By Surly Trader

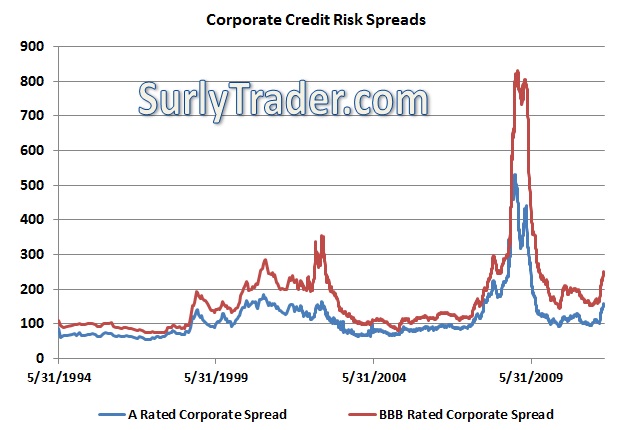

There are very few widely available data

points for most investors to track corporate credit spreads. The corporate

credit spread is the difference between the interest rate that a company has to

pay and the US Government has to pay on their treasury bonds to borrow money. A

company that issues debt at a spread of 250 bps over the 10 year treasury will

have to pay 2.5% plus the current yield on the 10 year treasury. The credit

spread represents the perceived riskiness of the company, its probability of

default and ability to pay its debts.

In 2008, the credit risk of corporations

blew out to record levels. If we just look at A rated and BBB rated US

corporations, the tail event of 2008 stands out starkly:

Credit spreads

have widened, but not past expected levels of fear

The markets of 2008 showed us what happens

when the financial markets freeze up. Loans and bonds are the lifeblood of the

economy and when no one is willing to lend or will only lend at extremely high

levels of interest rates then we question the solvency of such companies as

General Electric. To date in 2011, the credit markets have not frozen. In

fact, with the 10 year treasury at 1.75%, even with a 250 bps spread, companies

are able to borrow money at very attractive levels of interest. Even at a

spread of 300 bps a company will pay less than 5% pretax on that debt. Why can

they borrow at such low rates? Because corporate balance sheets are

in terrific shape.

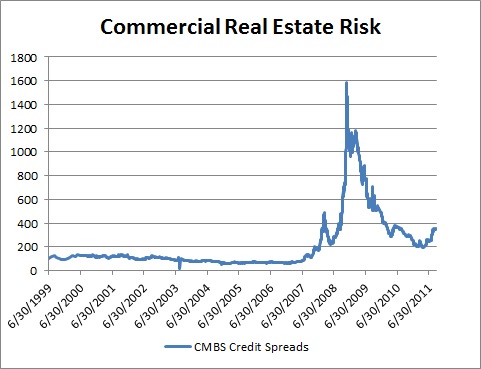

What really stands out is the CMBS market.

CMBS (Commercial Mortgage Backed Securities) represents pooled commercial loan

assets. In 2008, this market absolutely imploded. Instead of gapping out from

60 bps to 600 bps, this market gapped out to nearly 1600 bps or 16% over

treasuries. If we look at the current risk flare we see a 350 spread that

actually seems stable at this level:

CMBS spreads

lack their past flare

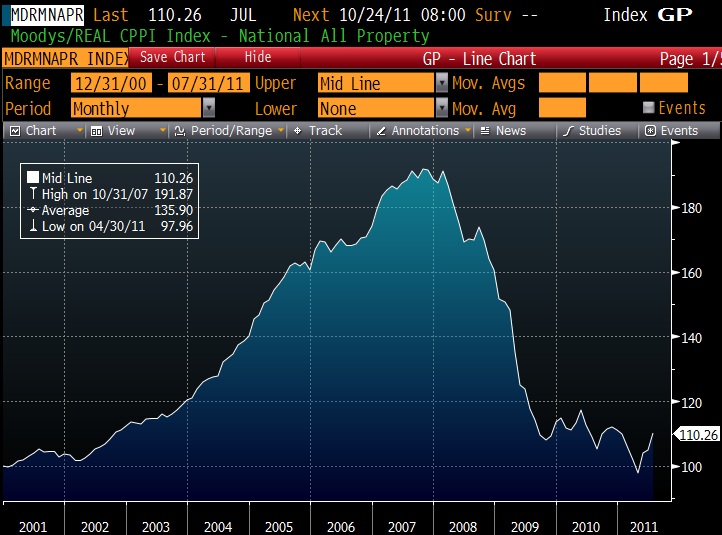

What is different

about this market? Mostly it has just absorbed the losses. Commercial real

estate has already fallen in price and appear to have bottomed out and might be

at fair value. Therefore the loss expectations today are nowhere near what they

were in 2007/2008:

Commercial

Property Prices bottomed and recovering?

This same argument applies to the

residential real estate market and the impact on bank balance sheets.

Are things rosy? No. Are things as bad as

2008? Not right now. If we do enter into a recession it seems improbable that

we could see the depths of this last crisis.

No comments:

Post a Comment