By Washingtons Blog

Washington’s Blog strives to provide real-time, well-researched and actionable information. George – the head writer at Washington’s Blog – is a busy professional and a former adjunct professor.

~~~

William Alden writes in a Huffington Post liveblog entitled “Inflation Vs. Jobs”:

Bernanke’s argument about inflation isn’t consistent, economist Paul Krugman says.

The Fed’s asset-purchase strategy is partially intended to promote maximum unemployment, but some experts are concerned that it will ultimately spark inflation once the recovery takes hold and the system remains awash in liquidity. In this view, there’s a tradeoff between jobs and prices.

Bernanke, however, doesn’t take this view: He said in the press conference that core inflation, or, as Krugman says, “inflation inertia,” isn’t a concern — and that expansionary monetary policy doesn’t stoke these forces.

But then, Bernanke is also saying that any further expansion would risk provoking inflation, Krugman notes. He continues:

This doesn’t make any sense in terms of his own expressed economic framework. I think the only way to read it is to say that he has been intimidated by the inflationistas, and is looking for excuses not to act.

And I agree with Mr. Krugman when he writes today:

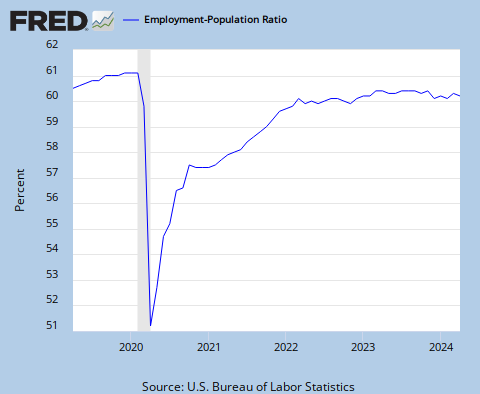

Also, [Bernanke's] assertions that the job market is “gradually improving” are suspect. Yes, the official unemployment rate has fallen. But this is the result less of job creation than of a fall in the labor force participation rate; the employment-population ratio has been flat:

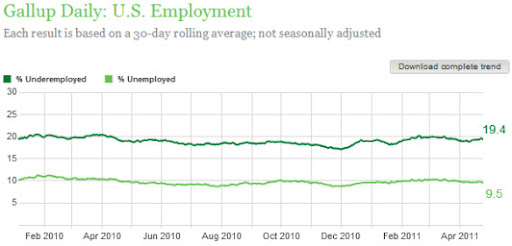

And I like to look at the Gallup polling data as a possible check on the BLS data; no sign there that things have improved:

The Fed Has Intentionally Discouraged Banks From Lending

It’s true – as I pointed out in 2009 – that the Fed has purposefully been encouraging banks to deposit their excess reserves at the Fed (for a profit), rather than loan them out to Main Street:

The Federal Reserve is mandated by law to maximize employment. The relevant statute states:

The Board of Governors of the Federal Reserve System and the Federal Open Market Committee shall maintain long run growth of the monetary and credit aggregates commensurate with the economy’s long run potential to increase production, so as to promote effectively the goals of maximum employment, stable prices, and moderate long-term interest rates.However, PhD economist Dean Baker says:

The country now has almost 25 million people who are unemployed or underemployed as a result of the Fed’s disastrous policies. Millions of people are losing their homes and tens of millions are losing their life savings. The country is likely to lose more than $6 trillion in output ($20,000 per person) due to the Fed’s inept job performance.The Fed could have stemmed the unemployment crisis by demanding that banks lend more as a condition to the various government assistance programs, but Mr. Bernanke failed to do so.

Ryan Grim argues that the Fed might have broken the law by letting unemployment rise in order to keep inflation low:

The Fed is mandated by law to maximize employment, but focuses on inflation — and “expected inflation” — at the expense of job creation. At its most recent meeting, board members bluntly stated that they feared banks might increase lending, which they worried could lead to inflation.In fact, the unemployment situation is getting worse, and many leading economists say that – under Mr. Bernanke’s leadership – America is suffering a permanent destruction of jobs.For example, JPMorgan Chase’s Chief Economist Bruce Kasman told Bloomberg:

Board members expressed concern “that banks might seek to reduce appreciably their excess reserves as the economy improves by purchasing securities or by easing credit standards and expanding their lending substantially. Such a development, if not offset by Federal Reserve actions, could give additional impetus to spending and, potentially, to actual and expected inflation.” That summary was spotted by Naked Capitalism and is included in a summary of the minutes of the most recent meeting…

Suffering high unemployment in order to keep inflation low cuts against the Fed’s legal mandate. Or, to put it more bluntly, it may be illegal.

[We've had a] permanent destruction of hundreds of thousands of jobs in industries from housing to finance.

The chief economists for Wells Fargo Securities, John Silvia, says:

Companies “really have diminished their willingness to hire labor for any production level,” Silvia said. “It’s really a strategic change,” where companies will be keeping fewer employees for any particular level of sales, in good times and bad, he said.And former Merrill Lynch chief economist David Rosenberg writes:

The number of people not on temporary layoff surged 220,000 in August and the level continues to reach new highs, now at 8.1 million. This accounts for 53.9% of the unemployed — again a record high — and this is a proxy for permanent job loss, in other words, these jobs are not coming back. Against that backdrop, the number of people who have been looking for a job for at least six months with no success rose a further half-percent in August, to stand at 5 million — the long-term unemployed now represent a record 33% of the total pool of joblessness.And see this.

