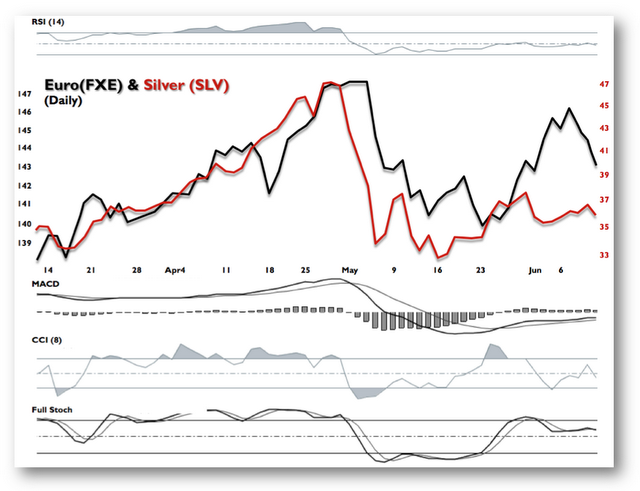

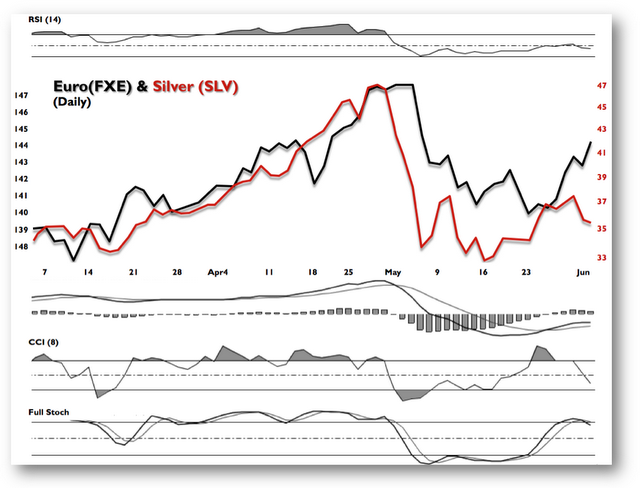

Considering the euro has followed script smartly – here is an update of the Euro:Silver chart from last Thursday.

From last Thursday’s notes:

“As the euro rips higher today after comments by Jean-Claud Trichet and the newly proposed bailout measures firm the struggling euro-zone, it would be wise to watch silver as a proxy for the currency markets. Since silver broke its parabolic formation over a month ago, both markets have been trading with great correlation – with silver leading the way by several sessions. This makes natural sense in the fact that silver is a much shallower and more impressionable market that will trade with greater nuance to the underlying market conditions. Jawboning by the ECB appears to be only momentarily supporting the euro. I would expect the euro to follow suit lower over the next several sessions.The fact that silver failed to take out the early May dead-cat-bounce highs indicates that the mid May lows will at the very least be tested and likely broken. The violent reversal in silver yesterday gives credibility towards that expectation.”

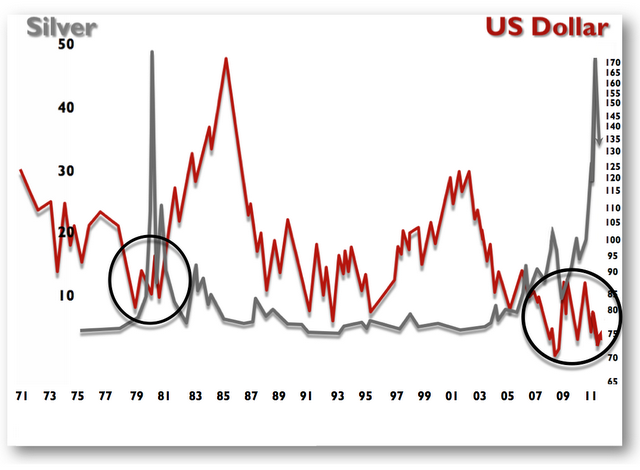

From my perspective, silver appears to be simply consolidating into its next move which will very likely be lower – considerably lower. The dollar continues to exhibit strong congruency to the early 1980′s bottom.

From my perspective, silver appears to be simply consolidating into its next move which will very likely be lower – considerably lower. The dollar continues to exhibit strong congruency to the early 1980′s bottom. You could say recently the tail (silver) has been wagging the dog (euro-currencies).This action typically precedes the dog bitting its own tail.

You could say recently the tail (silver) has been wagging the dog (euro-currencies).This action typically precedes the dog bitting its own tail.

No comments:

Post a Comment