by Greg Harmon

Last week’s review of the macro market indicators suggested, heading into the last week of January, that the equity markets were churning, but at different paces. Elsewhere looked for Gold ($GLD) to continue in its uptrend while Crude Oil ($USO) continued lower. The US Dollar Index ($UUP) also looked to continue higher while US Treasuries ($TLT) consolidated in the uptrend. The Shanghai Composite ($ASHR) was taking a breather in its uptrend but Emerging Markets ($EEM) were breaking higher, at least in the short term.

Volatility ($VXX) looked to remain low but drifting gently higher over time slowing the wind at the back of the equity market. The equity index ETF’s were reacting differently to these factors. The $IWM was continuing its consolidation but with signs it may break higher, while the $SPY consolidated in its uptrend, perhaps passing the baton to the small caps. The $QQQ was been acting mostly like the SPY but looked much stronger, with a possible break of a bull flag higher brewing.

The week played out with Gold finding resistance at 1300 again and pulling back while Crude Oil continued to leak lower until a massive rebounded late in the week. The US Dollar consolidated its move until late in the week it moved back higher higher while Treasuries made a new all-time high.

The Shanghai Composite tested resistance again and pulled back slightly while Emerging Markets held higher over support early only to give it up at the end of the week. Volatility moved back higher ending the week at the highs, but below the prior high. The Equity Index ETF’s all pulled back in their recent consolidation zones, leaving Monday as the high of the week.

What does this mean for the coming week? Lets look at some charts.

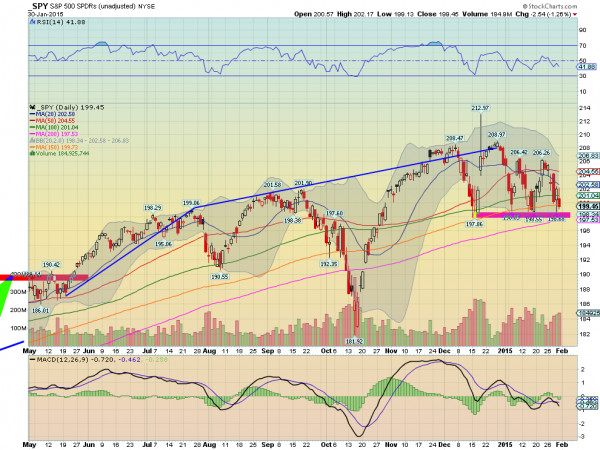

SPY Daily, $SPY

The SPY started the week holding over the 50 day SMA Monday but it was downhill from there. By Tuesday it broke below the 50 and 20 day SMA’s and printed a Spinning Top doji. This signals indecision and can resolve either up or down. It decided for the downside with a strong move lower Wednesday. After only a modest bounce Thursday it fell again Friday to end the week near the lows. It did hold the recent support zone that has been in place since mid December. The RSI on the daily chart is testing the 40 level again while the MACD has crossed down. The risk is to the downside on this timeframe.

SPY Weekly, $SPY

On the weekly chart the range since October remains in control with the 50 week SMA fast approaching. The RSI on this timeframe is about to cross down through the mid line while the MACD is running lower. More risk of downside on this timeframe as well. There is support lower at 198.60 and 196.60 followed by 194.40 and 191. Resistance higher may come at 200 and 202.30 followed by 204.30 and 205.70. Consolidation with a Chance of Pullback in the Uptrend.

Heading into February the equity markets look biased to the downside to start the month. Elsewhere look for Gold to continue to consolidate in the short term uptrend while Crude Oil may be ready for a bounce or reversal in the downtrend. The US Dollar Index seems ready to consolidate sideways in the uptrend while US Treasuries continue to be biased higher. The Shanghai Composite is also consolidating in its uptrend while Emerging Markets look to have failed in their attempt to rally and are biased to the downside.

Volatility looks to remain low but drifting up easing the wind behind the equity markets to a light breeze. The equity index ETF’s SPY, IWM and QQQ, all see risk to the downside in both the daily and weekly charts with the QQQ the strongest on the longer timeframe followed by the IWM and then the SPY, but the IWM possibly a bit stronger on the short timeframe over both the QQQ and SPY. Use this information as you prepare for the coming week and trad’em well.

No comments:

Post a Comment