by Greg Harmon

Last month in this space my Monthly Macro Review/Preview had the monthly outlook suggesting the short term upside for Gold ($GLD) would continue while Copper ($JJC) might continue to drift. Crude Oil ($USO) was also set up to continue to consolidate as Natural Gas ($UNG) moved higher. The US Dollar Index ($UUP) looked stuck in the tightening triangle with US Treasuries ($TLT) biased to break the long consolidation to the downside. The Shanghai Composite ($SSEC) looked better to the upside, but not nearly as strong as the German DAX ($DAX) while Emerging Markets ($EEM) looked to continue to move lower. Volatility ($VIX) could go either way but looks to remain low keeping a tailwind at the backs of the Equity Index ETF’s. The Equity Index ETF’s themselves, $SPY, $IWM and $QQQ were set up to continue higher in the coming months with the trend in the QQQ the strongest. How does an additional month impact the longer term picture? Let’s look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

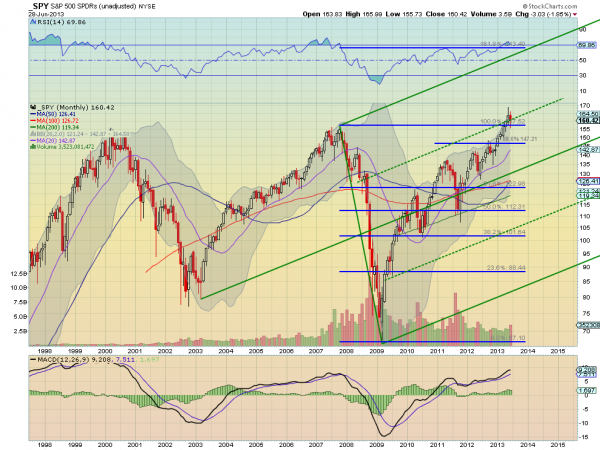

SPY, $SPY

The SPY finally hit a top and consolidated the move higher from the January break up. It held above the previous high and is riding the middle between the Upper and Median and Median Lines on the Andrew’s Pitchfork. The Relative Strength Index (RSI) is stalling and starting to pullback from being technically overbought while the Moving Average Convergence Divergence indicator (MACD) continues higher slowly. All of the Simple Moving Averages (SMA) are pointing higher though and below the price as the Bollinger bands are pointing up. This has the feel of a pause and go. There is no resistance above 169.07, the 113% extension of the move lower, and the 127% extension is above at 181.8 with 138.2% at 192 well above. There is support lower at 157.52 and 145.50. Consolidation in the Uptrend.

The monthly outlook suggests that Gold and Copper will consolidate with downside biases, much strong on the bias for Gold than Copper. Crude Oil also looks to consolidate as it has been but with an upward bias, while Natural Gas pulls back in the uptrend. US Treasuries look to be a mess and will continue the trend lower while the US Dollar Index consolidates in its uptrend. The Shanghai Composite and Emerging Markets look to continue to move lower as the DAX pulls back in the short term in its uptrend. Volatility looks to remain low but with a slight upward drift. This paints a mosaic for the Equity Index ETF’s SPY, IWM and QQQ that supports more upward movement in the coming months. As noted on the individual charts, there is room for some short term consolidation and even a short pullback without breaking the upward bias. Use this information to understand the long term trends in Equities and their influencers as you prepare for the coming months.

No comments:

Post a Comment