by Greg Harmon

Last week’s review of the macro

market indicators looked like the moves that revealed themselves the

previous Friday would continue. Gold and US Treasuries were ready to continue

higher. Crude Oil looked poised to drop further and the US Dollar Index to move

sideways in the top of its range. The Shanghai Composite and Emerging Markets

looked to continue lower. Volatility looked to remain elevated with the US

Equity Index ETF’s SPY, IWM and QQQ ready to continue lower in their bear flags.

US Treasuries breaking out and Gold racing higher again could be the catalyst

for a break of the bear flags lower.

The week began Gold making a new high before pulling back to consolidate, US

Treasuries gapped higher and held there. Crude Oil held narrow range between 86

and 90 while the US Dollar Index marched to the top of the range and then peaked

out. The Shanghai Composite and Emerging Markets did move lower but with a mid

week blip higher for Emerging Markets. Volatility did hold higher with and the

Equity Index ETF’s remained lower, but still in their bear flags. What does this

mean for the coming week? Lets look at some charts.

As always you can see details of individual charts and more on my StockTwits feed and on chartly.)

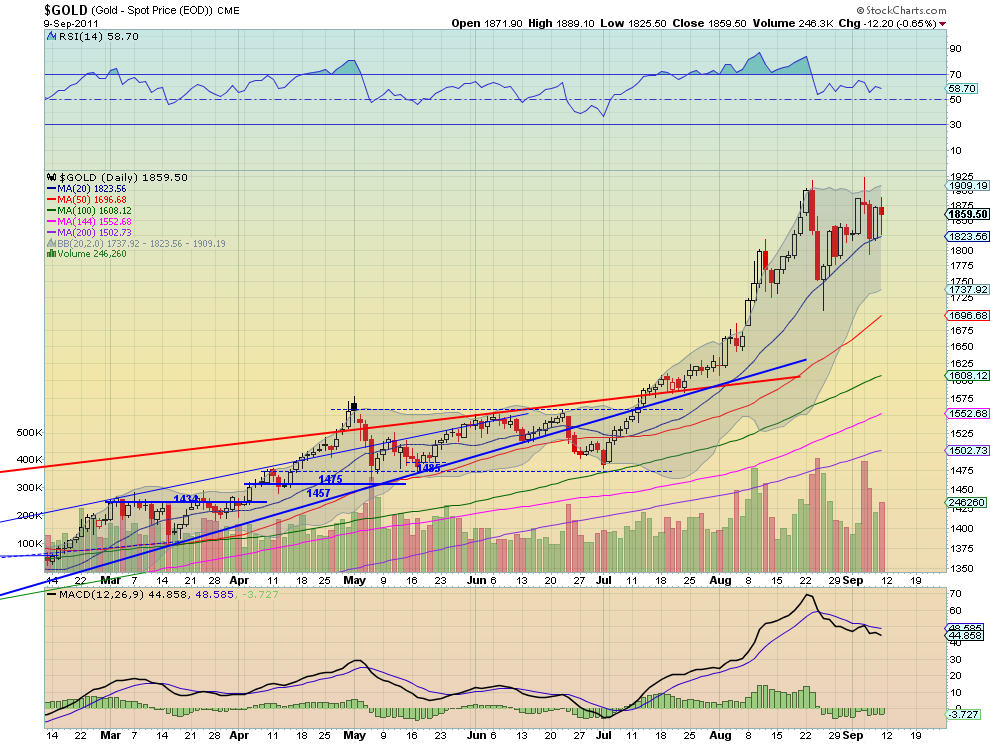

Gold Weekly, $GC_F

Gold consolidated this week over the break out of the ascending triangle

Monday and near resistance at 1875, after it made a new intraday high Tuesday.

The Relative Strength Index (RSI) on the daily chart remains in bullish

territory but moving sideways. The Moving Average Convergence Divergence (MACD)

indicator has been running flat but slightly negative on the daily chart but has

been rising on the weekly chart. The RSI on the weekly has held in the high 70′s

for several weeks. Look for the bull flag on the weekly chart and symmetrical

triangle on the daily chart to play out with either more upside or continuation

of consolidation near 1875 in the coming week. Any pullback should find support

at 1840 or 1800 lower. A move over 1930 triggers a target of 2250.

