Fields of Gold

You'll remember me when the west wind moves

Upon the fields of barley You'll forget the sun in his jealous sky As we walk in fields of gold So she took her love for to gaze awhile Upon the fields of barley In his arms she fell as her hair came down Among the fields of gold Will you stay with me, will you be my love Among the fields of barley? We'll forget the sun in his jealous sky As we lie in fields of gold See the west wind move like a lover so Upon the fields of barley Feel her body rise when you kiss her mouth Among the fields of gold I never made promises lightly And there have been some that I've broken But I swear in the days still left We'll walk in fields of gold We'll walk in fields of gold Many years have passed since those summer days Among the fields of barley See the children run as the sun goes down Among the fields of gold You'll remember me when the west wind moves Upon the fields of barley You can tell the sun in his jealous sky When we walked in fields of gold When we walked in fields of gold When we walked in fields of gold |

Friday, September 5, 2014

Sting - Fields of Gold

How Will Europe Survive This Winter Under Putin's Energy Chokehold?

By Karim Rahemtulla

Vladimir Putin has a death grip around Europe’s neck, and he could deliver the final squeeze at any moment.

As you likely know, Russia provides about one-third of all the fuel used by Europe, fuel that Putin can cut off whenever he pleases.

In other words, there’s very little that Europe can do to stop Russian forces from advancing on Ukraine.

Now, Putin has called for a “political solution” to the situation in Ukraine, and EU leaders have put off any further sanctions against Russia at this time.

But as these peace talks ensue, what options do Putin and EU leaders have going forward?

The Choking Point

In the short term, the Russians are in the driver’s seat.

Ukraine is a major conduit for Russian energy to Europe. It’s a country blessed with rich farmland – a regional breadbasket of sorts. Russian natural gas passes through pipelines in Ukraine to customers all over Europe.

Some countries – like Bulgaria, the Czech Republic, Hungary, and Slovakia – are wholly dependent on energy from Russia.

Europe cannot put the screws on Russia by halting energy imports, as it currently has no alternative. Especially when the temperature drops and energy demands rise in the coming months.

At the same time, Russia would be foolish to stop energy exports to Europe, as it would only hurt their coffers. According to Eurostat data, Russia supplied some $250-billion worth of coal, oil, and gas to Europe. That’s around two-thirds of the government’s revenue.

Putin does have another option, however… By deliberately disrupting energy exports, he could trigger a winter of discontent and further torpedo any hope of economic recovery.

If Russia did decide to take the route of deliberate disruptions, it would be able to survive the financial shortfall as it sits on nearly half a trillion dollars in reserves.

That’s not to say Europe is completely out of options, though…

Just as the United States learned an important lesson during the Arab Oil Embargo – the real beginnings of major independent oil and gas exploration within its borders – the Europeans will have to source its energy from providers more friendly to their long-term needs.

Indeed, the Russians will force Europe to respond in four ways, three of which present immediate profit opportunities for perceptive investors…

European Response #1: Boost Imports From Other Sources. Europe will increase energy imports from companies like Norway’s Statoil (STO), which currently supplies 14% of the natural gas used in Europe. Statoil cannot replace all the gas coming from Russia, but it can boost production and its bottom line. STO stands to benefit the most in the near term.

European Response #2: Going Nuclear. Europe will have to turn its attention to nuclear energy again – just a couple of years after the region began shuttering nuclear plants after the Fukushima accident in Japan. This bodes well for companies like Cameco (CCJ), the global uranium powerhouse. Uranium prices are guaranteed to rise at the first hint of a reversal in policies regarding nuclear energy.

European Response #3: New Natural Gas Resources. It will also need to tap into fresh natural gas reserves, like the fields off the coast of Israel and potentially Cyprus (a region I visited last year). Companies like Noble Energy (NBL) are developing these massive fields in the Mediterranean. NBL isn’t ready to supply the region just yet. Pipelines and liquid natural gas facilities are still lacking. But those issues are being addressed, and natural gas could be flowing from the Mediterranean to Europe within the next three years.

European Response #4: The Long-Term (Yet Least-Profitable) Solution. The fourth option is renewable energy, such as wind and solar. Of course, producing renewable energy is still way too expensive compared to fossil fuels. The economies in Europe just aren’t strong enough to support the subsidies needed to make a difference.

None of these solutions will prevent a winter that will probably be devastatingly expensive to Europe this year. But the Russians have provided a very loud wake-up call to Europe – and the world… A wake-up call that will lead to profits for investors willing to bet on a future that confronts Russia’s imperial ambitions.

Europe Needs A New Source Of Oil And Gas, Fast

Summer is over and many Europeans may have to keep warm this coming winter by thinking about their summer holidays while wrapped in blankets, praying for a short winter or for the world to come to its senses. It both cases, they may well be disappointed.

The never-ending conflicts in the Middle East, mayhem in Libya, uncertainty in the Gulf and a war in Ukraine are all going to take a toll on the energy supplies this winter.

Russia sold 86 billion cubic meters of gas last year, all of which passed through Ukraine. Given what’s happening there now, it is highly unlikely that the Russians would allow their gas to transit a country they are (unofficially) at war with. Just as it is unlikely that Ukrainians would allow Russian gas access through its territory.

Result? Many cold Europeans, many angry Europeans and many very pissed off Europeans. Many Europeans will have to make do without enough gas to heat homes, offices and factories. That’s a bad prospect in northern European countries, where winter is no laughing matter. Winter defeated the armies of both Napoleon and Hitler.

And what does history tell us about cold, angry, pissed-off Europeans? Well, whenever two opposing camps got cold, angry and pissed off enough at each other in the past, they typically went to war.

War in Europe? In our time?

It’s not impossible. If current trends continue, it is not at all impossible. Here’s why:

1. Mounting tension between Russia and the West over Ukraine -- a situation that is very likely to worsen as the United States and European Union tighten sanctions on Moscow.

2. NATO forces edging dangerously close to Russian forces.

3. The spread of the violence and reach of the Islamic State. Besides the havoc they are creating in the region, there is the added threat of hundreds, if not thousands, of their supporters who have learned how to fight in Syria and Iraq returning to their home countries in Europe.

4. Turkey, which in recent years has played a stabilizing role in the region, is moving today in a different direction that could well lead to a new point of conflict. From jumping head first into the Middle East conundrum under former prime minister and now President Recep Tayyip Erdogan, the country’s new prime minister, Ahmet Davutoglu, started off by possibly igniting a new fight when he announced -- much to the pleasure of Azerbaijan, and certainly to the dismay of Armenia -- that “the liberation of occupied Azerbaijani lands would be a strategic goal for Turkey.”

These remarks refer to the conflict between Armenia and Azerbaijan over Nagorno-Karabakh and outlying areas that have been occupied by Armenia since a violent conflagration around the time of the break-up of the Soviet Union. Armenians and Azerbaijani troops have been engaging in exchanges of fire on a daily basis over the past few months.

5: Mounting tension between Iran and Israel, and between Iran and an unnamed former Soviet republic in the region that Iran says allowed Israel to launch a drone from its territory to spy on Iran. Tehran has promised a stern response. The country in question is thought to be Azerbaijan, Armenia or Turkmenistan.

6. Continued mayhem in Libya, where the political turmoil is affecting the flow of oil and gas to Europe.

7. The continued state of unrest in Israel/Gaza and the surrounding area.

All these points of conflict are complicating Europe’s search for more reliable sources of energy. Europe is hoping to solve its gas shortage problems by purchasing Azerbaijani gas, but it’s unrealistic to depend only on Azerbaijani gas, since Europeans would be at the mercy of interruptions to gas and oil flows from this South Caucasus country.

What Europe desperately needs is a source of energy that with not be interrupted by conflict or politics, that can be delivered via pipeline or by sea, but will not need to transit through sea lanes in areas of conflict.

And although EU Energy Commissioner Guenther Oettinger said last week that he is not worried about gas supplies from Russia via Ukraine, that show of confidence did not stop him from going to Moscow to plead Europe’s case with the Russians.

So where does that leave the Europeans other than out in the cold? Trend energy analyst Vagif Sharifov believes the new bonanza of natural gas lies in the Arctic, where more than 1,500 trillion cubic feet of natural gas can be found.

But polar drilling comes with a high cost and huge challenges. Europe might need to keep looking.

Guarire (morire?) con l'ipnosi

by Stefano Masa

Nel secolo trascorso, Milton Hyland Erickson già sapeva le sorti del nostro paese. Probabilmente immaginava e aveva scoperto come poter entrare nella mente umana e soprattutto sfruttare il potenziale inespresso. Autorevole studioso, psichiatra e psicoterapeuta, grazie a lui ha preso forma l’ipnoterapia che prende il suo stesso nome: l’ipnosi ericksoniana. Oggi, dopo questa scoperta, stiamo rivivendo – solo noi italiani – un ulteriore passo avanti. L’Ipnotismo Italicum o più preferibilmente “renziano”.

