Commodities are notoriously difficult to value which is why commercial traders have a huge demand to hedge and also why many commodity traders prefer to use technical analysis. Commodity price ratios use technical analysis to provide a glimpse into the historical perspective on prices. This gives the trader a 30,000 foot view of the relative value of commodity price changes over long periods of time.

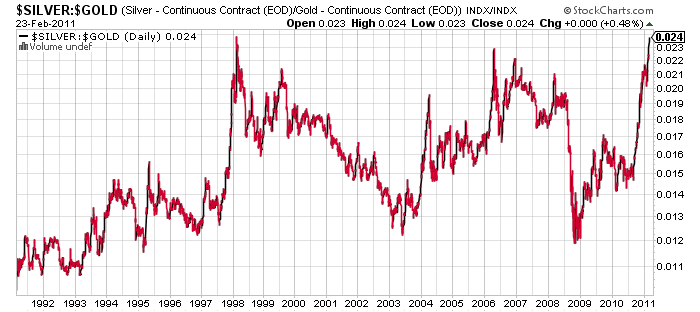

Silver looks expensive compared to gold

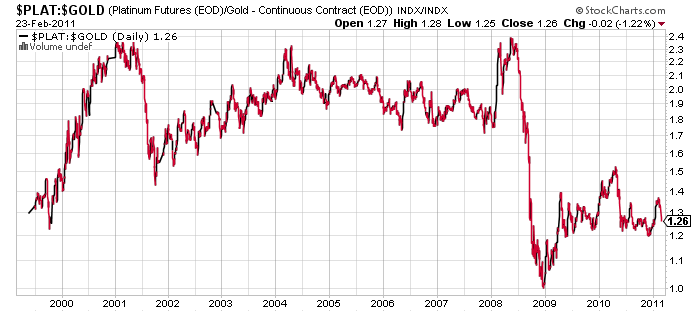

Platinum looks moderately inexpensive compared to gold

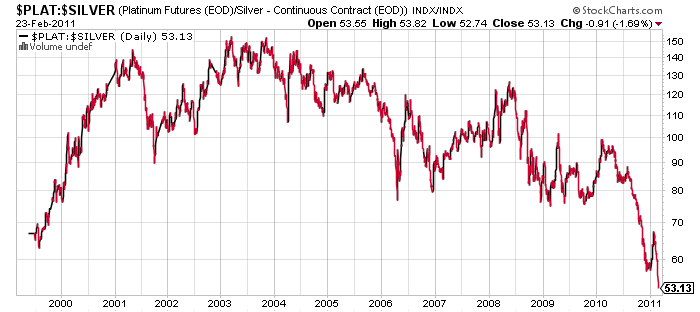

Platinum looks inexpensive compared to silver

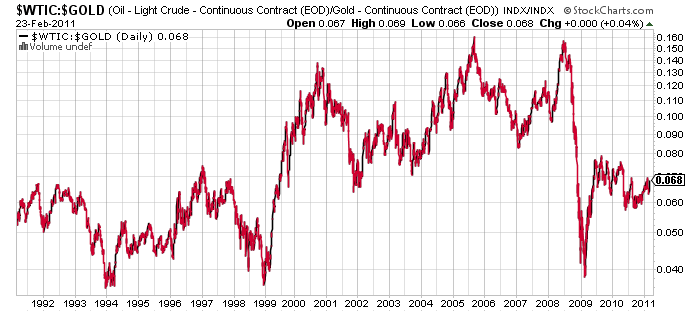

Oil looks fairly valued compared to gold

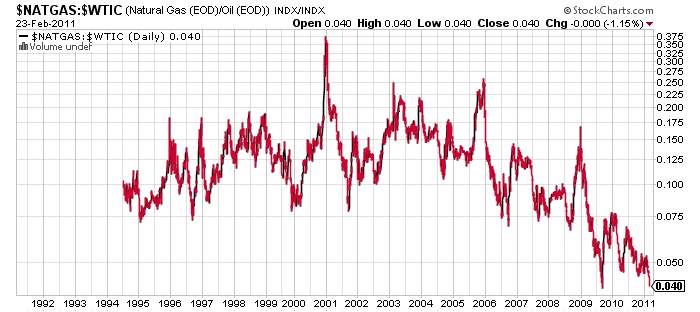

Natural Gas looks inexpensive compared to oil

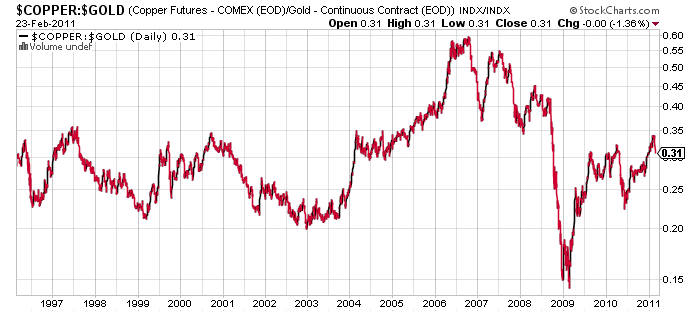

Copper looks fairly valued compared to gold

Continue reading this article >>

No comments:

Post a Comment