by Charles Hugh Smith

It's not the managers who are incompetent, it's the organization itself that is incompetent.

I received a number of interesting reader responses to my previous entries on the incompetence of the Federal Reserve and the Deep State:

The Federal Reserve: Masters of the Universe or Trapped Incompetents? (March 21, 2014)

Why Is Our Government (and Deep State) So Incompetent? (March 6, 2014)

Some readers thought I was underestimating the power of these institutions to pursue essentially unlimited money-printing and related global strategies.

While I understand the apparent power of unlimited money-printing and global Empire, my point (poorly articulated the first time around) was this:

The incompetence of these organizations is not a reflection of the competence or intelligence of their managers--it is the intrinsic consequence of their limited control of complex systems. If the system has reached the point of being ungovernable, even the most brilliant and experienced managers will fail because it's not the managers who are incompetent, it's the organization itself that is incompetent.

If we boil down the Fed's vaunted god-like powers, they can be reduced to four

levers: lower interest rates by purchasing interest-bearing assets, create the money to buy the assets, make free money (zero interest or near-zero interest) available to the global banking sector via lines of credit, and support/rig currency, bond and stock markets with purchases made directly or through proxies. (Thank you, correspondent Mike L., for reminding me about the Working Group on Financial Markets and the Exchange Stabilization Fund.)

That's it. Everything else is window-dressing.

Is it even plausible that any organization can control an immensely complex economy with four levers? The Fed's four levers exert no control over how much money is borrowed from the Fed or what insanely risky speculations and malinvestments the borrowed money funds.

The Fed can't even control if the free money stays in the U.S.; by one estimate, fully 60% of the Fed's free money has left the U.S. for higher-interest carry trades and speculations in the emerging economies.

The levers of power wielded by the centralized Fed and Deep State are too clumsy and limited to control a complex system at any useful level. The Fed, the Federal government and the deep State are all the wrong unit size.

This excerpt from Preparing for the Twenty-First Century by Paul Kennedy (1993) explains why:

The key autonomous actor in political and international affairs for the past few centuries (the nation-state) appears not just to be losing its control and integrity, but to be the wrong sort of unit to handle the newer circumstances. For some problems, it is too large to operate effectively; for others, it is too small. In consequence there are pressures for the "relocation of authority" both upward and downward, creating structures that might respond better to today's and tomorrow's forces of change.

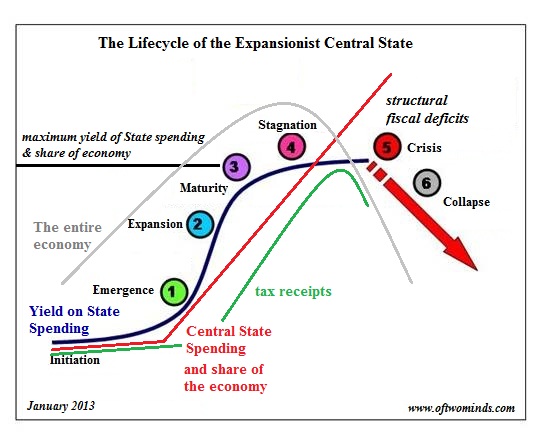

All these centralized concentrations of power have moved into the diminishing returns phase of the S-Curve. As the unintended consequences of their efforts to manage complex systems with their clumsy, limited tools pile up, their profound failure of imagination kicks in and they do more of what has already failed.

The structural incompetence of centralized, wrong-unit-size agencies and central banks is global: the centralized strategies of China, Japan, the European Union and yes, Russia, too, will all fail for the same reasons: organizations with a few limited controls are intrinsically incapable of managing complex systems.

The Global Status Quo Strategy: Do More of What Has Failed Spectacularly (April 23, 2013)

The Master Narrative Nobody Dares Admit: Centralization Has Failed (June 21, 2012)

"Do you know what amazes me more than anything else? The impotence of force to organize anything." (Napoleon Bonaparte)

No comments:

Post a Comment