Milton H. Erickson nella sua opera – dal titolo eloquente Guarire con l’ipnosi – evidenziava come nel cosiddetto apprendimento esperienziale si «poteva entrare nel quadro di riferimento del paziente per facilitare un approccio graduato alla riduzione del sintomo». Allo stesso tempo, per affrontare l’eliminazione di una psicopatologia, si doveva procedere «attraverso una sua estirpazione graduale, non cercando di combatterla, di discuterla o di eliminarla completamente». Per come descritto appare tutto molto semplice e chiaro ma – allo stesso tempo e solo per i più attenti – un processo che prevede un certo tipo di sofferenza per il paziente perché da ricondurre ad una «estirpazione graduale».

Probabilmente – ma non ne siamo consapevoli – al nostro attuale premier di governo dobbiamo molto: grazie al suo operato del fare veloce, sempre veloce, e rispetto al passato inaspettatamente veloce, beneficiamo di una cura ipnotica somministrata quotidianamente ed apparentemente gratuita. Non sono presenti lettini dove poterci sdraiare. Non ci vengono fatte domande riguardanti il nostro passato, presente e futuro. Non si indaga nel e sul nostro Io. Non ci sono appuntamenti da fissare periodicamente. Fare, fare veloce e basta. Liberi. Tutti liberi ed in ascolto delle parole che arrivano via twitter o attraverso altro strumento e/o persona.

Tutti possiamo e potremmo aver bisogno di questa cura perché negarlo, ma come tutte le cure, nel tempo, bisogna verificarne i progressi. Per fare questo, ho approfittato e letto con estremo interesse il recente articolo pubblicato dal "Sole24Ore" lo scorso 24 agosto, dove attraverso il periodico rapporto Rating24, si osserva oggettivamente lo stato di avanzamento lavori del governo in carica.

Dal monitoraggio degli ultimi tre governi, si possono trarre dati significativi che cito testualmente: «le otto manovre cardine dell’esecutivo Monti vedono crescere il tasso di attuazione dal 63,1% di luglio al 72,2%, mentre per gli undici provvedimenti Letta si sale dal 23,5% al 38,3%. Renzi, che al suo attivo ha sei Dl, passa dall’1,2% al 4,3%».

Riepilogando in termini assoluti quanto è stato fatto (o non fatto), si possono sintetizzare e distinguere i cosiddetti provvedimenti “adottati” da quelli “non adottati o scaduti”. Forse, come lo stesso titolo citato relativo all’opera di Erickson, la sintesi diventa eloquente: il governo Monti aveva in cantiere 421 provvedimenti di cui portati a termine 304. Il successivo governo Letta ne contava un numero più ristretto pari a 329 di cui conclusi 135. All’attuale governo Renzi invece si fanno carico 164 provvedimenti dei quali, portati a termine, 7. Sono dati, pubblici e divulgati in maniera oggettiva. Nessuno commento è necessario.

Nei giorni scorsi si è sentito parlare dell’”agenda dei 1.000 giorni” che regolerà l’attività del governo da qui fino a maggio 2017. Prepariamoci. Quello che abbiamo visto finora è stato solo il primo incontro conoscitivo tra Specialista e Paziente. La cura è solo all’inizio.

I confini dell'universo e la finanza dei prestigiatori

di Edoardo Varini

L'incessante e fantasioso sforzo di motivare l'altalenare dei prezzi di borsa con considerazioni più o meno macro economiche se non fosse truffaldino sarebbe commovente. Forse una cosa non esclude l'altra: che c'è di più patetico di un truffatore per bisogno? Ci sono stati anche uomini grandi, come per esempio Edward Kelley o l'ancor più grande John Dee, che s'inventarono angeliche lingue e inusitate alchimie per spalancare gli occhi e le tasche del gran credulone Rodolfo II, protettore di arti e di illusioni.

A chi conosca i tarocchi basterà guardare il primo degli arcani maggiori, il Bagatto, per capire che il gioco, la burla è all'inizio di tutto e che se un giorno qualcuno giungerà a toccare i confini di questo universo con l'assai tremebondo dito della scienza, verrà poi probabilmente a riferirci che essi sono della stessa sostanza dei cilindri – da prestigiatore, certo – e dunque di feltro di pelliccia di castoro oppur di seta.

Ieri la Bce gioca l'ultima carta nel mazzo, e riduce i tassi di interesse al minimo storico dello 0,05% e rilancia con carte truccate quali l'acquisto ottobrino di titoli cartolarizzati e covered bond. Spread a livelli pre-crisi e le borse risollevano il collo più del cigno di Mallarmé, per riabbassarlo oggi: il patetico, commovente motivo, sarebbe che gli occupati nei settori non agricoli USA sono aumentati ad agosto di sole 142.000 unità anziché delle stimate 228.000.

Ma in realtà la disoccupazione statunitense da un anno a questa parte è passata dal 7,2 al 6,1, che non sarà un risultato esaltante ma certo soddisfacente: lo avessimo noi! Il problema è che si tratta di un risultato drogato. Un gioco di prestidigitazione bell'e buono. L'occupazione Usa non è sostenuta da un reale rilancio dell'economia (l'ultimo dato sui consumi è negativo: -0,1) bensì dalla poderosa politica espansionistica monetaria iniziata nel settembre del 2012 dall'allora presidente della Fed Ben Bernanke e chiamata "Quantitative easing 3", una politica della disperazione di cui nemmeno si conoscevano i termini temporali: "openended" si disse all'epoca, senza alcun limite. Fino alla ripresa.

Il piano prevedeva l'acquisto di 85 miliardi di dollari al mese di treasury e di titoli garantiti da mutui ipotecari, roba, quest'ultima, che nessuno avrebbe mai comprato. E come sapere quando la ripresa avrebbe finalmente fatto capolino? Con quel dato sulla disoccupazione la cui negatività mensile e parziale oggi si enfatizza solo per non andare a vedere le carte.

La disoccupazione USA da gennaio è calata, non è aumentata. Perché la riduzione del piano di acquisto di bond e titoli da parte della FED, lo stracitato "tapering", si è solo ridotta e non finisce? Dicono che terminerà ad ottobre. E c'è anche qualcuno che ci crede, senza la straziante malinconia di Rodolfo II.

La vendemmia piovosa del secolo fa la prima vittima, niente Amarone Bertani 2014. Ma alle annate minori non rinuncio

y Jacopo Cossater

Pazza, pazza estate. Non c’è stata giornata di pioggia durante la quale il mio pensiero non sia andato ai tanti vignaioli impegnati a combattere una delle stagioni più piovose che la nostra memoria ricordi. E anche quando tra le nuvole si affacciava un timido raggio di sole bastava aprire Facebook o Twitter per trovare decine di testimonianze relative a tutte le difficoltà della stagione.

Dalla Romagna alla zona del Prosecco, dal Trentino alla zona di Montefalco le mie timeline erano ricche di foto, di commenti, di tristi constatazioni sul meteo del giorno dopo, raramente migliore del precedente. Una raccolta che mentre scrivo si preannuncia davvero complicata e che fa tornare alla mente tutte le problematiche vissute poco più di un decennio fa con il 2002 e le sue (con sparute eccezioni) certo non indimenticabili bottiglie.

Per dire, è notizia di questi giorni che Bertani, storica cantina della Valpolicella, non produrrà l’Amarone Classico 2014. Riprendo pari pari dal comunicato stampa: una scelta precisa, con risvolti economici di grande portata determinata da una convinzione che per Bertani è molto più che una filosofia: la massima ricerca della qualità, che passa attraverso l’appassimento naturale non realizzabile in un’annata come questa, caratterizzata dalle continue piogge. «Chi produce Amarone in fruttai ad appassimento naturale per coerenza al proprio stile, alla propria identità, secondo la tradizione più pura, dovrebbe a nostro avviso rinunciare inevitabilmente a questa annata. Noi abbiamo fatto questa scelta per l’Amarone Classico Bertani», spiega Emilio Pedron, AD del gruppo Bertani Domains, «E’ stata una decisione importante, costosa ma coerente con il nostro stile, la nostra identità, e soprattutto di grande rispetto nei confronti dei nostri consumatori e clienti».

