by Greg Harmon

The dollar stores rebounded significantly from their November through March Base, but recently have been either stalled or pulling back. That is now changing. Take a look at Dollar General, $DG. After pulling back to the 200 day Simple Moving Average (SMA) to start June, it has been building an ascending triangle since. Monday it tried to peek over the top but failed. But it looks to have some support to get there. The Relative Strength Index (RSI) is trending higher and the Moving Average Convergence Divergence indicator (MACD) is also turning up and crossed to positive. The Measured Move on the break higher takes it to 56.40.

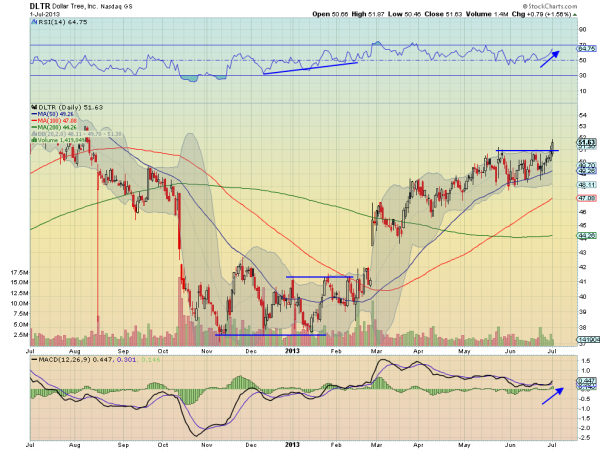

And Dollar Tree, $DLTR, is just as good. In fact it is breaking resistance of an ascending triangle that formed with the 50 day SMA as the base Monday. The Measured Move takes it higher to 55. The RSI is running higher and bullish and the MACD is turning up.

No comments:

Post a Comment