by

Last week’s review of the macro market indicators looked for for Gold ($GLD) to continue its run higher and for Crude Oil ($USO) to continue to consolidate with a bias for any breakout to the upside. The US Dollar Index ($UUP) looks ready to move higher but could consolidate further, while US Treasuries ($TLT) move sideways. The Shanghai Composite ($SSEC) looks ready to break the flag higher while Emerging Markets ($EEM) consolidate in a broad range between 44.2 and 48.2. Volatility ($VIX) looks to remain subdued but despite this Equity Index ETF’s, $SPY, $IWM and $QQQ look biased to the downside in their broad ranges, but near support. A true stock pickers market.

The week began by Gold and Crude Oil reversing roles, with Gold consolidating around the 1600 level and Crude Oil moving higher. The US Dollar Index tested higher Monday but then fell throughout the week while Treasuries did consolidate. The Shanghai Composite continued its flag, and Emerging Markets kept the range drifting towards the top end. Volatility came back in and as it did the SPY, IWM and QQQ dropped Monday and rose through out the rest of the week, with the QQQ’s making a new high. What does this mean for the coming week? Let’s look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

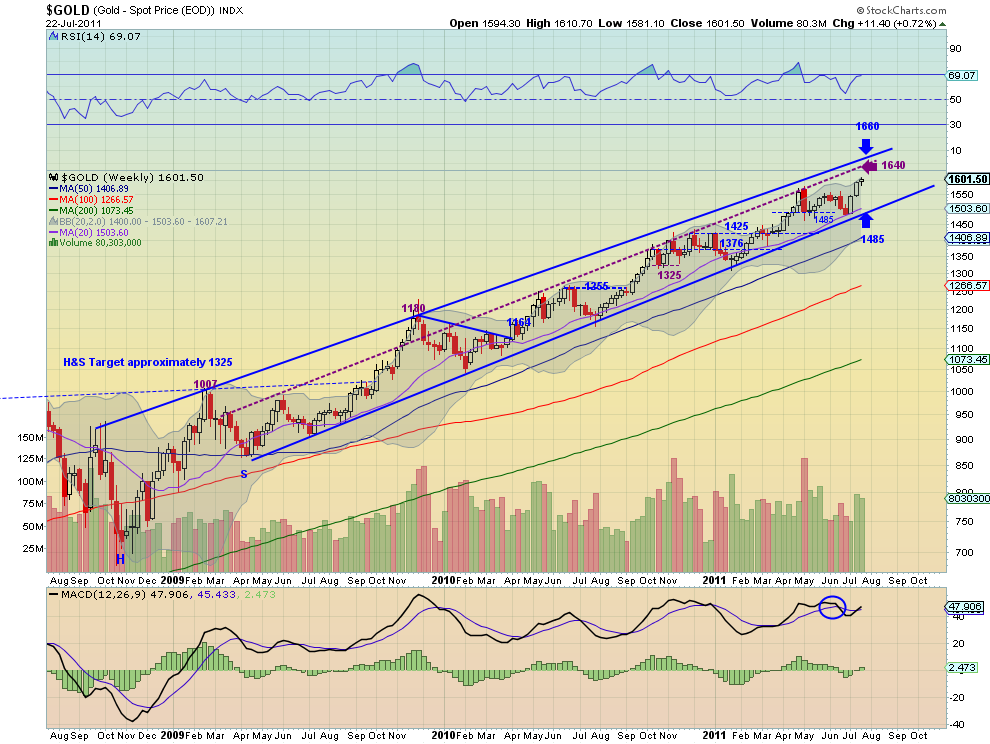

Gold spent the week building a bull flag between 1580 and 1600. On the daily chart it has positive reinforcement for more upside from the Relative Strength Index (RSI) and the rising Simple Moving Averages (SMA). But the diverging Moving Average Divergence Convergence (MACD) waning has led to consolidation. On the weekly chart the bull case for Gold remains very strong. The RSI is high and the MACD has crossed positive to join the upward sloping SMA’s. look for Gold to continue higher next week with short term targets in the 1640-1665 area and with any pullback limited to 1560 area.