Given that the law mandates that the Fed maximize employment, but that unemployment is instead becoming catastrophic under Mr. Bernanke’s watch, how can Mr. Bernanke justify his actions to date?

I explained last year:

Ben Bernanke has said that the Fed is trying to promote inflation, increase lending, reduce unemployment, and stimulate the economy.

However, the Fed has … been working against all of these goals.

As I reported in March, the Fed has been paying the big banks high enough interest on the funds which they deposit at the Fed to discourage banks from making loans. Indeed, the Fed has explicitly stated that – in order to prevent inflation – it wants to ensure that the banks don’t loan out money into the economy, but instead deposit it at the Fed …

Would More Stimulus Help?

But I disagree when Krugman writes today:

Whatever your take, a robust job recovery this is not. All in all, this is an economy crying out for more stimulus, wherever you can get it.

We don’t need more stimulus … at least not the kind we’ve had to date, which has only stimulated bonuses for the big banksters and big defense contractors.

As I wrote last year:

“Deficit doves” – i.e. Keynesians like Paul Krugman – say that unless we spend much more on stimulus, we’ll slide into a depression. And yet the government isn’t spending money on the types of stimulus that will have the most bang for the buck … let alone rebuilding America’s manufacturing base. See this, this and this. [Indeed, as Steve Keen demonstrated last year, it is the American citizen who needs stimulus, not the big banks.]

***

Today, however, Bernanke … and the rest of the boys haven’t fixed any of the major structural defects in the economy. So even if Keynesianism were the answer, it cannot work without the implementation of structural reforms to the financial system.

A little extra water in the plumbing can’t fix pipes that have been corroded and are thoroughly rotten. The government hasn’t even tried to replace the leaking sections of pipe in our economy.In truth and in fact, the government’s policies are not only not working to stem the rising tide of unemployment, they are making it worse.

Forget the whole “Keynesian” versus “deficit hawk” debate. The real debate is between good and bad policy.

I noted in 2009 (footnotes in original):

The government has committed to give trillions to the financial industry. President Obama’s stimulus bill was $787 billion, which is less than a tenth of the money pledged to the banks and the financial system.

Of the $787 billion, little more than perhaps 10% has been spent as of this writing.

The Government Accountability Office says that the $787 billion stimulus package is not being used for stimulus. Instead, the states are in such dire financial straights that the stimulus money is instead being used to “cushion” state budgets, prevent teacher layoffs, make more Medicaid payments and head off other fiscal problems. So even the money which is actually earmarked to help the states stimulate their economies is not being used for that purpose.

Indeed, much of the $787 billion was earmarked pork, not for anything which could actually stimulate the economy.

Mark Zandi – chief economist for Moody’s – has calculated which stimulus programs give the most bang for the buck in terms of the economy:

But very little of the stimulus funds are actually going to high-value stimulus projects.

Indeed, as the Los Angeles Times points out:

Critics say the [stimulus money reaching California] is being used for projects that would have been built anyway, instead of on ways to change how Californians live. Case in point: Army latrines, not high-speed rail.

***

Critics say those aren’t the types of projects with lasting effects on the economy.

“Whether it’s talking about building a new [military] hospital or bachelor’s quarters, there isn’t that return on investment that you’d find on something that increases efficiency like a road or transit project,” said Ellis of Taxpayers for Common Sense.

Job creation is another question. A recent survey by the Associated General Contractors of America found that slightly more than one-third of the companies awarded stimulus projects planned to hire new employees. But about one-third of the companies that weren’t awarded stimulus projects also planned to hire new employees.

“While the construction portion of the stimulus is having an impact, it is far from delivering its full promise and potential,” said Stephen E. Sandherr, chief executive of the contractors group.

It’s unclear how many jobs will be created through the Defense Department projects. Most of the construction jobs are awarded through multiple award contracts, in which the department guarantees a minimum amount of business to certain contractors, and lets only those contractors bid on projects.

That means many of the contractors working on stimulus projects already have been busy at work on government projects.even the stimulus money which is being spentDavid Rosenberg writes:

Our advice to the Obama team would be to create and nurture a fiscal backdrop that tackles this jobs crisis with some permanent solutions rather than recurring populist short-term fiscal goodies that are only inducing households to add to their burdensome debt loads with no long-term multiplier impacts. The problem is not that we have an insufficient number of vehicles on the road or homes on the market; the problem is that we have insufficient labour demand.Donald W. Riegle Jr. – former chair of the Senate Banking Committee from 1989 to 1994 – wrote (along with the former CEO of AT&T Broadband and the international president of the United Steelworkers union):

It’s almost as if the administration is opting for a rose-colored-glasses PR strategy rather than taking a hard-nose look at actual consumer and employment figures and their trends, and modifying its economic policies accordingly.

As I noted in 2008:

This is not a question of big government versus small government, or republican versus democrat. It is not even a question of Keynes versus Friedman (two influential, competing economic thinkers).

It is a question of focusing any government funding which is made to the majority of poker players – instead of the titans of finance – so that the game can continue. If the hundreds of billions or trillions spent on bailouts had instead been given to ease the burden of consumers, we would have already recovered from the financial crisis.

In reality, the entire debate regarding more-versus-less stimulus misses the mark. As painful as it is to think about, the Fed’s policies – like those of the Treasury, White House and Congress – have been geared towards redistributing wealth upwards. See this, this, this, this, this and this.

No comments:

Post a Comment