By tothetick

It was bound to happen some might say. We were warned! Chinese banks have stopped lending due to pressure from liquidity deposits. Some branches of the Bank of China and the Industrial and Commercial Bank of China have issued statements in which they announce that they are halting lending for a temporary period.

Industrial and Commercial Bank of China Ltd Bank of China Ltd

Loans to businesses and individuals will resume according to the Bank of China on July 15th. The Industrial and Commercial Bank of China has stated that it is normal for them to put limits on the amount of lending that they do and those limits are set each month. Cases of where the bank has to interrupt their lending have already occurred. However, it would appear that the amount of lending was reduced in comparison with previous months by the banks head office for June. Apparently, the credit line will be reopened in July, but it will be only for a few days as they do not have enough deposits. On June 23rd, the Industrial and Commercial Bank’s customers had trouble withdrawing cash from cash machines and they also did not see bank transfers going through on their accounts on time. The Bank of China suffered the same setbacks on June 24th. Today they have cut loans heightening worry both inside and outside of China as to the stability of the banks. Statements were issued by the banks giving upgrades in IT services as the reason. Rather strange, however, that both banks updated their systems at the same time and suffered the same glitch in the system.

There are two other banks that have interrupted their mortgage loans also: CITIC Bank and Huxua Bank.

Analysts have always stated that the larger banks have stopped lending to smaller banks as they are worried about liquidity and there are deposit issues, but they seem to believe that the large banks will not stop lending to individuals and businesses. Only smaller banks will suffer from the credit crunch taking place in China right now. But, the banks that have halted lending today are not in line with that thinking. The Bank of China, which has existed since 1905, is the 2nd largest lender in China at the present time. It is the 5th largest bank in the world in terms of market capitalization. It employs nearly three hundred thousand people and has total assets to the value of CN¥ 11.829 trillion. That doesn’t sound very much like a small bank. It also has branches in 27 countries around the world. The knock-on effect in those countries will surely be felt too. Investors are not worried for the moment as share value rose today by 3.3%. But, will that continue?

The Industrial and Commercial Bank of China is also one of China’s big four banks (Bank of China, Agricultural Bank of China, and China Construction Bank). It is the largest bank in the world with regard to profit and market capitalization and was listed by Forbes Global 2000 in number one position as the world’s largest public company. It employs four hundred thousand people. In 2010 net lending of the bank stood at 70 billion Yuan, meaning that it lent than any other bank in China. 20% of its lending goes to manufacturing industry and personal loans are over 15% of its business also. It was the world’s largest Initial Public Offering at US$21.9 billion when it was listed on the Hong Kong Stock Exchange and the Shanghai Stock Exchange simultaneously in 2006. However, the news doesn’t seem to worry investors for the moment as share value rose by 6.82% today to 4, 700HKD (up 0.3 points).

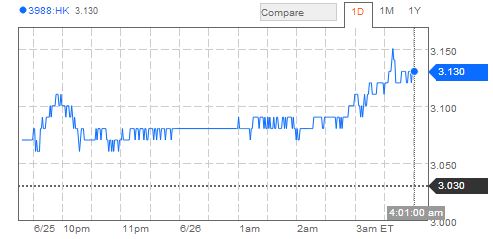

This is all cause for major concern however. It will be an issue in the coming days, in particular in light of the People’s Bank of China’s recent statements that there was ‘reasonable’ liquidity statement that was issued a couple of days ago. The ‘reasonable’ turned into ‘ample’. Share value is still rising for the moment for both banks, but the Bank of China is below what it was just a few days ago as can be seen in the chart.

Bank of China Ltd

The Bank of China had already tightened lending in early 2010 in a bid to increase deposits and liquidity. But today the reining in of loans is in a different set of circumstances. The entire banking sector in China is currently strapped for cash and not just one bank.

How much the People’s Bank of China will be able to ward of accusations that there is indeed a big liquidity problem in China today is far from certain.

So, the options that are open to businesses and individuals? Unless the People’s Bank of China comes up with some cash to unfreeze the situation and double-quick, the Chinese (but, unfortunately, not only the Chinese) had better start popping down to the pawnbrokers and speaking to Uncle. Otherwise it looks as if they are in for a rough time. If money dries up in those two banks and continues, then small and medium sized businesses are likely to suffer and there will be a bank-run on. Don’t envy them at all for that. We could always send Ben Bernanke, couldn’t we? He will sort the problem out in true Federal-Reserve fashion. Uncle Ben would be a better option than the pawnbrokers maybe for some! He may be looking for a short stopover in Shanghai when his stint at the Federal Reserve is up in 2014.

No comments:

Post a Comment