by Greg Harmon

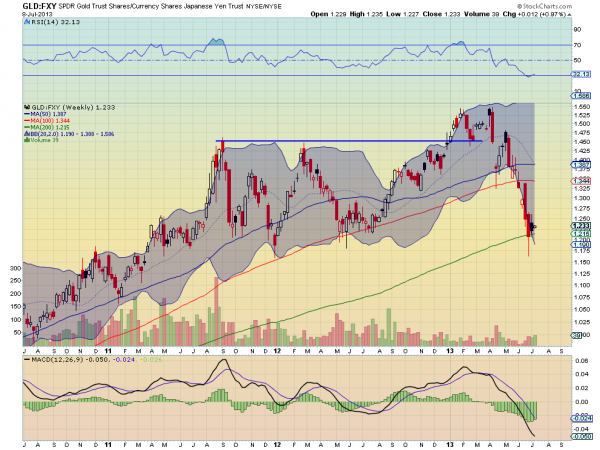

Gold has been in the dumper since it cracked below the 1550 level in early April. And it does not look like it is going to get better anytime soon. Unless, you trade your Gold in terms of other currencies. There is one famous television commentator that will always state that he likes Gold against another currency. Perhaps he is reading or thinking the same way now about Gold priced in Yen. The chart below uses the SPDR Gold Trust ETF, $GLD, and the Currency Shares Japanese Yen Trust, $FXY, as a proxy for Gold and the Yen. It shows the hard sell off in Gold since April but the last 3 candles are what is intriguing and force you to consider a reversal. The Harami, or inside weeks, indicate a potential

reversal. It needs to be confirmed, but there are additional signs as well. The 200 week Simple Moving Average (SMA) acted as support on the move lower and is still holding. The Relative Strength Index (RSI) is flattening and possibly turning up at the technically oversold level. The Moving Average Convergence Divergence indicator (MACD) continues to move lower on the signal line but the histogram has leveled and is starting to improve. You could wait for the signal, a move over 1.25, or start a small position now against the 200 week SMA. Then you too can be long Gold in Yen terms.

No comments:

Post a Comment