by Graham Summers

Today marks the final day of Bernanke’s testimony to Congress.

Highlights from the first day of testimony and Q&A include:

Q: Are You Printing Money?

Bernanke: Not Literally

Amazingly, no one said anything after this comment. But far more importantly was the last statement made by the Fed Chairman,

“If we were to tighten (monetary) policy, the economy would tank.”

Tightening monetary policy means if interest rates rise. Interest rates are currently being held at ZERO and have been there four nearly five years. And Bernanke has just announced that if interest rates rise, at all, then the economy would tank.

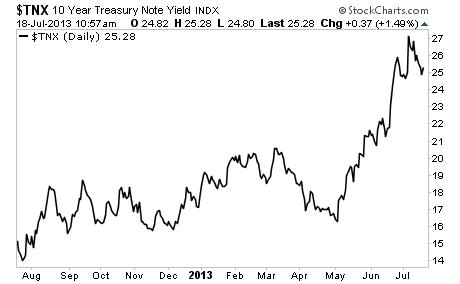

Unfortunately for Ben, rates are already rising around the world. Rates on Portugal’s ten-year are over 7%. Rates on Greece’s ten-year are back over 10%. Japan, the country of zero interest rates has seen a spike in its rates since April. Even Treasuries are surging higher, despite the Fed buying $45 billion worth of them every month.

Bernanke has told us point blank what will happen if rates rise (economic collapse). But he’s not telling us the whole truth. The fact of the matter is that if rates rise now while the Fed is running QE 3 and QE 4 then it’s game over. The Fed will have officially lost control of the system and a wave of defaults will implode the markets.

This process has already begun. As I noted before we’re seeing rates spiking around the world.

Stocks may hit new highs, but this rally has all the hallmarks of a blow off top, coming at the final stage of a bubble. Indeed, stocks have not been this overextended in over 20 years… that includes the 2007 peak. Soon after we reached that point… we then plunged into one of the worst market Crashes of all time.

By today’s metrics, this would mean the S&P 500 falling to 1,300 then eventually plummeting to new lows.

This is not doom and gloom. This is a fact. The Fed has created an even bigger bubble than the 2007 one.

No comments:

Post a Comment