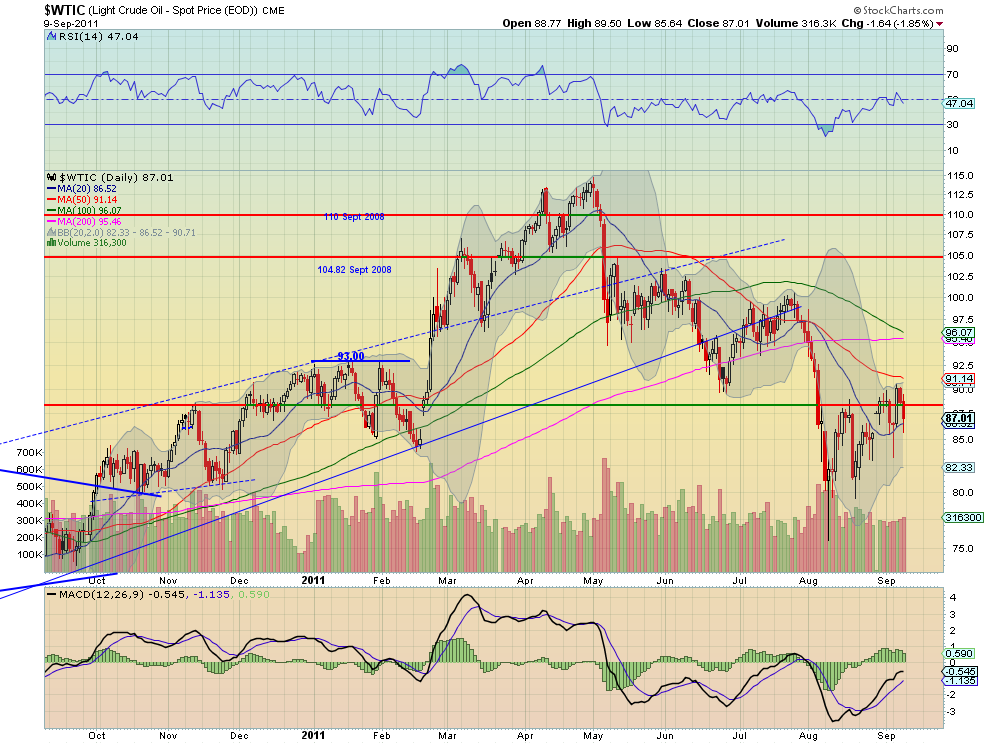

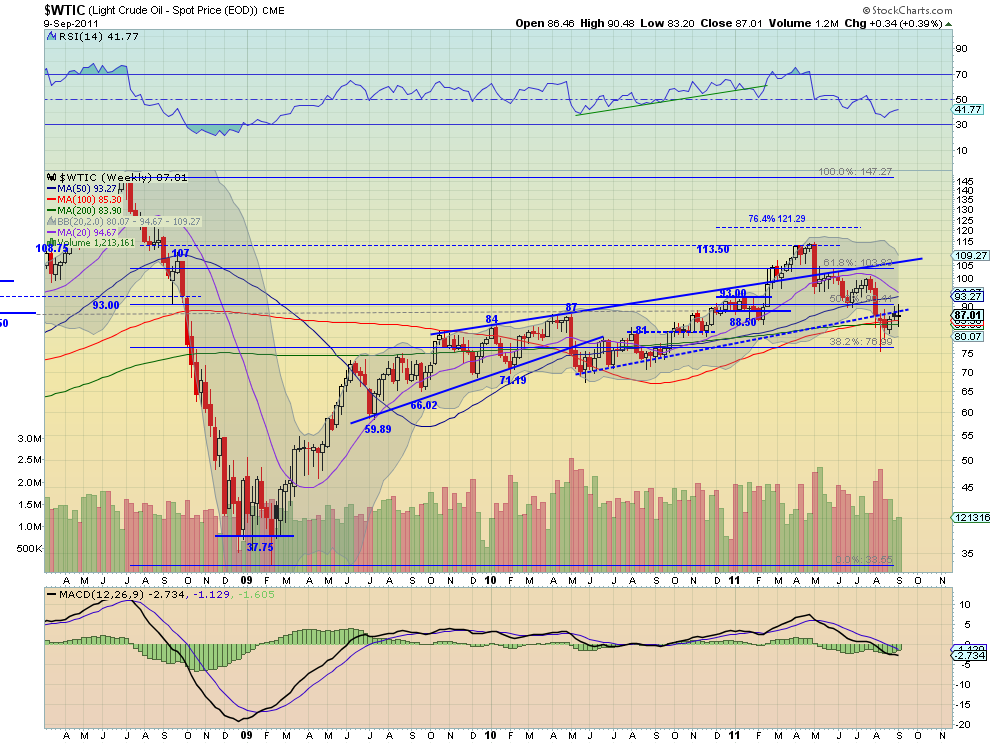

West Texas Intermediate Crude Weekly, $CL_F

Crude Oil continued its bear flag ending the week little changed and

vacillating around the 88.50 support/resistance line. The weekly chart shows

that resistance of the rising trendline extension form May 2010 is holding. The

RSI on the daily chart has stalled near the mid line and the MACD is positive

but fading slightly. The weekly chart shows the RSI currently rising but in a

downtrend and the MACD improving. These suggest the bear flag will continue next

week. Look for upside to be capped at 90 and a move to 93 above that as a break

of the bear flag. A move under 84 finds support at 81 and then 77 lower which

would trigger a target of 70 on the Measures Move (MM) out of the bear flag.

