by Cullen Roche

The news has been rather upbeat in the last few days, but it’s important not to let euphoria corrupt a good approach. Remember, the climb to the top of the investment mountain is filled with loose stones. If you focus only on the top of the mountain and not the pitfalls in front of you you’re guaranteed to slip along the way. So while you are better off maintaining that optimistic long-term approach (I am a super bull about the progress of people, innovation, the USA and the global economy in the long-term), risk management is all about uncovering those loose stones in the near term.

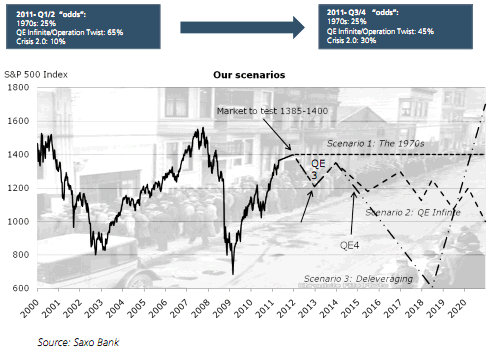

A recent piece by Saxo Bank lays out three scenarios that look like loose stones to me. Although they see the market revisiting the 1385-1400 level in the coming quarters they think the market will ultimately be tripped up by the macro headwinds. They see 3 (all bearish) outcomes:

“In times of uncertainty, and certainly in times of what we call maximum uncertainty, we operate with three main scenarios:

1) QE /Operation Twist to infinity – which is our high probability scenario with 45 percent odds. This is the ‘buying more time – more of the same, kicking the can down the road’ scenario. We realise and calculate that doing nothing, or more of the same, always is the policy choice of preference. But we have lowered our odds from 65% in Q1 and Q2 to 45% for Q3 and Q4 due to an upside correction to Crisis 2.0.

2) Crisis 2.0 is now our second most likely scenario with 30 percent probability, but one which is rising in probability (from 15 percent) due to the almost total standstill on debt in Europe and the U.S. and continued rising inflation in Asia. This is a scenario where the bill needs paying. We have a short relative deep correction, not only in the stock market but also on higher unemployment and interest rates, which create a sense of urgency, and crisis, which could be used to facilitate both the political and structural changes needed. A historical fact remains: only in the deepest times of trouble does mankind become truly rational and constructive. We think a quick crisis 2.0 could create a political environment for change, and this is an important start to one of the best periods in our history, as we, after the crisis, would have better leverage in society, more sense of urgency, agendas for balanced growth and a need to employ people. Crisis 2.0 is a bad short-term step on the way towards something good and necessary to move on from.

3) Finally, our last scenario is the 1970s, with odds of 15 percent. It entails big government, stagflation, high energy prices and rising interest rates. Stock markets going nowhere, not falling too much either as the micro level works its wonders on the macro level, not necessarily the worst scenario but one which will challenge the social construct.

That’s a good breakdown of our potential future. I think this environment does not resemble the 70′s to a large degree although there does remain the risk of rising inflation due to cost push energy increases. The crisis 2.0 situation looks far fetched unless the periphery citizens revolt and remove the can kicking politicians. That leaves scenario 2 as the most likely in my opinion. This means we muddle through the balance sheet recession, growth is low, government implements misguided policies and exogenous risks remain high. Fun times.

No comments:

Post a Comment