By Chris Tell

James Rickards, the author of the book Currency Wars tells a short story along the following lines: you’re sitting in a movie theatre and a couple of people get up and leave. Nobody takes much notice, now a half a dozen people all get up and leave at the same time, people take more notice this time around. The tipping point of course comes when a sufficient number of theatre goers get up and leave all at once. At some point EVERYONE RUSHES FOR THE EXITS.

Fire? Bomb? Drone strike? Who knows, but nobody is waiting to find out.

I think the story is telling since it describes human behavior so brilliantly. I talked a bit about this in my post, Finding Your Sneetch.

Mark and I were having a conversation the other day with a friend and colleague. We were discussing what happens when the theatre clears, with the background to the conversation being the discussion of reckless monetary policy, profound arrogance, and incompetence on the part of central bankers across the developed world, but most importantly how their actions are affecting and will affect society.

The German Theater Clears

There are the extreme examples, such as the rampant inflation of the Weimar republic which laid the seeds of Hitler’s rise, the Holocaust, and of course the devastation, death and destruction given birth by World War II.

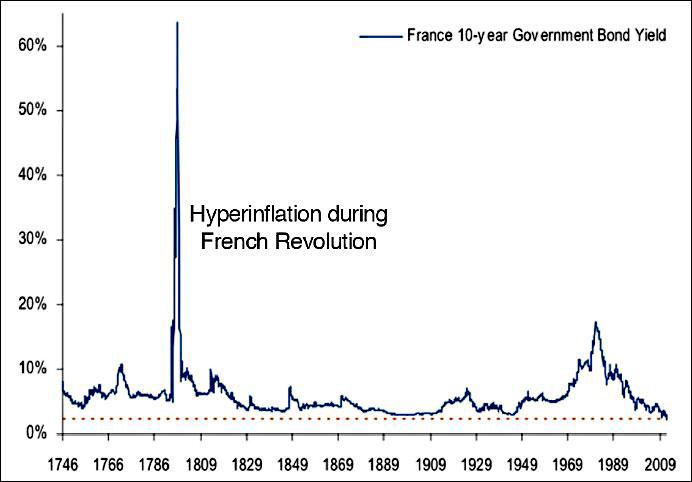

Well before that was the collapse in currency that coincides with Robespierre’s reign of terror and the French Revolution. We could go even further back to Roman times to look for similar “coincidences”.

French Movie Theatre Clears!

Myriad examples throughout history show us what and how people react when trust is lost. Trust, and ignorance after all are the key pillars holding together the worlds monetary system today. It certainly isn’t intrinsic value.

So the question we were collectively asking ourselves was this: at the moment of impact, which is to say when the realisation hits that one can no longer trust in a particular currency, or heaven forbid, the entire monetary system, how does one respond?

We covered the usual suspects, namely foreign currencies, precious metals, real estate in countries relatively uncorrelated to the breakdown-centric countries that can boast of existing resiliency, and of course owning agriculture in various forms. Then the topic of crypto-currencies came up.

My arguments against any crypto-currency, or indeed any alternative currency were as follows:

Anything not under the thumb of government mismanagement will come under fire from that same establishment. They don’t have to destroy it, and they may in fact be incapable of doing so. In that case it will simply be made “illegal” to use it! It will be “demonized”, and those using it will be pushed into the underground. Provided sufficient “examples” are made of those who refuse to comply, fear of use will be sufficient to marginalize its use.

Take the example of the liberty dollar. In May 2009, Bernard von NotHaus and others were charged with federal crimes in connection with the Liberty Dollar and, on March 18, 2011, von NotHaus was pronounced guilty of “making, possessing, and selling his own currency”.

The powers that be don’t want any competition, and they don’t want you to know what they are up to. Just look at the current environment surrounding any kind of “freedom to know”. Reporters are being hounded, whistleblowers like Snowden, Manning and Asange are pursued as if they are crazed psychopaths. The establishment WILL set an example.

It is the modern day equivalent of chopping off someone’s head and sticking it on a pole outside the city gates in order to warn others not to “misbehave”.

I make the analogy between crypto currencies and Mr. Snowden for the simple reason that we’re dealing with the same “powers”, and they are in control of the entire system – legal, monetary, military, and corporate – you name it. Watching their actions now provides us with insight into how they will react when things really come unglued. It promises to be ugly!

Increasingly the free market is and will continue to become a “black market”. This happens when the crooks are in control and citizens have to resort to alternative means simply in order to survive. When I say alternative I don’t mean immoral or unethical, but these actions will likely be deemed illegal nevertheless.

On the other side of the digital coin, what can happen is that a tipping point is reached which makes the use of these “illegal” currencies an absolute necessity and people flood into them. While the vast majority of citizens in most any country in the world today do not see a crypto-currency as a reliable or viable substitute for the scraps of paper they shuffle around daily, this perception can change rapidly when panic sets in. Suddenly ANYTHING seems viable.

This perception change can come before a revolution or during, where the “powers that be” are losing control. I’m not sure whether one breeds the other or vice versa, but history indicates that it happens all the same. As a recent test case we could consider Cyprus, and the Cypriots grasp of what was happening. How many would have given pause to a law banning their use of something like Bitcoin if such a law had existed, and if they had any inkling of the impending theft?

Was it mere coincidence that as the Cypriot banking crisis played out Bitcoins rose from around $35 to over $200?

In fairness I tend to spend my days focusing on private equity deals, so I’m not necessarily qualified to answer “unanswered” questions. Therefore I post this in the hope that others will contribute their own thoughts on the topic.

So as my parting “unanswered question”, I ask you: does a basket full of crypto-currencies deserve any place in a diversified portfolio?

No comments:

Post a Comment