It’s the season for shopping. We have Cyber Monday in the United States and Singles Day in China (November 11 or 11/11). So, while we are pondering shopping, try to guess which consumer market is growing the fastest. The answer is…China!

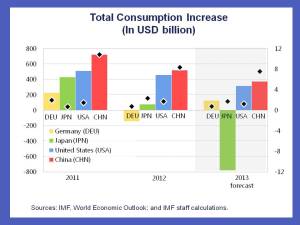

China had the largest consumption increase in the world. This was true in 2011, true in 2012, and likely to be true again this year (see chart). Consumption in China is also generally thought to be weak. Indeed, the government and the IMF are calling for more consumer-based growth. How could consumption, in effect, be both weak and strong at the same time?

The chart shows the US$ increase of consumption in China and other large economies. China has been tops for the past few years (see the bars). It has also had the fastest real growth in consumption (see the dots). The US$ increase (bars) is a combination of the pace of consumption growth, size of the economy, and exchange rate. For China, exchange rate appreciation also contributes to the large measured increase in US$, as well as the negative bar for Japan this year. So whether measured in US$ terms or real growth, among major economies, China’s consumer market is the fastest growing in the world.

The chart shows the US$ increase of consumption in China and other large economies. China has been tops for the past few years (see the bars). It has also had the fastest real growth in consumption (see the dots). The US$ increase (bars) is a combination of the pace of consumption growth, size of the economy, and exchange rate. For China, exchange rate appreciation also contributes to the large measured increase in US$, as well as the negative bar for Japan this year. So whether measured in US$ terms or real growth, among major economies, China’s consumer market is the fastest growing in the world.

It is also true that consumption as a share of GDP has been declining. It has fallen by some 10 percent of GDP over the past 10 years or so. However, a big reason for the decline is that GDP has been growing fast, even faster than consumption. This is just arithmetic. In real terms, however, consumption has grown about 9 percent a year for the past decade—a fantastic outcome! This just happens to be less than the 10 percent average growth in GDP.

Two factors are behind the declining share of consumption. First, household saving has been rising. The reasons are complex, and perhaps not fully understood, but pre-cautionary motives are a popular explanation. Households are uncertain about how much health, education, and pension the government will provide, so self-insure by increasing saving. Second, household income has been growing slower than GDP. Same story as above: Household income has been growing fast, but just not as fast as GDP. These factors are each discussed further in “Sino-Spending”.

Moving to consumer-based growth

Rebalancing toward more consumer-based growth means, in short, boosting the consumption to GDP ratio. Consumer-based growth, however, is a foreign concept to macroeconomists. We tend to look at growth from the supply-side of the economy: Capital (factories) and labor (workers) are combined with technology (total factor productivity) to produce output (GDP). The consumer-based growth story, however, can also be told from the supply-side of the economy.

Expanding the service sector is a critical step for achieving more consumer-based growth. The service sector, while growing, is smaller in China in terms of output and employment than comparator economies. As the service sector takes a larger and larger share of the economy, household income (and thus consumption) will naturally rise as a share of GDP. Moreover, advances in the service sector could also lower the price for many consumer services and thereby increase sales (e.g., consumption) see IMF Working Paper.

Other reforms will also help. Strengthening the financial sector will help finance the expansion of the service sector, a part of the economy that currently has difficulty accessing credit. It will also boost household income directly, as new financial products boost investment income. Social security reform, meanwhile, could help reduce pre-cautionary saving. Moreover, payroll taxes are very high and regressive (employee plus employer social contributions often exceed 40 percent of wages). Reducing the contribution rates will help boost labor income directly through lower taxes and indirectly by boosting employment.

These are just some examples. In fact, many other reforms announced at the recent Third Plenum will also help lift the consumption ratio. Higher resource taxation, labor market reforms, and land reform could all help boost household income and lower household saving—either directly or indirectly by shifting the economy more toward services.

As reforms take hold, the end result should be a rise in the consumption to GDP ratio. It happens as a welcome by-product of moving to a more balanced and sustainable growth path, which also leads to a larger service sector, lower household saving rates, and a higher labor share of income. It also means a more inclusive (improved labor market) and environment-friendly (services are less polluting than industry) growth path.

And, since consumption will be growing faster than GDP, it will also be more consumer-based growth.

No comments:

Post a Comment