Everything we’ve been warning you about is starting to happen — fast!

The U.S. job market is crumbling … the Washington debt talks are failing … and the unprecedented convergence of both these events is mandating urgent steps by all prudent investors.

Here’s what I recommend:

Did the Great Recession Ever End?

Obama administration economists have repeatedly sworn that the answer is “yes.” Since early last year, they’ve told you the recession is “history” — and nearly every day since, they’ve had a chant to cheerlead the “recovery.”

For reasons I’ll explain in a moment, I have always found that quite remarkable. But what’s even more remarkable is that nearly everyone has believed it.

Widespread belief in the existence of an economic recovery has been the underlying assumption behind virtually every new piece of economic legislation, every new policy initiative by the U.S. Treasury, and every decision by the Federal Open Market Committee (FOMC).

It has been the basis for estimates of corporate earnings, government tax revenues, and global growth projections.

It has guided corporate boardrooms, fund managers, and average investors.

And in the debt debate between the White House and Congress, it has been the fundamental underpinning of every single understanding or misunderstanding, agreement or disagreement. But now …

Suppose — just suppose — that, one day, with no prior warning, it suddenly begins to dawn on millions of financial decision-makers, big or small, that we never had a true economic recovery to begin with.

Suppose it’s revealed that the U.S. economic growth since 2009 was nothing more than (a) bad data, (b) misinterpretation of numbers, plus (c) some knee-jerk reactions to massive stimulus.

In other words …

Suppose nearly everyone suddenly realizes that the economic recovery was mostly a hoax!

All hell will break loose!

And that’s essentially what began to happen this past Friday with the release of the official unemployment numbers — the nation’s broadest and most widely watched measures of the state of the economy.

Hard to believe? Then consider the facts …

Fact #1. We have the worst long-term unemployment in recorded history.

On average, once someone loses a job, it takes more than 25 weeks to find a new one.

That’s not just a wee bit worse than during prior bad recessions.

It’s more than 2.5 times worse than during the mid-1970s, when the U.S. suffered its worst recession since World War II!

It could even be worse than during the Great Depression, but we’ll never know; no similar records were taken during that period.

Most important, since the recession officially began in 2008, this all-important measure has NEVER — not once — shown any improvement. Quite the contrary, it has continually telegraphed the message that the U.S. job market has been in a rapid, nonstop decline all along!

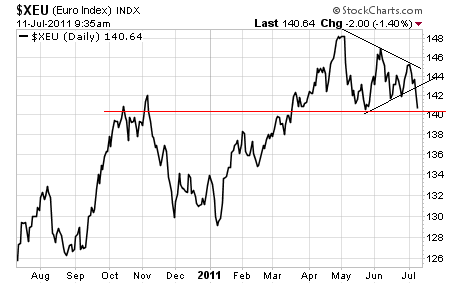

If you find this unbelievable, just check out the chart above. Look how this official stealth measure of the recession’s severity has literally gone through the roof! Note how there was no intermediate improvements — not even the faintest hint of recovery!

Fact #2. Just as we’ve been warning all along, this dire truth has now begun to finally seep into the more traditional measures as well. As master trader Kevin Kerr highlighted in his video update on Friday …

- U.S. employers added 18,000 workers in June. That was 82% less than the 105,000 job gain that economists had forecast. They missed their target by a country mile!

- A separate government survey, believed to be more accurate, showed that the economy actually lost 445,000 jobs in June.

- Despite the rising cost of living, average hourly earnings didn’t go up by one iota. In fact, they actually fell by 1 cent to $22.99.

Fact #3. The broadest, most reliable measure of unemployment in the United States has gotten progressively worse throughout most of the so-called recovery.

This measure comes from John Williams, editor of

Shadow Government Statistics (

www.shadowstats.com), who has been persistent in his warnings that data distortions and manipulations have long been hiding the truth about the continually deteriorating job market.

Let me explain …

As you can see in the chart, Williams tracks three unemployment rates:

- The “official unemployment” number that the government and the press headline (called “U-3″). This is the most narrow and least accurate, because it includes only workers actively looking for full-time work. But even that number rose from 9.1% to 9.2% last month.

- The all-inclusive unemployment according to the government (“U-6″). This measure does include workers who are not currently looking for jobs or have been forced to accept lower-paying, part-time jobs. And even the government admits this number is terrible, surging in June from 15.8% to 16.2%, the highest this year.

- But what I want you to focus your attention on is Williams’ Shadow Government Statistics estimate of the true, all-inclusive unemployment (the “SGS Alternate”). Why are the government’s numbers wrong? Because in 1994, the Clinton administration decided to stop counting workers who had been looking for a job for more than a year. If you include them, says Williams, the true unemployment rate in the U.S. is now about 22.7%!

Here’s the key: While the government’s numbers improved somewhat during the recent “recovery,” this broadest measure of all continued to deteriorate — another confirmation that the recovery was largely bogus.

Fact #4. The housing market!

This is where the Great Recession began. And this is where it would have to end. But it has done nothing of the kind!

In fact, except for a momentary pop in response to massive government infusions of capital and tax incentives, it’s been getting worse almost every quarter since the “recovery” supposedly began.

Now, U.S. median home prices have fallen BELOW their lowest level of the debt crisis (see chart). And now, home foreclosures are at or near their worst level of all time.

Does this look like a recovery to you?

How much longer do you think Washington and Wall Street can maintain the “recovery” charade?

The Real Reason the Debt

Ceiling Talks Are Failing

As I said at the outset, the entire assumption of the debt talks in Washington was that we did have a recovery of sorts, albeit a weak one.

Now, as the realization sinks in that the recovery was bogus to begin with, any chance of a grand compromise has been dashed.

Instead of the $4 trillion in cuts discussed last week, both the

White House and Republican leadership now admit that, at best, they’ll probably wind up with $2 trillion in cuts.

What’s worse, it looks like our leaders are getting ready to pull the same trick they’ve pulled for decades — promise big savings in later years, but do little more than tinker with the deficits of current years.

Bottom line: We can expect …

Too little, too late in savings — far from enough to save the country from fiscal Armageddon, but …

Too much, too soon in cuts — a big blow to an economy with sinking job and housing markets.

Too pessimistic for you? Sorry, but until and unless America faces the facts and collectively makes the needed sacrifices, that’s the dire reality of our era.

You have only one choice: To ignore the Wall Street hype and prepare for the worst.

Here’s What to Do …

See the original article >>