Ogni annata è una storia a sé, si dice. Io per esempio sono un grande fan di quella del 2010. Senza infatti stare a scomodare alcune delle più importanti denominazioni italiane – a Barolo è già considerata come un grande classico – un po’ in tutta la Penisola è vendemmia che si è rivelata come una delle più interessanti degli ultimi tempi. Vini completi, spesso aggraziati ed eleganti. Vini lontani dalla potenza delle annate più calde (ogni riferimento al 2003 non è casuale) e al tempo stesso giocati su un dettaglio che il crescente calore dell’ultimo decennio aveva forse un po’ nascosto. Alcuni dei miei vini del cuore nascono proprio nel 2010. Bottiglie per cui ho fatto pazzie e per le quali ho investito cifre davvero considerevoli, so che sarà affascinante seguirne l’evoluzione nei prossimi anni.

Guardando le nuvole fuori dalla finestra mi chiedo però se, come appassionato, io non abbia anche una certa responsabilità nei confronti di quelle cantine che amo di più. Realtà spesso molto piccole, artigianali e non solo, aziende agricole che un’annata particolarmente sfortunata può mettere in seria difficoltà (scrivo dall’Umbria: basta andare a Montefalco e chiedere informazioni a proposito del 2013 per rendersene conto).

Se quindi da una parte è legittimo entusiasmarsi per l’annata del decennio, dall’altra non è altrettanto importante sostenere coi nostri acquisti anche i prodotti di annate considerate minori? Come se inseguire solamente i vini nelle loro performance più entusiasmanti fosse troppo facile, se rendo l’idea.

In fondo è bellissimo affezionarsi a questa o quella etichetta, conoscerla a fondo in tutte le sue più profonde sfumature e magari tenere da parte l’annata migliore per l’occasione più importante. Un po’ come fece (o quasi) il meraviglioso personaggio di Paul Giamatti in Sideways – Miles – con quel Cheval Blanc del 1961*, una delle vendemmie più memorabili che la storia di Bordeaux ricordi.

*Evabbè, mi piaceva l’idea di chiudere con una citazione cinematografica, se potessi permettermi di conoscere a menadito tutte le annate di Cheval Blanc probabilmente non passerei il mio tempo libero a scrivere su Intra (o forse sì, chissà).

Che tempo che fa nel vigneto naturale. Angiolino Maule ci parla della piovosa estate 2014

by Fiorenzo Sartore

Un altro sabato mattina di fine agosto col rumore del temporale. Le previsioni dicevano “variabile”, e invece: cielo nero, tuoni, pioggia. Qui sul mare la temperatura segna 21 gradi. L’estate del 2014 resterà memorabile: quasi ogni giorno d’agosto ha avuto le nubi a coprire il sole. E poi la pioggia. Tra tutti, c’è almeno una categoria che avrebbe da ridire su quest’estate – ed in effetti lo fa: sulle reti sociali i produttori di vino hanno inaugurato un nuovo stile comunicativo quanto a lamentazioni ed esecrazioni. Come dargli torto? Appunto, questa piovosa estate 2014 si avvia ad entrare nella storia.

Tempo fa mi capitò di incontrare alcuni produttori di vini naturali della Lucchesia. In quella zona, una delle più piovose d’Italia, a detta di uno di loro il vigneto naturale regge meglio l’impatto del maltempo. La conduzione naturale, cioè, preparerebbe meglio il terreno a ricevere le piogge in eccesso.

Anche per questo motivo, ora che la vendemmia si avvicina, ho voluto chiedere ad Angiolino Maule, un vigneron che si identifica col movimento del vino naturale (pure nelle sue mille sfaccettature) se e in che misura quel tipo di coltivazione del vigneto possa fare la differenza, in annate così. E poi s’è parlato del tempo.

Domanda: signor Maule, al netto degli eventi atmosferici particolari (grandine, allagamenti) questa estate 2014 sembra la “tempesta perfetta” per chi conduce il vigneto naturale. Si potrebbe pensare, cioè, che il principio “zero chimica in vigna” sia messo duramente alla prova. È così?

Risposta: tutti quest’anno sono stati messi a dura prova. Una situazione climatica peggiore non si ricorda a memoria d’uomo. Il mese di luglio 2014 è stato il più piovoso degli ultimi anni, con un aumento delle precipitazioni di oltre il 70% rispetto alla media stagionale. Decisamente peggiori, a titolo di esempio, i dati per la Toscana (+490% nella piovosità a luglio rispetto alla media degli ultimi trent’anni). Questo eccesso di precipitazioni ha messo in seria difficoltà molte attività agricole (Fonte Coldiretti) comprese quelle dei vignaioli che conducono i vigneti con tecniche e prodotti maggiormente rispettosi del suolo, delle acque e delle piante. Sicuramente gli interventi in vigna sono aumentati quest’anno a seguito delle avversità atmosferiche ma è anche vero che la “memoria” delle nostre vigne va ben oltre quella di chi oggi conduce i vigneti. La vite ha una sua capacità di reazione che possiamo stimolare con coadiuvanti vegetali e con adeguate pratiche agronomiche. Non riteniamo che contrastare gli sviluppi fungini o gli attacchi di insetti alla vite, e conseguentemente all’uva, debba trovare risoluzione necessariamente in questa o in quella “medicina” (o particolare molecola se preferite), semmai dobbiamo porre sempre maggiore attenzione alla conduzione dei terreni dove le nostre viti vivono, alle piante che esistono nelle nostre aziende e che possono aiutarci a mantenere le “aggressioni” in misure accettabili per la salubrità delle viti prima e dell’uva e del vino poi.

Nel suo caso specifico, che cosa ha osservato nei suoi vigneti?

Meglio che negli altri anni si è vista la differenza tra i vigneti più vocati e quelli meno; lo stesso vale per i vitigni autoctoni che hanno superato meglio l’ondata di maltempo. Ora però non posso dare una risposta in merito al nostro lavoro poiché il 3 agosto siamo stati travolti da una violenta grandinata che ha portato via gran parte dell’uva e rovinato irrimediabilmente la qualità della poca rimasta.

In che misura è corretto affermare che la conduzione naturale del vigneto è d’aiuto in annate particolarmente avverse? Nel caso, esistono verifiche empiriche? (Differenze di risultati tra vigne confinanti, per esempio).

La “conduzione naturale del vigneto” per utilizzare la sua espressione è un percorso che necessita di tempo e di attenzione. Un arco di tempo di 5/10 anni può permettere di constatare anno per anno il differente sviluppo delle piante e la loro differente resistenza all’attacco fungino. In un contesto dove la biodiversità viene rispettata, e quando possibile agevolata, le piante trovano nel terreno un maggior numero di “nutrienti” che permettono loro di resistere maggiormente agli attacchi sia dei funghi che degli insetti.

L’associazione VinNatur esercita qualche tipo di controllo tra i suoi associati, affinché la conduzione naturale dell’azienda ottenga una forma di certificazione. Esiste, in una situazione limite come potrebbe essere il 2014, una specie di protocollo d’emergenza, per il quale è consentito agli associati usare sostanze chimiche normalmente “vietate” dall’associazione?

Occorre comprendere che ogni 30/50 km la normale vita del vigneto si differenzia, per clima, posizione, terreno, vitigno, sistema di allevamento etc., e quindi un protocollo di gestione del vigneto è di difficile realizzazione, stante le molteplici varianti in gioco. L’annata può anche essere difficile, come quest’anno, ma il nostro credo non ammette deroghe di sorta. No chimica in vigna e in cantina.

Che notizie ha dai suoi associati a VinNatur? Ci sono aree che hanno reagito meglio? E nel caso, perché?

Quest’anno il maltempo ha flagellato il nord e il centro Italia. Difficile dire oggi, a lavori ancora in corso e con le vendemmie appena iniziate, quali saranno le aree che meglio si sono difese. Siamo in contatto con gli associati periodicamente, anche grazie al lavoro di gruppo svolto con le nostre sperimentazioni e consulenze. L’agronomo Stefano Zaninotti, ad esempio, ci tiene aggiornati sulle situazioni delle 14 aziende sparse nel territorio nazionale che stanno portando avanti il progetto “Fertilità Biologica dei terreni”. Come lui l’agronomo e amico Ruggero Mazzilli, che opera in Toscana e Piemonte. Sicuramente durante la nostra assemblea annuale, che si terrà come di consueto a Villa Favorita il 21/22 e 23 marzo, avremo l’occasione di scambiarci le esperienze e di poter valutare a “bocce ferme” quanto l’annata 2014 ha permesso di portare in bottiglia.

Un’ultima domanda. Recentemente alcune aziende dichiarano di “rinunciare” alla vendemmia 2014, e qualcuno addirittura lo consiglia a tutti i produttori del nord. Che opinione ha in proposito?

