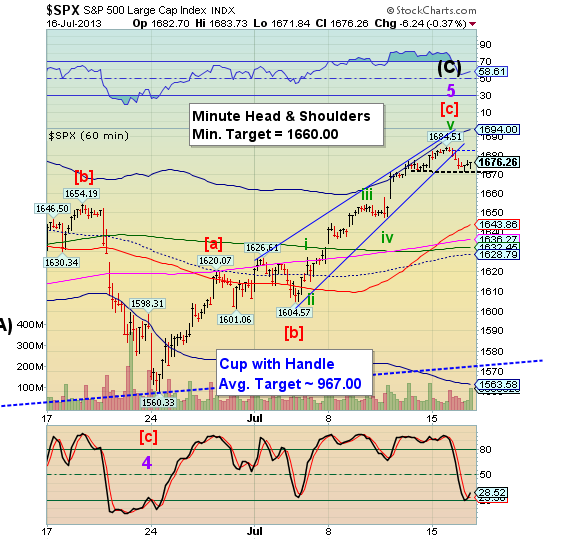

SPX made its first impulse down and the correction appears complete at the 38.2% retracement. What would be interesting is what happens at the open tomorrow. Given that this decline hasn’t a lot of time, I think it may pack a lot of punch right from the start. It took two days for the SPX to rally from 1671.00 to the top and only one day for it to retrace that move.

The Cup with Handle formation is intact, which means that there is a better than 50% probability that the target may be met. However, once SPX declines beneath 1570.00, the probability rises to 90%. The only issue is the time frame. If this turns into a panic decline then the likelihood of meeting this target can be very high. We will know by the time we hit 1570.00.

Meanwhile, the target for this decline offered by the Cycles Model is near 1300.00. I could settle for that by the first week of August.

No comments:

Post a Comment