By Rohan Clarke

In its latest Bulletin, the RBA added its two-pence into the Central Bank piggy bank of analysis for the reasons for high commodity prices (here). They conclude:

Commodity prices are currently both high and volatile relative to the past few decades, consistent with the physical supply and demand fundamentals that underpin these markets. However, the increase in prices and volatility is not unprecedented, having occurred during other large global supply and demand shocks throughout the past century. There is a lack of convincing evidence (at least to date) that financial markets have had a materially adverse effect on commodity markets over time periods of relevance to the economy. It is possible that speculators have had some effect on commodity price volatility, but their contribution would appear to be relatively small – particularly when compared with the contribution from fundamental factors – and short term in nature.

If we line up the central banks with the papers they have published, we get some interesting correlations (apologies for the simplistic paraphrasing):

Federal Reserve – commodity prices are driven by physical demand from emerging economies; not our monetary policy

Bank of Japan – commodity prices are higher than physical demand alone implies; we should know, we are a commodity importer

Australia – commodity prices are driven by ever increasing demand from emerging economies; we should know, they are our best customers

Hmm.

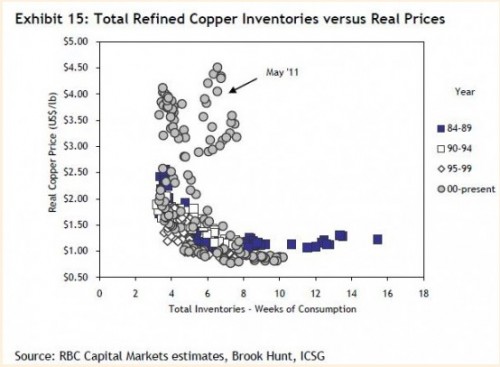

Speaking of correlations in the commodities markets, RBC published an interesting chart recently (via FT) that compares real copper prices to inventories:

All those grey circles in the upper left quadrant are telling us that the last decade has been very different to previous ones – prices have remained stubbornly high against relatively stable supply. The big question is why?

Clearly, demand from China for industrial resources has grown very strongly, just as it has risen for agricultural products and energy across the developing economies. This supports the argument that the growing demand in absolute volume terms requires a higher level of inventories on a weeks-of-consumption basis. There is no doubt then that higher demand from China et al has pushed up prices relative to the experience of the prior two decades.

But to downplay the impact of investors that have plowed relentlessly into the supercycle commodity story, as the RBA has done, is plain irresponsible. It is self-evident, to me at least, that the weight of investor money in the sector means that this capital flow is capable of being the marginal price setter. With commodity investors making up some 40% to 50% of futures markets turnover, can they really be anything else?

We’ve discussed this before (in May last year here and with some charts from James Montier here). The evidence is plentiful – from the volumes being traded in futures markets to the distortions being created in the forward curves.

If nothing else, the growing presence of investors increases the potential for extreme movements in commodities prices. It is well to remember in this context that commodities as an investment in their own right do not pay a dividend. Investors rely solely on higher prices to generate returns – or at the very least, stable prices to get their money back.

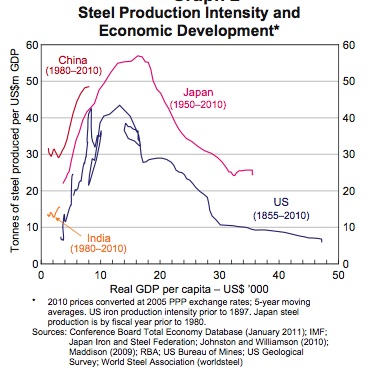

Still when you look at this chart from the RBA’s analysis, one gets the sense that the supercycle proponents are comfortable with the risks for some time yet. To be fair, it’s a pretty compelling picture…

No comments:

Post a Comment