Sono discorsi che un vignaiolo non fa. Chi alleva le proprie viti, vive ogni giorno la vigna, in tutte le stagioni e condizioni, e se ne prende cura, ha rispetto delle piante, della terra e del proprio lavoro. Fare agricoltura significa affrontare anche annate come questa. Che fare? Raccogliere quello che c’è, selezionare, valutare cosa si può fare. Siamo piccole imprese, la vigna non è un passatempo per noi, quindi dobbiamo andare avanti, nonostante le difficoltà.

5 Things To Ponder: Perspicacious Observations

by Lance Roberts

This past week has seen the market repeatedly attempt new "all-time" highs only to be found wanting. There has been plenty of headline data for the "bulls" to feast on from the ECB announcing a program to buy bonds, surging ISM data and improvement in productivity. However, the underlying data has kept the "bears" in the game with new orders and employment showing weakness, unit labor costs shrinking and the realization that the ECB's plans are likely be ineffectual.

I thought one of the most interesting comments this week came from Brad Delong with referenceto the exit of the Federal Reserve from its monetary campaigns:

"Meanwhile, in the US, the Federal Reserve under Janet Yellen is no longer wondering whether it is appropriate to stop purchasing long-term assets and raise interest rates until there is a significant upturn in employment. Instead, despite the absence of a significant increase in employment or a substantial increase in inflation, the Fed already is cutting its asset purchases and considering when, not whether, to raise interest rates."

There is mounting evidence that these monetary campaigns have very little effect on stimulating economic growth, yet the ECB specifically noted yesterday that they are engaging in the same program in hopes of stimulating economic growth and inflation. What the actual outcome will be is yet to be seen, but over the last 24-hours the markets seem to less convinced of a positive outcome.

This weekend's reading list covers a rather wide range of topics to contemplate between football games, "couch naps" and junk-food. Since my goal is to be of service to you, here is the official schedule of games this weekend via NFL:

1) You Suck At Investing by Shawn Langolis via Marketwatch

As this chart from Richard Bernstein Advisors shows, mom and pop stink it up on a pretty steady basis and have lagged gains in every asset class, with the exceptions of Asian emerging markets and Japanese equities, over the last 20 years. The average investor has even managed to underperform cash – represented in the chart by 3-month T-bills.

The chronic underperformance confirms that investors' are generally plagued by emotional behaviors (i.e. buy high/sell low). Despite the recent media deluge of "buy and hold" advice,"passive beats active" investing, etc., the reality is that individuals never survive the long game. The evidence is pretty clear that for most, putting money into bonds and cash is actually the best choice. The problem is that such advice doesn't generate fees for WallStreet, viewership for the media or feed our personal "greed."

2) What Risk Really Means by Howard Marks via Oaktree Capital Management

If you read nothing else this weekend...read this.

"In thinking about risk, we want to identify the thing that investors worry about and thus demand compensation for bearing. I don't think most investors fear volatility. In fact, I've never heard anyone say, 'The prospective return isn't high enough to warrant bearing all that volatility.' What they fear is the possibility of permanent loss."

Risk Revisited by Howard Marks

3) Stocks Are NOT Fairly Valued by GaveKal Capital

"No matter how many times we hear 'stocks are trading right around their average valuation levels of the past 15 years' and this chart is trotted out as evidence that stocks are 'fairly valued', we cringe a little bit.

By every measure that we look at stocks have flown by fairly value and have entered into richly valued territory."

4) The Four Most Useless Things Advisers Tell You by Howard Gold via MarketWatch

[Note: As a financial adviser it is important that you understand the arguments "against" you. Unfortunately, Howard's points are correct are the reality that is currently prevailing in the markets today. What is the old saying about dinosaurs?]

- Your biggest retirement risk is outliving your money.

- Wait until you are 70 to claim Social Security benefits.

- The only good IRA is a Roth IRA

- Why accept "mediocre" returns when you can beat the market?

"Academic research has demolished the whole notion of market-beating stock picking, of course, and now the trend toward index funds is unstoppable. But those with a vested interest are clinging to the old ways by appealing to Americans’ desire to be “better than average.”

Oh, if only they were truly mediocre! My MarketWatch colleague Chuck Jaffe wrote recently about how badly investors perform, mostly because they move in and out of stocks at exactly the wrong time, missing much of the upside that’s part of every bull market. If they really bought and held, their equity holdings could keep up with the market while their wealth grew over time."

5) A Brain In Doubt Leaves It Out by Robert Seawright via AboveTheMarket

"The bottom line here is that the way we’re built makes it really hard for us to make good decisions and sometimes (quite literally) to see things accurately. To have even a fighting chance to do so, we need actively to consider and test opposing viewpoints. We don’t like to think that we’re wrong, but we are – a lot, about yellow dots and broad concepts alike. As Jeff Bezos of Amazon insightfullyexpresses it, people who are right a lot of the time are people who change their minds a lot.

Good science, good practice and good process all demand that we remain open to new and better evidence and to change our minds when and as events warrant. But doing so is much easier said than done, of course. Information may be cheap, but meaning is expensive and elusive. If we are going to make better decisions in the markets and elsewhere, we need a much broader perspective and we need to be constantly refining and updating our viewpoints. More than that, we need really talented people actively empowered to try to discover where we are going and where we have already gone wrong…even when and as our conflicted brains wants to leave such things out of our consideration."

Bonus Read: Even Bull Markets Aren' t Easy by Ben Carlson via A Wealth Of Common Sense

"Risk, then, comes in two flavors: 'shallow risk,' a loss of real capital that recovers relatively quickly, say within several years; and 'deep risk,' a permanent loss of real capital.” – William Bernstein

Plenty of pundits think we’re due for a healthy pullback or even an end to the current bull market. The problem is that healthy turns into scary pretty quickly for most investors when stocks do finally fall.

Investors must remember that losses come with the territory when investing in stocks. It’s always for a different reason, but even when things are rolling along nicely, markets do tend to take a breather on occasion."

Have a great weekend.

"People say that money is not the key to happiness, but I always figured if you have enough money, you can have a key made." -- Joan Rivers, RIP.

Momentum back at 2007 levels for Small & Mid caps

by Chris Kimble

CLICK ON CHART TO ENLARGE

Small and Mid Caps monthly momentum is reaching lofty levels, last seen in 2007.

At the same time both are hitting Fibonacci 161% extension levels based upon their 2003 lows and 2011 highs as a resistance line off the 2003 lows is coming into play at (1) above.

Joe Friday just the facts - This situation is not bearish at this moment. It does suggest caution for long-term bullish holdings.

Coffee fundamentals defy dollar strength

Coffee volumes surge as weather threat sinks in

What do you trust most: the prospect of a continuation in the rally for the dollar or the weather in Brazil?

Investors lit a fire under the U.S. dollar (NYBOT:DXZ4) earlier in the week, lifting the dollar index to its highest since last December, and driving the euro down to its lowest price in a whole year. The typical flip side to a strong dollar is a wholesale weakening in commodity prices, most of which are priced in terms of the USD. A weakening dollar therefore tends to make commodity alternatives look more appealing.

A period of dollar strength could have the same effect on commodity traders as swimming against the tide. Perhaps the clearest illustration of the dollar-commodity dynamic was shown by the sliding price of gold, which fell to its weakest since June 2. It is worth noting, however, that it is difficult to disentangle the impact on the yellow metal of rising treasury yields at the same time investors were second guessing the timeline for monetary tightening at the Fed, as both factors tend to undermine the price of gold.

Still, gold traders might have been envious of coffee traders at the same time as prices for Arabica futures rose in spite of the currency impact. Coffee futures (NYBOT:KCV4) trading on the ICE exchange in New York surged by 4.1% to $2.0995 per pound at the start of this week before giving most of that back on Wednesday. It was the most expensive price since May, save a price spike one month ago, and accompanied by the highest volume on record for the year-end contract. The current price leaves Robusta coffee prices about 20% higher than it was just six weeks ago.

Chart shows December coffee futures

Coffee prices jumped due to dry weather in Brazil – the world’s largest producer – as traders projected lower crops resulting from an ongoing moisture deficit ahead of a time crucial for flowering. Earlier in the year too, the coffee market responded to hot, dry weather in Brazil and the negative implications for crop yields by sending coffee prices sharply higher (see earlier article from July 14).

Because it was difficult to judge the full extent of the damage from the adverse weather conditions, the market retreated, at least in the short-run. Coffee prices fell as shipments remained strong. However, as Ms. Ganes of J. Ganes Consulting noted in her Softs in Focus monthly report recently, the additional supply may be welcome, but warned that, “What need[s] to be considered are both sides of the ledger because if consumption growth is even stronger, a shortage could exist.”

