1. Ongoing demand growth in Asia

The argument goes something like this: The economy in China is starting to be driven by internal consumption, i.e. emergence of a local consumer class over there, and therefore a continued soft economy in the US will not slow down Chinese and therefore global demand growth for oil.

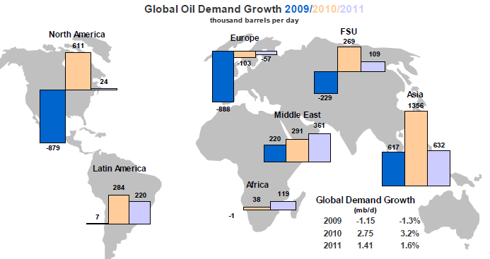

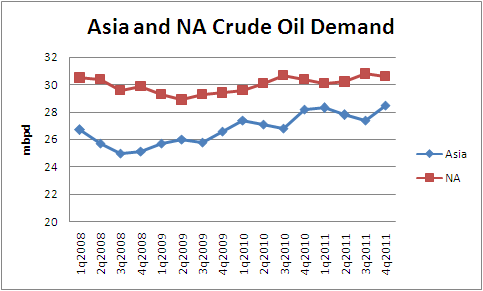

Here are a couple of graphs from the January 18th IEA Oil Monthly Report: The first one is just a graphic that says what we all know, Asia is leading the demand growth for this year, the second graph is using IEA data for the previous few quarters and projected until the end of 2011.

As a further point, the January 2010 forecast for 4Q2010 crude oil demand called for 26.7 and 29.7 mbpd for Asia and North America respectively, and the "actuals" for the 4th quarter were 28.2 and 30.4 mbpd respectively. The IEA already forecasts a 1.5 mbpd global demand growth for 2011 and if they turn out to be equally off on their forecast this year, you're really looking at closer to 3 mbpd....

The crossover event, that is the point at which Asia demand exceeds NA demand, will probably happen at the end of 2011 or beginning of 2012, and would have happened already were it not for the efficient nation of Japan actually decreasing its energy demand over the past few years.

2. The Bernanke Effect

This theory is: When the current QE2 or QE3 or whichever we are now on comes up for review in June, the US economy will still be so weak that Bernanke will be forced to continue some form of the practice, thereby further weakening the dollar.

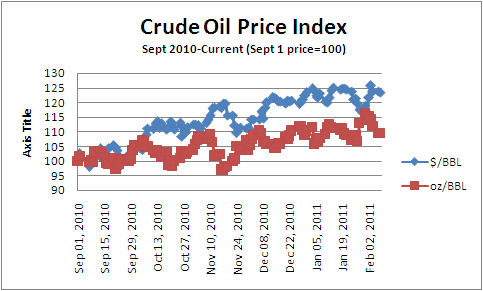

I would refer you to the chart I posted previously:

Which says that the dollar-denominated price of oil is actually going up faster than the gold-denominated price of oil, i.e. More dollars in the system equals a cheaper dollar, weak dollar equals a higher nominal oil price. This will be particuarly true if countries start to trade oil in currencies other than the dollar.

3. There will be increased demand for Oil as an Asset Class.

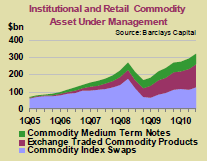

All distractions aside, there are still a lot of potential black swans floating around and shoes to drop in the financial system, including the likelihood of (2) above, and oil, like all commodities, will increasingly be sought out as a place to park wealth so as to avoid some of the chaos.

The following graph from the IEA that illlustrates this point: Increased use of commodities as an asset class by fund managers and institutions. More demand equals higher pricing. One only need look at the current grain prices as further evidence of this.

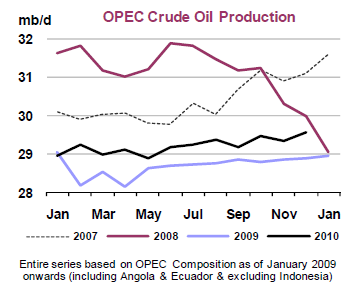

4. Questionable ability of OPEC to increase their Production

There has been a lot of conversation lately about the ongoing ability of various OPEC members to sustain a higher level of production. Here's a graph from the IEA that suggests that for awhile in 2007 and 2008, OPEC was able to maintain production at 32 mbpd, which is about 3 mbpd higher than the current level.

Per argument (1) above, there is some risk that there will be roughly that much additional demand by the end of the year in 2011 or more likely by mid 2012. The ongoing question is: what is the ability of OPEC to produce at their formerly demonstrated level, due to supposed depletion of some of their existing fields and what is their capability to bring new production online fast enough to replace it? Publicly, the OPEC ministers are not too worried about it, but there are plenty of theories to the contrary.

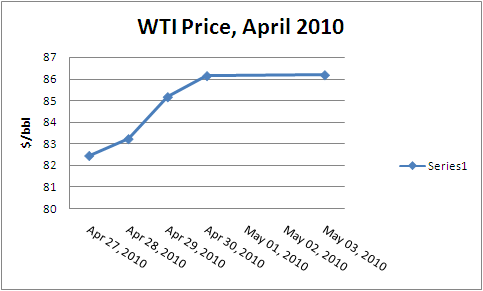

5. Headline Chaos

In the five days after April 27, 2010 the oil price increased by an average of a dollar per day because of the actions of a couple of offshore platform workers and their supervisor working in the Gulf of Mexico. That story is still ongoing.

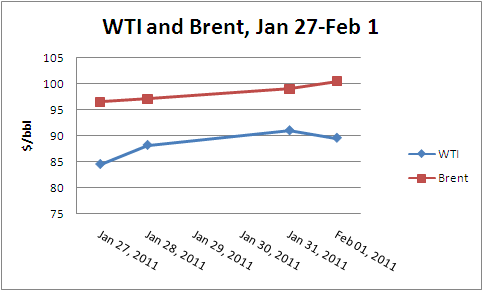

The actions of a single Egyptian security guard, who overzealously shot a demonstrator on January 27, 2010 and touched off the Egyptian Revolution caused a $6 per barrel increase in the WTI price in the following days, and aggravated the short squeeze that sent the WTI/Brent spread to unprecedented levels in the days afterward.

Moral: The "headline effect" bias is toward higher pricing. The actions of some lone, underpaid, overworked person, someplace in the world can cause a pretty dramatic effect like this because of the complexity and fragility of the system as it is now functioning.

The world is chaotic. There are no guarantees on anything. Remember that on your drive home today.

No comments:

Post a Comment