by Cullen Roche

Some pretty interesting thoughts here from Societe Generale on the economic “ice age”. This is what their analysts refer to as the period after a bubble bursting has occurred. They’ve used the same Japan analogy that I am fond of. Pretty pessimistic thoughts (more so than mine), but I think they’ve got the macro situation understood better than most:

“In the aftermath of last week’s stunningly weak economic data the market is now beginning to acknowledge that, without a further round of QE a relapse back into economic stagnation or recession surely beckons.

In the post-bubble world, economic downturns = the most dangerous phase in the cycle. Both equity PE’s and government bond yields will make surprising new lows for a consensus totally convinced of extreme cheapness of equities and expensiveness of government bonds.

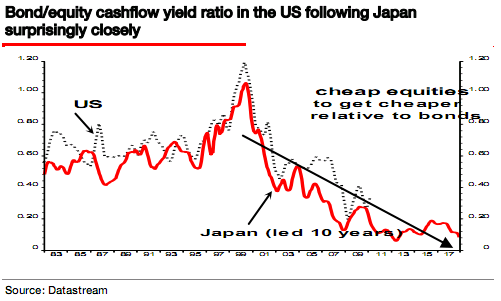

So, this week we revisit some of our old favourite “Ice Age charts” to see how far advanced we are in out post-bubble long march. The one below shows the US de-rating in exactly the same way Japan did a decade earlier.

The ice age theme = in a world of very low inflation, equities de-rate both absolutely and relative to government bonds. After equity valuations extremes seen during the 2000 bubble, we have entered a long valuation bear market which should end in extreme levels of cheapness consistent with an S&P around 400 and the unavoidable deep recession will drag an already “expensive” bond market to even higher levels.”

Sorry to ruin your pre-weekend with that delightfully bearish note. If it makes you feel any better, I think S&P 400 is extreme to say the least, but then again, I foresaw the housing crash and didn’t think equities would decline to 666 so I’ve been wrong before….

No comments:

Post a Comment