By Lance Roberts

You are being lied to. There is currently

more than sufficient evidence that indicates that we are either in, or about to

be in, a recession. The last time I made that statement was in December of

2007. In December of 2008 the National Bureau of Economic Research stated that

we were correct. I don’t make statements like that lightly and, honestly, I

hope I am wrong as this is a horrible time for the economy to relapse.

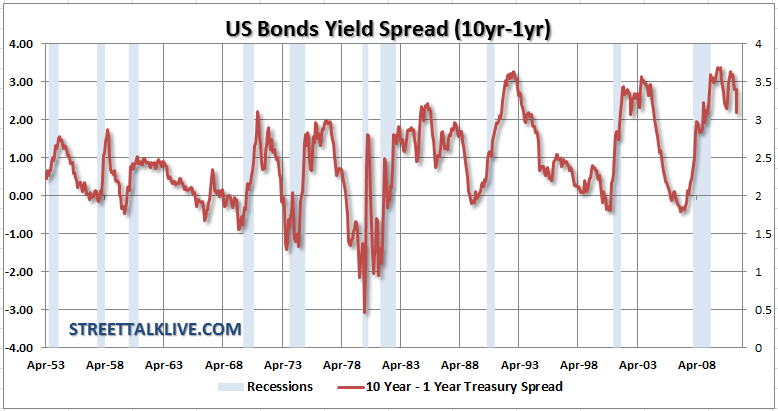

However, the reason that I bring this up is

that there have been numerous analysts and economists stating that the economy

cannot be going into recession due to the spread between various sets of

interest rates. (For the purpose of this report

we will focus on the spread between the 1-year Treasury bond and the 10-year

Treasury note.) Historically speaking they would be correct and I will

explain why.

The steepness of the yield curve has been

an excellent indicator of a possible future recession for several reasons.

First, the spread is heavily influenced by current monetary policy which has a

significant influence on real activity over the next several quarters. When

there is a rise in the shorter rate this tends to flatten the yield curve as

well as to slow real growth in the near term. This relationship, however, is

only one part of the explanation for the yield curve’s usefulness as a

forecasting tool. The steepness of the curve also reflects the expectations of

future inflation. Because economic growth is affected by the level and trend

of both interest rates and inflation it is not surprising that the spread has

historically been a good predictor of future recessions.

This time it could be wrong.

The issues with the spread between interest

rates today are twofold. First, the U.S., via the Federal Reserve, has

embarked upon an unprecedented series of policies to deliberately suppress the

yield curve. Through outright purchases of treasuries through Permanent Open

Market Operations (POMO) and Quantitative Easing (debt monetization) programs

have been implemented to specifically target areas of the interest rate curve.

Even the recent announcement of “Operation

Twist” is specifically designed to flatten the yield curve to “help promote the demand for credit”.

Therefore, since abnormal and artificial influences are being applied to the

bond market to manipulate interest rates it removes the usefulness of the yield

curve as a forward indicator of recessions.

Secondly, and most importantly, the economy

is currently not operating under a normal economic environment. As we have

discussed in recent missives the U.S., for the first time since the “Great Depression”, is undergoing a balance

sheet recession. During the “Great

Depression” beginning in 1929, the Total Credit Market Debt as a percentage

of GDP rose substantially before eventually collapsing. We saw this phenomenon

begin again in the 1980′s as total debt began to expand dramatically until the

Total Credit Market Debt hit 380% of GDP in early 2009. We are now experiencing

the deleveraging of those credit excesses which creates economic drag as money

is diverted from savings and consumption to the repayment of debt.

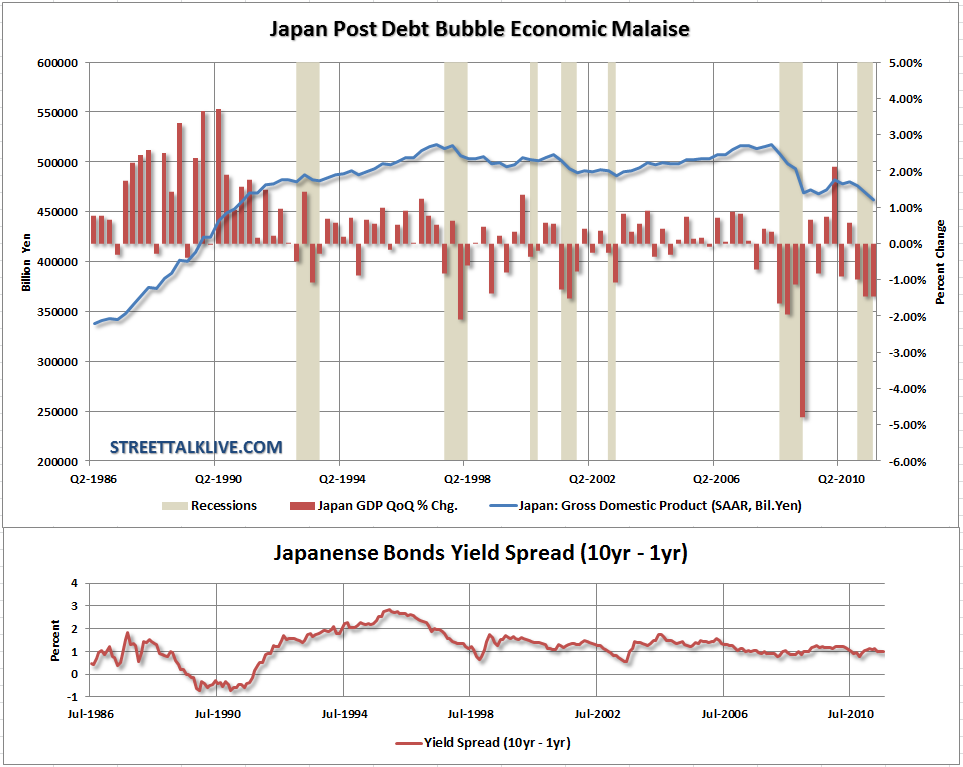

Japan has been struggling with the same

reality since the bursting of their real-estate/credit bubble and subsequent

balance sheet recession. The government of Japan has implemented many of the

same policies that Ben Bernanke has been foisting upon the US economy but to no

avail. As a result Japan has been mired in a stagnating/declining economic

growth environment for the last two decades with frequently recurring

recessionary downturns.

The yield spread between Japanese bonds,

much like we expect to happen here in the U.S., has remained positive due to

government interventions since the beginning of their economic malaise some two

decades ago. As far as a recessionary indicator goes – the yield spread has

failed miserably.

Japan has been struggling with the same

declining employment to population ratio, stagnating wages, an overburdened

pension system and weak economic growth enviroment that currently faces the U.S.

today. If that is the case then the economic future that has been laid out

before us is not a bright one. The coming deleveraging of debt which will

result in a needed cleansing of the excesses from the system will result in

continued weakness in economic growth as consumers and businesses remain on the

defensive. This defensive posture leads to deterioration in the demand for

credit, stagnation of wages and lack of productive investment.

If the recent history of Japan is any

reflection of the path that we have been set upon then we will likely enter a

recession by the beginning of 2012. Of course, it will confound, confuse and

surprise the mainstream analysts and media as the yield curve will most likely

remain positive. As I stated before, I sincerely hope I am wrong, and that

everything turns out for the best. Deep down I am an enternal optomist and

believe in the innovation, ingenuity and passion that has made this country

great. However, “hope” and “optimism” are not investment strategies by

which we can successfully navigate the finanical markets today or in the

future.

No comments:

Post a Comment