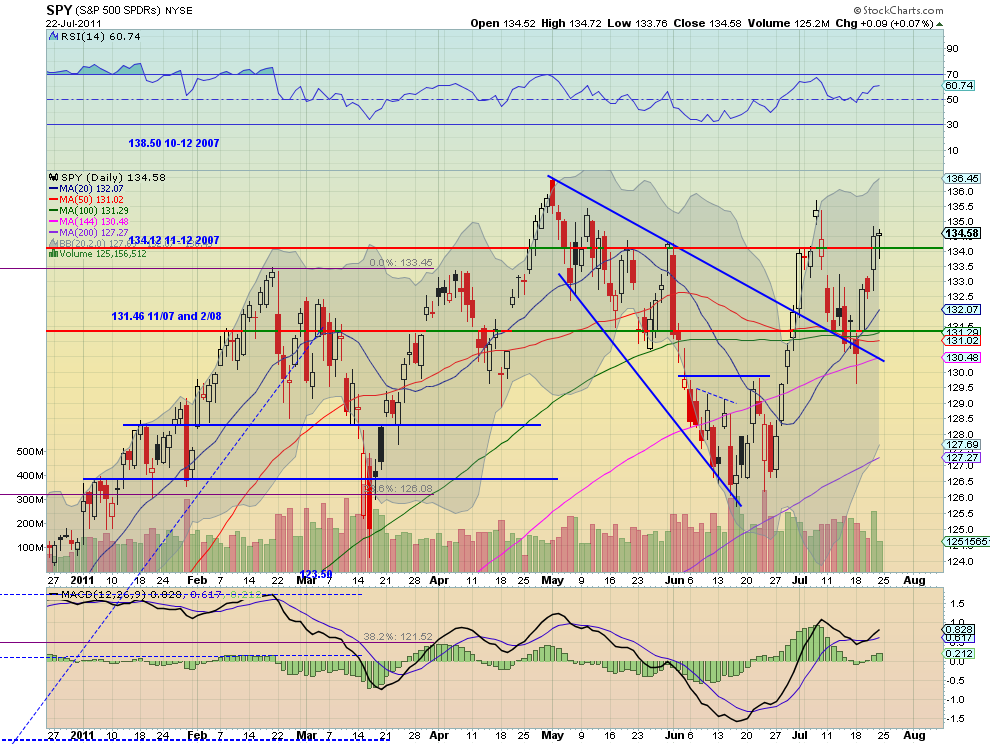

SPY Daily, $SPY

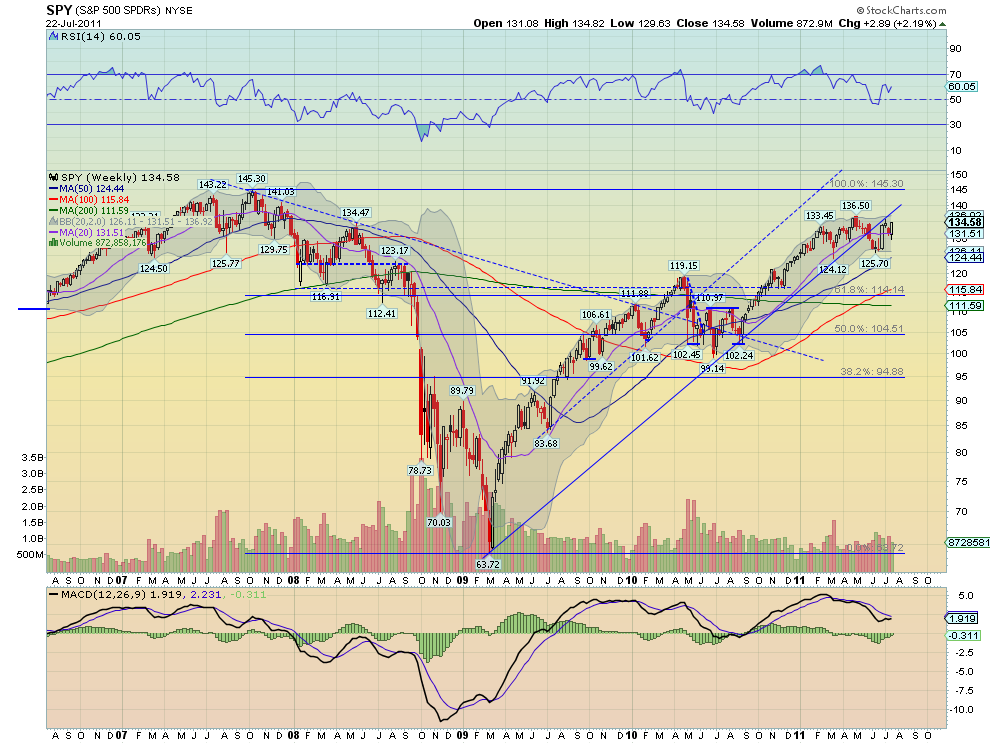

SPY Weekly, $SPY

The SPY found a bottom Monday printing a Hammer reversal candle near the previous downtrend support and then rising through the week, finishing with a Hanging Man. It is over long term support/resistance at 134.12 and with a MACD that is increasing and a RSI that is slowly moving up, looks positive. The weekly chart shows that it bounced off of the 20 week SMA and is now approaching resistance. The RSI is trending higher and the MACD is about to cross up. Look for next week to be biased to the upside with resistance higher at 135.60 followed by 136.50 and then 141. Any pullback should find support at the 134.12 or 131.46 levels. A hold and move higher above 136.50 would signal an end to consolidation and a trend change to higher.

Next week looks for the move higher in GOLD and Crude Oil to continue. The US Dollar Index and US Treasuries conversely are set up to move lower, with a chance of Treasuries just running in place. The Shanghai Composite and Emerging Markets look as though they may test the top of their consolidation ranges. Volatility appears to remain muted and allow for the Equity Indexes SPY IWM and QQQ to continue to test higher and perhaps break their consolidation ranges, with the QQQ already making a new high. Use this information to understand the major trend and how it may be influenced as you prepare for the coming week ahead. Trade’m well.

No comments:

Post a Comment