by Alex Cho

Summary

- Apple Watch comes with new technology and is set to be launched in early 2015.

- Apple Watch will come in three different variations and has a unique user interface.

- I estimate that Apple Watch will contribute $6.91 billion in net income in FY 2015.

The Apple (NASDAQ:AAPL) Watch took the spotlight at the September 9th event. While other products like the iPhone 6 and 6 Plus offered immense insight into supply chain mechanics, the real show stopper was the disruptive innovation that Apple was able to demonstrate in its new product, the Apple Watch.

Technologically, aesthetically, the Apple Watch is a marvel. But more importantly, I have high conviction that Apple's upcoming device will add meaningful contribution to bottom and top line results.

Here's what we know about the Apple Watch

The watch will come in three different formats - the Apple Watch, Apple Watch Sport Edition, and Apple Watch Edition. The three different watches will be differentiated by materials and wrist straps. The Apple Watch Edition is made of 18k gold, whereas the Apple Watch is made of stainless steel.

The device uses a digital crown, basically a rolling knob, which allows you to zoom in and out of applications, and scroll through stuff. It's the mouse wheel for the Apple Watch, and it works in combination with both touch and voice commands. The Apple watch OS also comes with advanced software to simplify the process of communicating and even includes Siri.

Apple Watch is different from the Galaxy Watch as it's not a shrunken-down version of the smartphone. Instead, it completes the smartphone in ways that the device by itself cannot.

The entry-level iWatch, i.e. the Apple Watch is priced at $350. The device comes with new features, such as a new health and fitness application that will track physical activity. Furthermore the Apple Watch will come in two size form factors, 38mm (height), and 42 mm (height).

Source: Apple

The Apple Watch comes with an accelerometer, gyroscopes, sensors to check heart pules, GPS and Wi-Fi. To use the device, you would need to have an iPhone 5 or above. This gives the iWatch an installed base of 200 million users to work with. Furthermore, the device is set to be launched sometime in early 2015.

The launch will come sometime after the holiday shopping season, which isn't exactly a good thing, but it does give consumers enough time to save money after spending so much during the Christmas holidays. My suspicion is that the sapphire display is what's delaying the shipment of the smartwatch.

The Apple Watch will have NFC capabilities, allowing legacy Apple iPhone 5 and 5S owners to get their hands on Apple's new payment application.

How much will the Apple Watch add to the bottom line?

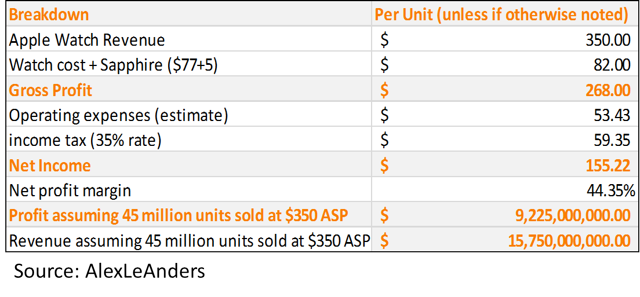

Based on pricing, the device will start at $350, and will increase from there. The Apple Watch Edition (the one made with 18k gold) will be priced significantly higher, for a very limited market. However, I'm going to work with a $350 figure, just to stay a little conservative, and to stay consistent with the mass market product the Apple Watch is meant to be.

Furthermore, I think that shipment figures will come in at the mid-point of the shipment figures that Apple anticipates (50 million) and what I estimate (42 million). However, for the sake of simplicity I'm going to go with 45 million, between 50 million and 40 million units.

The Apple Watch base cost is $77. However, when including the cost of sapphire, it should cost $82. The base cost came from the Taiwan Topology Institute, whereas the cost of sapphire came from Charles Margolis.

After breaking the figures down, I think the device is an extremely high margin device, as it will leverage the pre-existing R&D and OPEX costs from other business segments. Furthermore, I estimate that after a full-year the new category may contribute $9.225 billion to bottom line, and $15.75 billion to top line results. The added impact from Apple Watch will help Apple beat analyst estimates in its next fiscal year.

Assuming the device is sold in the beginning of 2015, the device will only contribute to sales for 3 out of 4 fiscal quarters. Therefore, I think the device contributes $6.91 billion in net income and $11.81 billion in revenue in fiscal year 2015. I'm highly confident that consumers will line-up for the Apple Watch product launch, and demand will be robust in the early innings of the product adoption cycle. Furthermore, because the device connects directly to the iPhone, the device won't need a separate wireless internet subscription, which diminishes the barrier of entry.

Conclusion

Investors should feel more confident than ever with Apple's product line-up. Beyond the favorable impact a new wearable should have, iPhone shipment growth paired with better margins will drive bottom and top line results. Assuming consumers refresh their iPhone and iPad, and purchase a smartwatch, Apple will report a fairly strong fiscal year. Not to mention, the median income of the average iPhone owner is $85,000, according to comScore Mobile Metrix, therefore, there's further room in a typical Apple owner's budget to afford additional devices, and make upgrades from older devices.

Apple Watch a long-anticipated wearable computing device by Apple

ReplyDelete