By HBL

I’ve wanted to do a more comprehensive post on the dynamics of endogenous money and the private sector’s response to large exogenous events such as quantitative easing, but for now this post will be another incremental update to my previous posts on the topic from October and April. As stated previously, it’s possible I’ve reached some incorrect conclusions, however my interpretation of a piece of Post-Keynesian Circuitist literature I was referred to suggests to me that these ideas are on the right track.

Basic QE Mechanics

Some people have read that the direct mechanics of Quantitative Easing only increase bank reserves but not deposits (broad money supply). That is true only in the narrow case where banks are net sellers of bonds from their own balance sheets to the Federal Reserve. But the evidence suggests banks have not drawn down their net bond assets in this way since QE began (the Fed has bought over $2 trillion in bonds!), and that the primary sellers are non-banks. To see why the immediate mechanical result of this is for QE to increase bank deposits (and thus broad money supply), please visit the Macroeconomic Balance Sheet Visualizer and run the operation “Quantitative Easing (Variation 1 – Households Sell)”. Also, see this guide from the NY Fed:

“When the Fed buys an asset, the effect on the broad money supply depends on who sold the assets and what they do with the funds they receive. If the seller is a bank, reserves go up, but broad money only increases if the bank responds to the increase in its reserves by lending more to households and businesses. If the seller is an investor other than a bank, reserves go up, and broad money also goes up in the first instance as the seller’s bank puts a sum equal to the amount it receives from the Fed into the seller’s bank account. But if the seller uses the money to pay down debt, the broad money supply declines again by the amount of the debt repayment. As of early 2011, the behavior of the broad money supply, economic activity and inflation all suggested that recent money growth had not been excessive.”

The guide mentions the well known idea that the broad money supply increase resulting from QE has been muted due to debt repayment, but as my past posts have indicated, I think that’s only half the story.

Actual Broad Money Supply Changes During QE

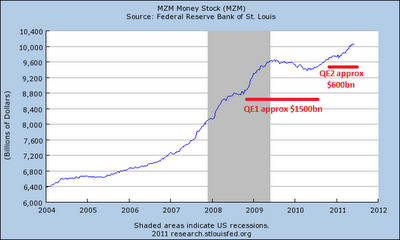

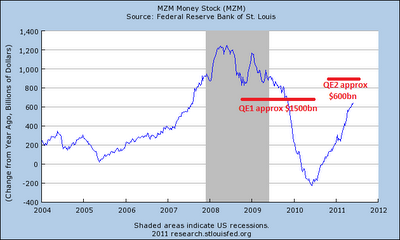

The first graph shows broad money supply as measured by MZM (Money Zero Maturity), the second graph shows the year on year change.

It’s not obvious that either QE program had a direct impact on the broad money supply trends, even though they should have if you consider only the direct mechanical results of the Fed buying bonds, and don’t consider any private sector response! Of course it is difficult to tell for sure, as the money supply changes for lots of reasons besides just QE (e.g., it generally expands during economic growth, but perhaps also during times of uncertainty).

So where did part of the roughly $2 trillion in “money” that replaced bonds go? Did it only “disappear” to the extent that the private sector wanted to pay down debt? I’ve argued that it disappeared INDEPENDENTLY of whatever level of desire there was to pay down debt, and that the money supply growth that did occur would have occurred to almost the EXACT SAME DEGREE even if QE had not happened. In other words, money supply grew because the private sector “wanted” a larger money supply as part of its aggregated portfolio preferences.

Money Supply Endogeneity in Pictures

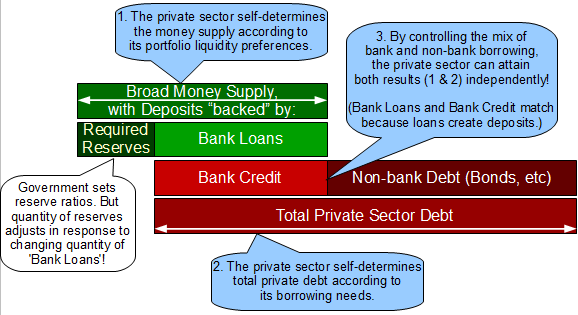

First, consider the general situation in which bank loans expand the broad money supply. The “Bank Loans” and “Bank Credit” bars are the same size by identity because loans create deposits:

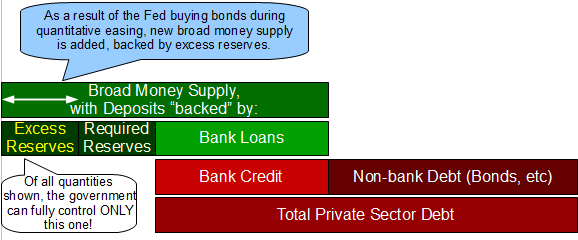

Next, consider what happens during Quantitative Easing in terms of the immediate mechanical result. Broad money supply expands, “backed” by an increase in excess reserves held by the banking system:

The private sector controls all quantities with white labels. Excess reserves, with a yellow label, is the only quantity here fully controlled by government! And because the Federal reserve’s standard open market operations automatically adjust required reserves (light yellow label) in the wake of bank lending decisions (banks lend first and look for needed reserves later, borrowing from the Fed if needed!), the government can only effect the quantity of required reserves if it changes the rules.

