by Cullen Roche

Mike Norman just posted a very good fact based story on the relationship between the Fed’s balance sheet and the US Dollar. As I have often noted, the Fed does not print money. QE2 is not money printing. It is not debt monetization. It will not cause high inflation. It will not cause hyperinflation. It will not cause a dollar collapse. And three years into this massive Fed balance sheet experiment we have the facts. Mike notes:

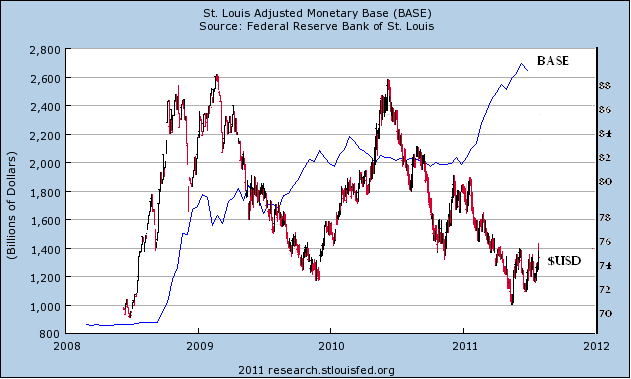

Below I give you the US Dollar Index and the size of the Fed’s balance sheet.

Date Dollar Index ValueFed’s Balance Sheet

3/14/2008 71.66 $921 bln

7/13/2011 75.24 $2.9 TRILLION!

Words don’t do this justice though. I put together this chart showing the dollar index versus the Fed’s balance sheet over the last three years. As you can clearly see – there is no real correlation between the size of the balance sheet and the USD. None at all. This has all been proven correct despite my repeated ramblings, yet the inflationists and fear mongerers still garner all of the attention. Clearly, people prefer to be scared as opposed to being told the truth.

See the original article >>

No comments:

Post a Comment