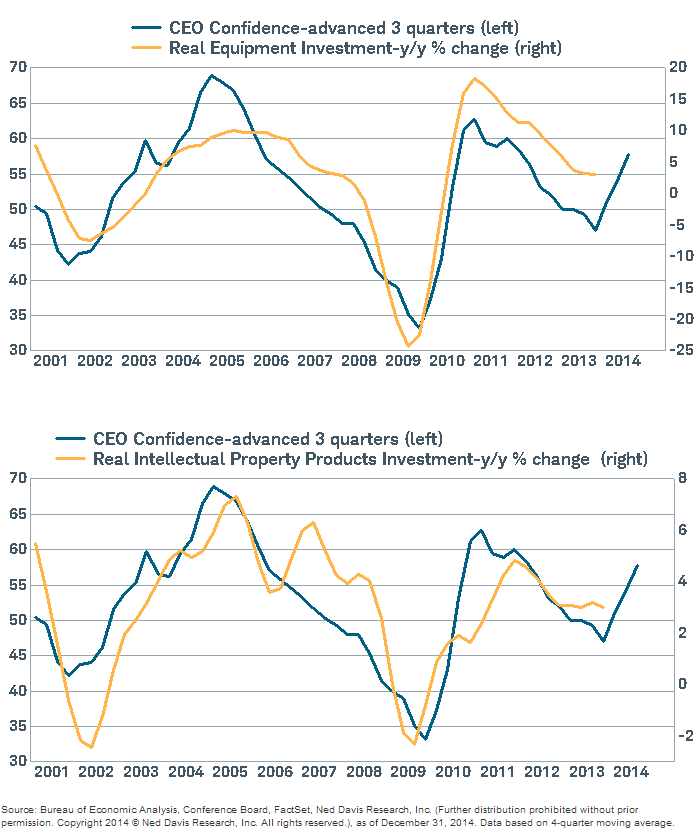

| We've received a number of e-mails regarding the recent post on the possibility that rising CAPEX spending in the US is driving corporations to tap their credit facilities, thus increasing loan growth (see post). Most were highly critical of this line of thinking in their comments, using words such as "bogus", "propaganda", "head fake", "delusional", etc. Thanks for all the feedback. The argument that "things are different this time" understandably meets a great deal of skepticism, especially after a number of false starts and years of uncertainty. But evidence for a significant rise in corporate CAPEX spending continues to build. One could write a dissertation on this topic, but let's just look at 4 key data points: Source: Economic Policy Uncertainty 2. Corporate infrastructure is aging. From software to planes to telecommunications equipment, companies have severely underinvested in recent years, and it's time to start upgrading. Consider the fact that the average age of fixed assets such as factories, storage facilities, etc. is at levels not seen in nearly 50 years. Source: BofA/Merrill Lynch Moreover, some economists argue that slow productivity growth in recent years (discussed here) is a direct result of weak corporate spending. With plenty of cheap labor one didn't need to be too efficient in order to be profitable. But at some point companies will need to upgrade their aging technology and infrastructure in order to improve worker productivity. Source: Charles Schwab 4. Investors. Shareholders are demanding that companies begin using more of their massive cash balances toward CAPEX. The chart below from Merrill Lynch is quite compelling. Source: BofA/Merrill Lynch It seems that the stage is set for corporate spending to finally accelerate. And yes, the experiences of recent years make this possibility hard to accept for some. But evidence continues to mount. |

Wednesday, April 9, 2014

4 key reasons for CAPEX accelerating

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment