by Cullen Roche

The NY Fed blog has an excellent post breaking down the decline in consumer spending during this most recent recession. They highlight two rather mind blowing charts that show just how severe the decline in discretionary spending has been:

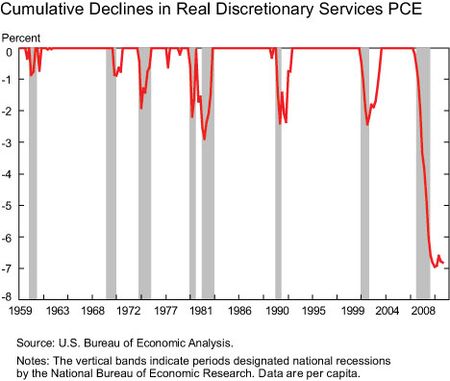

“The chart below shows how much real per capita (to account for differing rates of population growth over time) discretionary services expenditures fell from their previous peak—a zero value in this chart means that these expenditures were above their previous peak. The drop in discretionary services expenditures in the last recession was much more severe than in previous recessions: the nearly 7 percent fall from the peak is more than double the percentage decline in the early 1980s recession (the previous “champion” in this dimension).”

They went on to show how much weaker the “recovery” in discretionary spending has been when compared to past recoveries:

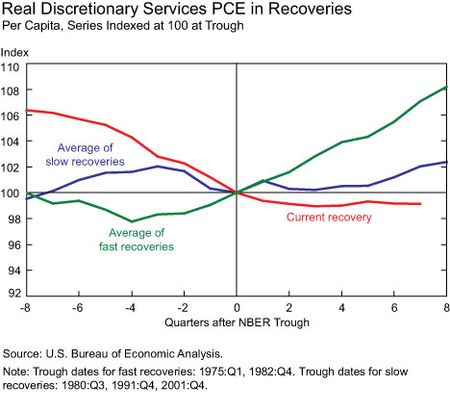

“Next, I compare the behavior of real per capita discretionary services expenditures in this recovery to that in “fast” recoveries (the average of those following the 1973-75 and 1981-83 recessions) and in “slow” recoveries (the average of those following the 1980, 1990-91, and 2001 recessions). To do this comparison, the chart below displays an index of real per capita discretionary services expenditures that equals 100 for the quarter at the end of a recession (as determined by the National Bureau of Economic Research). Using this index, we then can evaluate how rapidly these expenditures have recovered since the end of the recession relative to previous economic expansions. This chart shows that the current “recovery” in these expenditures has been exceptionally sluggish, and even slower than that in previous slow recoveries. In fact, these expenditures in 2010:Q4—six quarters after the end of the recession—were still below their level at the trough! As such, these expenditures have been a major contributor to the overall sluggish recovery we have experienced so far.”

This is particularly interesting to me because of the balance sheet recession theory and our misguided policy approach. The real weakness in this recovery is rooted in the fact that consumer balance sheets are so mangled that they’re spending primarily on non-discretionary items and saving the rest of their incomes to pay down debts. This is important to understand because policy must be geared in such a way that it does not further hinder the household balance sheet. And therein lies the problem with a policy such as QE2. Anything that can potentially cause cost push inflation will only further weaken the household sector and detract from any possible recovery. In the case of QE2 I think we saw the increased speculation contribute directly to rising commodity prices which ultimately squeezed consumers further and led to the current soft spot in the economy.

No comments:

Post a Comment