks and Farm Credit System Banks. They also singled out Fannie Mae and Freddie Mac, the two government-sponsored enterprises that are central to the residential mortgage market. S&P characterized its targets as “entities with direct links to, or reliance on, the federal government.” Separately, the agency said the four remaining U.S. nonfinancial companies with triple-A ratings were not affected by the downgrade threat.

•The Associated Press – S&P warns it may downgrade Fannie, Freddie credit

Standard & Poor’s warned mortgage giants Fannie Mae and Freddie Mac on Friday that they may lose their top credit ratings if lawmakers don’t raise the U.S. government’s borrowing limit in time to avoid a default. S&P said government-controlled Fannie and Freddie, along with certain Federal Home Loan Banks and Farm Credit System Banks, could also default on their debts, given each institution’s “direct reliance on the U.S. government.” The rating agency this week threatened to lower the U.S. government’s credit rating if the White House and Congress can’t agree to raise the $14.3 trillion borrowing limit and avoid a default in the coming weeks. It said there was at least a one-in-two likelihood that it will lower the rating within the next 90 days.

Comment:

Essentially S&P has put every AAA rating that assumes a government backstop on watch. The main reason is the potential for a spike in volatility if no debt deal is reached. Critics will argue that S&P has never used volatility as a reason for a downgrade before. Even when volatility was rampant during the 1987 stock market crash, the Gulf Wars, September 11, the popping of the tech bubble or the 1,000 points daily gyrations in the Dow Jones Industrial Average in late 2008, this was not given as a reason for a downgrade.

If the potential for volatility is a new standard to put every government related AAA rating on credit watch, will S&P be doing this regularly? If they are making a political statement, will they reinforce the idea that ratings are arbitrary and undermine their already sagging credibility?

So why is S&P doing this? If volatility is reason enough for a downgrade, why not put every AAA in Europe on credit watch for the same reason?

•The Financial Times – Ratings easy to criticise, harder to exorcise

A similar recasting has happened in finance, too. In the decades leading up to the financial crisis, global debt markets grew as never before precisely because it was assumed that risks could be measured and managed. At the centre of this transformation were credit ratings. A simple proxy for risk, the use of credit ratings allowed regulators, banks and investors to have an easy-to-use reference point. This had benefits, and fuelled growth across the globe. But the existence of ratings led to sloppy risk assessments: the work was subcontracted to the likes of Fitch, Moody’s and Standard & Poor’s. The agencies have had no shortage of critics for failing to spot risks in the repackaging of billions of dollars of risky mortgages into top-rated mortgage-backed securities. Now, they are again in the spotlight. European politicians have attacked them for recent downgrades of eurozone sovereigns.

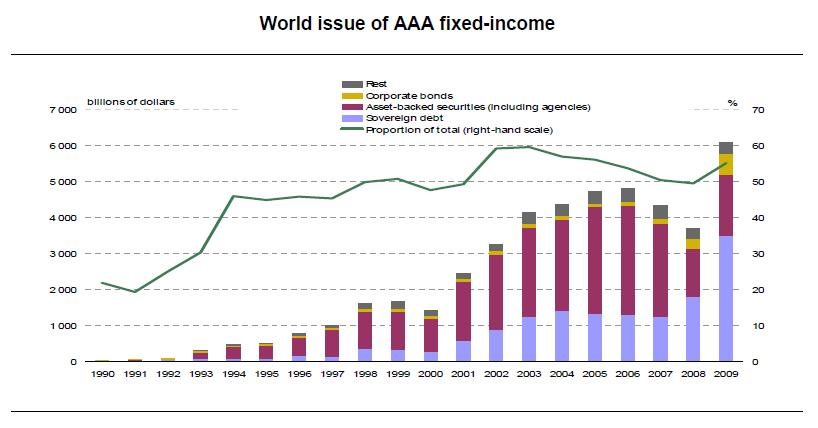

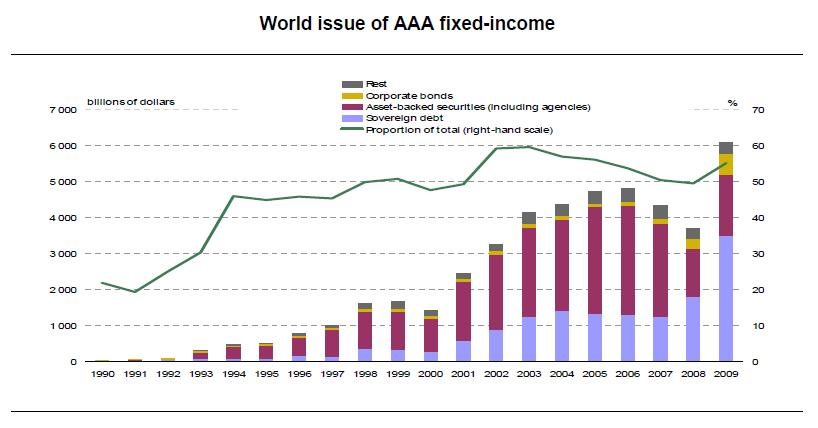

•The Atlantic – Should We Worry About a AAA-Rated Debt Bubble?

Investor love risk-free bonds, but is it possible to have so many of them?

In 1999, about $1.5 trillion AAA-rated securities were issued globally. In 2009, AAA-rated issuance peaked at over $6 trillion. Are we in bubble territory? … Tracy Alloway at the Financial Times Alphaville blogs says that this could be the most important chart in the world right now. Is this a clear indication that the rating agencies and investors are both out of their minds? The chart shows two things. First, AAA-rated security issuance has grown at an extremely rapid pace over the past decade. Second, the portion of bonds that are AAA-rated has also grown significantly, to more than 50% of all fixed-income bonds issued, from around 20% in 1991.*

In 1999, about $1.5 trillion AAA-rated securities were issued globally. In 2009, AAA-rated issuance peaked at over $6 trillion. Are we in bubble territory? … Tracy Alloway at the Financial Times Alphaville blogs says that this could be the most important chart in the world right now. Is this a clear indication that the rating agencies and investors are both out of their minds? The chart shows two things. First, AAA-rated security issuance has grown at an extremely rapid pace over the past decade. Second, the portion of bonds that are AAA-rated has also grown significantly, to more than 50% of all fixed-income bonds issued, from around 20% in 1991.*

Etichette:

articles,

Economy article,

Finance article,

market articles

Exploding Government Debt to Send Gold to $3000, Silver to $300

By: George_Maniere

For those of you that have not read my writing I will save you the suspense and tell you here and now that I have been I gold and silver bug since I was 8 years old. I'm now 58. As far as I know I was the only kid I know that wanted either a St. Gauden's Gold Double Eagle or an 1885 Carson City PCGS MS 67 Morgan Dollar for my birthday. Back then it was a hobby. Now it is very serious business.

I only preface my remarks to save the readers who don't want to hear from any more gold and silver bugs. However, if you are like me and think that gold and silver will be our hedge against whatever economic winds and "Black Swans" come our way, please read on.

