There are two types of investors in the world. The first type is like Warren Buffet – he invests capital for a return but has no definitive time horizon for that to occur. He can invest capital today for a return that he will most likely never see in his lifetime as his views can be 30 years or more. Berkshire will be around long after he is gone and will realize the benefit of his investing savvy.

The other type of investor is the average American who is investing their hard earned savings for a very definitive time horizon. The real goal here is to ensure that those savings have adjusted for inflation over time. That time horizon is on average 15 years which is shorter than the length of most secular cycles in the market and poses a real problem for individuals trapped in a secular bear market as we are in today.

As a manager of assets for the latter, my job is not to make sure that my clients beat some random benchmark index from one year to the next, but rather that an event doesn’t come along that takes away a large portion of their “savings”.

What individuals have forgotten over the last decade is that the stock market was never meant to be a “casino” or a “get rich quick scheme” but rather a tool to ensure that those very hard earned savings retain purchasing power parity over time.

My job, as I see it, is like a lifeguard at the beach staring out at the ocean. As long as the waves are gently lapping at the shore, blue skies extend to the horizon and a soft breeze is blowing; the environment is safe and I allow swimmers to play in the water. However, if I began to notice the breeze picking up, waves becoming a bit too aggressive or storm clouds forming in the distance I am going to start making preparations to remove swimmers from the water to safety.

The problem with most investors is that they fail to read the warning signs and suddenly find themselves struggling to get to shore as the storm rolls in over them. By that point it is far too late.

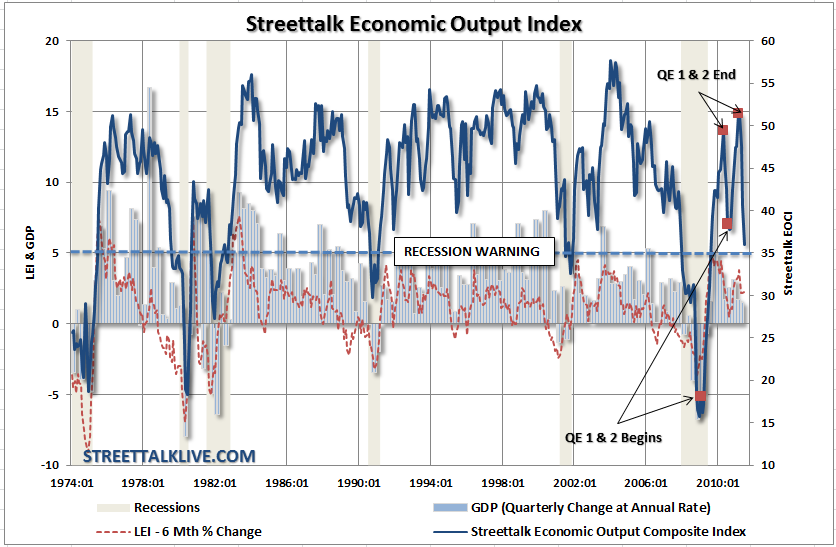

This leads me to today. We have been writing about these warning clouds since late last year and that it was only a function of time before reality caught up with the fantasy of markets. Today we are seeing the storm began to roll in and I wanted to touch on things that have me worried and why we will likely see a recession by the end of this year or early 2012.

