The NYSE Hi-Lo index went negative this morning and exceeded its two prior lows. This confirms the sell signal in SPX.

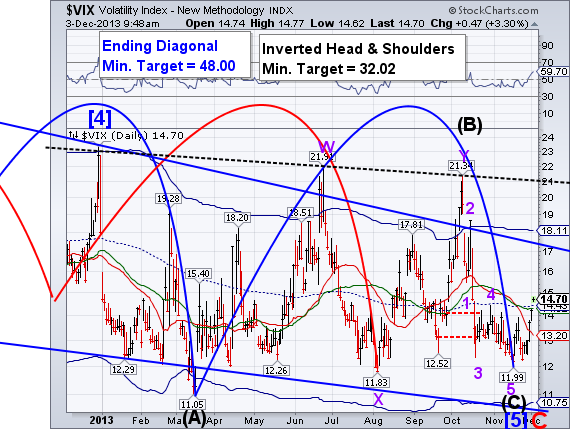

The VIX also confirmed its buy signal and inversely, confirmed the SPX sell signal as well. We may see an extended, super-sized minute Wave [iii] that could push it to its Cycle Top at 18.11 and send it on its way back to its inverted Head & Shoulders neckline at 24.00. The small Head & Shoulders pattern that was triggered yesterday (not shown) has a minimum target of 15.89.

SPX is back-testing its Broadening Wedge trendline. We could see further a bounce back to the Head & Shoulders neckline at 1802.76 before resuming its decline. That may be an indication of a more complex and possibly stronger decline.

1802.00 would be an excellent area to max out on the short side.

More to come later.

Regards,

Tony

No comments:

Post a Comment