I don't for one minute doubt that the debt this country has run up over the last 6 years has exploded. I also don't think for one minute that the debt that has been run up was truly "AAA." I can't possibly be the only one who finds it ironical that the same agencies that stamped the collateralized debt obligations and derivatives "AAA", while they allegedly took bribes, and share equally for the economic morass we find ourselves in are the same agencies that are now holding us hostage by warning of a possible credit downgrade. The truth, as I see it, is that the financial sector as a whole was the great enabler of this scheme as the cause of the economic collapse was their voracious appetite for risky loans as a way to work the system. This certainly has to rate as one of the greatest lies in economic history.

In Europe, Greece has already defaulted. It's just a matter of semantics. Meanwhile, the EU continues to fiddle while Lisbon, Dublin, Madrid and now Rome burn. As reported in this week's Barron's eight European banks failed the "stress tests" and the other 16 banks passed marginally but the IMF warned that these banks were also insufficiently funded.

Those of you that read me regularly know that I am a big fan of Martin Armstrong. Those of you that are not conversant in Martin Armstrong and his Princeton Economic Model I strongly urge that use visit http://martinarmstorng.org and read about this truly unrecognized and unappreciated genius. This man's understanding of money and debt is most assuredly still not appreciated today.

Everything he warned would happen in Europe did happen because Europe failed to listen when he told the ECB that all the debts had to be consolidated into a single national debt in order for there to be a single currency (the Euro). The politicians would not listen because politically they assumed it would have been a bailout of the lesser states and that they could not sell it to their people. They were wrong and we are now reaping what they sowed.

What Armstrong is saying about the gold standard idea is that money is never a constant. It fluctuates in purchasing power rising in depression and declining in booms. Those who cannot see what he is saying are making the same mistake as Karl Marx made assuming that there can be a perfect world without a business cycle where gold as money is the magical constant value. Sadly the same scenario is playing out in this country today.

The much maligned, Dr. Bernanke this week displayed better tap dancing than I've seen on "Star Search." On Tuesday Congress heard him say that he was ready to step in with further QE3 measures and on Wednesday Congress heard him say that while QE3 is an option it is not something that the FOMC is considering at this time. On Friday, he was quoted as saying that "even with the federal funds close to zero, we have a number of ways in which we could ease financial conditions further." I can only conclude that the Fed needed to open the door to QE3 given the deteriorating economic conditions, particularly the weak payroll data that was released on Friday.

The only thing that could derail gold and silver assent would be if Congress starts to act in a rational manner, the Federal Reserve starts to normalize monetary policy or if conditions in Europe begin to settle down. I see this as the least likely of all possibilities.

I will use the Gold ETF (GLD) and the Silver ETF (SLV) to base my analysis on. Please see the charts below:

While GLD fooled me in May and I sold my position at $152.00 I was given another chance and reopened half my position at 144.05 because I thought it would go back to $142.00 or the 150 DMA. GLD has enjoyed a slow, steady and healthy rise but while it looks like it could go to $170.00, it seems to be getting a little long in the tooth and I will start taking profits at $160.00.

SLV which enjoyed an amazing parabolic run from January to the last day in April seems to have put in a firm area of support at $32.50 but also seems to have some resistance in the $38.50 area. I opened small positions in SLV at $33.00 and $35.00. However I am not sure the faint of heart investors and institutional buyers have been sufficiently punished. While I see silver going to at least $60.00 within a year, for now I will stand aside and wait until I am sure which way the wind is blowing. I certainly see the possibility of silver going back for one more try at the $32.500 support level. Especially if gold corrects back to $141.50 or the 150 DMA.

Oddly, if Congress continues its squabbling and does not raise the debt ceiling, Moody's and S&P will have no choice but to downgrade our credit rating and Gold will be $3000.00 an ounce and silver will be $300.00 an ounce in a week. Either way things play out, Gold and Silver will be long term winners.

Etichette:

Analysis Technic,

analysis technic article,

articles,

commodity,

gold,

market articles,

metals,

silver

An Epic Energy Crunch, Global Crude Oil Demand Exceeds Production

By: Puru_Saxena

The majority of the world’s developed economies are growing at a sluggish pace, yet the price of NYMEX crude is trading around US$100 per barrel. Interestingly, the price of Brent Crude (the price most nations pay) is even higher!

You may recall that during the last oil spike in 2008, world governments blamed those wily speculators. Therefore, in order to diminish speculation, the authorities banned leveraged ‘long’ oil exchange traded funds.

It is notable that a few months ago, the price of NYMEX crude (once again) spiked to US$115 per barrel and this caused the politicians to panic. This time around, the governments could not blame the speculators so, a few days ago, they decided to dump 60 million barrels of crude on the market from their strategic petroleum reserves. This ‘oil pour’ created a lot of sensational headlines in the media and caused the price of crude to drop sharply. However, this decline proved to be short-lived and the oil price bounced right back up again.

Political manipulation notwithstanding, the truth is that the fundamentals for petroleum are wildly bullish and all the governments put together will not succeed in suppressing the price of oil. According to the International Energy Agency, the world is likely to consume 89.3 million barrels of liquid fuels per day in 2011 (Figure 1) and in May, global production came in at 87.68 million barrels per day. Thus, you can see that output is failing to keep up with rising worldwide consumption and the 60 million barrels ‘oil pour’ represents less than a single day’s usage!

Figure 1: Global oil demand exceeds production

Source: International Energy Agency

Bearing in mind the fact that global usage of liquid fuels will only increase in the future, one does not need to be a rocket scientist to figure out that the world will need to raise its production. So, in this editorial, we will evaluate whether the oil producing nations will be able to rise to the challenge.

When reviewing crude’s supply picture, it is important to realise that several oil producing regions are already past their peak flow rates and have entered an irreversible decline. For instance, it is no secret that the North Sea, Mexico, Indonesia and a host of other areas are past their prime. In terms of future production growth, all eyes are now fixated on OPEC which claims to have almost 5 million barrels per day of spare capacity. Nobody really knows whether OPEC is capable of increasing production by such a large amount but Saudi Arabia keeps insisting that it can ramp up daily output by approximately 3.5 million barrels (Figure 2).

Figure 2: Saudi Arabia holds the key!

Source: www.theoildrum.com

Now, given the fact that the vast majority of Saudi Arabia’s super-giant oil fields are extremely old, one has to wonder whether the nation is capable of boosting production. According to some reports, Saudi Arabia is struggling to maintain its current flow rates and in a desperate attempt to maintain reservoir pressure, it is pumping huge amounts of water into its ageing oil fields.

More importantly, we are of the view that Saudi Arabia has grossly overstated its oil reserves and it is extremely unlikely that the nation has 270 billion barrels of petroleum. After all, the Saudi reserves have never been audited and a recent report by WikiLeaks suggests that the Saudis have inflated their oil bounty by 40%!

The proof of the pudding is in the eating and when one reviews Saudi oil production data, it becomes clear that despite all the rhetoric, its flow rate is in decline! Figure 3 shows that Saudi oil production reached a high in 2004 and ever since, it has been heading south.

Figure 3: Why is Saudi oil production declining?

