By: Richard_Shaw

Benjamin Graham once said that markets are voting machines in the short-term and weighing machines in the long-term — sentiment vs fundamentals.

These days, the primary driver of sentiment tends to be central bank statements and actions — with mere statements having huge impact.

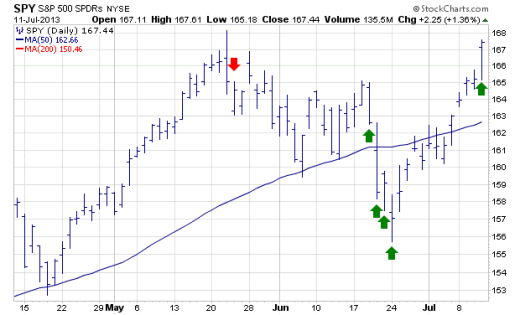

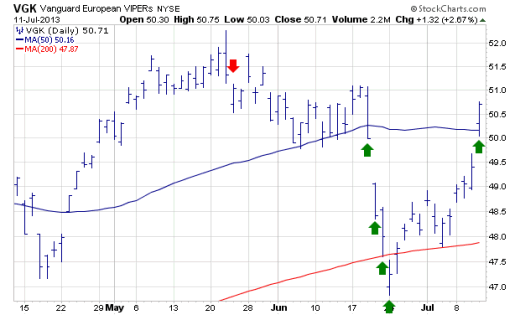

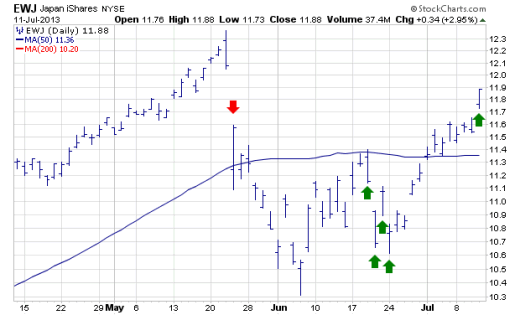

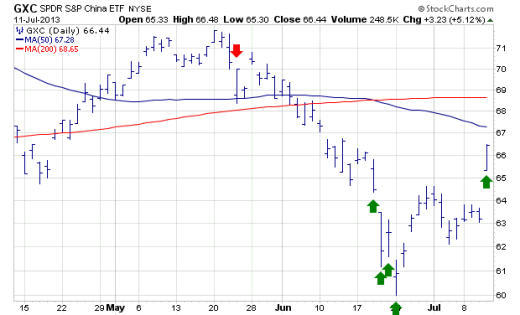

If you have doubts about the market impact of central-bank-speak, just take a gander at this calendar of central bank statements compared to market price action:

- 05/22 Federal Reserve president Ben Bernanke said that a tapering of quantitative easing could begin later this year if conditions warrant

- 06/18 European Central Bank president Mario Draghi said he had an open mind to doing what was necessary

- 06/19 Bank of Japan president Haruhiko Kuroda said they are taking steps and felt things would work out

- 06/20 Peoples Bank of China governor Zhou Xiaochuan added liquidity to their banking system to relieve a liquidity crunch

- 06/21 St. Louis Fed president James Bullard said QE could actually be increased if inflation slows

- 07/10 Federal Reserve president Ben Bernanke said the economy needs the Fed’s easy-money policy “for the foreseeable future.”

Now let’s look at price movements on the day after each of those statements/actions:

US Stocks

European Stocks

Japanese Stocks

Chinese Stocks

Bernanke frightened the markets, and other central banks stepped in with voice and cash to stem the decline, followed by a dovish “clarification” by Bernanke yesterday.

It appears that all is well for now, at least as far as central bank driven sentiment is concerned.

No comments:

Post a Comment