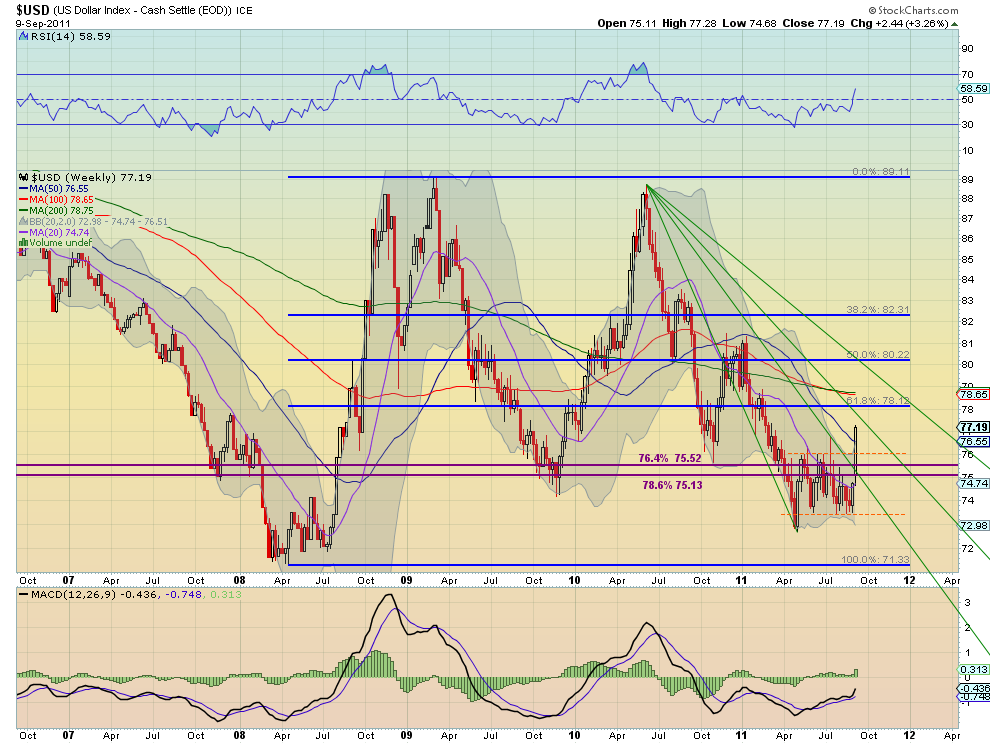

US Dollar Index Weekly, $DX_F

After peaking over the channel Thursday, the US Dollar Index broke the

channel higher Friday. It has a RSI that raced higher all week and is strongly

in bullish territory, and a MACD that is increasing on the daily chart. The

weekly view shows a vault over the resistance area, opening over the Fibonacci

Fan line and rising strongly towards the next line. The RSI on this timeframe

moved steeply higher and the MACD jumped higher. Look for continued movement to

the upside in the coming week with resistance higher at 77.50 and 78.15 as it

heads to the channel breakout target of 78.50 near the previous 78.66 resistance

area from February. As with any breakout, a retest of the channel at 76 is

possible and a move below it has support at 75.52 and 75.