Ms. Ganes points out, by way of example that Colombian output of coffee was battered for several seasons due to disease and poor weather, but production has now recovered. The weaker Brazilian crop for this year and expectations for a smaller crop in the 2015-16 season means that additional Colombian coffee supplies should have no problem finding a home. Yet, “the rise in production is not sufficient to offset problems elsewhere”, notes Ms. Ganes. She also argues that it was Arabica production that was impacted by the drought and not Robusta production, where Brazil even raised its exports to meet demand in the face of ongoing issues in India, Indonesia and possibly Vietnam.

Ahead, those shortages may ultimately weigh on Brazil’s ability to meet growing demand for the more popular Arabica bean. The 2015-16 forecast of 46 million bags for Brazil is 14 million lower than the abundant 2014-15 crop forecast predicted after trees flowered that season. That number of bags, states Ms. Ganes, is greater than all of Colombia’s production, which is why she suggests Brazil may have little choice but to curb its exports ahead. Brazil may not be able to rely on stock overhang because it will have been utilized in the face of unusual climatic conditions across many of the global growing regions. “The only way to ration this more limited supply and push hard on the brakes to slow the flow of coffee would be through higher prices”, Ganes suggests. “The market is beginning to acknowledge that business won’t be as usual in Brazil and there is little other coffee available to make up the shortfall”.

Should Venezuela Default?

by Ricardo Hausmann, Miguel Angel Santos

CAMBRIDGE – Will Venezuela default on its foreign bonds? Markets fear that it might. That is why Venezuelan bonds pay over 11 percentage points more than US Treasuries, which is 12 times more than Mexico, four times more than Nigeria, and double what Bolivia pays. Last May, when Venezuela made a $5 billion private placement of ten-year bonds with a 6% coupon, it effectively had to give a 40% discount, leaving it with barely $3 billion. The extra $2 billion that it will have to pay in ten years is the compensation that investors demand for the likelihood of default, in excess of the already hefty coupon.

Venezuela’s government needs to pay $5.2 billion in the first days of October. Will it? Does it have the cash on hand? Will it raise the money by hurriedly selling CITGO, now wholly owned by Venezuela’s state oil company, PDVSA?

A different question is whether Venezuela should pay. Granted, what governments should do and what they will do are not always independent questions, because people often do what they should. But “should” questions involve some kind of moral judgment that is not central to “will” questions, which makes them more complex.

One point of view holds that if you can make good on your commitments, then that is what you should do. That is what most parents teach their children.

But the moral calculus becomes a bit more intricate when you cannot make good on all of your commitments and have to decide which to honor and which to avoid. To date, under former President Hugo Chávez and his successor, Nicolás Maduro, Venezuela has opted to service its foreign bonds, many of which are held by well-connected wealthy Venezuelans.

Yordano, a popular Venezuelan singer, probably would have a different set of priorities. He was diagnosed with cancer earlier this year and had to launch a social-media campaign to locate the drugs that his treatment required. Severe shortages of life-saving drugs in Venezuela are the result of the government’s default on a $3.5 billion bill for pharmaceutical imports.

A similar situation prevails throughout the rest of the economy. Payment arrears on food imports amount to $2.4 billion, leading to a substantial shortage of staple goods. In the automobile sector, the default exceeds $3 billion, leading to a collapse in transport services as a result of a lack of spare parts. Airline companies are owed $3.7 billion, causing many to suspend activities and overall service to fall by half.

In Venezuela, importers must wait six months after goods have cleared customs to buy previously authorized dollars. But the government has opted to default on these obligations, too, leaving importers with a lot of useless local currency. For a while, credit from foreign suppliers and headquarters made up for the lack of access to foreign currency; but, given mounting arrears and massive devaluations, credit has dried up.

The list of defaults goes on and on. Venezuela has defaulted on PDVSA’s suppliers, contractors, and joint-venture partners, causing oil exports to fall by 45% relative to 1997 and production to amount to about half what the 2005 plan had projected for 2012.

In addition, Venezuela’s central bank has defaulted on its obligation to maintain price stability by nearly quadrupling the money supply in 24 months, which has resulted in a 90% decline in the bolivar’s value on the black market and the world’s highest inflation rate. To add insult to injury, since May the central bank has defaulted on its obligation to publish inflation and other statistics.

Venezuela functions with four exchange rates, with the difference between the strongest and the weakest being a factor of 13. Unsurprisingly, currency arbitrage has propelled Venezuela to the top ranks of global corruption indicators.

All of this chaos is the consequence of a massive fiscal deficit that is being financed by out-of-control money creation, financial repression, and mounting defaults – despite a budget windfall from $100-a-barrel oil. Instead of fixing the problem, Maduro’s government has decided to complement ineffective exchange and price controls with measures like closing borders to stop smuggling and fingerprinting shoppers to prevent “hoarding.” This constitutes a default on Venezuelans’ most basic freedoms, which Bolivia, Ecuador, and Nicaragua – three ideologically kindred countries that have a single exchange rate and single-digit inflation – have managed to preserve.

So, should Venezuela default on its foreign bonds? If the authorities adopted common-sense policies and sought support from the International Monetary Fund and other multilateral lenders, as most troubled countries tend to do, they would rightly be told to default on the country’s debts. That way, the burden of adjustment would be shared with other creditors, as has occurred in Greece, and the economy would gain time to recover, particularly as investments in the world’s largest oil reserves began to bear fruit. Bondholders would be wise to exchange their current bonds for longer-dated instruments that would benefit from the upturn.

None of this will happen under Maduro’s government, which lacks the capacity, political capital, and will to move in this direction. But the fact that his administration has chosen to default on 30 million Venezuelans, rather than on Wall Street, is not a sign of its moral rectitude. It is a signal of its moral bankruptcy.

Coffee set for largest shortage in 9 years

Coffee (NYBOT:KCV4) is set for the largest shortage in nine years as drought shrinks the crop in Brazil, the biggest grower, according to Volcafe Ltd.

Demand will exceed production by 8.8 million bags in the 12 months starting Oct. 1, the most since 2005-06, the Winterthur, Switzerland-based unit of commodities trader ED&F Man Holdings Ltd. said in a report e-mailed today. The surplus was 7 million bags in 2013-14. Brazil’s arabica crop will be 29.5 million bags in 2014-15, the smallest in seven years.

“The condition of the coffee trees in Brazil, just ahead of the main flowering, is poor,” Volcafe said, referring to next year’s crop. “The vast rainfall deficit in the arabica areas of Brazil has negatively impacted vegetative growth and yield potential.”

Arabica coffee prices jumped 83 percent this year as dry weather damaged trees carrying this year’s harvest. The surge forced buyers including J.M. Smucker Co., maker of Folgers, the best-selling U.S. brand, to raise retail prices.

Global production will fall 8.1 percent to 142.7 million bags, a three-year low, as consumption climbs 2 percent to 151.5 million bags, Volcafe said.

The Brazil crop estimate was raised to 47 million bags from 45.5 million bags in May, partly because of a larger robusta crop, according to the report. The arabica deficit will be 6.9 million bags and robusta 1.9 million bags.

The estimate of Brazil’s robusta output was raised to 17.5 million bags from 17.1 million bags, while Indonesia’s robusta production is seen falling to 7.5 million bags from 10.5 million bags last year. Vietnam, the world’s largest robusta grower, will produce 27.5 million bags of the beans, down from 28.8 million bags a year earlier, Volcafe said.

Production in Colombia, the second-biggest arabica grower, will rise to 12 million bags from a previous estimate of 11.5 million bags, it said. The next crop stands to benefit from the best conditions in six seasons, after a tree renovation program boosted output from 7 million bags in 2011-12, Volcafe said.

U. S. Dollar is once again the King

By: Dan Hueber

Wheat

Mercifully, we are witnessing a little rebound this morning but it has been a rough week for the grain and soy markets as the increasing weight of larger crops caused the foundation to crumble once again. While we do not know where the close will be today just yet, at current levels December wheat is down 30 cents from the close last Friday.

While there has not been any real "fresh" negative news for the wheat market this week, neither has the been much positive and with Russia and Ukraine at least making plans for more cease fire discussions this weekend, you have eliminated the need for risk premium, assuming there was any to begin with. Of course the other negative generated from the problems over there has been the collapse of the currencies of those two countries and then add in the bleak economic performance in Europe and it is understandable as to why the U.S. Dollar is once again the currency of choice for investors. It has reached up to levels this week not seen since July 2013.

Export sales did not provide us with anything to be encouraged about either. For the week ending August 28th we sold just 168,700 MT of wheat or 6.2 million bushels. This is down 58% from last week, 56% from the 4-week average and 60% from the 10-week average. Year to date this bring sales up to 11,436,000 MT or 420.2 million bushels and moving forward, we now need to average 12.9 million in sales each week to reach the 925 million target. The Black Sea dominates.

