By Lee Adler

Average hourly earnings rose by 2.7% on a yearly basis in May, up from 1.2% in April and 2% in May. The rate of increase has fluctuated from 1% to 2.9% since 2010, averaging around 2%.

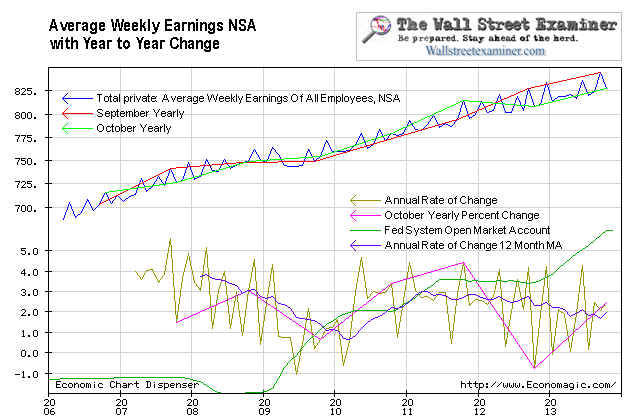

Average weekly earnings showed a 4.24% gain year to year, matching December 2012′s year to year gain. They were the highest percentage gains since October 2011. The 12 month moving average has dropped from around 3% in 2011 to around 2.1% now.

Average Weekly Earnings – Click to enlarge

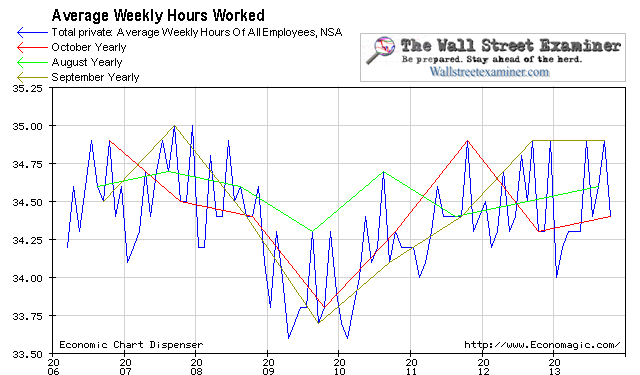

QE isn’t boosting the number of full time jobs but maybe it’s beginning to boost compensation. Average hours worked rose to 34.9, tieing last December and September and up from 34.4 a year ago. This surge accounted for most of the gain in weekly earnings and suggests that the labor market may be tightening. Business has mostly responded by hiring part time rather than full time workers. But if this continues the market will tighten and there will be upward pressure on wages in some sectors of the economy. It’s too early to know if this is the start of a trend, but it’s worth watching.

Average Weekly Hours Worked – Click to enlarge

I have written essentially the same thing for the past several months in these last two paragraphs, which bear repeating.

Why isn’t all the new money which the Fed is pumping into the system causing job growth or wage growth? Many of the unemployed do not possess the skills that are in demand in the market. Or they are overskilled. All of the growth is in low wage, low skilled service work. Economic pundits and FOMC policy makers must realize that the 10 million fake jobs spawned by the 2004-07 housing bubble are not coming back, which is why the Fed is trying to spawn new bubbles, hoping for the bubble jobs they create.

The 7.6% unemployment rate is probably “normal.” The bubble unemployment rate of 5.5% was abnormal. If the goal is to continue QE until the unemployment rate hits a target of 6.5%, then the policy is simply a matter of fomenting the next bubble to generate millions of fake jobs. The problem with that is that as bubbles grow and the economy overheats, inflation will eventually force the Fed to stop printing, and all the new fake jobs will once again disappear. While we have asset inflation, that’s fine with the Fed. Consumer price inflation hasn’t shown up in the conventional measures that the Fed watches, but then neither have the good jobs, so in spite of the fact that there’s no evidence that it increases jobs or wages, the money printing goes on.

No comments:

Post a Comment