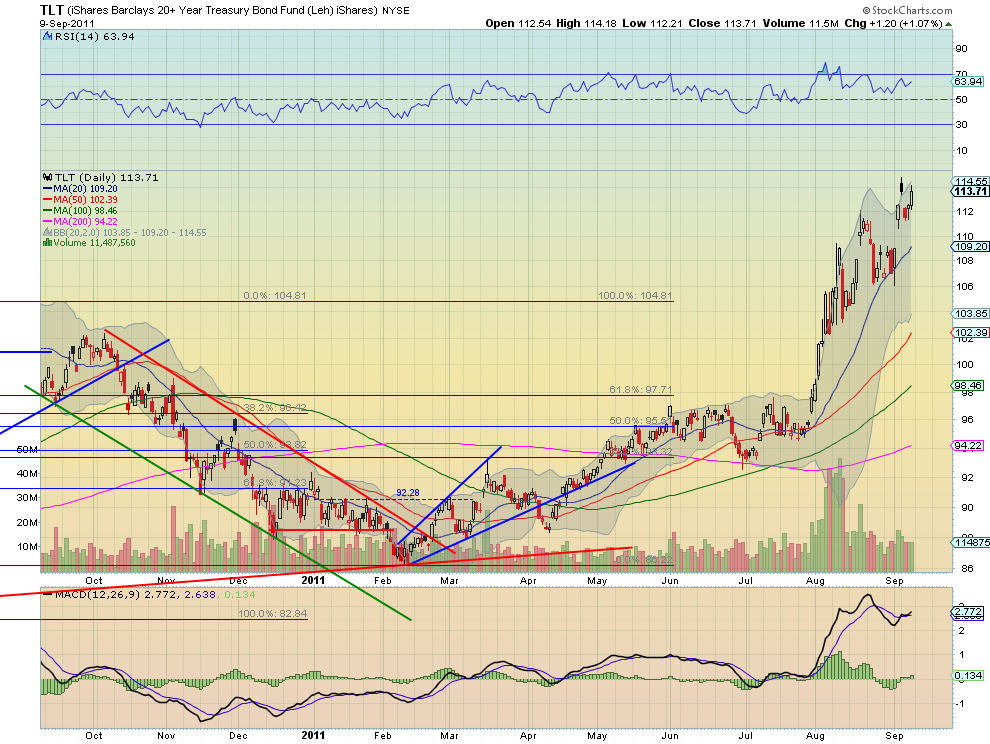

iShares Barclays 20+ Yr Treasury Bond Fund Weekly, $TLT

US Treasuries, measured by the ETF $TLT,

gapped up higher on Monday and held the gap. The daily chart shows the RSI

continuing to move in a range in bullish territory but with a MACD that has

crossed positive. The weekly chart adds that it broke the broad consolidation

around the 106 to 111.33 area and now has a MM higher to about 120.70. The RSI

on this timeframe remains bullish in the high 70′s with a MACD that is

increasing. With a touch of 115 this week, next week or shortly after looks a

lock to tag 120.70 and above that triggers a target on the symmetrical triangle

break at 137. Any pullback will find support 111.33 and 109.30, with a move

under 106 signalling a trend change.

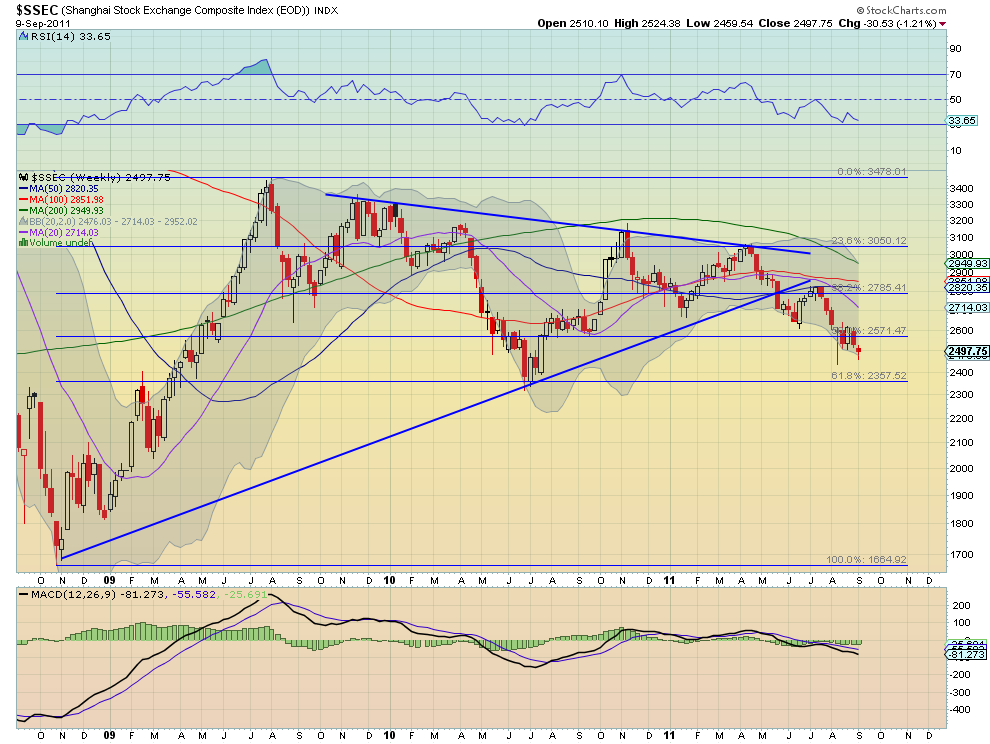

Shanghai Stock Exchange Composite Weekly, $SSEC

The Shanghai Composite showed continued resistance at the 2500 level holding

lower for the week. The daily chart has a RSI that has been bumping along the 30

technically oversold level, but no where near an extreme reading while the MACD

fluctuates around zero. The weekly chart shows the long trend of the RSI lower,

making lower highs, and the flat MACD. It also shows that it is starting to fall

out of the bear flag lower. Continue to favor the downside in the coming week a

move below support at 2400 leading to a test of 2357 and a target of 2300 on the

bear flag break. Upside should be capped for the week at 2571-2590.

