by Jason Draut

Stocks are flying high and equity markets feel like a low-risk, high-return, can't-lose investment right now. Each sell-off stops after just a few percentage points of decline and then moves on to new all-time highs. At the same time, most people think the 30-year Treasury bond has excessive interest rate risk for very little yield. Aren't all the experts saying we are headed for higher interest rates and therefore a sell-off in bonds? With a yield of 3.3%, the 30-year Treasury bond is not exactly something people get excited about.

Nonetheless, let's investigate the benefits of holding long-dated Treasuries as a diversifier for stocks. To analyze this, we take two well-known ETFs, SPDR S&P 500 ETF (NYSEARCA:SPY) and iShares 20+ Year Treasury Bond ETF (NYSEARCA:TLT), and use monthly returns to compare the performance and risk of various portfolios with different amounts of each of these two assets. To start we can look at the two assets in isolation, i.e., a portfolio of 100% SPY vs 100% TLT. We want to know about the portfolios' returns as well as their risk. To do this we look at several statistical measures:

- Annualized returns

- Annualized volatility (standard deviation of the monthly returns scaled by the square root of 12)

- Maximum drawdown (worst peak-to-trough performance in full sample)

- Sharpe Ratio (annualized excess return over 3-month T-bills divided by annualized volatility)

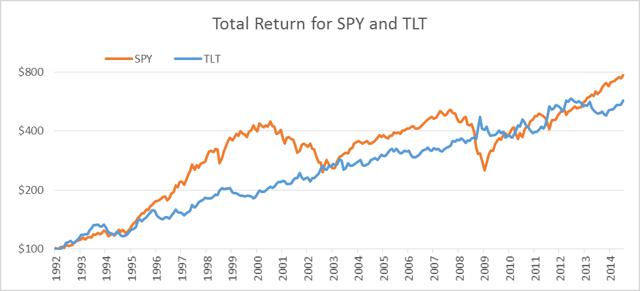

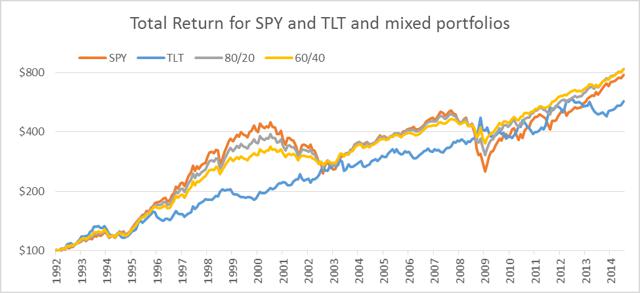

These measures can give us a good sense of how the portfolios' risk and returns compare. Before getting to the statistics, here's a chart of the two assets total returns since 1992 for some context on how the assets have performed over time. The ETF returns are taken from Yahoo! Finance. In order to have data that was contemporaneous and covers as much history as possible TLT's benchmark returns are used as a proxy before its 2002 inception date and similarly SPY's benchmark returns prior to its 1993 inception. The TLT benchmark started in February 1992, so this study begins that month as well. The chart below shows the pre-tax account value for a $100 investment in each asset starting in February 1992. The y-axis is on a log scale so that a 1% change in value in 1992 looks the same as a 1% change in value in 2014.

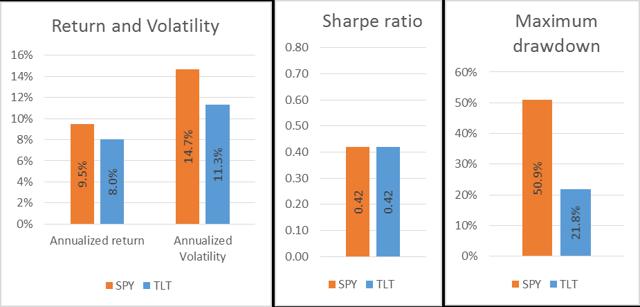

Now let's look at the various statistics to see how the two assets perform by the numbers. In terms of returns and risk (volatility) the two assets are similar with SPY having slightly higher returns as well as slightly higher volatility. They turn out to have almost exactly the same Sharpe ratio, but the differentiator comes when looking at drawdowns. SPY has experienced a 51% drawdown (2007-09) whereas TLT's maximum drawdown was only 22%.

Despite all the fears of rising interest rates, at Wynn Capital Management we think equities are at a greater risk of a major drawdown. Even looking at the largest interest rate increase on record in the late 1970s (1977-1981) the 30-year Treasury bond lost about 25% in that four year period (estimated using simple bond model in Excel) after taking interest payments into account. Given the currently low interest rate of 3.3%, long-dated Treasuries don't have quite the safety net from high interest payments (the 30-year Treasury bond yield was over 7% in 1977), but they are also very unlikely to have interest rates move up as quickly as the 1970s given the current low level of inflation, especially the low wage inflation.

Now let's investigate what happens when we combine SPY and TLT into a mixed portfolio. For all the results below, we rebalance the portfolio back to the starting weights each January. Let's start with a fairly small addition of TLT to SPY, say 80% SPY and 20% TLT.