Corn

The bearish supply news continued to pile up on the corn market this week, which brought on what appeared to be the inevitable; that being a push into lower lows for the year. While I believe many in the trade feel the USDA will not hit us with both barrels next week, they also believe that the September report will not be the largest. Informa will release their September estimate later this morning and The Hueber Report did issue ours yesterday pegging the corn yield at 171.6 for a crop of 14.38 billion bushels. We are also looking for ending stocks to crest the psychologically negative 2 billion mark, looking for 2.038 billion. If/once carryout is above 2, it will potentially be the first time we have been north of that mark since the 2004/05-crop year.

The export sales to finish out the 2013/14 marketing year were a negative 300,000 bushels but unfortunately the new sales were pretty uninspired. We sold 525,600 MT or 20.7 million bushels. This number was down 24% from last week, 29% from the 4-week average and 25% from the 10-week average. The best purchasers were unknown destination at 268.3k MT, Mexico at 103.1k MT and Columbia at 86.2k MT. There was another sales of 120k Mt reported to unknown destination yesterday.

I am not terribly confident that corn will be able to maintain strength for the close today but at the current trade, we will have lost around 18 cents since last Friday and will potentially post the lowest weekly close for a December contract since early October 2009. With no surprises next week, I have to imagine that prices will continue to drift lower between now and the report on the 11th of September. In light of the overall bearish sentiment, this appears to be a market that could set the extreme lows early in the fall but the challenge then would be to find a reason as to why we could need to rally from there.

Soybeans

The selling in November beans appeared to have kicked into a higher gear this week, which is understandable with the onset of harvest and consistent reports of exceptional yields trickling in. Numbers in the 70 to 90 bushel range are not uncommon. While certainly not out of the question, to see a private company print a projection of a 4 billion bushels crop I believe was a shock to the trade. This is not to say that others will not come up to that level eventually but I suspect many will not expect the USDA to do so. We have yet to breech the 10.00 mark for November futures but came within a penny of doing so and unless we see some kind of surprising turn around later today, we should post the lowest weekly close for a November contract since July 2010.

Informa issues their estimate later this morning and The Hueber Report published an estimate yesterday of 45.6 yield and 3.833 billion bushels production. For a reference point for next week, the record production for beans in the country was set last year at 3.369 billion bushels so it is just matter now of finding out how large of a new record we can set. We have ending stocks projected at 447 million, which would be the largest since the 2006/07-crop year.

Exports sales for 2013/14 came through at a negative 3.2 million bushels, which still leaves us 48 million bushels above the USDA target of 1.64 billion but that is somewhat of a moot point right now. Sales for 2014/15 were also a bit of a let down coming through at 869,000 MT or 31.9 million bushels. This was 32% below last week, 28% below the 4-week average and 20% below the 10-week average. The major purchasers were a familiar bunch with China taking 338.3k MT, unknown destinations at 293.1k MT and Spain at 55k MT.

There are still a few forecasters keeping the potential for frost in the outlook for next week in the upper Midwest but most I have read believe damage would be slight to none even if it did occur. As I commented earlier this week and noticed again on travels over the past couple days, I am amazed a just how rapidly many bean fields have begun to turn. If frost cannot provide a pop, I have to imagine that prices will continue to work sideways to lower into the report.

Another Warning Sign: Stocks Hit Highs on Collapsing Volume

by Michael Lombardi

Will the S&P 500 continue to march to new highs?

Well, my opinion towards the stock market hasn’t changed. I remain skeptical for a variety of reasons, many of which I have shared with my readers over the past few months.

But I have a new concern about the stock market, something that hasn’t been touched on by analysts: trading volume is collapsing.

Please look at the table below. It shows the performance of the S&P 500 and its change in trading volume.

Key stock indices like the S&P 500 (it is the same story for the Dow Jones) are rising as volumes are declining, suggesting buyers’ participation in the stock market advance is very low. For a healthy stock market rally, any technical analyst will tell you that you need rising volume, not declining volume.

It’s Economics 101: rising demand pushes prices higher. In the case of the S&P 500, we have declining demand (low trading volume) and rising prices. Something doesn’t make sense here.

Looking at the economic data, it further suggests key stock indices are stretched. We continue to see the factors that are supposed to drive the U.S. economy to deteriorate.

Just look at the housing market. The number of new homes sold continues to decline. In January, the annual rate of new-home sales in the U.S. was 457,000 units. By July, it was down more than 10% to 412,000 units. (Source: Federal Reserve Bank of St. Louis web site, last accessed August 25, 2014.)

Major economic hubs are struggling. The three main economies in the eurozone are begging for growth. Italy is in recession, France’s economy is teetering on recession, and Germany’s economy is showing signs of softening. Today, the European Central Bank dropped interest rates again—but those lower rates are not spurring bank lending or consumer demand.

China and Japan, the second- and third-biggest economic hubs in the global economy, are seeing their economies slow as well.

Key stock indices are completely ignoring the worldwide economic slowdown.

Dear reader, irrationality and manipulation can run longer than anticipated, but not forever. The S&P 500 reaching 2,000 doesn’t really say or mean much except for this: the higher key stock indices go, the harder they will fall and the bigger the damage they will cause to consumer sentiment and the economy.

Here's Why the Market Could Crash--Not in Two Years, But Now

by Charles Hugh Smith

Markets crash not from "bad news" but from the exhaustion of temporary stability.

Yesterday I made the case for a Financial Singularity that will never allow stocks to crash. We can summarize this view as: the market and the economy are not systems, they are carefully controlled monocultures. There are no inputs that can't be controlled, and as a result the stock market is completely controllable.

Today I make the case for a crushing stock market crash that isn't just possible or likely--it's absolutely inevitable. The conceptual foundation of this view is: regardless of how much money central banks print and distribute and how much they intervene in the markets, these remain complex systems that necessarily exhibit the semi-random instability that characterizes all complex systems.

This is a key distinction, because it relates not to the power of central banks but to the intrinsic nature of systems.

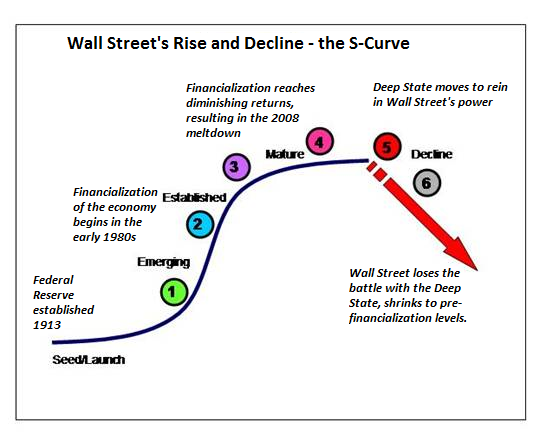

One of the primary motivators of my work is the idea that systems analysis can tell us a great deal about the dysfunctions and future pathways of the market and economy. Systems analysis enables us to discern certain pathways of instability that repeat over and over in all complex systems--for example, the S-Curve of rapid growth, maturation and diminishing returns/decline.

One ontological feature of complex systems is that they are not entirely predictable. An agricultural monoculture is a good example: we can control all the visible inputs--fertilizer, seeds, water, pesticides, etc.--and conclude that we can completely control the output, but evolution throws a monkey wrench into our carefully controlled system at semi-random times: an insect pest develops immunity to pesticides or the GMO seeds, a drought disrupts the irrigation system, etc.

The irony of assuming that controlling all the visible inputs gives us ultimate control over all outputs is the more we centralize control of each input, the more vulnerability we introduce to the system.

Those arguing that central banks (and their proxies) can control the stock market have the past six years as evidence. Those of us who see this heavy-handed control as increasing the risk of unpredictable instability have no systems-analysis model that can pinpoint the dissolution of central bank controlled stability. As a result, we seem to be waiting for something that may never happen.

Despite its inability to predict a date for the collapse of stability, I still see systems analysis as providing the most accurate and comprehensive model of how complex systems function in the real world. If the economy and the market are indeed systems, then we can predict that any level of control will fail no matter how extreme, and it will fail in an unpredictable fashion that is unrelated to the power of the control mechanism.

Indeed, we can posit that the apparent perfection of central-bank engineered stability (i.e. a low VIX and an ever-rising market) sets up a crash that surprises everyone who is confident that central-bank monocultures never crash. In the real world, manipulated stability is so vulnerable to cascading collapses that crashes are probabilistically inevitable.

That raises the question; why not crash now? After all, all the good news is known and priced in, and all the bad news has been fully discounted. Why shouldn't global stock markets crash big and crash hard, not in two years but right now?

