by Greg Harmon

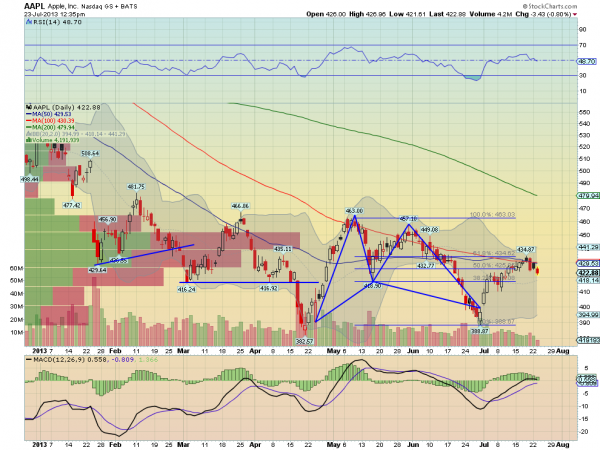

Apple reports tonight as well. Heading into the report it had completed a bullish Gartley and retraced 61.8% of the pattern before failing. This was at the confluence of the 50 and 100 day SMA’s and makes the 435 level very important. The RSI is drifting lower after barely crossing the mid line, not getting bullish and the MACD is leveling on the signal line with the histogram falling. This all gives a bias lower. There is support at 416-418 and then at 385-390. Below that there is noise until the 340-345 area for next real support. Resistance higher over 435 is found at 454 and then 463 before 477. The reaction to the last 6 earnings reports has been a move of about 5.43% on average or $23 making for an expected range of 400 to 446. The at-the money July weekly Straddles suggest a slightly smaller $20 move by Expiry Friday with Implied Volatility at 61% above the August at 30%. Some sizeable weekly 460/470 Call Spreads have traded on the offer side and the largest Open Interest this week is at the 400 Put by over 2:1 on any other strike, but similar at the 440 and 460 Calls.

No comments:

Post a Comment