Source: www.theoildrum.com

If Saudi Arabia is indeed sitting on humungous oil reserves and it has the ability to raise output, why has production failed to climb above the level recorded seven years ago?

Now some may argue that the Saudis are deliberately keeping a lid on production, but we have a different view. Call us sceptics, but we believe that Saudi Arabia is already stretched to the limit and will find it hard to increase production.

Unfortunately, if Saudi Arabian oil production is close to its peak, then the world simply cannot produce more crude. Furthermore, when you take into account the ongoing depletion in the world’s existing oil fields, it becomes clear that the world is heading into an epic energy crunch.

Under these circumstances, we believe that the price of oil will appreciate considerably and the impending surge will cause the next worldwide recession. However, as long as the global economy is expanding, the oil bull will charge ahead and it is likely that the all-time high recorded in 2008 will be left in the dust. Accordingly, we are maintaining our overweight investment position in upstream energy companies, oil services firms and nuclear energy plays.

Although we are aware that nuclear energy is currently out of favour and many are unsure about its future, we are convinced that there is no Plan B. With the finite supply of liquid fuels, the world will need to generate more electricity and nuclear energy is the only viable option. Sceptics may want to note that if France can generate over 75% of its power from nuclear energy and do so without any accidents, then the rest of the world can surely do the same. It is notable that with the exception of Germany, most other nations are going ahead with their nuclear programs and this is good news for the sector. In summary, we view the panic fueled sell off in the nuclear sector as a great opportunity for the patient investor.

Etichette:

articles,

commodity,

commodity article,

crude oil,

energy,

market articles,

oil

Confusion reigns as Europe limps toward Greece summit

By Luke Baker and Jan Strupczewski

French government spokeswoman Valerie Pecresse said she believed a summit of the euro zone's 17 national leaders scheduled for Thursday in Brussels would agree on a rescue of Greece, supplementing a 110 billion euro ($154 billion) bailout launched in May last year.

But after three weeks of preparatory talks, it remained unclear whether government officials and commercial bankers could agree on a way for private owners of Greek government bonds -- banks, insurers and other investors -- to contribute to the bailout by taking cuts in the face value of their holdings.

The uncertainty pushed the euro down against other currencies on Monday and the government bond yields of indebted euro zone states rose, with Italy's 10-year yield climbing more than 0.2 percentage point to a euro-era high.

Paul de Grauwe, a professor of international economics at Leuven University in Belgium who has informally advised European Commission President Jose Manuel Barroso, said politicians had delayed taking decisive action on Greece for so long that their options were narrowing fast.

"I'm afraid to hope. I still hope, yes, but I'm not optimistic," he said.

"We've had solutions in the past, but we haven't grasped them. Now it's too late for some of those solutions to work anymore; the opportunity has been lost."

"CANNOT RULE OUT ANYTHING"

Officials are wrestling with a range of schemes for Europe's bailout fund, the European Financial Stability Facility, to finance a voluntary buy-back or swap of Greek debt that would be conducted at a discount to face value, helping to reduce Greece's 340 billion euro mountain of sovereign debt.

But all of the schemes could face major technical and legal obstacles, in some cases requiring the approval of national parliaments in the euro zone. Other proposals still appear to be on the table; Germany's Die Welt newspaper reported on Monday that governments were considering a levy on banks as a way to involve private creditors in rescuing Greece.

An official of a major euro zone government who is familiar with the talks said he had not heard of a proposal for a bank levy, but added: "There are at the moment so many proposals that you cannot rule out anything."

If a deal on private creditor participation is reached, it may cut Greece's debt by just 20 or 30 billion euros, not nearly enough by itself to solve the problem. Analysts have estimated the debt would have to be roughly halved, to 80 percent of gross domestic product, to make it manageable in the long run.

German Chancellor Angela Merkel said on Sunday that while this week's summit was "urgently necessary," she would only attend if lower-ranking officials had already prepared a clear rescue plan. "I will only go there if there is a result."

BAILOUT

As part of the second bailout, officials have also been looking at other measures to help Greece including up to 60 billion euros of additional emergency loans from European governments and the International Monetary Fund; steps to recapitalize Greek and European banks; and ways to stimulate Greek economic growth.

Some official sources have said interest rates on bailout loans extended to Greece, Ireland and Portugal may be cut and maturities on those loans extended drastically, perhaps to 30 years.

There has also been talk of expanding the 750 billion euro bailout facility which the European Union and the IMF jointly created last year as the debt crisis erupted.

But de Grauwe said financial markets were now putting so much pressure on weak euro zone states that it was unclear whether cutting interest and extending maturities on their emergency loans would help them regain access to the markets.

"If that was to be a solution, it's a solution we should have implemented months ago, when it would have worked."

Another source of concern is signs that the IMF and other major governments around the world, which want to prevent the European crisis from poisoning debt markets globally, may lose patience with Europe's handling of the problem.

Die Welt quoted unnamed diplomatic sources as saying the IMF was angered by Europe's crisis management and that "influential parties" in the Fund wished not to take part in further bailouts of Greece. It did not elaborate.

Former U.S. Treasury Secretary and White House adviser Lawrence Summers, writing in a column contributed to Reuters on Sunday, said Europe needed to act much more aggressively than it had done so far to prevent the Greek crisis from damaging both the region's single currency and the global economic recovery.

He recommended steps including sharp cuts in interest paid on bailout loans, allowing countries to buy European Union guarantees for their issues of new debt, and a menu of options for private investors to become involved.

"It is to be hoped that European officials can engineer a decisive change in direction but if not, the world can no longer afford the deference that the IMF and non-European G20 officials have shown toward European policymakers over the last 15 months," Summers wrote.

Many private economists think some form of regional guarantee for countries' debt along the lines suggested by Summers -- or perhaps even the issuance of joint euro zone bonds -- may ultimately be the only way to emerge from the crisis without one or more weak states being forced out of the zone.

But Germany has shown no appetite for such a sweeping solution, which in any case would require a complex and time-consuming revision of the EU treaty.

"We are against euro bonds," German government spokesman Steffen Seibert said on Friday, repeating Berlin's concern that a common bond for the single currency area would provide no meaningful incentives for national governments to pursue prudent budget policies.

Etichette:

articles,

Economy article,

Finance article,

market articles

Feed Outlook – July 2011

by TCS

Higher Stocks and Production Boost Feed Grain Supply

The June Grain Stocks report indicated lower- than-expected March-May corn use for 2010/11, boosting projected corn carryin for 2011/12 by 150 million bushels. The June Acreage report increased planted acreage relative to March intentions and the previous month’s projection, boosting 2011/12 projected corn production 270 million bushels. Corn supplies for 2011/12 are projected 420 million bushels higher. Forecast 2011/12 prices were lowered for all four feed grains. With corn price prospects reduced, domestic use is projected up 145 million bushels as increased feed and residual and ethanol use more than offset small reductions for starch and high fructose corn syrup (HFCS). US corn exports are increased 100 million bushels, mostly due to increased demand from China. Increased US corn supplies more than offset higher use, leaving projected 2011/12 ending stocks up 175 million bushels.