Markets crash not from "bad news" but from the exhaustion of temporary stability. The longer that temporary stability is maintained by manipulation, the greater the severity of the resulting crash.

As I noted in The Coming Crash Is Simply the Normalization of a Mispriced Market, this line from songwriter Jackson Browne captures the ontological falsity of permanent market stability: Don't think it won't happen just because it hasn't happened yet.

Market reaction to the ECB announcement

by Sober Look

The ECB rolled out the big guns today but stopped short of an all-out quantitative easing. In addition to the TLTRO, there will be ABS and mortgage bond purchases. However these markets are relatively small in Europe – particularly the higher rated paper that would qualify for the ECB purchases.

The deposit rate on bank excess reserves was set to -20bp. With Germany continuing to resist full QE, Draghi’s best two options are to try stimulating consumer and business credit (via ABS purchases and TLTRO) as well as to push down the euro (via negative deposit rates). So we got a “bazooka lite”.

The euro took the biggest single-day hit in over two years in response to the decrease in deposit rate.

And the French 2-year government bond yield went negative for the first time.

But without the full QE in place, longer dated bond yields actually increased, as yield curves steepened. This carried over to the US where long-term yields rose as well.

And by the way here is one reason Germany remains uneasy with an all-out QE program –

Source: ECB

Wall Street Called A Rally, But No One Came

Trading volume on the major U.S. exchanges suffered the slowest August since 2006, according to Credit Suisse CSGN.VX -1.52% Trading Strategy. And it got even slower as the month wound down: The final six trading days last month ranked among the lowest 15 volume days of the past seven years.

“What makes it feel even slower, though, is how much volumes dropped compared to the beginning of the year,” said Ana Avramovic, an analyst at Credit Suisse.

She notes that the first four months of the year saw higher volumes than the equivalent periods in 2012 and 2013. But as the chart below shows, average daily volumes this year started slumping in May and have only fallen further since.

The slowdown in trading over the past several months comes as investors see little reason to make big changes to their portfolios. Major U.S. stock indexes keep climbing to fresh records amid a growing economy and improving corporate profits.

Diminished volatility has played a role in keeping trading down. Volume from high-frequency trading also dropped significantly over the summer, according to Credit Suisse, continuing a years-long downtrend from the 2009 peak.

Overall, year-to-date trading volumes across U.S. exchanges are down 1.6% from a year ago, Credit Suisse says. At the moment, there’s little indication that the trend of low trading activity will change anytime soon.

The Monetary Stimulus Obsession: It Will End In Disaster

It is now six years since the collapse of Lehman Brothers, and considering that the US economy has officially been in recovery for the past five years, that equity indexes have put in new all-time highs, and that credit markets are once again ebullient to the point of carelessness, it is worth contemplating that monetary policy remains stuck in pedal-to-the-floor stimulus mode. Granted, quantitative easing is (once again) scheduled to end, and the first rates hikes are now expected for next year, but the present policy stance certainly remains highly accommodative. A full ‘exit’ by the Fed is still merely a prospect.

Expectations appear to be for the US economy to finally emerge from its long stay in monetary intensive care healthier and fit for self-sustained, if modest, growth. I think this is unlikely. The lengthy period of monetary stimulus will have saddled the economy with new dislocations. And if central bank intervention did indeed manage to arrest the forces of liquidation that the crisis had unleashed, then some old imbalances will also still hang around.

“Easy money” is – contrary to how it is frequently portrayed – not some tonic that simply lifts the general mood and boosts all economic activity proportionally. Monetary stimulus is always a form of market intervention. It changes relative prices (as distinguished from the ‘price level’ that most economists obsess about); it alters the allocation of scarce resources and the direction of economic activity. Monetary policy always affects the structure of the economy – otherwise no impact on real activity could be generated. It is a drug with considerable side effects.

The latest crisis should provide a warning. As David Stockman pointed out, it did not arrive on a meteor from space, but had its origin in distortions in the housing market in the US – and the UK, Spain and Ireland – and in related credit markets, and therefore ultimately in the “easy money” policies of the early 2000s. Administratively suppressing short rates down to 1 percent for a prolonged period was then the “unconventional” policy du jour, and it was a success of sorts. A credit crunch and deleveraging were indeed avoided, which were then feared as a consequence of WorldCom and Enron defaulting and the dot.com-bubble bursting, but only at the price of blowing an even bigger bubble elsewhere.

This is the problem with our modern fiat money system. With the supply of money no longer constrained by a nature-given, scarce commodity (gold or silver), but now fully elastic, essentially unlimited, and under the control of a lender of last resort central bank, the parameters of risk-taking are forever altered.

Allegedly, we can now stop bank-runs and ignite short-term growth spurts, or keep the overall “price level” advancing on some arbitrarily chosen path of 2 percent. But we can achieve all of this only through monetary manipulations that must create imbalances in the economy. And as the overwhelming temptation is now to use “easy money” to avoid or shorten any period of liquidation, to go for all growth and no correction, distortions will accumulate over time.

As we move from cycle to cycle, the imbalances get bigger, asset valuations become more stretched, the debt load rises, and central banks take policy to new extremes to arrest the market’s growing desire for a much needed cleansing. That policy rates around the world have converged on zero is not a cyclical but a structural phenomenon.

Central bank stimulus is not leading to virtuous circles but to vicious ones. How can we get out? – Only by changing our attitudes to monetary interventions fundamentally. Only if we accept that interest rates are market prices, not policy levers. Only if we accept that the growth we generate through cheap credit and interest-rate suppression is always fleeting, and always comes at the price of new capital misallocations.

The prospect for such a change looks dim at present. Last year’s feverish excitement about Abenomics and this year’s urgent demands for Eurozone QE show that the belief in central bank activism is unbroken, and I remain sceptical as to whether the Fed and the Bank of England can achieve a proper and lasting “exit” from ultra-loose policy in this environment. The near-term outlook is for more heavy-handed interventions everywhere, and the endgame is probably inflation. This will end badly.

Deflazione, non è una fatale maledizione divina

by Guido Ascari

La deflazione è un pericolo reale per l’Eurozona: unita alla stagnazione può diventare una tenaglia letale per i paesi con alto debito pubblico. Uscirne si può, a patto di vincere alcuni tabù. Per esempio, avviando una politica di investimenti pubblici finanziata direttamente dalla Bce.

LO SPETTRO DELLA DEFLAZIONE

Uno spettro si aggira per l’Europa: la deflazione. In Italia è già diventato realtà e la tenaglia di stagnazione e deflazione è letale in particolare per paesi a elevato debito pubblico, come il nostro. Nell’area euro i prezzi sono da troppo tempo in continuo rallentamento e senza un intervento chiaro, credibile e massiccio, lo spettro si manifesterà anche a livello europeo.

Spesso, nei commenti giornalistici (e non solo) sembra che la deflazione sia una maledizione divina, mentre è importante che i cittadini europei sappiano che la deflazione è un scelta di (non) policy.

La maggior parte degli economisti ormai concorda che in Europa la situazione di stagnazione più deflazione sia causata da una carenza di domanda. La crisi ha determinato un fiorire di studi su economie in condizioni di trappola della liquidità e di tassi di interesse nominali vicini al limite minimo di zero, e un revival della letteratura su interrelazione fra politica monetaria e fiscale.

I risultati ci dicono molto. Semplificando al massimo:

- la deflazione si combatte generando domanda aggregata e aspettative di futura inflazione;

- in tempi di tassi di interesse a zero, la politica fiscale è meglio equipaggiata di quella monetaria. (1)

È ovvio che la politica fiscale può produrre un aumento diretto di domanda, ma può anche generare aspettative d’inflazione tramite una promessa di aumento delle future tasse sul consumo.

Come scrivono Francesco Giavazzi e Guido Tabellini, una politica di quantitative easing da sola non può funzionare, perché non garantisce che la massa monetaria raggiunga l’economia reale tramite credito e si trasformi in domanda aggregata. Anche l’acquisto di Abs, da solo, non può risolvere il problema.

COME VINCERE I TABÙ

L’Eurozona ha bisogno di un mix di politica economica straordinario per tempi straordinari.

Alla luce della letteratura economica, in una situazione di carenza di domanda e deflazione, è difficile contestare che nel breve periodo una politica fiscale espansiva finanziata con moneta generi crescita temporanea e inflazione.

