Yesterday’s discussion of the intensity and duration of bull markets — and the current powerful market — led to an interesting question: Exactly how much has QE1 & 2 impacted stocks?

The Fed’s historically unique monetary policy is obviously a factor in the current market — but how much?

Perhaps we can fashion a guess looking at duration and intensity of market moves.

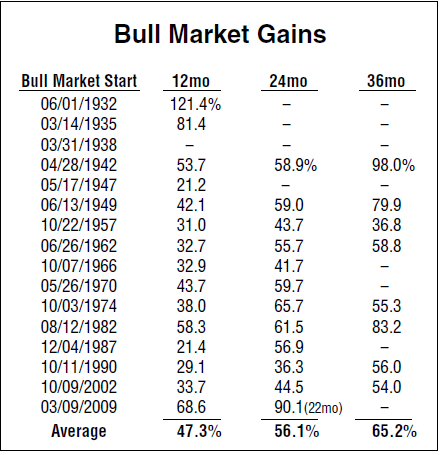

Let’s use the averages of the rallies over 12 and 24 months, going back to the 1930s: After 12 months, returns range from 21.4% (1987) to 121.4% (1932). But its worth noting that the other post-depression rally (1935) was 81.4%; remove these two outliers, and the next most intense move was 1982 at 58.3%. That is, until the 2009 rally. After 12 months, it stood at 68.6%. The average of these rallies at the 1 year mark was 47.3%.

After one year, we had a rally that was 20% stronger than the previous post-WW2 rallies, but not as strong as the post depression rallies.

Looking at these rallies after two years is where things get very interesting: On average, the rallies strengthened, from 47.3% to 56.1%. This despite by month 24, the two post depression rally outliers had given up all their gains and were in the red.

I have been saying for several years now that 1973-74 is an excellent parallel to the current crash/recovery. And indeed, up until 2009, the strongest rally from post Great Depression was 1974 — at 65.7% after 24 months.

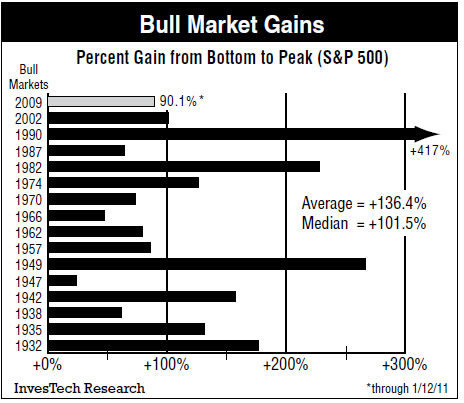

Until 2009. After just 22 months, this market broke through the 90.1% level. No other rally even comes close, and 1974 as the runner up. The current run is a full 37% greater than the next closest rally, and over 60% greater than the 2 year average.

How much of this is attributable to the Fed? Its only a guess, but if merely half of the markets excess gains (over the past rallies) are attributable to the Fed,it means that the US Central Bank has artificially created several trillion dollars in market capitalization.

The end game of this, and the unintended consequences, are beyond my ability to guess . . .

Tables after the jump . . .

Courtesy of Investech Research

Continue reading this article >>

No comments:

Post a Comment