Domestic Outlook

Feed Grain Supply Prospects Raised for 2011/12

US feed grain supplies for 2011/12 are projected higher for July, reflecting higher beginning stocks and production for corn. US feed grain production for 2011/12 is projected at 382.6 million tons, up 9.6 million tons from a month ago and down 2 million tons from the 2010/11 estimate. The June 30 Acreage report showed planted acreage increased relative to intentions for corn and decreased for the other feedgrains. Corn beginning stocks are raised 150 million bushels reflecting changes in 2010/11 use. Corn production for 2011/12 is projected 270 million bushels higher based on harvested and planted area reported in the Acreage report.

The first survey-based production forecast for barley in the July 12 Crop Production report lowers output 2 million bushels from the June projection as lower harvested acreage more than offsets an increase in yield. Barley beginning stocks are reduced 3 million bushels due to increased 2010/11 use revealed by the June 1 stocks estimate. The first survey-based production forecast for oats is 15 million bushels lower than the June projection, reflecting a decline in projected harvested acres and expected lower yield. Oat imports are projected 5 million bushels lower than last month’s projection but 7 million bushels above the 2010/11 estimate. USDA will make its first survey-based forecasts for corn and sorghum production in the August 11 Crop Production report.

The first survey-based production forecast for barley in the July 12 Crop Production report lowers output 2 million bushels from the June projection as lower harvested acreage more than offsets an increase in yield. Barley beginning stocks are reduced 3 million bushels due to increased 2010/11 use revealed by the June 1 stocks estimate. The first survey-based production forecast for oats is 15 million bushels lower than the June projection, reflecting a decline in projected harvested acres and expected lower yield. Oat imports are projected 5 million bushels lower than last month’s projection but 7 million bushels above the 2010/11 estimate. USDA will make its first survey-based forecasts for corn and sorghum production in the August 11 Crop Production report.

June 1 Stocks Estimate Eases Stocks Situation

The Grain Stocks report, issued by USDA’s National Agricultural Statistics Service on June 30, 2011, showed higher-than-expected June 1 corn stocks indicating a lower-than-expected March-May disappearance during 2010/11. This month’s changes to 2010/11 corn usage raise carryin for the 2011/12 crop year 150 million bushels over last month’s projection, but beginning stocks remain down dramatically, at 52 per cent of the 2010/11 estimate. June 1 stocks for sorghum raise indicated March-May disappearance, lowering expected ending stocks for 2010/11. June 1 stock estimates reduce barley 2010/11 ending stocks 3 million bushels and raise oats 2010/11 ending stocks 2 million bushels. Ending stocks for 2010/11 are down year to year for all four of the feed grains.

Corn ending stocks for 2011/12 are raised 175 million bushels from last month’s projection based on higher production and carryin. Sorghum, barley, and oats ending stocks are down 5, 6, and 8 million bushels, respectively, as projected supplies tighten this month.

Corn ending stocks for 2011/12 are raised 175 million bushels from last month’s projection based on higher production and carryin. Sorghum, barley, and oats ending stocks are down 5, 6, and 8 million bushels, respectively, as projected supplies tighten this month.

There is no change this month in the 2011/12 corn import projection of 20 million bushels. Estimated imports of corn for 2010/11 are raised 5 million bushels to 30 million bushels on continued strong shipments from Canada.

Corn feed and residual use for 2011/12 is increased 50 million bushels as lower prices encourage feeding. The 2010/11 feed and residual use forecast is lowered 150 million bushels based on lower-than-expected March-May disappearance as indicated by the June 1 stocks. Continuing high prices are expected to limit corn use for feed with increased supplies of soft red winter wheat priced to substitute for corn in livestock feed this summer. June-August corn feed and residual use, however, is expected to be up from last year as delayed planting in eastern and southern portions of the Corn Belt limit early availability of new-crop corn. Feed and residual use in the second half of the marketing year is estimated at 1,364 million bushels, or only 27 per cent of the 5,000 million bushels projected for the year. This would be lower than any year since at least 1975, both in absolute and per centage terms.

Sorghum feed and residual for 2011/12 is projected 10 million bushels lower at 80 million bushels as reduced plantings lower supplies especially in Texas and Kansas where drought is adversely affecting this year’s crop. For 2010/11, sorghum feed and residual use are increased 5 million bushels based on indications from the June 1 stocks. The July projection for barley feed and residual use is unchanged for 2011/12 and increased 3 million for 2010/11, reflecting the lower ending stocks estimate. For oats, the July 2011/12 projection for feed and residual use is lowered 10 million bushels, reflecting lower production. For 2010/11, ending stocks are estimated 2 million bushels lower, reflecting the June 1 stocks.

Grain consuming animal units (GCAUs) are increased for July. For 2011/12, higher inventory numbers for cattle on feed and hogs boosted GCAUs from 94.2 to 94.3. For 2010/11, GCAUs increased from 92.7 to 92.9 on higher poultry inventory.

Corn feed and residual use for 2011/12 is increased 50 million bushels as lower prices encourage feeding. The 2010/11 feed and residual use forecast is lowered 150 million bushels based on lower-than-expected March-May disappearance as indicated by the June 1 stocks. Continuing high prices are expected to limit corn use for feed with increased supplies of soft red winter wheat priced to substitute for corn in livestock feed this summer. June-August corn feed and residual use, however, is expected to be up from last year as delayed planting in eastern and southern portions of the Corn Belt limit early availability of new-crop corn. Feed and residual use in the second half of the marketing year is estimated at 1,364 million bushels, or only 27 per cent of the 5,000 million bushels projected for the year. This would be lower than any year since at least 1975, both in absolute and per centage terms.

Sorghum feed and residual for 2011/12 is projected 10 million bushels lower at 80 million bushels as reduced plantings lower supplies especially in Texas and Kansas where drought is adversely affecting this year’s crop. For 2010/11, sorghum feed and residual use are increased 5 million bushels based on indications from the June 1 stocks. The July projection for barley feed and residual use is unchanged for 2011/12 and increased 3 million for 2010/11, reflecting the lower ending stocks estimate. For oats, the July 2011/12 projection for feed and residual use is lowered 10 million bushels, reflecting lower production. For 2010/11, ending stocks are estimated 2 million bushels lower, reflecting the June 1 stocks.

Grain consuming animal units (GCAUs) are increased for July. For 2011/12, higher inventory numbers for cattle on feed and hogs boosted GCAUs from 94.2 to 94.3. For 2010/11, GCAUs increased from 92.7 to 92.9 on higher poultry inventory.

Corn Used for Ethanol Increased, Sorghum Decreased

Projected corn use for ethanol is raised 100 million bushels for 2011/12 and 50 million for 2010/11. Continued expansion in the ethanol sector as reported by Energy Department weekly data for recent months, favorable margins for refiners, and long-term trends in fuel consumption resulted in the increase to 5,150 million bushels in 2011/12 and 5,050 million in 2010/11. Sorghum food, seed, and industrial use is lowered 5 million bushels for 2011/12, with this month’s 25-million-bushel reduction in projected supplies and likely sharp production declines in the Southern Plains, due to the ongoing drought.

