By Global Macro Monitor

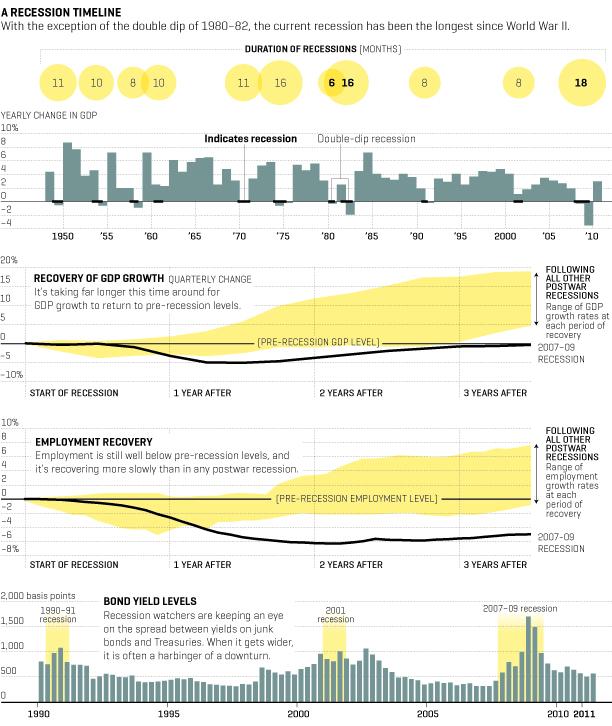

Those dreaded words you never want to hear as an investor. But check out the

Fortune Magazine graphic of this recession relative to others

since the WWII. Yes it’s a balance sheet problem and the economy needs more

time to heal and delever.

We also maintain, however, at least some, if not much of the weakness,

especially in the labor market, is structural and not cyclical. Take the U.S.

Postal Service (USPS) as the poster child of the current problems plaguing the

U.S. labor market. The USPS has 571,566 full-time workers making it the

country’s second-largest civilian employer after Wal-Mart. It has

eliminated 110,000 jobs in the past four years and according to the FT,

During the next five years, the service plans to cut 220,000 staff – about 120,000 through lay-offs – and close up to 300 processing centres on top of plans to shutter up to 3,700 post offices released last month.

Now why is this? Not enough stimulus? Monetary policy too tight?

Insufficient quantitative easing? To paraphrase James Carville, “It’s technology, stupid!” The rise of the

internet, e-mail, and Twitter coupled with some piss poor management, which

failed to adapt to the changing times, and the result is one of the nation’s

largest employers facing bankruptcy and mass layoffs.

Borders Books Inc. is also in the process of liquidating the

last of its stores, which will result in a final mass layoff of close to 11,000

employees. True, they failed because of “lack of demand” for their goods and

services. But not because of cyclical forces that could be offset by fiscal and

monetary expansion. The rise of the e-book, Kindle, and iPad shut them

down.

The Shumpeterian “creative destruction” of one sector is not being equally and

instantaneously offset by job creation in the sectors benefiting from

technology. This takes time, retraining, political vision and strong

leadership. Companies can’t hire enough software engineers in these fields

because the current labor pool lacks the education, training and skills.

Policymakers must recognize the global economy is sitting at the elbow of an

exponential curve in technological advances that is and will uproot everything

from manufacturing to how we read our mail and books to how medical

services will be delivered.

We’ve posted several pieces on the Global Macro Monitor blog about the role of transformative tech, including medical apps where smart phones

can be transformed into EKG monitors and cataract detecting devices. How do you think this revolution

will impact the traditional health care workforce?

We haven’t even touched on the mobile payments revolution, which will reduce the demand for

retail salespersons and cashiers. Not a near-term positive for employment as

the the BLS points out,

Retail salespersons and cashiers were the occupations with the highest employment in 2010. These two occupations combined made up nearly 6 percent of total U.S. employment.

The painkillers of fiscal and monetary stimulus, including negative real

interest rates and quantitative easing, has no doubt cushioned the blow of the

great crash of 2007-08. We’re the first to thank Paulson, Bernanke, Geithner

and Co. that we are not all farmers living under the freeway. They all deserve

the Presidential Medal of Freedom in our book for saving and

stabilizing the global financial system.

But the continued use of cyclical policies to deal with structural issues has

created an acute addiction in the markets and economy causing more uncertainty,

political angst, and volatility, in our opinion. This is especially true in

the equity markets, which was evident yesterday in its reaction to Mr.

Bernanke’s speech.

The policy medicine has now become an additional disease

afflicting and distorting markets and the economy, which are now hooked on the

painkillers.

Policies that address structural issues, though painful, will go a long way

in healing the economy. A long-term credible budget plan which addresses the

structural deficit will instantly reduce much of the uncertainty holding back

investment. Punishing savers with negative real interest rates “for at least two more years” will not and may actually consume

the rest of the decade in cleaning up the unintended consequences of the Fed’s

serial distorting of the relative price of money.

There’s now talk of the Fed targeting unemployment. How ’bout this. As part

of the next quantitative easing, the Fed creates a $1,000 checking deposit for

every citizen who agrees to write ten letters to friends, especially in rural

parts of the country. This stimulates demand for postal services and thus

eliminates, for a time, the need for mass layoffs at the USPS.

In no way do we intend to be insensitive to the workers at risk of losing

their jobs. But is this really where economic policy is headed? Where is the

leadership?

>

>

No comments:

Post a Comment