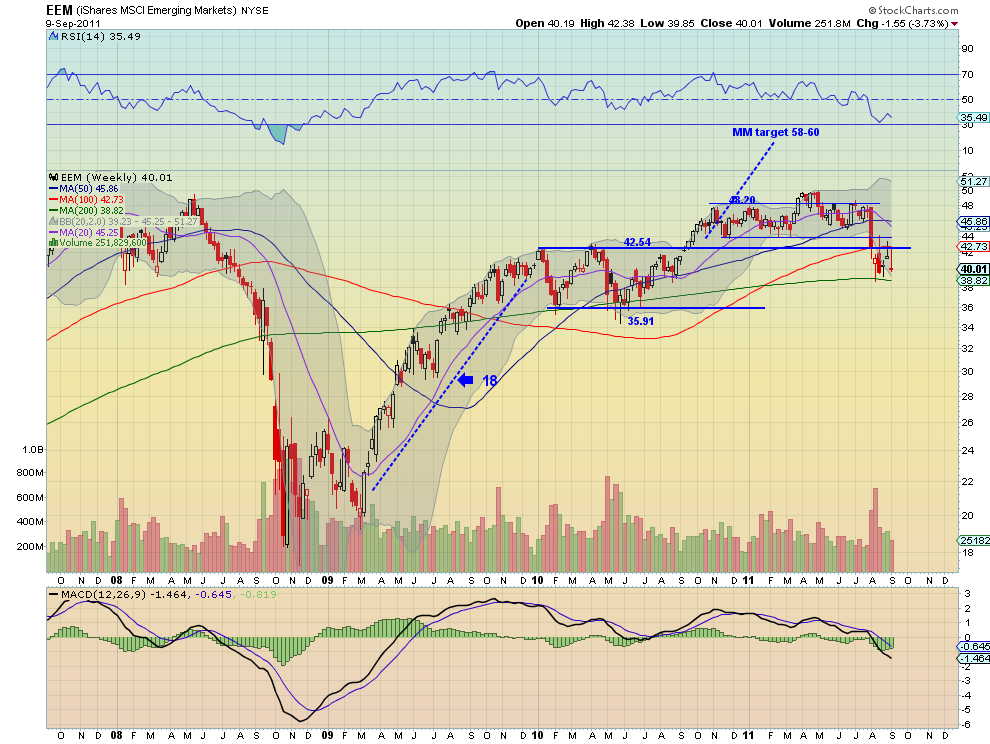

iShares MSCI Emerging Markets Index Weekly, $EEM

Emerging Markets, as measured by the ETF $EEM,

continued in their bear flag similar to the domestic markets. Notice the RSI on

the daily chart rejected lower at the mid line continuing in bearish territory

as the MACD fades lower. On the weekly chart the bear flag is distinct under the

42.54 resistance level. The RSI on this timeframe is struggling to stay over 30,

and is bearish, but the MACD is starting to improve. The downward bias remains

for eh coming week with a break below 39, out of the bear flag seeing support

lower at 35.91 and triggering a target of 32. Any upside will meet resistance at

42.54 and then 44.10 above that.

VIX Weekly, $VIX

Volatility continues to remain elevated. The daily chart is sporting a

descending triangle and is testing the top side resistance with a RSI that

refuses to fall back below 50 and a MACD that is improving quickly. The RSI and

MACD on the weekly chart equally are supportive of further upside in volatility.

Look for volatility to continue to remain high next week with a move above 40

and then 45 triggering a target of 58. It would take a break below 30 to change

the mood and expectations for a move to support at 28 or 23 lower. The charts do

not show that now.