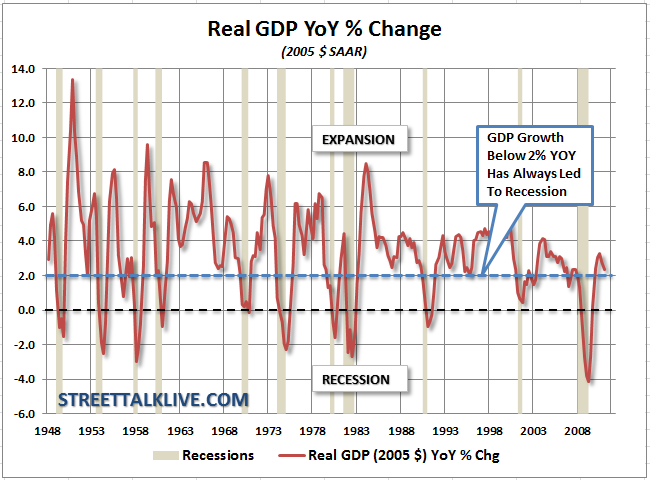

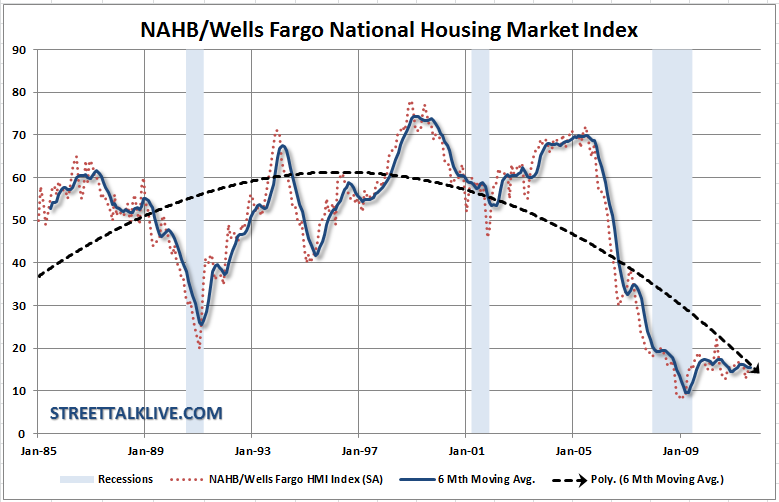

1) GDP

Statistically speaking, the data suggest the definite possibility of a second recession and potentially sooner rather than later. With the most recent release and revisions of the Gross Domestic Product data, the economy is currently growing at 1.6% on a year over year basis.

As the graph shows - when growth declines below 2% GDP growth it has been indicative of a recession in the past. Almost every drop below this line has led to a recession measuring back to 1947.

The issue is more than just a weak quarterly number. The long term trend of economic growth is also on the decline which is more indicative of economic destabilization as the credit boom has led to balance sheet recession rather than a normal manufacturing cycle.

Policymakers need to realize that unemployment is the real problem that needs to be addressed now rather than focusing on the deficit. Employment is the foundation for the organic economic growth cycle that will lead to higher government revenues which can then be used to pay down the deficit. Unfortunately, the current Administration has become entangled in deficit debates and have failed to realize that austerity measures implemented in a high unemployment environment will only exacerbate the situation. Maintaining a large deficit for a long period of time is not desirable for the economy, however, without focusing on the growth side of the equation first the deficit solution can not be solved without extremely deleterious long term effects.

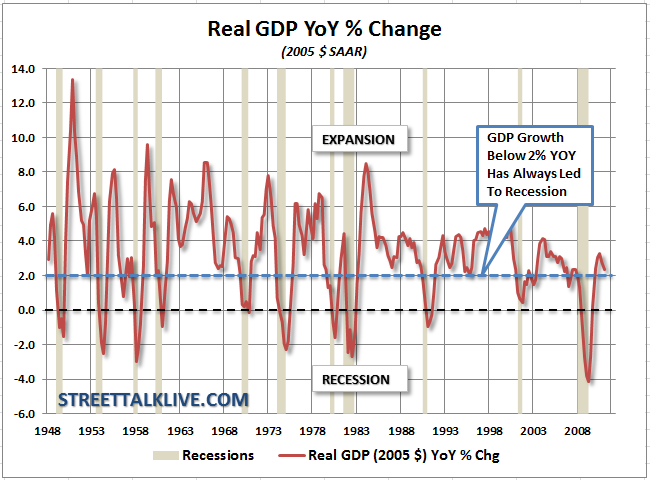

2) Housing

For all the hopes, prayers and wishes of a housing market recovery it has remained as elusive as “Sasquatch”.

The problem with the housing recovery is not just the massive problems that it brings to the banks holding pools of underwater assets but the lack of mobility for millions of Americans.

Part of the employment problem is that many families are literally trapped in their mortgage. Roughly 1 in 5 Americans are underwater in the mortgage meaning they can’t sell the home in order to move to another locale for a better job.

Furthermore, the over supply of homes is also crimping new home construction. When it comes to economic growth two of the biggest multipliers of dollars input are manufacturing and new home construction. In fact, every economic recovery in history has been led by construction and manufacturing. With new home construction clearly not showing any evidence of recovery it is little wonder that the economy is stagnating as well.

3) Manufacturing

Speaking of manufacturing that area of economic rebound that we saw during 2009 and 2010 is now rolling over and headed towards recessionary levels. Roughly 2/3rds of the growth in the GDP numbers over the last several quarters have been directly attributable to inventory rebuilding and restocking. After massive liquidations of inventories in 2008 those inventories have now been fully replenished. Unfortunately, the demand side of the equation has been weaker than expected and inventories are now bulging at the seams.

As we have seen in many of the recent releases from the manufacturing regions backlogs are declining, deliveries are slowing and prices received are falling behind prices paid. None of this bodes well for stronger economic growth in the future or for corporate profits.

