Summary

- There is a link between stock market returns and the pace of tightening of monetary policy.

- I use a "exit speed" indicator to highlight this relationship.

- Interestingly, the correlation is highly dependent on the ability of the Fed to drive the long end of the yield curve.

While the ECB has entered a long lasting status quo, the Fed is preparing to bring several years of unconventional monetary policy to an end and start tightening. Mid-2015 should be when the Fed starts raising the level of Fed Funds. Of course more disappointing job data or a sharp appreciation of the USD could have an impact on the timing, but there is no coming back: the Fed will tighten next year.

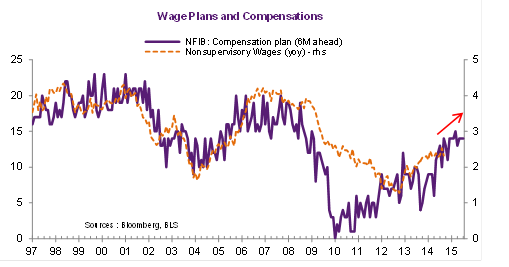

While the "dots" provided by the Fed give us a sense of the terminal value of Fed Funds rates, there is still a lot of uncertainty on the speed of the tightening. For instance, the Fed might have to speed up or slow down its tightening stance whether it is behind the curve or not (business surveys call for a higher rate of growth for wage of non-supervisory workers in the next six months - see chart below - which may "force" the Fed to act earlier than expected).

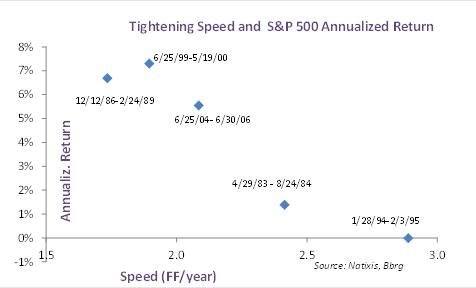

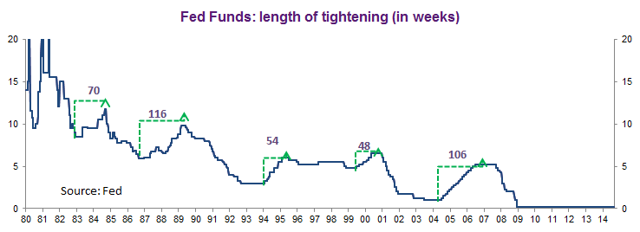

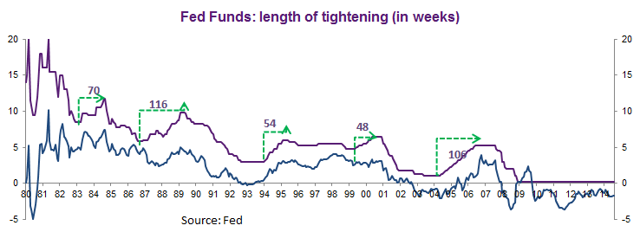

Speed is nothing else than the ratio of distance to time. To assess the impact of the speed of monetary policy tightening on stock indexes, I divided the change in Fed Funds rates by the length of the tightening periods.

Then I compared this measure of speed (change in Fed Fund per year) with the annualized return of the S&P 500 over the period. We clearly see that the higher the speed (in Fed Funds per year) of the tightening, the lower the annualized return of the S&P 500.

This would call for a smooth exit, something that an early start of the tightening cycle (that is before wage inflation really kicks in) would facilitate.

The chart has a flow yet. It is based on absolute changes of nominal Fed Funds. The underlying assumption is thus that a 100 basis point increase in the level of Fed Funds has the same impact on equity returns whether Fed Funds stand at 10%, 5% or 1%.

Using the relative change in Fed Funds in my calculation of speed (that is the ratio of the change in Fed Funds to their initial level) would suggest that there is no link between the pace of Fed tightening and equity returns. Yet, I doubt that investors really gauge the Fed actions with such a metric.

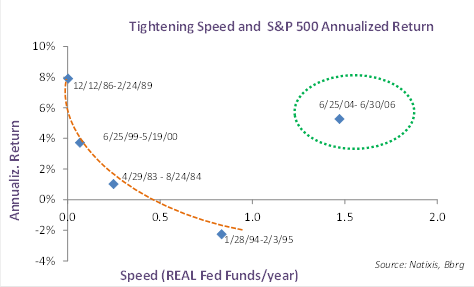

Interestingly enough, using real Red Funds (Fed Funds minus inflation) to assess the speed of tightening provides some interesting results. As can be seen below, there is a huge difference in the behavior of real and nominal fed funds when the Fed acts preemptively (1994/95 and 2005/06) or has already lost grip and is running behind inflation (1987/88 and 1999/2000).

With this new metric of speed (based on the adjustment of real Fed Funds), the relationship with equity returns is still relevant but slightly different:

i. A rapid increase in real Fed Funds rates is detrimental to stock market returns;

ii. There is an outlier: the mid-2000 tightening was by far the most rapid, but it did not weight negatively on annualized stock returns. The most likely explanation is the conundrum, a term that describes the period when the long end of the yield curve failed to react to Fed tightening.

The speed of Fed tightening has an impact on equity returns, whether it is gauged through nominal or real Fed Funds rates. The relationship is rather robust, but seems to be dependent on the ability of the Fed to steer the whole spectrum of the yield curve.

If the secular stagnation hypothesis, the regulation trap, the accumulation of reserves by emerging countries are strong enough to offset the upward pressure on the long end of the curve that the end of Fed assets purchases might entail, then the forthcoming Fed tightening will lead to another conundrum. And the current stock market rally might continue, whatever the pace of tightening.

No comments:

Post a Comment