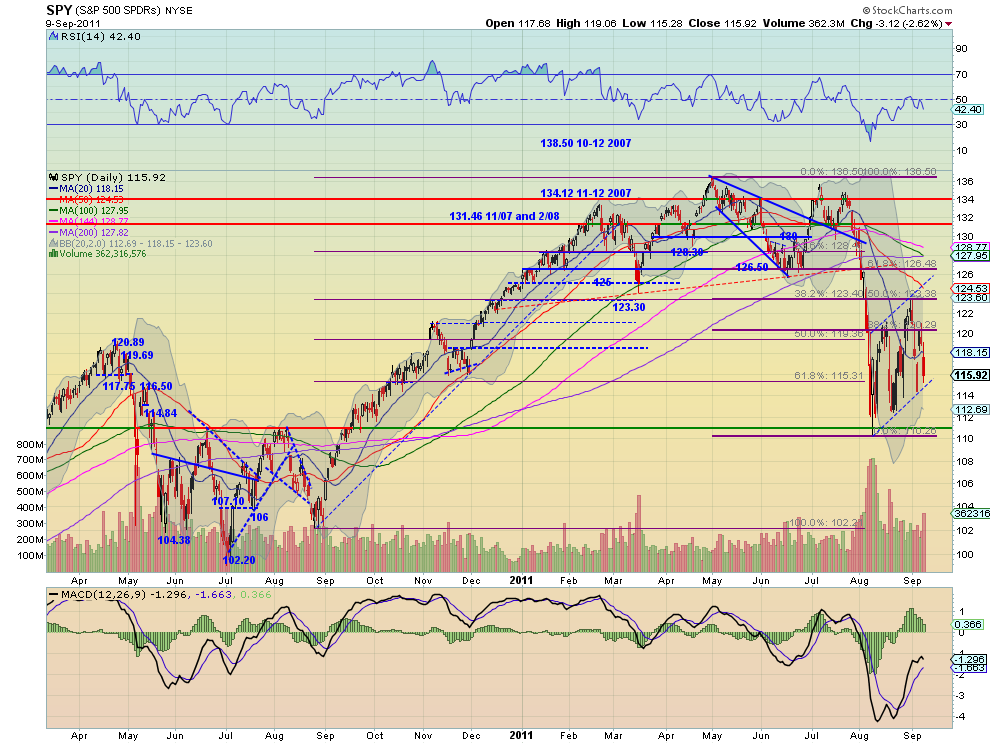

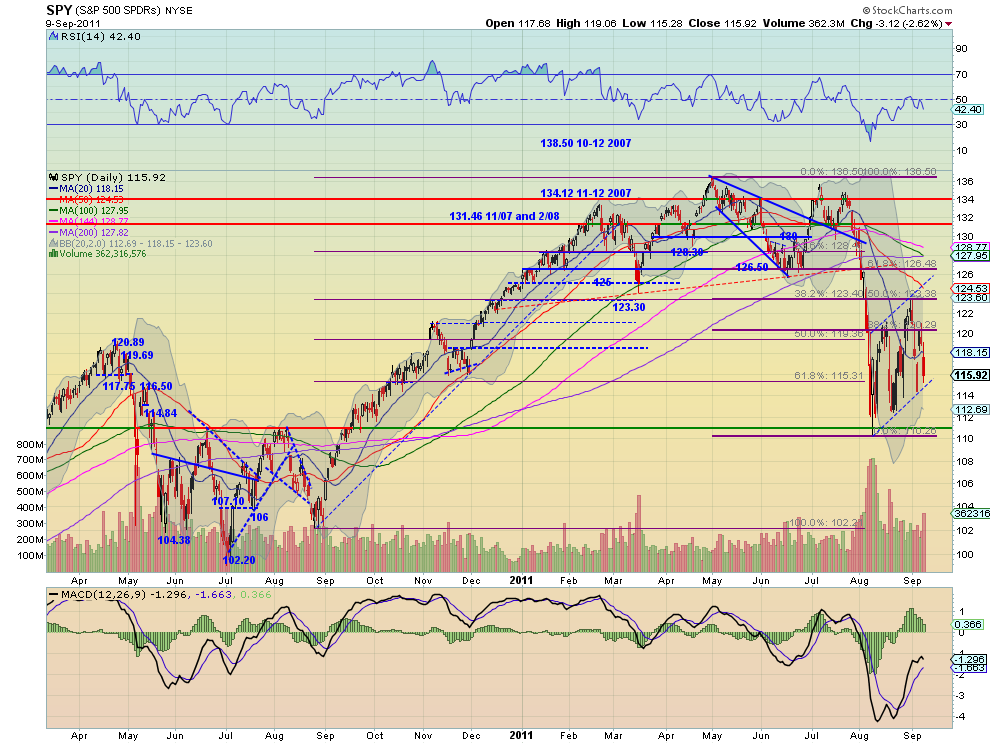

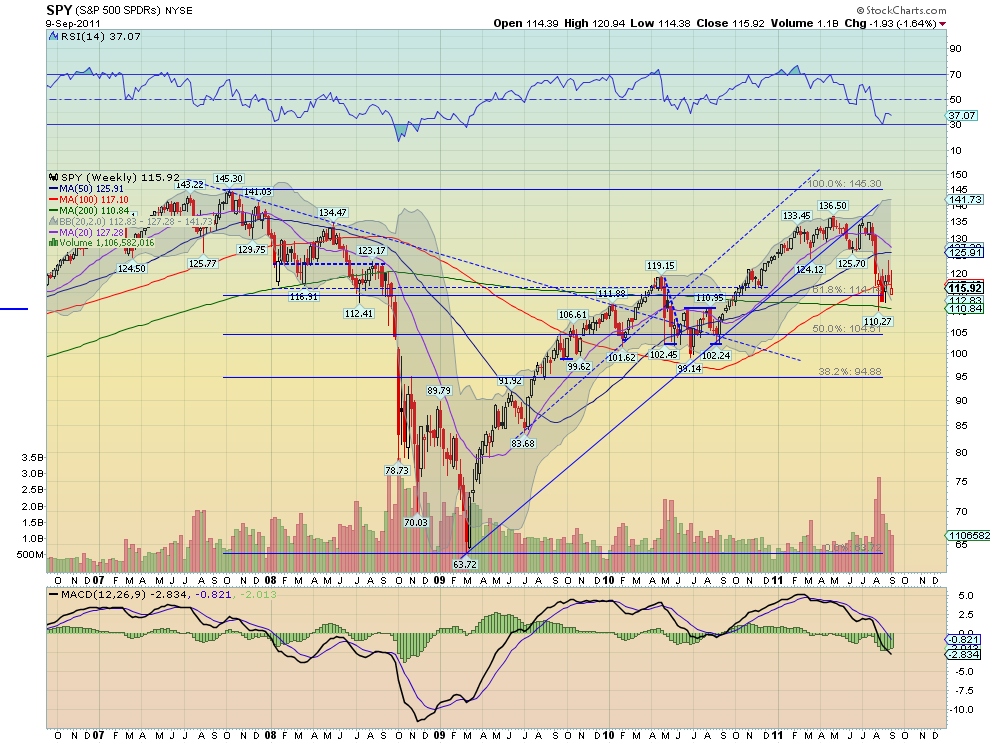

SPY Weekly, $SPY

The SPY continued in the bear flag this week moving back lower after

rejecting a retest at the 38.2% Fibonacci level from the broad move lower. It

has a RSI that also rejected at the mid line and is heading lower on the daily

chart and a MACD that continues to fade. The weekly chart shows the RSI bounce

off of the 30 level fading back towards it and the MACD remaining negative. The

downtrend remains for next week. If it breaks the flag lower under 115.30 there

is support at 111.15 and 104 on the way to a target of 95-100. Any upside should

