by Andrew Hecht

Summary

- Last year the price of coffee was under incredible pressure and growers were losing money -- then the price exploded.

- This year the price of sugar is under incredible pressure.

- Is the market structure in sugar telling us that the commodity offers a low-risk/high-reward long side opportunity?

Last year, the price of coffee was in a long-term bear market. No analyst, trader or anyone in the coffee business could say anything positive about the future prospects for the price of the forlorn commodity. Coffee growers were under siege, the future economics of growing a coffee crop deteriorated with price. There was a huge Arabica and Robusta crop on the horizon, warehouses were full and the fundamentals looked bleak for the price of the beans. Open interest in ICE coffee futures started to grow as sellers dominated the market. Speculative shorts lined up to take advantage of the bear market. The low price traded on one day became the high price of the next. In November 2013, the price dropped to $1.0095 per pound, and it looked like prices would drop below the psychologically important $1 mark. There was no bottom too low and there was no hope for the coffee growers of the world. Then, all of a sudden, the price turned around.

Coffee went from bear to bull...

Reports that coffee growers were preparing to plant other more profitable crops gave way to news that a drought was descending on Brazil, the world's largest producer of java beans. The price of coffee started to rise and by April, it had more than doubled trading up to $2.23 a pound.

In the commodity markets, particularly the markets for agricultural commodities that periodically suffer from weather issues, crop diseases and where shelf life is often a brief period of time, fortunes can change quickly. That is what happened in the coffee market in 2014.

The price of sugar is under siege

Today, another soft commodity, sugar, looks and smells a lot like coffee did as its price languished in late 2013.

Sugar is in a long-term bear market, the price has fallen over 35% since July 2012. The situation is actually worse than the chart illustrates. As recently as February 2011, three and a half short years ago, the price of the commodity was at 36 cents a pound. Today we are trading at less than half that level. This year's sugar crop is big -- warehouses are full and growers and millers are under pressure. Sound familiar?

The rumblings from the sugar industry are starting to get louder. Indian millers are saying that they will close mills this coming season if prices do not rise or if their government does not subsidize sugar crops. Brazilian growers are hurting and considering alternative, more profitable crops. Thai sugar growers are hurting with the prospect of lower prices. The US government, which heavily subsidizes domestic sugar producers, has just announced that it plans to tax imports of Mexican sugar into the US. Sugar is under siege as the price falls. Open interest has started to rise in the ICE sugar futures market as the price continues to fall. An oversold condition with weekly stochastics below 18 and the relative strength index falling exists, but that does not matter; the trend is your friend and all signals in sugar point lower.

Is market structure in sugar is flashing a signal?

The current low price of sugar and market action should be intriguing to any market contrarian. While hunting around the market looking at fundamental supply and demand data and scouring charts for clues, I came across a very interesting piece of data.

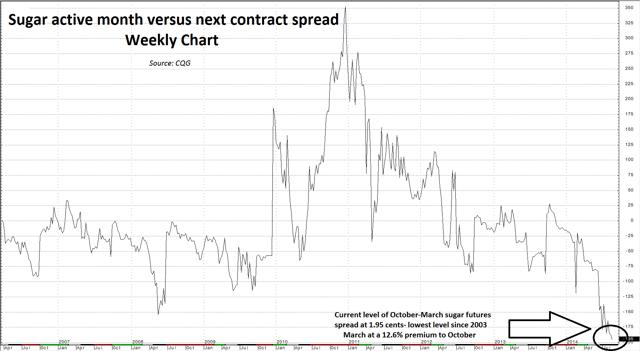

The spread between active month October sugar futures and the next month, March, is huge. March sugar futures closed the month of August at 17.44 cents, with October closing at 15.49 cents per pound. The differential amounts to 1.95 cents, or 12.6% of the price of active month sugar. This is the biggest premium since December 2003, when the price of sugar was trading at 5.66 cents per pound before it blasted off and tripled over the next twenty-four months, trading up to 18.82 cents by January 2006.

Soft commodities can be the most volatile commodities of all. Weather, crop diseases, perishability and political factors can turn these markets from bearish to bullish and vice versa on a dime. In commodities like metals and energies, fundamentals tend to change over longer-term horizons; those commodities can be stored for long periods. In soft commodities, like coffee and sugar, the markets tend change course quickly and it is often hard to jump on board once a move has begun, as those price moves can be violent. Therefore, the lower sugar goes, the greater the upside potential will be. Sugar is starting to smell a lot like coffee given the current state of the market.

How to play the sugar market from the long side

Futures and options contracts on ICE sugar are the most direct way to trade and invest in the future price of sugar. Option prices are low these days as weekly historical volatility in sugar is below 25%. Traditionally, when sugar gets moving, volatility explodes and trades much higher than current levels. The chief determinant of option values is implied volatility, and at current levels, options are attractive limited-risk vehicles. When you purchase an option, all you risk is the premium that you pay for that option.

Another instrument to keep an eye on is the iPath DJ-UBS Sugar Sub TR ETN (NYSEARCA:SGG) that trades on the NYSE. SGG has a 52-week price range of $45.96 to $66.46. Over the past 5 years, it has traded as high as $106 and as low as $38.80, so it is certainly closer to the lows than the highs. The SGG seeks to replicate the performance of sugar through unleveraged investments in sugar futures contracts. The ETN has an expense ratio of 0.75%, and currently has net assets of $33.58 million. SGG trades an average of 15,000 shares each day, so there is liquidity in the product. Finally, there are also options listed on this ETN product.

The bottom line...

The price of sugar looks terrible today, but so did the price of coffee twelve short months ago. Maybe sugar will be the next commodity to percolate. The spread between October and March sugar futures contracts could be telling us important information about the future price of the commodity. Keep your eyes on the price of sugar. Getting in early could offer some really sweet returns.

No comments:

Post a Comment