Projected food, seed, and industrial use of corn for 2011/12 advance 95 million bushels, with increases in corn for ethanol partly offset by lower expected use for HFCS, reflecting slower shipments to Mexico. For 2010/11, food, seed and industrial use increases 30 million bushels as corn use for starch and HFCS is reduced 20 million bushels, partly offsetting the higher projected corn use for ethanol.

Corn export projections for 2011/12 are increased to reflect increased demand from China. Projections of sorghum exports are lowered 5 million bushels to reflect tighter supplies. For 2010/11, corn exports are lowered 25 million bushels to reflect slower shipments in recent months.

Projected food, seed, and industrial use of corn for 2011/12 advance 95 million bushels, with increases in corn for ethanol partly offset by lower expected use for HFCS, reflecting slower shipments to Mexico. For 2010/11, food, seed and industrial use increases 30 million bushels as corn use for starch and HFCS is reduced 20 million bushels, partly offsetting the higher projected corn use for ethanol.

Corn export projections for 2011/12 are increased to reflect increased demand from China. Projections of sorghum exports are lowered 5 million bushels to reflect tighter supplies. For 2010/11, corn exports are lowered 25 million bushels to reflect slower shipments in recent months.

Feed Grain Prices

Price projections for 2011/12 are lowered for the four feed grains. The season average farm price for corn is projected at $5.50 to $6.50, a 50-cent reduction in both the high and low ends of the range compared with June’s projection, but still a record with a midpoint of $6.00. The projected sorghum upper and lower price ranges are lowered 50 cents per bushel to $5.10 to $6.10. The upper and lower ends of the projected ranges are lowered 30 cents per bushel for barley and 40 cents per bushel for oats, resulting in projections of $5.65 to $6.75 and $3.20 to $3.80, respectively.

For the 2010/11 corn price estimate, the upper end of the range is lowered 15 cents and the lower end lowered 5 cents. Sorghum is reduced 5 cents on the lower end of the range and 15 cents on the upper end. Final estimates for barley and oats are increased slightly.

Hay Acreage for 2011 Record Low

The June 30 Acreage report forecasts 2011 harvested acres of all hay at 57.6, down 2.3 million from last year. This would be the lowest all hay area on record going back to 1919. Harvested area of alfalfa and alfalfa mixtures is forecast at 19.3 million acres, down 627,000 million from 2010. Area for harvest of all other types of hay is expected to total 38.3 million acres, down 1.6 million acres from 2009. Harvested area for alfalfa and alfalfa mixtures is expected to the lowest since 1949 and harvested area for all other hay is expected to be the lowest since 2000. At 5- year average yields, all hay production would be 138 million tons, down 7 million from 2010 and the lowest since 1988.

Harvested acres of all hay are expected to be below or equal to last year for most States in the Corn Belt, Great Plains, Pacific Northwest, and the Rocky Mountain region. Record low harvested acreage is expected in Iowa, Nebraska, Minnesota, Maine, Pennsylvania, and Wisconsin while record high acreage is expected in Arkansas. Record high acres of alfalfa and alfalfa mixtures are expected to be harvested in Montana. In Arkansas, record low acreage is expected for alfalfa and alfalfa mixtures in contrast to the record-tying high harvested acreage of other hay that is expected.

Harvested acres of all hay are expected to be below or equal to last year for most States in the Corn Belt, Great Plains, Pacific Northwest, and the Rocky Mountain region. Record low harvested acreage is expected in Iowa, Nebraska, Minnesota, Maine, Pennsylvania, and Wisconsin while record high acreage is expected in Arkansas. Record high acres of alfalfa and alfalfa mixtures are expected to be harvested in Montana. In Arkansas, record low acreage is expected for alfalfa and alfalfa mixtures in contrast to the record-tying high harvested acreage of other hay that is expected.

Corn Used for Dry Mill Fuel Ethanol Production and Distillers’ Grain By-Products

As corn-based fuel ethanol production has risen over the past decade, there has been interest in the volume of distillers’ grains produced. Distillers’ grains are a by-product from dry-mill ethanol plants and can be used in livestock rations, particularly by ruminants such as beef and dairy cattle. Since most of the expansion in fuel ethanol production has been in corn-based dry mill plants, production of distillers’ grains has shown a rapid expansion as well.

Figure 7 provides an indicator of the growing importance of distillers’ grains by showing estimates of the amount of corn utilization that produces distillers’ grains from dry mill fuel ethanol production. Calculations are based on data provided in Hoffman and Baker, Market Issues and Prospects for US Distillers’ Grains Supply, Use, and Price Relationships, USDA-ERS Outlook Report No. FDS-10K-01, December 2010.

To arrive at the estimates for corn that produces distillers’ grains from dry mill fuel ethanol production, two steps are made in the calculations. First, the volume of corn used in dry mill fuel ethanol (and by-products) production is separated from the volume used for all ethanol (and by-products) production. This share has risen from 30-35 per cent a decade ago to about 90 per cent in 2010/11. Second, since about 17.5 pounds of distillers’ grains are typically produced from each bushel of corn used in dry mill ethanol production, 31.25 per cent (17.5 lbs. distillers’ grains per each 56 pound corn bushel) of the corn used in dry mill ethanol production was allocated to the production of distillers’ grains. Based on these assumptions, the amount of corn that produces distillers’ grains from dry mill fuel ethanol plants is expected to account for about 11 per cent of total corn utilization in 2010/11.

Allocation of corn to the production of other ethanol byproducts, such as corn gluten feed and corn gluten meal from wet-mill ethanol plants, are not separated in this depiction. For more information regarding the breakout of these categories, see the Hoffman and Baker report cited above.

Figure 7 provides an indicator of the growing importance of distillers’ grains by showing estimates of the amount of corn utilization that produces distillers’ grains from dry mill fuel ethanol production. Calculations are based on data provided in Hoffman and Baker, Market Issues and Prospects for US Distillers’ Grains Supply, Use, and Price Relationships, USDA-ERS Outlook Report No. FDS-10K-01, December 2010.

To arrive at the estimates for corn that produces distillers’ grains from dry mill fuel ethanol production, two steps are made in the calculations. First, the volume of corn used in dry mill fuel ethanol (and by-products) production is separated from the volume used for all ethanol (and by-products) production. This share has risen from 30-35 per cent a decade ago to about 90 per cent in 2010/11. Second, since about 17.5 pounds of distillers’ grains are typically produced from each bushel of corn used in dry mill ethanol production, 31.25 per cent (17.5 lbs. distillers’ grains per each 56 pound corn bushel) of the corn used in dry mill ethanol production was allocated to the production of distillers’ grains. Based on these assumptions, the amount of corn that produces distillers’ grains from dry mill fuel ethanol plants is expected to account for about 11 per cent of total corn utilization in 2010/11.

Allocation of corn to the production of other ethanol byproducts, such as corn gluten feed and corn gluten meal from wet-mill ethanol plants, are not separated in this depiction. For more information regarding the breakout of these categories, see the Hoffman and Baker report cited above.