find resistance over 121.50 at 123.30. Above that the trend may be changing.

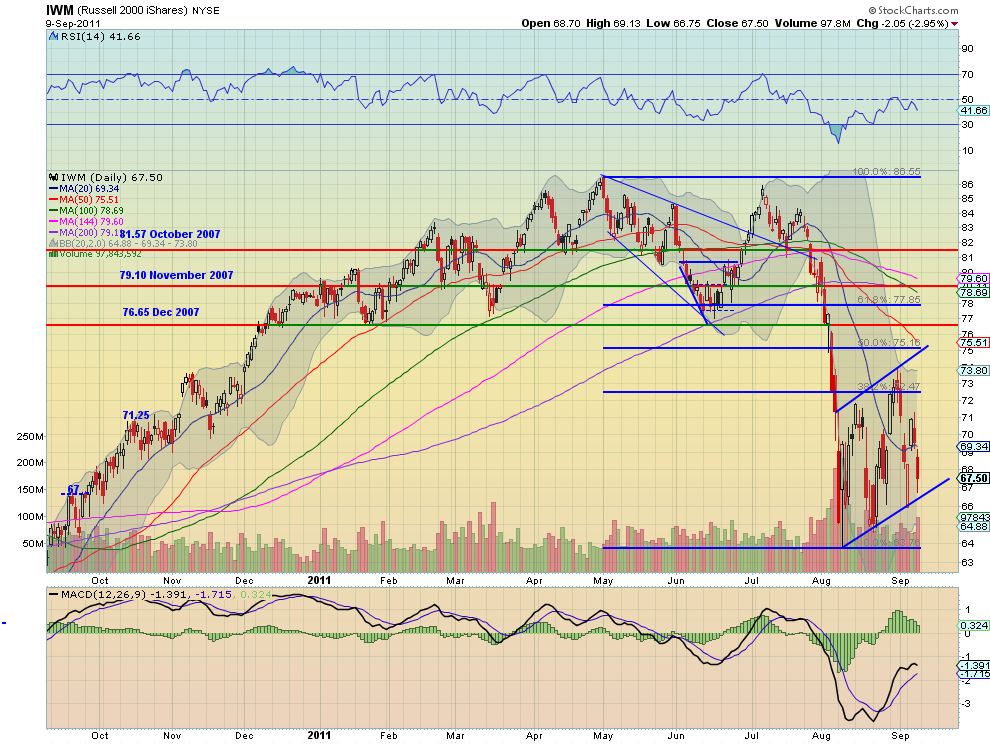

IWM Weekly, $IWM

The IWM moved in its bear flag this week, moving back lower after rejecting

at resistance at 71. It has a RSI that rejected at the mid line and is heading

lower on the daily chart and a MACD that continues to fade. The weekly chart

shows the same RSI bounce off of the 30 level fading back towards it and the

MACD remaining negative. The downtrend remains for next week. If it breaks the

flag lower under 66 there is support at 62.80 and 58.68 on the way to a target

of 44. Any upside should find resistance over 71 at 73.60. Above 75 the trend

may be changing.