Su un piano prettamente teorico, e tralasciando per il momento gli (importanti) aspetti politici, una politica di investimenti pubblici finanziata direttamente dalla Bce con moneta sarebbe a mio parere la strada preferibile:

- Il finanziamento con moneta non aumenterebbe il debito pubblico, vincolo imposto dai mercati, dal fiscal compact e sostenuto con forza da alcuni paesi del nord dell’Eurozona;

- Non comporta previsioni di maggiori tasse (o minore spese) future per ripagare l’aumento del debito, diminuendo l’effetto sulla domanda;

- Investimenti pubblici in settori che stimolano la crescita come infrastrutture, educazione e ricerca si trasformano direttamente in domanda aggregata e possono avere effetti positivi di lungo periodo. (2) Si tratterebbe di ampliare il piano Junker finanziandolo direttamente con moneta;

- Una diminuzione delle tasse (sul reddito o sulle imprese), invece non è detto che si traduca in maggiori consumi o in maggiori investimenti in momenti in cui questi agenti sono ancora afflitti da overhang di debito oppure in clima di elevata incertezza. Inoltre, se crediamo sia necessario agire con urgenza in modo coordinato a livello Europeo, potrebbe essere più veloce finanziare cantieri e progetti messi nel cassetto per mancanza di fondi.

- Risultati teorici ed evidenza ci dicono che il moltiplicatore della spesa sia maggiore di quello delle tasse, soprattutto vicino al limite di zero del tasso d’interesse o in recessione. È vero che in paesi ad elevato tasso di corruzione, esiste il pericolo di forte inefficienza. Si potrebbe creare una entità Europea temporanea che controlli e monitori direttamente l’implementazione degli investimenti.

- L’aumento di massa monetaria genera aspettative d’inflazione e la monetizzazione dovrebbe limitare la minimo gli effetti negativi sull’investimento privato. Anzi una manovra così radicale potrebbe determinare un “cambiare verso” delle aspettative.

- Monetizzazione da parte della Bce o finanziamento diretto del debito senza sterilizzazione non hanno differenza sostanziale, se la banca centrale detiene i titoli a scadenza. (3)

Non risolve i problemi di medio periodo

Queste politiche sono fatte per rispondere alla situazione congiunturale, e non risolvono i problemi strutturali che necessitano riforme profonde per dare competitività ad economie come Francia e Italia, per esempio, e quindi renderle capaci di generare crescita duratura nel medio periodo. Queste riforme nel breve potrebbero essere controproducenti per la deflazione (4) e necessitano tempi lunghi per produrre i propri effetti. Non risolverebbero il problema di breve periodo, ma sono fondamentali per non rendere vano questo sforzo. Da qui la necessità di legare il finanziamento monetario degli investimenti pubblici nei singoli paesi a concreti passi in avanti sulle riforme strutturali. Insomma la Bce paga moneta solo se vede cammello.

L’INDIPENDENZA BANCA CENTRALE E LA MONETIZZAZIONE

L’articolo 123 del Trattato vieta alla Bce di finanziare direttamente il debito pubblico (proposta Giavazzi-Tabellini) e tanto meno di finanziare direttamente stampando moneta.

La Bce ha un obiettivo chiaro, il 2 per cento d’inflazione, e lo sta mancando da troppo tempo. Se ci fosse un contratto, sarebbe inadempiente. Uscendo dal testo scritto del suo intervento, a Jackson Hole, Mario Draghi ha detto che la Bce è pronta a usare qualsiasi strumento per raggiungere la stabilità dei prezzi. Quest’affermazione prelude a un secondo “whatever it takes”? Si potrebbe riproporre lo stesso argomento usato per giustificare l’Omt: dato l’obiettivo, la Banca centrale dovrebbe avere indipendenza sulla scelta dello strumento migliore per perseguirlo, anche se lo strumento ha implicazioni “fiscali”. L’articolo 123 è stato aggirato già con l’Omt, acquistando titoli sul mercato secondario e mettendo quindi un piede nella politica fiscale dei paesi dell’Eurozona. Si tratterebbe ora di entrare a piedi uniti.

Peraltro, forse paradossalmente, il Trattato non mi pare vieti alla Bce né di investire direttamente, né di finanziare i privati, via “helicopter drop” o anche mediante linee di finanziamento dirette.

È del tutto ovvio come, politicamente, questa proposta sarebbe difficilmente accettabile in Europa.

L’Eurozona è malata. Molti paesi, come l’Italia, non possono permettersi altri trimestri di recessione-deflazione. Uscire da questa situazione è una priorità assoluta, bisogna essere creativi e andare al di là di clausole di Trattati pensati per altri momenti storici.

È il momento di rilanciare il “whatever it takes”, se non si vuole lasciare l’Europa alla mercé dei partiti euroscettici, che a quel punto avrebbero un argomento forte: l’inazione dell’Europa di fronte alla crisi.

(1) Per esempio, Correia, I., Farhi E., Nicolini J.P, and Pedro Teles. 2013, “Unconventional Fiscal Policy at the Zero Bound”, American Economic Review, 103(4): 1172-1211, Eggerston, G. and N. R. Mehrotra, 2014, “A Model of Secular Stagnation”, mimeo, Brown University.

(2) Si veda per esempio il recente contributo di M. Fratzscher sul Financial Times, che suggerisce di aumentare gli investimenti tedeschi in questi settori.

(3) È ovvio come nel caso della Bce, che sovraintende una zona euro a 18 paesi, le cose siano un po’ più complicate, ma lo sostanza è questa. Si noti inoltre che questo accade già con il quantitative easing (Ascari in lavoce.info sul carteggio fra il Cancelliere dello Scacchiere e il governatore della Bank of England).

(4)Eggertsson, G., Ferrero, A. and A. Raffo, 2014, “Can structural reforms help Europe?”, Journal of Monetary Economics, 61, 2-22.

Draghi’s War on Savers and the Euro

ECB Cuts Rates From Nada to Zilch (and Less), Announces QE

In his Jackson Hole speech, Mario Draghi already hinted at further ECB interventions, pointing out that 5 year forward inflation breakevens indicated that long term inflation expectations had fallen below 2% (i.e., 2% CPI rate of change). Consumers would of course see this as a reason to rejoice, but not our vaunted planners. It was already widely expected than an ABS purchase program would eventually be announced, as preparations for this have been underway for several months.

Frankly, we thought that given that the TLTROs are beginning in September, the ECB would likely wait for their impact before announcing additional interventionist steps. As it turned out, they announced so many things at once on Thursday, they actually managed to surprise not only us, but apparently the great majority of market participants.

The announcement included: further rate cuts; with the repo rate now at 5 basis points, which we might as well call zero, this avenue is now rapidly closing. Since all rates were cut, they also increased the bizarre penalty rate on excess reserves to minus 20 basis points. All this measure achieves is that it costs the banks money. It's not going to make them more eager to lend, but it will lead to them cutting the paltry interest they pay to savers even further. So the war on savers is continuing at full blast.

As to these rate cuts, we would note that the central bank has been trying to “rescue” the economy with rate cuts for quite some time. It hasn't worked so far, but that is of course not stopping them from doing more of what hasn't worked. This may be properly called “central planning insanity”. Even so, it is not clear to us why they believe another 10 basis points can possibly make a difference. Even if one erroneously thinks that economic growth can actually be spurred by monetary pumping, this appears to be an utterly futile gesture.

More surprising was that the ABS purchase program was announced concurrently, and along with it a covered bond purchase program. In his press conference Draghi promised a “substantial increase in the ECB's balance sheet”, which can actually be fairly easily achieved with this latter monetization initiative. Euro area covered bonds consist of two types, they are either backed by mortgage bonds, or by public sector debt securities (including agency debt). This is a big market, and there are very large covered bond programs out there, which can be used to add further to the already large supply of such bonds. Draghi pointed out that this will inject additional money directly into the economy.

Apparently the decision was not unanimous, and we can guess who the dissenters were (hint, the name of one of them starts with a “W”).

From experience we know that ECB refinancing operations do tend to lead to money supply growth acceleration in the short to medium term, and the combination of TLTROs and QE will surely have a noticeable effect with respect to that, unless the decline in private sector lending actually accelerates concurrently. For all the talk about “inflation being too low” (which is a totally absurd assertion anyway, since consumers can only benefit from the fact that prices are only rising slowly for a change), euro area-wide monetary inflation recently stood at 5.6% (narrow money supply). This is what we regard as the actual “inflation rate”.

Monetary inflation in the euro area. Note the y/y growth rate in blue. Thank God our central planners are able to implement such long term stability! – click to enlarge.

Bowing to Mercantilism

There has been a lot of yammering by various Mercantilists in Europe about the allegedly “too strong euro” (government minions in France are usually especially vocal about this). A strong euro benefits consumers and countless businesses that buy goods and services from abroad, while a weak euro is solely to the strictly temporary benefit of a small group of exporters. In other words, the idea is to help a small sector of the economy for a limited period, in exchange for hurting a much larger sector of the economy permanently. Brilliant.