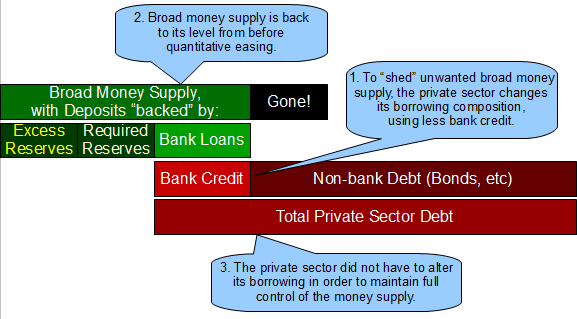

Lastly, consider how the private sector can work to “undo” the change in money supply imposed by QE, without having to alter its borrowing desires!

One of the reasons bank loans can be replaced by other forms of borrowing (perhaps with a lag?) is that when you look inside the aggregates, the economy is very dynamic under the surface. There are always some households and companies borrowing new money, others making debt repayments and others completely paying off debt.

Some bank loans may be repaid early and replaced by non-bank borrowing, but in general there is always new borrowing being done, even when the big picture is one of deleveraging.

When there is “excess” money and investors would rather hold bond assets, those investors will likely outbid banks in the contest to fund new borrowing needs. That is how the mix of bank debt versus non-bank debt can be affected. Even unconventional borrowing markets may play a part in this, such as “peer-to-peer” lending (going to family and friends for a loan instead of to the local bank). Another example of non-bank borrowing is new corporate equity issuance — perhaps angel investors and the like are outbidding banks on meeting funding needs, too.

Overview of Ways the Private Sector Can Reduce “Unwanted” Broad Money Supply:

- Replace loans (which create money) with non-bank borrowing (which does not create money) independent of total debt levels. Examples of non-bank debt include corporate bonds, peer to peer loans, securitized loan pools, housing agency debt, etc. Most of this post focused on this mechanism.

- Induce less bank lending by changing aggregated propensities to borrow. For example, many reports indicate a record number of cash buyers have been supporting the housing market. Logically, if there is an “excess” of deposits in the economy, then investors who would rather own other assets may slightly outbid other potential buyers of those same assets who would have bought using debt. Thus, while QE’s added money supply in this case doesn’t eliminate existing bank loans, it serves to reduce the number of houses bought using bank loans, while at the same time other loans are continually being paid down. The net effect is that bank lending moves to a lower level than it would have been at had QE not occurred. Those who lost the bid for new houses (who would otherwise have bought with a bank loan) might rent from the investors instead, so this point does not imply that QE will cause some to have no place to live.

- Banks can sell assets (treasuries, loans, etc) to the rest of the private sector. A net decrease in assets in this way causes a net decrease in broad money supply. To see how this works, visit the Macroeconomic Balance Sheet Visualizer, and choose the operation “Bank Loan” followed by “Bank Loan is Securitized” (which is one way banks sell assets to the non-bank sector).

- Banks can fund themselves with a higher portion of non-deposit liabilities (e.g., bonds) instead of deposit liabilities. This results in less broad money supply. As I understand it, this was part of the dynamic that RSJ described in this post.

Implications

Why does this matter? To the extent that these dynamics really occur as described in my three posts so far:

- This shows in even stronger terms why Quantitative Easing as practiced so far (targeting quantities rather than prices) has had no meaningful effect other than on sentiment. QE truly was a placebo.

- It lends even more power to the concept that money is always debt and can NOT be modeled like a commodity. Its quantity is extremely dynamic and subject to the portfolio desires of the private sector. IS/LM curves and the like are not relevant. One of the arguments by the Fed was that QE would increase deposits in portfolios and provide a bid under other assets due to “formulaic” institutional portfolio investing, but the premise of persistently expanded money supply appears to be false.

- It lends even more weight to the idea (commonly argued by MMTers) that interest rates are determined independently of borrowing demand, and thus that there can be no financial crowding out of the private sector when the government issues debt! Economy-wide interest rates truly are anchored to the short term Fed Funds rate plus expectations of future rate settings. (Not that the market can always consistently estimate future rate settings!)

No comments:

Post a Comment