International Outlook

US 2011/12 Corn Export Prospects Boosted, 2010/11 Trimmed

Increased US corn supplies and more competitive prices are supporting US corn export prospects for 2011/12. This month, trade year (October-September) exports are increased 2.0 million tons to 48.0 million while local marketing year (September-August) exports are projected up 100 million bushels to 1.9 billion. World corn trade is boosted 1.2 million tons to 93.7 million as lower corn prices encourage additional imports, especially by China. Competing corn export prospects are reduced 0.8 million tons this month mostly due to tight supplies in a few minor exporting countries.

Canada’s corn export prospects are cut 0.5 million tons to 0.5 million because of reduced supplies. Canada’s 2011/12 corn beginning stocks prospects are reduced 0.5 million to 1.1 million due to strong corn use for ethanol in 2010/11. Canada’s corn production prospects for 2011/12 are reduced 0.2 million tons to 11.3 million because not all the intended corn acres got planted.

Mexico’s 2011/12 corn exports are cut 0.2 million tons this month to 0.1 million, mostly due to reduced production for both 2010/11 and 2011/12. Russia’s corn exports are also trimmed 0.2 million tons as the planned area increase is reported to have fallen short of expectations, reducing production prospects 0.5 million tons to 5.5 million. These declines are partly offset by a small increase in export prospects for Belarus, where corn area increases are reportedly greater than expected, boosting production prospects 0.2 million tons to 1.2 million.

China’s corn imports for 2011/12 are increased 1.5 million tons to 2.0 million. On July 7, USDA announced a sale of 0.54 million tons to China for delivery in 2011/12. Moreover, some of the unusually large corn sales to “unknown” destinations for both 2010/11 and 2011/12 are rumored to be for China. High corn prices in China make imports attractive, and growth in pork prices and hog numbers support prospects for continued strong corn prices in China.

Canada’s corn export prospects are cut 0.5 million tons to 0.5 million because of reduced supplies. Canada’s 2011/12 corn beginning stocks prospects are reduced 0.5 million to 1.1 million due to strong corn use for ethanol in 2010/11. Canada’s corn production prospects for 2011/12 are reduced 0.2 million tons to 11.3 million because not all the intended corn acres got planted.

Mexico’s 2011/12 corn exports are cut 0.2 million tons this month to 0.1 million, mostly due to reduced production for both 2010/11 and 2011/12. Russia’s corn exports are also trimmed 0.2 million tons as the planned area increase is reported to have fallen short of expectations, reducing production prospects 0.5 million tons to 5.5 million. These declines are partly offset by a small increase in export prospects for Belarus, where corn area increases are reportedly greater than expected, boosting production prospects 0.2 million tons to 1.2 million.

China’s corn imports for 2011/12 are increased 1.5 million tons to 2.0 million. On July 7, USDA announced a sale of 0.54 million tons to China for delivery in 2011/12. Moreover, some of the unusually large corn sales to “unknown” destinations for both 2010/11 and 2011/12 are rumored to be for China. High corn prices in China make imports attractive, and growth in pork prices and hog numbers support prospects for continued strong corn prices in China.

Algeria’s corn imports for 2011/12 are increased 0.1 million tons to 2.6 million, reflecting strong demand driven mostly by increasing poultry production. Based on recent trade data, the country’s 2010/11 corn imports are raised 0.3 million tons to 2.7 million. Similarly, Peru’s corn imports for 2011/12 are raised 0.1 million tons to 1.5 million, while 2010/11 imports are boosted 0.2 million tons to 1.7 million.

Partly offsetting is Syria’s 2011/12 corn imports, which are reduced 0.2 million to 2.0 million, while 2010/11 imports are trimmed 0.3 million tons to 1.7 million. Also, there is a 0.1-million-ton reduction in 2011/12 corn import prospects for Taiwan, to 4.6 million tons. The slow pace of corn purchases and shipments caused a reduction of 0.3 million tons to 4.3 million for 2010/11 imports.

Other changes to forecast of 2010/11 imports based on the pace of ongoing sales and shipments include: an increase of 0.3 million tons to 7.3 million for the EU, based on the pace of shipments and import licenses; a reduction of 0.1 million to 0.2 million for Russia; and an increase of 0.15 million tons to 0.75 for US trade year imports (the local marketing year imports are raised 5 million bushels to 30 million) due to shipments from Canada.

This month, US corn exports for 2010/11 are reduced 0.5 million tons to 48.0 million, (trimmed 25 million bushels to 1.875 billion for the local marketing year). The pace of sales and shipments in recent weeks has fallen below expectations. Census exports for October 2010 to May 2011 reached 30.3 million tons, down 4 per cent from the previous year, and June 2011 corn grain inspections were only 3.9 million tons, down 5 per cent. Moreover, at the end of June, outstanding export sales for shipments in the old marketing year were 8.3 million tons, down 16 per cent from a year ago. Corn export shipments during summer 2011 are no longer expected to support a year-over-year decline in exports of 4 per cent as forecast last month for the local marketing year and 3 per cent for the trade year.

Partly offsetting is Syria’s 2011/12 corn imports, which are reduced 0.2 million to 2.0 million, while 2010/11 imports are trimmed 0.3 million tons to 1.7 million. Also, there is a 0.1-million-ton reduction in 2011/12 corn import prospects for Taiwan, to 4.6 million tons. The slow pace of corn purchases and shipments caused a reduction of 0.3 million tons to 4.3 million for 2010/11 imports.

Other changes to forecast of 2010/11 imports based on the pace of ongoing sales and shipments include: an increase of 0.3 million tons to 7.3 million for the EU, based on the pace of shipments and import licenses; a reduction of 0.1 million to 0.2 million for Russia; and an increase of 0.15 million tons to 0.75 for US trade year imports (the local marketing year imports are raised 5 million bushels to 30 million) due to shipments from Canada.

This month, US corn exports for 2010/11 are reduced 0.5 million tons to 48.0 million, (trimmed 25 million bushels to 1.875 billion for the local marketing year). The pace of sales and shipments in recent weeks has fallen below expectations. Census exports for October 2010 to May 2011 reached 30.3 million tons, down 4 per cent from the previous year, and June 2011 corn grain inspections were only 3.9 million tons, down 5 per cent. Moreover, at the end of June, outstanding export sales for shipments in the old marketing year were 8.3 million tons, down 16 per cent from a year ago. Corn export shipments during summer 2011 are no longer expected to support a year-over-year decline in exports of 4 per cent as forecast last month for the local marketing year and 3 per cent for the trade year.

Changes to projected 2010/11 corn exports for other countries based on the pace of shipments include a 0.1-million-ton increase for Thailand and a smaller boost for Moldova.

US 2011/12 Sorghum Export Prospects Reduced

US sorghum export prospects for 2011/12 are limited by reduced production prospects. Exports are reduced 0.2 million tons this month to 3.3 million (cut 5 million bushels to 130 million for the local marketing year). An offsetting change is made for Argentina, with sorghum exports up 0.2 million tons this month to 1.7 million. Sorghum trade changes for 2010/11 include an increase of 0.2 million tons to 1.8 million for Argentina’s exports, based on the strong pace of sales and shipments, and a reduction of 0.2 million tons in imports for Mexico, due to a reported increase in production and the pace of imports and purchases.

