By tothetick

The Financial Times has revealed that Italy is facing losses of €8 billion due to derivative contracts that were taken out in the 1990s and that were restructured during the Eurozone crisis.

The Financial Times has gained access to secret documents that show that the Italian Treasury Department is sitting on losses that were the result of restructuring of eight debt contracts. The terms seem to have been badly negotiated with foreign banks in 2012.

Apparently, the report does not go into too much detail and omits certain essential information leading analysts at the FT to believe that the €8 billion are not quite the full picture. Italy negotiated to stagger payments over a longer period of time, but the notional value of the debt stands at €31.7 billion, meaning that the losses are extremely high. Who was doing the negotiating?

Well, it turns out that none other than Mario Draghi, the President of the European Central Bank (since 1st November 2011) was the head of the Italian Treasury between 1991 and 2001. This is the man that announced that the European Central Bank had done ‘a great job’ supporting the Euro and restoring market functioning. It now looks like Mr. Draghi may have some explaining to do about those derivative deals back in the 1990s. Whether he was the main-man or not, he will have some answering to do, it seems.

The report fails to give crucial details such as the names of the banks or the original contracts, but the derivatives date back to the period when Italy was preparing to enter the Euro. It goes without saying that the derivative contracts would have enabled Italy (just like Greece) to boost their accounts in the short-term and make it look like they were flush with cash just before entering the Euro as one of the 11 countries to do so at the start. But it also meant that in the long-term when the derivative contracts had to be repaid, they would add to the debt of the country enormously. Public deficit in 1997 as reduced from 6% in the previous year to just 3%, which meant that Italy qualified for entering the Eurozone. By 1998 it had fallen to just 2.7%, which was the largest reduction in budget deficit of any of the first 11 countries to join the Eurozone at the time. Somebody was obviously trying to pull the wool over the eyes of everybody that was looking on at the time. Although, honestly, it has to be asked if that was anything unusual. Weren’t they all doing it in the EU to make themselves look like cash-flash Harry?

Italy Deficit in Euros

The Italian state auditors, the Corte dei Conte, requested the report to be submitted and the Finance Police (the Guardia di Finanza) were called in to the office of the present head of the Treasury debt-management department, Maria Cannata. Maria Cannata was also working alongside Mario Draghi at the time as a senior official working on deficit accounting.

The European Central Bank has declined to make any comment for the moment, but it certainly looks as if Mario Draghi will have some answering to do over the deals that were negotiated back then. This is particularly alarming since the report that was submitted only provides evidence of a six-month period and there are fears that Italy’s debt due to these derivative contracts may be far higher.

The current Prime Minister, Enrico Letta looks as if he may be in for a rough ride too now even more so due to the report being leaked to the press. He is currently under great pressure to keep his coalition government together and especially since tomorrow Italy will be auctioning off €5-billion worth of five and ten year Treasury Bonds. There was a bond auction yesterday already when Italy auctioned off 186-day Treasury Bonds and raised €4.5 billion. They were purchased at 1.052%, which was a rise from the previous figure of 0.538% on May 29th. Letta’s coalition is seeing a split already over fiscal reforms and the Italian economy is in dire straits with the recession.

Italy is the EU’s third largest economy. Its economy shrank by 0.6% in the first quarter this year. At a conference in London yesterday Maria Cannata stated that there was no need for concern about the fallshort in economic growth as investment from the USA was increasing. She spoke of “a good sign of confidence”. We shall see if that confidence now wanes given the leaking of the report.

The European Commission recommended removing the excessive-deficit procedure that has been held against Italy only at the end of May 2013. Italy’s deficit is projected to reach 2.9% of Gross Domestic Product this year. Quarterly deficit for Italy stood as follows last year:

-

Q1: -24,861.50 €

-

Q2: -8,974.50 €

-

Q3: -6,313.60 €

-

Q4: -5,517.40 €

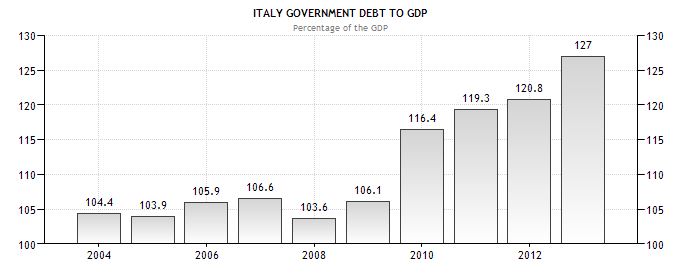

In 2012 government debt to GDP amounted to a total of 127%.

Italy Government Debt

Whatever the report states, it shall probably come as no surprise to anyone that Italy fiddled the books to make its accounts look flush. Banking on the future always remaining positive is the worst mistake to be made. Or, perhaps Mr. Draghi didn’t imagine for one moment that he would be the head of the European Central Bank today when the report came to light. If you are going to do something, it would be well-advisable to either bury that report so deep that nobody finds it or turn yourself into a gladiator in the ring that will be championed by the people. Is that a fitting description of Mr. Draghi? Might be time to raise your hand and come clean, Mr. Draghi.

Italy's Debt

Back in January, when Silvio Berlusconi joined forces with the Northern League Party just before the elections in February 2013, he stated in a radio interview that he didn’t want to be Prime Minister again, but that he would gladly take on the job of Finance Minister. Lucky escape for the Italians that Berlusconi never made it into office. But he was briefly Finance Minister between 3rd July and 16th July 2004, while in office as Prime Minister. In the last elections, his coalition party gained 29.1% of the votes in the Chamber of Deputies and 30.7% of the votes in the Senate, however. The present Minister of Finance is Fabrizzio Saccomanni (since 28th April 2013).

No comments:

Post a Comment