By Surly Trader

James Montier of GMO offered his perspective on the efficacy of “tail risk hedging” using tail risk protection. Tail risk can be defined as those “black swan” events that can rock an all equity portfolio and bring any long only investor to his/her knees. I agree with Mr. Montier that, after the 2008 crisis, tail risk hedging seems to be the sales pitch of the day:

“Keynes argued that the “central principle of investment is to go contrary to general opinion, on the grounds that, if everyone is agreed about its merits, the investment is inevitably too dear and therefore unattractive.” This powerful statement of the need for contrarianism is frequently ignored, with disturbing alacrity, by many investors. The latest example in the long line of such behavior may well be the general enthusiasm for so-called tail risk protection. The range of tail risk protection products seems to be exploding. Investment banks are offering “solutions”(investment bank speak for high-fee products) to investors and fund management companies are launching “black swan” funds. There can be little doubt that tail risk protection is certainly an investment topic du jour.”

I also agree that most of the time when an investment bank offers you a “structured solution” you should run the other way.

What I did not necessarily agree with was Mr. Montier’s simplistic look at tail risk hedging products.

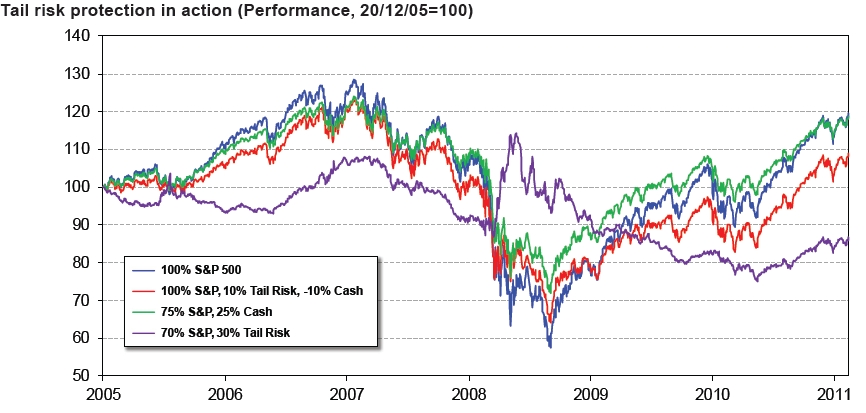

His examples included 4 strategies:

- 100% long S&P 500

- 100% long S&P 500, borrow 10% and invest in SPXSTR (AKA Ticker: VXX)

- 75% long S&P 500, put 25% in cash

- 70% long S&P 500, invest 30% in SPXSTR (VXX)

If you simply look at this chart, you would draw the conclusion that you prefer to sit in some cash rather than try to hedge the tail with VXX. I would like to point out two big issues that I have with that conclusion: 1) VXX has a terrible decay factor because of the upward sloping contango of the VIX futures curve (you can read about that fact for yourself) and 2) James Montier completely ignores the possibility that someone who hedges with VXX or some other volatility product might actually decide to take the hedge off when the VIX gets to 80%!

This chart would look completely different had James Montier also looked at midterm VIX futures (VXZ) as a hedge to tail risk. I get his point that cash is not bad as an allocation strategy and as a way to wait for the right risk premiums to show up in the market, I just think he could have made his point without throwing the idea of hedging equities out the door completely.

Read the full whitepaper here: James Montier – Tail Risk Hedging

No comments:

Post a Comment