The results are impressive. Adding a lower total return asset to the 100% SPY portfolio actually increases the total return! This is a result of the annual rebalancing that buys more of the asset that has underperformed and sells the asset that outperformed in the prior year. Each year we buy one asset at a discount and sell the other at a premium. The outperformance of the 80/20 portfolio versus the 100% SPY portfolio is certainly not guaranteed going forward, but we can expect annual rebalancing to outperform over a market cycle versus the investor who buys the 80/20 portfolio at the beginning of the cycle and never rebalances. Along with the somewhat surprising results in portfolio returns, the realized volatility of the portfolio drops significantly from the 100% SPY volatility level. It is basically the same as the 100% TLT portfolio. This is due to the wonders of combining uncorrelated assets in a portfolio (diversification!). If you look back at the first time-series chart of total return, you will see that when SPY goes down, TLT often (but not always) goes up. They are actually slightly negatively correlated in the 22-year data sample used in this study. Given this increase in returns and decrease in risk it is no surprise that the Sharpe ratio goes up significantly. The maximum drawdown decreases basically in proportion to the volatility since the equity risk dominates the portfolio risk for this ratio of stocks to bonds (80/20).

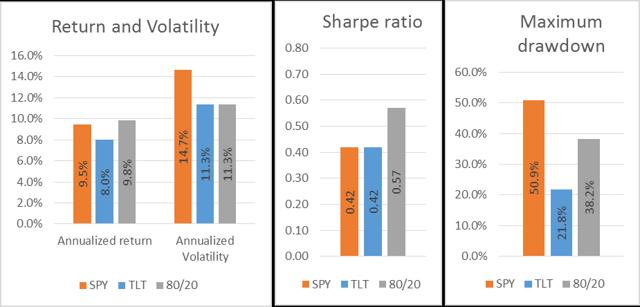

Next let's do this same analysis for a portfolio with a larger proportion of bonds. We take the standard 60/40 ratio as our final example, so we rebalance the portfolio to 60% SPY and 40% TLT at the beginning of each calendar year.

The advantages or rebalancing continue to keep the total returns above either of the individual assets, and the level of volatility comes down even more. The mixed portfolio's realized volatility continues to drop and the Sharpe ratio continues to rise. As the bond asset starts to contribute to portfolio risk the maximum drawdown starts to decrease faster than the volatility does. Continuing to increase the percentage of TLT in the portfolio causes these trend to continue until we get to an SPY weight near 40% where the annualized volatility falls to about 8.3%. The Sharpe ratio peaks just above 0.75, again this occurs when the portfolio mix is near 40% SPY and 60% TLT. At this level the maximum drawdown falls all the way to 16%, below either individual asset's maximum drawdown. Now that is diversification at its best! The annualized total returns for this 40/60 portfolio are basically equivalent to the 100% SPY portfolio at 9.5% (Thank you, Annual Rebalancing!). The fact that the volatilities of the two assets are similar is quite important for gaining these benefits of diversification. Using a lower volatility bond asset, like the iShares Core US Aggregate Bond ETF (NYSEARCA:AGG), the maximum drawdown and Sharpe ratios don't improve nearly as much until the portfolio holds well over 50% AGG, and then returns fall noticeably as well.

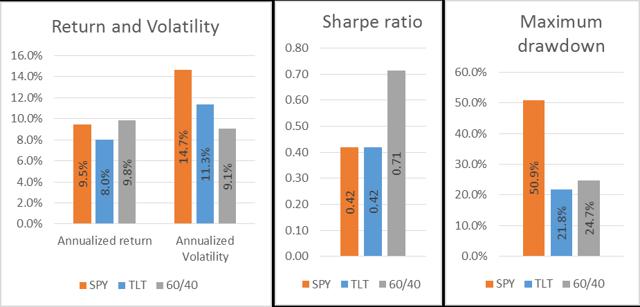

Before you go buying a big chunk of TLT, you must remember that at the beginning of February 1992 the 30-year Treasury bond had a yield of 7.8%. It's no coincidence that TLT has returned 8.0% annualized since then. Future returns of Treasuries are highly dependent on their current yield, even when you roll the bonds to keep the maturity constant as TLT does. That is a topic for a separate article, but the basic idea is that if you roll the 30-year bond each year into the next 30-year bond (something akin to what TLT does), you will take some loses if rates rise in a given year, but you will then have a higher yielding asset and these two effects largely cancel each other out over the long-term. We expect TLT to return about 3% annualized over the next 20-30 years, not the 8% we have seen in the past 20 years. This does not tell us much about the fund's returns next month or next year only that we can expect around 3% over the long term. At the same time the US equity market has had many 20-year periods where annualized total returns were under 5% (see Crestmont Research for a great summary of historical S&P 500 returns). Given current valuations, it would not be a surprise if the next twenty years fell into that category for equities, so don't think 3% for a long-term return is all that bad in today's market environment either! Forecasting long-term equity market returns is yet another topic for a separate article so we won't go any further into that. Investigating the benefits of diversification across uncorrelated assets is really the goal here. Let's close with one final chart that shows the two mixed portfolios total realized returns over time alongside SPY and TLT. It illustrates the main points of this article in a single picture.

The two mixed portfolios give up some of the gains in equity bull markets, but they make up for it with smaller losses in the bear markets. This can allow an investor to sleep better at night with less volatility and smaller drawdowns. We think it's worth the reduced upside in euphoric bull markets. Finally, the concepts of diversification and rebalancing discussed here also apply to larger groups of assets, but we chose to use SPY and TLT to illustrate the effect in a simple and clear way. We are not suggesting that this two-asset portfolio is all there is to building a diversified portfolio. It's really is just the beginning.

No comments:

Post a Comment