by Charles Hugh Smith

Since stocks rise when the Fed is adding assets and tank when the Fed pauses...

Now that financial pundits are claiming the current stock market rally is good to go until 2016, it's appropriate to see where the market will be in 2016 if current trends hold.

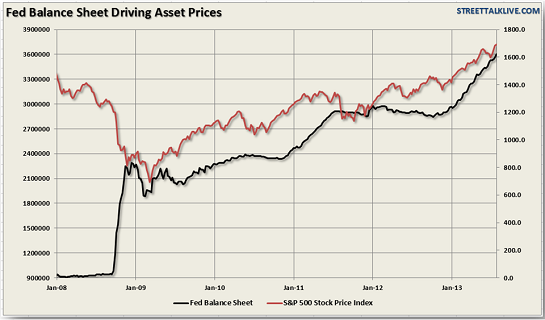

Let's start with the well-known correlation between the Federal Reserve's balance sheet and the stock market: stocks rise when the Fed is adding assets and tank when the Fed pauses. (Chart courtesy of STA Wealth Management)

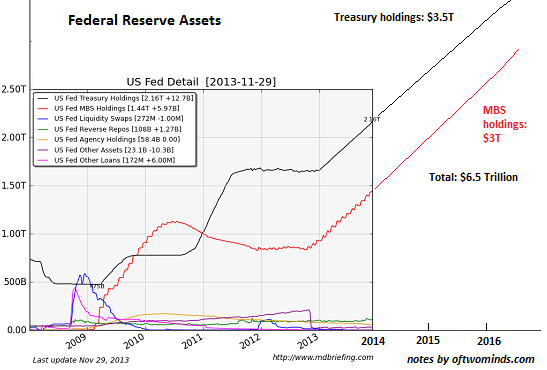

Courtesy of Market Daily Briefing, let's look a little closer at the Fed's ballooning holdings of home mortgages (MBS) and Treasury bonds, and extend those trends into the future:

By mid-2016, the Fed will have nearly doubled its Treasury bonds from $2.16 trillion to over $3.5 trillion, and its mortgage holdings will double from $1.44 trillion to $3 trillion. This would represent about a third of total mortgages outstanding.

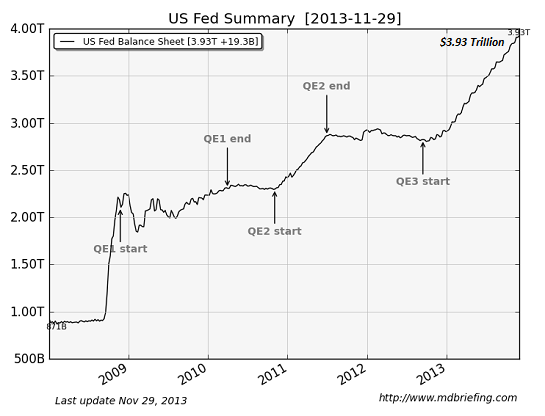

Here is the Fed's aggregated balance sheet, with the start of each quantitative easing (QE) program indicated:

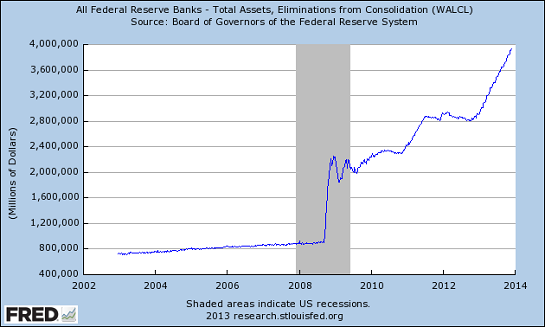

Grab a ruler and pencil and extend this trendline--you reach about the same target of Fed assets $6.5 - $7 trillion by 2016:

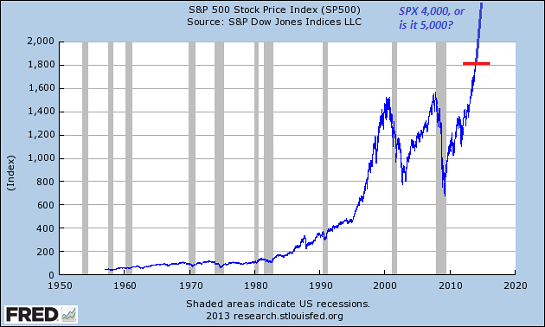

If the S&P 500 (SPX) continues higher in lockstep with the Fed's expanding balance sheet:

Is that SPX 4,000 in 2016, or is it SPX 5,000? The upward trendline is so steep it's hard to project.

Is this uptrend sustainable? You're kidding, right? Don't fight the Fed, Baby--it's Dow 40,000 or 50,000/SPX 4,000 or 5,000 by 2016, guaranteed.

Please note this is sarcasm, not a forecast.

No comments:

Post a Comment