Barley Trade Highlights Offsetting Changes

Global barley trade in 2011/12 (October-September) is projected down slightly this month at 13.1 million tons. Production changes support reduced export prospects for Ukraine, offset by increases for Argentina and Turkey.

Ukraine reported lower barley area planted and spring dryness followed by excessive rains in June trimmed yield prospects. Production for 2011/12 is reduced 1.0 million tons this month to 7.5 million. The reduced production during summer 2011 is projected to reduce 2011/12 exports 0.6 million tons to 2.9 million, and 2010/11 exports 0.4 million tons to 2.1 million.

Argentina’s barley area and production are up this month for both 2010/11 (up 0.6 million tons to 2.9 million) and 2011/12 (up 0.2 million to 2.7 million). The production increases and the strong pace of recent sales and shipments support increased exports forecast for 2010/11 (up 0.3 million tons to 1.6 million) and 2011/12 (up 0.4 million to 1.5 million).

Turkey’s barley yields are projected higher this month as a wet cool spring delayed crop development but boosted yields. Production in 2011/12 is projected up 0.8 million tons to 6.5 million. While the slow pace of old-crop exports is dropping the 2010/11 export forecast 0.1 million tons to 0.05 million, the increased production prospects support an increase in 2011/12 exports, up 0.1 million tons to 0.15 million.

Australia’s 2010/11 barley export pace has been slow, reducing the forecast 0.3 million tons to 4.0 million. Global barley trade in 2010/11 is reduced 0.5 million tons this month to 13.8 million, the lowest in 13 years. Import changes for 2010/11 include: Syria, down 0.4 million tons to 0.2 million; Israel, down 0.1 million to 0.25 million; China, up 0.1 million to 1.6 million: and Algeria, up 0.075 million to 0.075 million.

Import changes for 2011/12 mostly follow adjustments for the previous year, with Syria and Israel each down 0.1 million tons, while China is up 0.1 million and Algeria is up slightly. Turkey’s 2011/12 imports are trimmed slightly.

Ukraine reported lower barley area planted and spring dryness followed by excessive rains in June trimmed yield prospects. Production for 2011/12 is reduced 1.0 million tons this month to 7.5 million. The reduced production during summer 2011 is projected to reduce 2011/12 exports 0.6 million tons to 2.9 million, and 2010/11 exports 0.4 million tons to 2.1 million.

Argentina’s barley area and production are up this month for both 2010/11 (up 0.6 million tons to 2.9 million) and 2011/12 (up 0.2 million to 2.7 million). The production increases and the strong pace of recent sales and shipments support increased exports forecast for 2010/11 (up 0.3 million tons to 1.6 million) and 2011/12 (up 0.4 million to 1.5 million).

Turkey’s barley yields are projected higher this month as a wet cool spring delayed crop development but boosted yields. Production in 2011/12 is projected up 0.8 million tons to 6.5 million. While the slow pace of old-crop exports is dropping the 2010/11 export forecast 0.1 million tons to 0.05 million, the increased production prospects support an increase in 2011/12 exports, up 0.1 million tons to 0.15 million.

Australia’s 2010/11 barley export pace has been slow, reducing the forecast 0.3 million tons to 4.0 million. Global barley trade in 2010/11 is reduced 0.5 million tons this month to 13.8 million, the lowest in 13 years. Import changes for 2010/11 include: Syria, down 0.4 million tons to 0.2 million; Israel, down 0.1 million to 0.25 million; China, up 0.1 million to 1.6 million: and Algeria, up 0.075 million to 0.075 million.

Import changes for 2011/12 mostly follow adjustments for the previous year, with Syria and Israel each down 0.1 million tons, while China is up 0.1 million and Algeria is up slightly. Turkey’s 2011/12 imports are trimmed slightly.

US Oat Imports To Be Limited by Canada’s Tight Supplies

Oats area planted in Canada is reduced this month due to extended rains throughout the planting season in southwest Manitoba and into southern Saskatchewan. Production for 2011/12 is down 0.4 million tons to 2.9 million. Canada’s beginning stocks for 2011/12 are reduced slightly this month because of the pace of 2010/11 exports (up 0.05 million tons to 1.4 million). Beginning stocks are forecast to be down more than 40 per cent from the previous year’s level. Exports prospects for 2011/12 are reduced 0.1 million tons to 1.45 million. This is reflected in a reduction in US imports, down 0.1 million tons to 1.5 million (local marketing year imports are reduced 5 million bushels to 90 million).

Global Coarse Grain Production Shifts Mostly US Changes

World coarse grain production for 2011/12 is projected up 6.5 million tons this month to 1,150.3 million, but foreign changes are mostly offsetting, netting an increase of 0.4 million tons to 795.8 million. Production changes not previously noted in the trade section include: Russia’s barley up 1.0 million tons to 15.5 million due to good preliminary yield reports; Ukraine corn up 0.5 million tons to 15.5 million with an increase in area planted; EU barley up 0.4 million tons to 52.1 million due to good yields in Spain; small increases in oats in Australia and barley in Georgia; and small reductions for corn in Kazakhstan and Australia and rye in Canada.

World Coarse Grain Use Prospects Increased

Global coarse grain consumption in 2011/12 is projected up 6.3 million tons this month to 1,158.4 million. Foreign use is up 3.2 million tons to 852.1 million. China’s use is up 1.6 million tons to 190.6 million, with increased corn imports and strong demand for meat supporting use. Russia is up 0.8 million tons to 27.3, with increased barley production and increasing meat production. Turkey is up 0.6 million tons to 11.4 million, supported by increased production. Other changes are small.

Global Ending Stocks Prospects Increase Mostly In the United States

While world coarse grain ending stocks for 2011/12 are projected up 4.0 million tons to 149.2 million, foreign stocks are down 0.1 million to 124.4 million. Canada’s ending stocks are reduced 0.5 million tons this month with reduced production. Mexico’s corn crop reductions trim ending stock prospects for coarse grain 0.4 million tons. Argentina’s increased barley exports more than offset increased production, leaving coarse grain ending stocks reduced 0.2 million tons. Lower barley imports trim Syria’s coarse grain stock projection 0.2 million tons. These and smaller reductions are offset by increased stocks prospects for: EU stocks, up 0.4 million tons supported by barley production; Australia, up 0.3 million due to reduced 2010/11 barley exports; Turkey, up 0.2 million, and several smaller increases in other countries.

See the original article >>

Etichette:

articles,

commodity,

commodity article,

feeder cattle,

market articles,

meats

Morning markets: India and weather conspire to weaken grains

by Agrimoney.com

There were a several reasons for farm commodities to get off to a soft start to the week.

For one, Monday began as a risk-off day, amid concerns that Europe's bank stress tests, which failed eight institutions, were not strong enough, and, in the US, with a continued lack of progress over talks on the debt ceiling.

The dollar, nonetheless, rose, fulfilling its role as an indicator of investor nerves, adding 0.5% against a basket of currencies and in turn making dollar-denominated assets, such as many commodities, less affordable as exports.