4) Employment

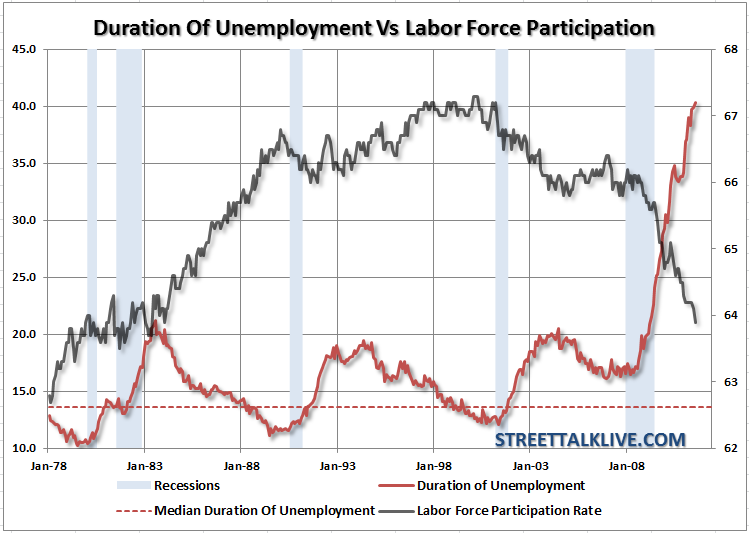

The state of employment, as stated previously, remains a huge problem for the economy. It fascinates me to no end that with each weeks release of the “jobless claims numbers”, which still hover at recessionary levels, that the mainstream media continues to try and extract an employment recovery story.

The reality of the story is that we are not created enough jobs now, or in the last decade for that fact, to offset the number of new entrants into the labor force.

Today, we are hovering at levels of employment relative to the total labor force that have not been witnessed since 1983.

Low levels of labor force participation continue to exacerbate the virtual spiral between the consumer and businesses. Individuals need to produce so that they can receive a paycheck. Once that paycheck is received they can then consume which puts a demand on businesses to increase production, inventories, etc. As final demand from the consumer increases more jobs are created and the cycle continues to perpetuate itself.

Currently, without the final demand there is no demand on businesses to create more “jobs, jobs, jobs” which continues to apply downward pressure on the economy. Now that companies have run through all of their alternatives for outsourcing jobs, cost cutting, layoffs, etc. it will now begin to eat the bottom line of their profitability which in turn applies more pressure on businesses to reduce costs – and that means no new jobs.

5) Retail Sales

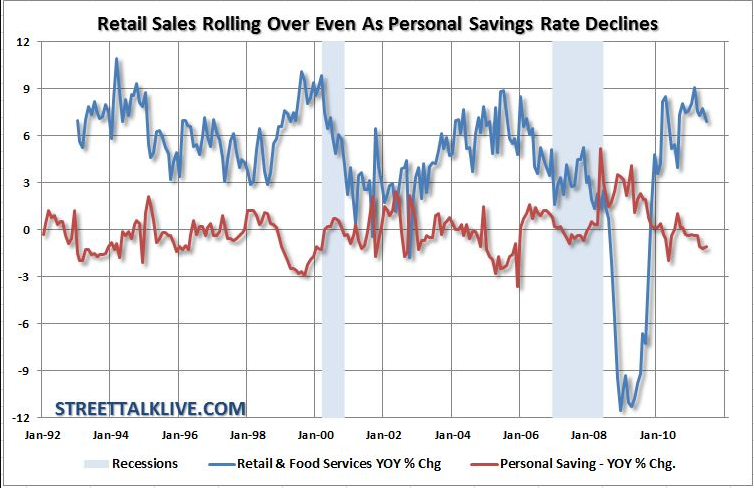

At the very end of the economic chain is the consumption by consumers. This shows up very well in retail sales.

While there was a huge spike up in year over year retail sales following the recessionary plummet; sales have now begun to peak. One of the main areas of retail sales has been gasoline sales which, combined with food, has been eating up more than 20% of wages and salaries.

The problem with this is that those sales are not being done by discretionary income alone but rather by draw downs in personal savings and with increases in credit.

In other words, in order for the average American family to make ends meet they can not do it out of free cash flow alone. They are still having to resort to personal savings and credit and hope that something will improve soon. The problem is that nothing is really improving for the average American. This is why most of the recent polls about the economy still show a large majority of Americans feeling like the recession never actually ended.

This doesn’t bode well for a future pick up in economic growth since the consumer is behaving like we are in a recession which then impacts the final demand on businesses who in turn don’t hire. In the most recent NFIB survey the majority of businesses do not think this is a “good time to expand” as “poor sales” are a major concern.

