We are currently witnessing a pattern in the stock markets that has occurred multiple times in the last century. And everytime we did, things got UGLY.

That pattern is:

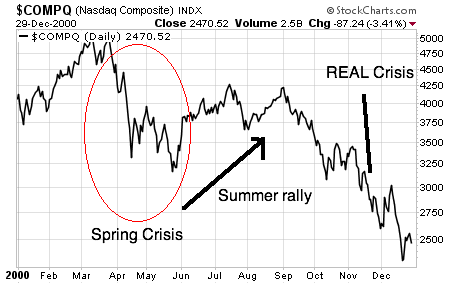

1) a Spring Crisis

2) a Summer rally (on light volume)

3) The BIG Crisis

This pattern has occurred in 1907, 1929, 1931, 1987, 2000 and 2008. In each of these years, stocks came undone via some kind of Crisis during the March –May period. There was then a brief summer “relief” rally, and then things got VERY ugly in the fall.

Here’s the pattern for 2000:

Here it is in 2008:

So far, the market has been trading sideways for most of 2011, but the pattern is emerging:

Given that the Financial System is now even more leveraged than it was during the Tech Bubble… and that we’ve added TRILLIONS in debt to the US’s balance sheet, the odds of another systemic collapse are getting higher by the day.

No comments:

Post a Comment