West Texas Intermediate crude slipped 0.4% below $97 a barrel.

'Demand evaporated'

Farm commodities continued their slide, including cotton, which in very early deals hitting 96.75 cents a pound in New York for December delivery – the contract's lowest level of 2011 – after falling 13% in the previous five sessions.

"In the past six weeks the December futures contract has slumped 30%, pressured by consistent cancellations of existing US cotton export sales," Luke Mathews at Commonwealth Bank of Australia, said.

"Global cotton demand has seemingly evaporated."

Still, with prices rise on the Zhengzhou exchange in China, the top producer, consumer and importer, rising, cotton this time staged some recovery to stand at 98.40 cents a pound by 07:45 GMT (08:45 UK time), down 1.1% on the day.

Mr Mathews added: "The terrible Texas drought, which has already caused significant downward revisions to US cotton production prospects and may cause even further future revisions, may start supporting prices. After all, US and global cotton supplies are already extremely tight."

Less heat?

Indeed, cotton was for once ahead of grains, which had other reasons to slip too - not least an apparent turn better, for corn farmers, in the US weather outlook, and the prospect for damaging heat in US Midwest.

A cool front is now expected the northern part of the eastern Corn Belt later this week, WxRisk.com said.

And, more importantly, the threat has receded of hot weather heading into August, when heat might cause real damage to plants protected for now to some extent by ample soil moisture reserves.

"While there is some data which suggests a new heat dome was going to form by the end of the month over the Rockies and then try and move east, right now the data that supports this is pretty weak," WxRisk.com said in an overnight report.

"Friday's data "was a lot more 'bullish' on this threat or risk of a second significant heat dome event occurring by the end of the month."

Corn for December fell 1.4% to $6.75 ½ a bushel in Chicago, with the near-term September lot shedding 1.0% to $6.94 a bushel.

India's return...

Even so, the September contract kept its premium over its Chicago wheat peer, which dipped 1.3% to $6.85 ½ a bushel, weighed down not just by harvest pressure but a report that India has returned to exporting the grain after four years.

With Russia reminding on Friday over its return to shipments, winning a second Egyptian tender, "we expect the flood of wheat in the world market may keep prices pressured for this week", Lynette Tan at Philip Futures said.

Indeed, the pressures were more than enough to make up, for now, for the idea that harvest is turning difficult in France – with a crop earlier tested by drought now receiving too much rain.

"Rainfall this weekend stopped harvests in the north of France. A rainy week ahead holds sellers, waiting for further details on both volumes and quality," Agritel, the Paris-based consultancy, said.

Falling beans

Soybeans too lost ground on thoughts of the improved US weather outlook, while retaining their knack for lower volatility.

Chicago's August lot shed 0.4% to $13.80 a bushel, matching the price of the better-traded November lot, which shed 0.5%.

Etichette:

articles,

commodity,

commodity article,

market articles

The Painful Consequences of a Debt Ceiling Increase

By Larry D. Spears

Failure to reach a compromise on a U.S. debt ceiling increase could result in an unmitigated economic disaster - one so unprecedented government and private analysts can't even accurately pinpoint all the potential consequences.

To avert this crisis, U.S. President Barack Obama wants a debt ceiling increase of $2 trillion, which analysts say would carry the country through the end of 2012. The president has moved the deadline for reaching an agreement up to July 22.

President Obama said the time cushion was needed to prevent a last-minute panic by the financial and debt markets that could "potentially create another recession" - panicking investors and possibly causing an economic meltdown even worse than the one in 2008.

But even after a debt ceiling increase is approved - though it would obviously produce a brief sigh of collective fiscal relief - the U.S. economy and markets will suffer painful effects, and almost no longer-term positive impact.

So what can investors expect once the U.S. debt limit is, in fact, raised?

To avert this crisis, U.S. President Barack Obama wants a debt ceiling increase of $2 trillion, which analysts say would carry the country through the end of 2012. The president has moved the deadline for reaching an agreement up to July 22.

President Obama said the time cushion was needed to prevent a last-minute panic by the financial and debt markets that could "potentially create another recession" - panicking investors and possibly causing an economic meltdown even worse than the one in 2008.

But even after a debt ceiling increase is approved - though it would obviously produce a brief sigh of collective fiscal relief - the U.S. economy and markets will suffer painful effects, and almost no longer-term positive impact.

So what can investors expect once the U.S. debt limit is, in fact, raised?

Higher Rates and Inflation

The prospect that the country will be able to add $2 trillion to its tab over the next 18 months is unlikely to make potential lenders (i.e., buyers of Treasury securities) jump with joy.Just ask your credit card companies for a 13.98% increase in your borrowing limits - assuring them you'll use every bit of it - and see what it does to your credit score.

This means a debt ceiling increase is likely to lead to a downgrade of the U.S. credit rating, which will cause investors to demand higher rates to compensate for the increased risk.

To gauge just how much higher, JPMorgan Chase & Co. (NYSE: JPM) recently surveyed its clients to see what they thought. According to The Washington Post, respondents from within the United States told the bank they expected rates to rise by 0.37%, but foreign investors - who hold about half of outstanding U.S. debt - predicted a rise of half a percent or more.

A rate increase of that size would boost U.S. interest payments on new debt by more than $7.5 billion a year. The cost of rolling over existing debt at those rates could rise by as much as $71 billion a year.

And there's no guarantee the increase would be short-lived. When a combination of similar events forced a two-week delay in U.S. debt payments in 1979, a study conducted 10 years later found it had caused interest rates to rise by an average of six-tenths of a percent for more than five years.

More borrowing and higher interest rates also will mean more inflation.

After all, even if the Republicans in Congress back down and allow some federal tax increases, there's no way those being discussed will be enough to cover the increased debt burden - or even the increased interest payments, for that matter.

The only way the U.S. can pay the increased interest - forget about principal - is to print more money. That means a weaker, devalued dollar, and higher prices for everything priced in dollars.

Beware the Market's Reaction

If (or when) the debt ceiling is increased, both stock and bond markets are likely to celebrate for a minute. Then they'll re-examine the longer-term effects and turn sharply lower, perhaps extending the slide for quite a while.That possibility was demonstrated quite clearly back in the spring when, following S&P's April 18 decision to downgrade the outlook for U.S. debt to "negative" from "stable," the stock market's extended rally quickly stalled out and the major averages began a six-week slide. That drop carried the Dow Jones Industrial Average from 12,807 on May 2 to 11,897 on June 15.

Now the stock market is notoriously fickle, which it proved when the Dow then rallied back to 12,719 on July 7 -- in spite of the looming debt deadline.

But then it dropped 202 points last Monday and Tuesday, choosing to ignore President Obama's debt assurances and instead focusing on the growing European sovereign-debt crisis and S&P's threat to lower its ratings on U.S. Treasury securities.

If you have large stock positions that could be at risk in the event of a market collapse, you might protect yourself by purchasing put options on either your individual companies or on stock index exchange-traded funds (ETFs).

Starting a Never-Ending Cycle