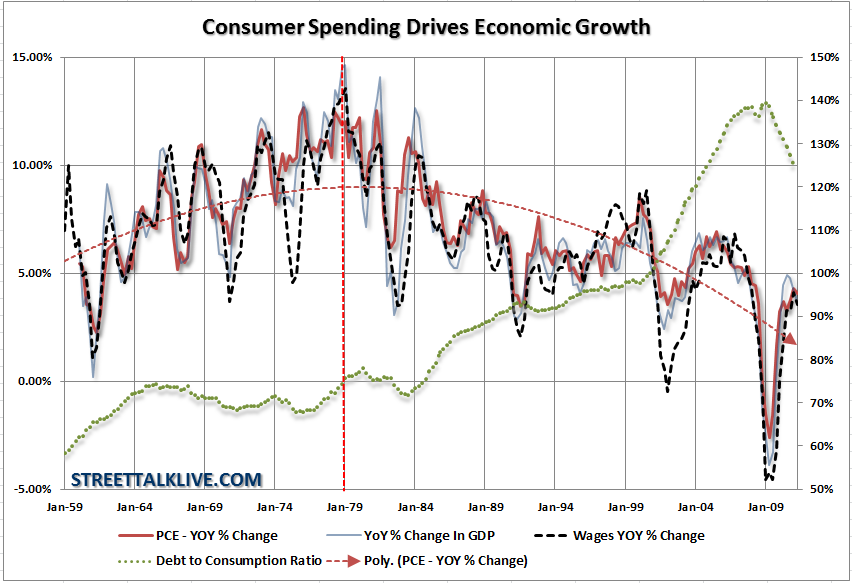

6) Personal Incomes

Personal incomes have been declining on a year-over-year basis since the 1980′s. As increases in productivity, a shift from manufacturing and production to a service based economy and a trend of outsourcing labor took hold wages have subsequently been brought under pressure. The problem is that during this same time as wages declined the standard of living of the average American actually increased. In order to maintain these higher standards of living consumers were forced to turn to credit to fill the gap.

This credit boom has now run its cycle and with the deleveraging of balance sheets currently underway by force (default, bankruptcy, etc.), and soon to be underway by choice, this will continue to have a negative impact on future economic growth and ultimately corporate profitability.

7) Profits

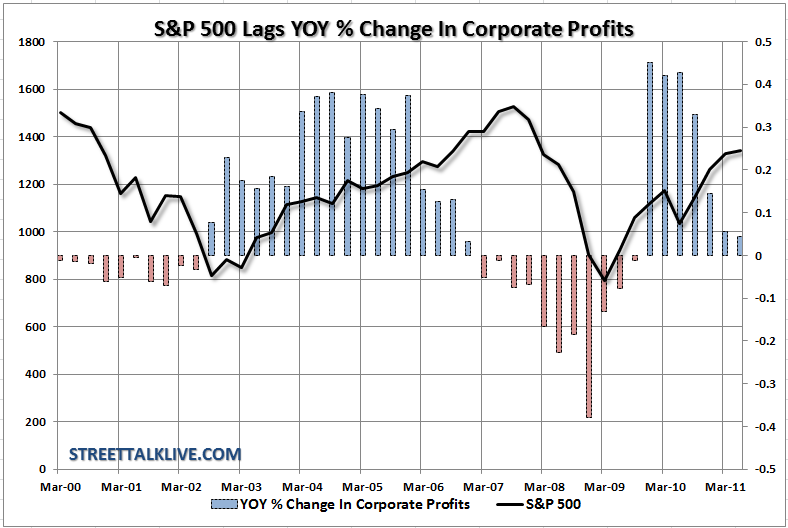

So, while most of this discussion has been on the state of the economy what this really boils down too is the market.

Analysts and commentators continue to point at the current level of corporate profits which is fine except for the fact that those profit margins have not been driven by top line revenue growth as much as cost cutting, layoffs and accounting gimmicks.

The real issue that needs to be paid attention to is that the year over year change in profits is about to turn negative, and will likely do so in the coming quarter. Historically, the markets tend to lag these declines in profits by a couple of quarters but nonetheless it is something that we will want to pay close attention as there is a high probability that we will begin to see negative earnings revisions in the coming quarters which will not play well with stocks that are still overly priced.

It’s The Clouds I Am Worried About

As I stated at the start of this missive – my job isn’t to warn you once the rain starts. My job is to warn you in advance of the storm so that you can safely clear off the beach and get to safety. Capital preservation is essential to long term investing success. It is the one thing that most investors fail to do by chasing market returns, yield or a variety of other blunders that lead to ruin.

The economy is showing tremendous weakness on many fronts and these are only a few of the issues that have me concerned at the moment. Could things turn around and began to improve, of course they can, and if they do then we will tell you that it’s okay to return to the water. Until then the advice is simple – be cautious, protect your assets and wait for the threat to pass before jumping back in. Sometimes having an umbrella with you, even when the sun is shining, can pay off in the end.

See the original article >>

No comments:

Post a Comment