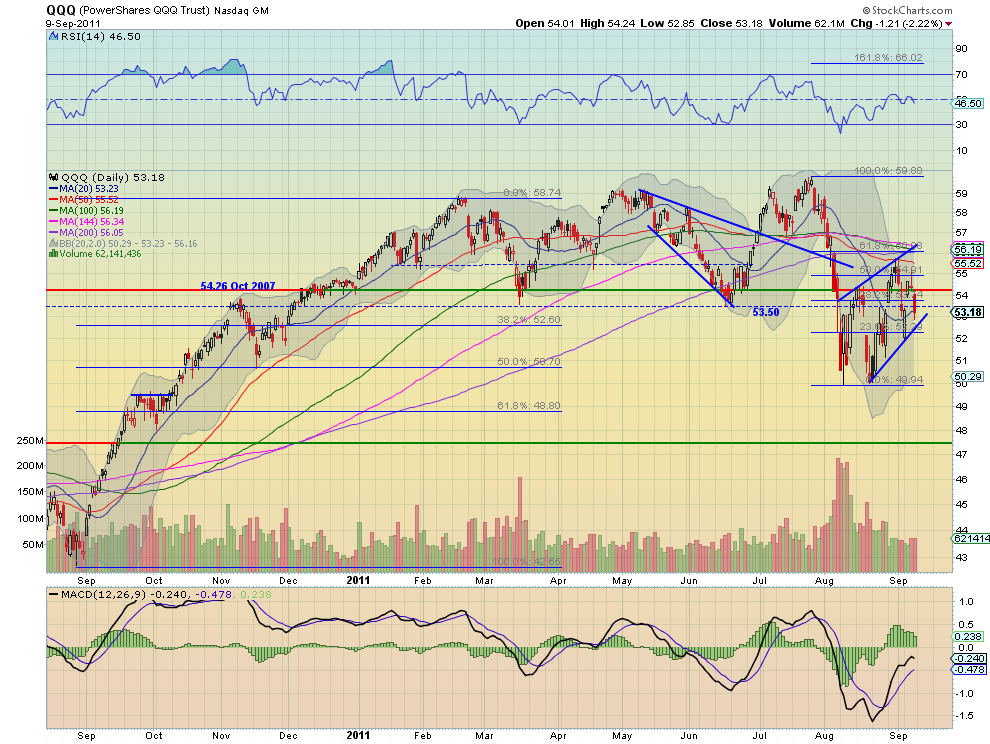

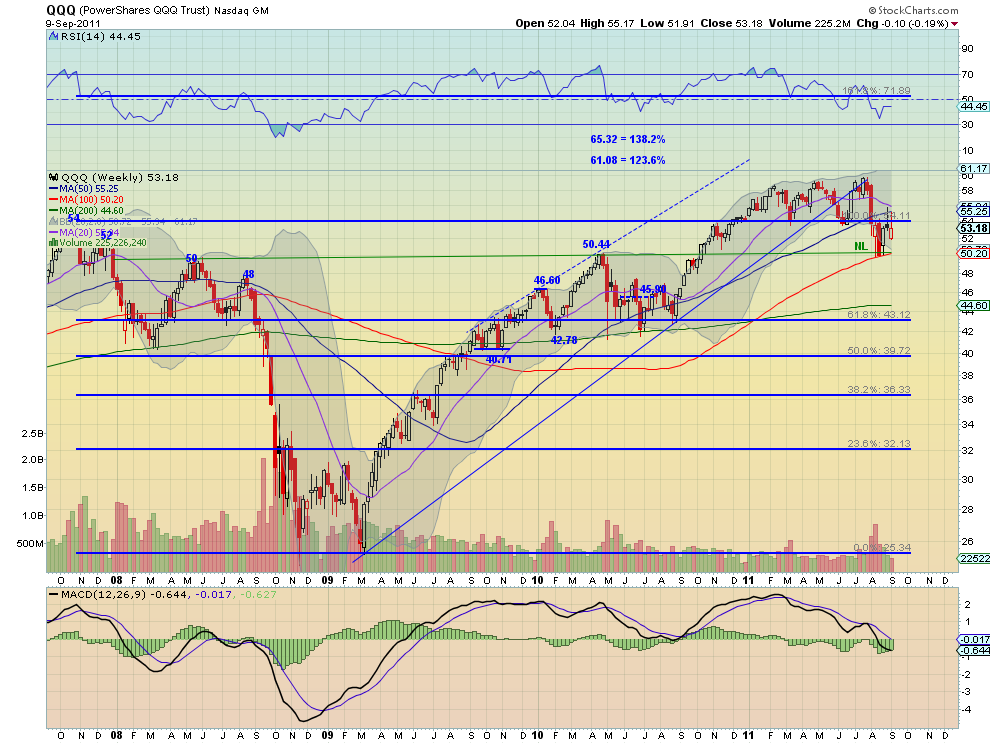

QQQ Daily, $QQQ

The QQQ moved in its bear flag as well, moving back lower after rejecting at

the 50% Fibonacci level. It has a RSI that rejected near the mid line and is

heading lower on the daily chart and a MACD that continues to fade. The weekly

chart shows the same RSI bounce leveling and the MACD remaining negative as the

flag sits on the 100 week Simple Moving Average (SMA). The downtrend remains for

next week. If it breaks the flag lower under 52.60 there is support at 50.03 on

the way to a target of 46-46.60. Any upside should find resistance over 55.50 at

57. Above that the trend may be changing.

The coming week looks positive for US Treasuries and the US Dollar Index.

Gold looks to continue to be biased higher and Crude Oil lower, but both may

also continue in the respective bull and bear flags. The Shanghai Composite and

Emerging Markets continue to favor the downside. Volatility looks to remain

elevated with a bias towards heading higher. This backdrop suggests favoring a

downside bias in the US Equity Index ETF’s SPY, IWM, and QQQ. They may continue

to hold their bear flags but a big push higher in the US Dollar Index and US

Treasuries are likely to push Volatility higher out of its range and lead to the

Equity flags breaking lower. Use this information as you prepare for the coming

week and trade’m well.

No comments:

Post a Comment