By Barry Ritholtz

“The only function of economic forecasting is to make astrology look respectable.” -John Kenneth Galbraith

>

Regular readers know that I do not hold the economics profession in particularly high regard. These sociologists too often have an unfortunate unfamiliarity with how Human Beings behave in the wild. Forget forecasting — economic theories fail to adequately describe what has already happened.

As JKG observed, Economists may give astrology respectability, but there is another group who exists solely to make Economists look respectable: Wall Street Analysts.

As we have discussed about a year ago (McKinsey: Equity Analysts Are Still Too Bullish), most of the time, Wall St analysts are excessively optimistic forecasts, looking for nearly 2X actual earnings growth. The exception is near earnings bottoms, where they are excessively pessimistic.

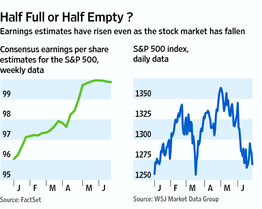

Today’s WSJ points put that the recent shift in market activity, coming after a 2 year, 100% market rally, has done nothing to dampen their enthusiasm. Analysts ardor for equities is as upbeat as ever. As a whole, the group is looking for S&P500 earnings of $99.86 a share for 2011. That’s up 2.3% from April, and reflects a 16% rise from Q2 2010.

Wall Street Strategists — not exactly a bearish group themselves — expect $95.24 in SPX earnings this year. John Butters, an earnings analyst at FactSet, notes that the gap between earnings estimates of Analysts vs Strategists is 5.6%, the biggest disparity in three years.

Here is the Journal:

“The U.S. economy has slowed noticeably in recent weeks, prompting economists to ratchet down their estimates for growth and investors to drive stocks down 7% since late April. Market strategists started reducing their year-end forecasts for the Standard & Poor’s 500-stock index.

But individual stock analysts have remained noticeably upbeat.

As a group, they have not only kept their estimates for corporate earnings for the current quarter intact, but they have raised them.

Skeptics warn that analysts have set the bar too high, increasing the chances companies may disappoint, triggering more market turmoil.

The disconnect between analysts on the one hand and strategists and economists on the other comes largely because analysts are largely focused on their individual companies and industries. That gives them a deeper but narrower view than those who look broadly at macroeconomic factors. As both camps look to the end of 2011, they are seeing very different outcomes.”

Analysts have a latency problem: They mostly produce bottoms up analyses, highly dependent upon quarterly earnings. But by the time changes in broad macro conditions are seen in earnings, it already deep in cyclical turn down. They almost never see the storm coming until it is too late.

My experience with the best of the fundie analysts is that they integrate something beyond quarterly earnings to act as an early warning device. Paul Sagawa, who covered Cisco and Nortel for Sanford Bernstein in the 1990s, was able to forecast a sharp deceleration by surveying carriers spending on telecom equipment. He sidestepped the entire 2000 telecom collapse.

Most analysts do not seem to be able to integrate this sort of additional earnings forecasting capability, to the detriment of their accuracy– and their clients.

No comments:

Post a Comment